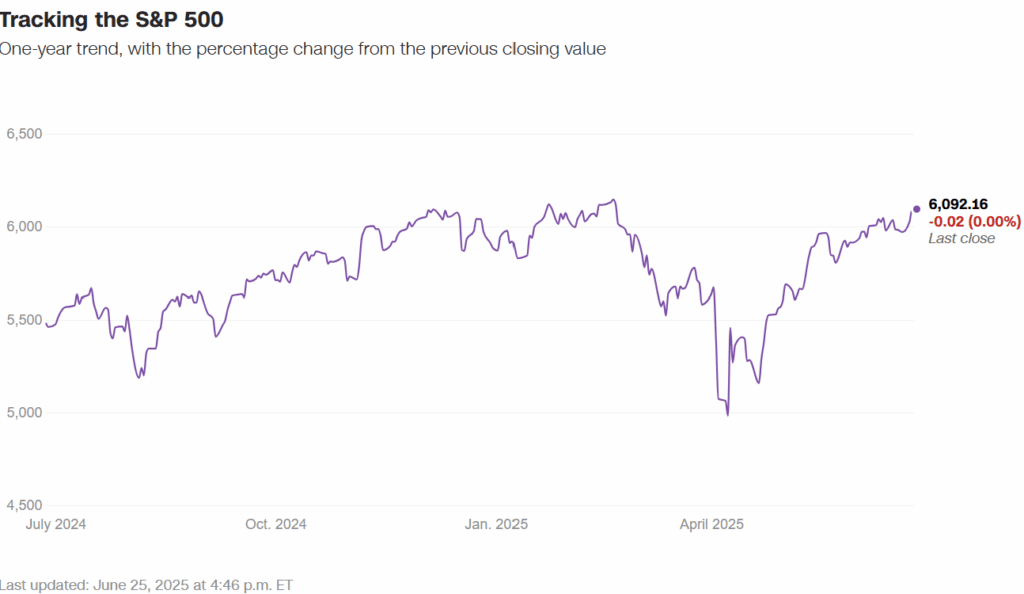

The S&P 500 is now less than 1% away from a record high, marking a dramatic turnaround from just two months ago when the index was on the brink of a bear market.

After rising 2.1% over the last two sessions, the S&P 500 closed flat on Wednesday, while the Nasdaq Composite gained 0.31% and the Dow slipped 0.25%. Analysts say markets are breathing easier after a fragile ceasefire between Israel and Iran, though underlying concerns — from inflation to tariffs — haven’t gone away.

“As Middle East tensions de-escalate, the focus will return to more fundamental concerns for investors such as tariffs, earnings, the federal deficit and President Trump’s One Big Beautiful Bill,” said Chris Brigati of SWBC.

From Correction to Comeback

The S&P 500’s climb has been swift and surprising. The index lost nearly 19% from its February peak to April 8, wiping out $9.8 trillion in market value after Trump’s sweeping “Liberation Day” tariffs. But sentiment flipped quickly when the White House walked back the most aggressive trade moves.

- In May, the S&P 500 posted a 6.15% gain, its best May since 1990.

- It’s now up 3% in June and more than 3.5% year-to-date.

- The Nasdaq 100 hit a new all-time high on Tuesday, powered by big tech and AI momentum.

Nvidia ($NVDA) surged 4.33% Wednesday, hitting an all-time high after falling 37% earlier this year. Analysts say AI and semiconductor stocks are back in market leadership, helping the indexes recover lost ground.

“Getting leadership from these big tech names is huge for a US market that’s hyper-concentrated in that area,” said Baird’s Ross Mayfield.

But Not All Clear

Despite the rally, experts warn that markets may be overlooking real economic headwinds. Tariffs, potentially sticky inflation, and rising deficits could weigh heavily later in the year.

- Tariff rates remain the highest in 90 years, according to Apollo’s Torsten Slok, posing threats to growth and price stability.

- Analysts are watching whether companies pass tariff costs to consumers during Q2 earnings season, which kicks off mid-July.

- Jefferies’ Mohit Kumar expects a “grind higher” but says the path isn’t without bumps — especially if jobs data softens or Treasury yields spike.

“There are concerns about what the future holds from a profitability standpoint,” said Keith Buchanan of Globalt Investments.

“It is nearly impossible to time the market, therefore maintaining a disciplined and long-term investing approach serves investors well,” Brigati added.

For now, investors are staying cautiously optimistic — riding the recovery, but bracing for a summer of volatility.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump rebukes Israel and Iran hours after ceasefire: Latest Updates

Ceasefire “Now in Effect” as Israel and Iran End 12 Days of War — But Deadly Strikes Continue

Trump Announces Ceasefire Between Israel and Iran

Why Oil Prices Plunged and Stocks Rose After Iran’s Missile Attack on US Bases

Markets Brace for Chaos as Strikes, Inflation, and FED: What to watch this week

Iran–Israel–US Conflict Erupts: Nuclear Strikes, Hormuz Threats, and Global Fallout

US-Iran Conflict Escalates After Strikes on Nuclear Sites: What We Know So Far