Stock futures tied to the S&P 500 and Nasdaq 100 surged past their previous intraday highs early Friday morning, marking a sharp recovery from the lows seen in April. The S&P 500 futures rose 0.11% to hit 6,202, breaking February’s record of 6,147. The Nasdaq 100 futures also gained 0.11%, while Dow Jones futures added 62 points, or 0.14%.

The gains helped push the Nasdaq Composite nearly 1% higher during Thursday’s session, bringing it within striking distance of a fresh all-time high. The Dow Jones Industrial Average and S&P 500 also advanced modestly and are now up more than 2% on the week. The Nasdaq has gained over 3% this week alone.

“There is so much money that wants to come into the market that didn’t for a while,” said Rick Rieder, BlackRock’s chief investment officer for global fixed income. “And I just think if you don’t have any negative news, the natural gravitational pull is across all these assets,” he told CNBC.

Eyes on Friday’s Inflation Data

Investor focus now turns to the May personal consumption expenditures (PCE) price index, due out later today. The core PCE, the Federal Reserve’s preferred inflation gauge, is expected to rise 0.1% month-over-month, and 2.6% year-over-year, according to economists polled by Dow Jones.

Markets will also digest data on personal income, consumer spending, and the University of Michigan’s consumer sentiment index — all of which could shape expectations for the Fed’s next moves.

Global Markets Rally on Trade Optimism and Rate-Cut Bets

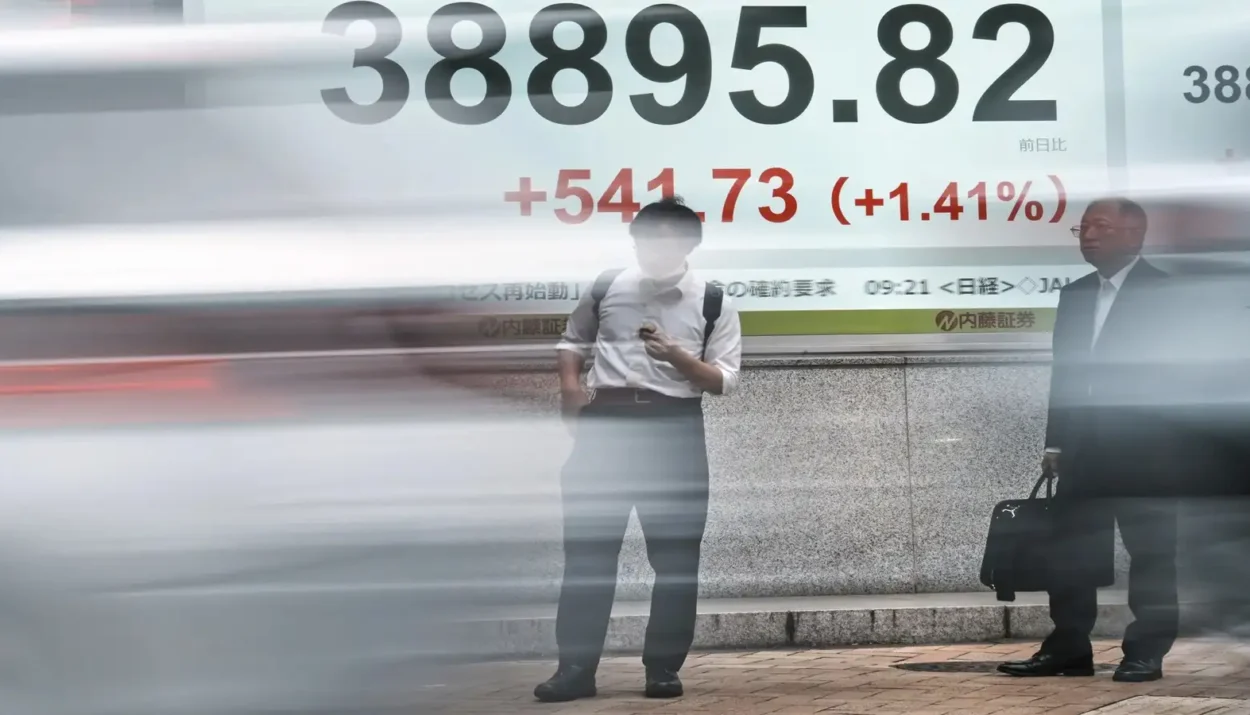

Asian and European markets followed Wall Street’s bullish momentum overnight. The MSCI All-Country World Index climbed to a new record, fueled by gains in tech stocks and hopes that a new trade deal could de-escalate tensions between the US and its global trading partners.

Stocks across the Asia-Pacific region rose as much as 0.7%, hitting their highest levels since September 2021. Japan’s Nikkei 225 advanced, while South Korea’s Kospi edged lower. European futures pointed to a higher open, as traders bet on a more accommodative stance from the European Central Bank and improving trade dynamics.

Oil and Gold Retreat as Risk Appetite Grows

Commodities softened overnight, with oil prices plunging amid receding fears of supply disruptions in the Middle East.

- Brent crude fell to $68.08 per barrel,

- WTI crude traded at $65.64,

marking their steepest weekly decline since March 2023.

According to Reuters, the geopolitical risk premium built into oil markets earlier this month has “completely vanished” following the Iran-Israel ceasefire.

Meanwhile, gold prices pulled back as traders rotated out of safe havens and into riskier assets.

- Gold futures slipped below $3,330 per ounce, down nearly 1% on the week.

The World Bank has forecast that commodity prices will continue to slide through 2025, with energy prices expected to remain soft and gold likely to stay elevated only if new volatility emerges.

Market Outlook

With core inflation slowing, interest-rate cuts increasingly likely, and tech stocks regaining momentum, analysts expect the rally in equities to extend into the second half of the year. However, risks remain — including the trajectory of US-China trade talks, upcoming US election uncertainty, and a potential rebound in oil prices if conflict reignites.

Still, for now, momentum appears firmly on the bulls’ side. The next big test: Friday morning’s PCE inflation print — the data that could shape the Fed’s July rate decision.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump’s Tariff Deadline? ‘Not Critical,’ Says White House

Nike Reports After the Bell: Here’s Why Wall Street Expects a Weak Quarter

US IPOs Soar 53% in 2025, Led by Circle and CoreWeave — But Can the Boom Last?

In a First-of-Its-Kind Decision, Anthropic and Meta Win Copyright Lawsuits Brought by Authors

Kalshi Hits $2 Billion Valuation as Prediction Markets Go Mainstream

S&P 500 Nears All-Time High After Stunning Rebound from April Lows

Trump rebukes Israel and Iran hours after ceasefire: Latest Updates