Global markets opened the week in risk-off mode after President Trump confirmed that new tariffs will take effect on August 1, threatened an additional 10% levy on BRICS-aligned nations, and left allies guessing about what comes next.

Wall Street futures dipped, oil slid, Bitcoin stayed flat, and Asian equities tumbled as investors tried to digest the evolving landscape of Trump’s global trade game — one now extending to geopolitics and BRICS realignment.

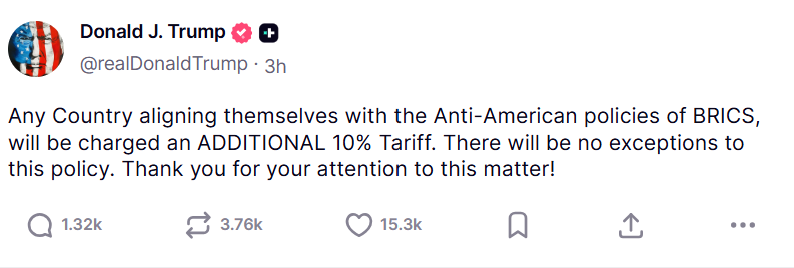

“Any country aligning themselves with the anti-American policies of BRICS will be charged an additional 10% tariff,” Trump declared Sunday on Truth Social.

The message? You’re either with us — or you’re paying up.

Markets Snapshot – Monday, July 7quities & Bonds

- US futures are down as trade confusion grows: Dow ~−0.3%, S&P 500 ~−0.5%, Nasdaq ~−0.6% .

- Asia: MSCI Asia −0.6%, Hong Kong weaker, Nikkei mildly lower

- Europe: Cautious start ahead of key data (EU retail, Sentix, German industrial output).

Currencies & Bonds

- US 10Y yield ~4.33%, down ~2 bps .

- Dollar index modestly stronger

- Chinese yuan pressured after Trump’s BRICS tariff threat

Commodities

- Oil dropped ~1% after OPEC+ raised output significantly to squeeze US shale .

- Gold remains relatively stable amid equities volatility.

Bitcoin & Crypto

Analysts are split: some see Bitcoin nearing peak (~$110K–$115K) with strong ETF support

Trading near $109K, up ~1% in the past week Institutional momentum continues: ETF inflows of $14.4B YTD, with forecasts pointing to potential new highs

Dormant wallets from 2011 recently moved $2B — stirring market watchers

The Trump Confusion Game: Deadline or Bluff?

Markets had been preparing for July 9 as the cutoff date for US trade deals before tariffs kicked back in at April 2 levels. But over the weekend, Trump and Commerce Secretary Lutnick clarified that August 1 is now the new effective date for higher tariffs.

“Tariffs go into effect Aug. 1. But the president is setting the rates and the deals right now,” Lutnick said. Trump nodded beside him.

Yet the April 9 executive order setting the July 9 deadline remains active — and no new executive order has been signed. Treasury Secretary Scott Bessent added another layer of ambiguity, noting that many countries didn’t even reach out for talks, and will likely face penalties.

What’s New This Time? BRICS Is Now a Target

Trump isn’t just targeting trade partners — now it’s geopolitical. He warned of an additional 10% tariff on nations supporting BRICS economic policies, which have recently challenged US-led institutions like the IMF.

The BRICS summit in Rio this weekend brought together India, South Africa, Brazil, and other members, with Russia attending remotely. The group condemned US tariff aggression and military strikes on Iran, which were supported by Israel and Washington in June.

Oil Drops as OPEC+ Moves to Undercut US Shale

While political headlines dominated, crude oil fell over 1%, surprising traders after OPEC+ signaled larger-than-expected output increases — both for July and September. Analysts view it as Saudi Arabia squeezing higher-cost producers, particularly US shale.

“It’s OPEC’s answer to ‘Drill, baby, drill,’” Reuters noted.

Market Outlook: Mixed Messages and Earnings Ahead

Despite recent S&P 500 and Nasdaq highs, investors are growing uneasy. The White House has repeatedly downplayed trade deadlines, yet markets now expect clarity through either deals — or consequences — by August.

Fundstrat’s Tom Lee told CNBC:

“This is the most hated V-shaped rally,” adding that tariff uncertainty might become an upside story if companies prove resilient during Q2 earnings.

Meanwhile, Morgan Stanley reminded investors that even mini-deals take time:

“Historically, US trade deals take three years on average to negotiate.”

Markets are reacting to less-than-clear communication, sudden geopolitical threats, and volatile oil signals. The next few weeks will be shaped by whether nations sign trade pacts — or receive tariff letters.

August 1 is now the real deadline.

July 9 may still matter — or it may not.

And BRICS is now officially on Trump’s radar.

What to Watch Next

- New trade letters: who gets them, and how they respond.

- Tuesday’s EU retail sales, Sentix confidence, and German industrial data.

- Continued moves in dormant Bitcoin wallets and institutional trends in ETFs.

More about: Markets This Week: Tariff Chaos, Fed Clarity, Prime Day, and Earnings Heat Up

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Elon Musk Launches ‘America Party’ After Breaking With Trump

US Manufacturing Hits 3-Year High, But Tariff Fears Loom

What’s in Tax and Spending Bill That Trump Signed Into Law

F1 The Business: Apple chases Netflix’s Formula 1 playbook

Markets Hit New Highs, Fed Cuts Off Table After Strong Jobs Data; Trade Talks & Tariff Risks Still Loom

Markets Hit Highs After Trump–Vietnam Deal, But All Eyes on US Jobs Report Now

FHFA Chief Claims Powell Lied to Congress; Trump Demands Immediate Resignation