Silver led a sharp market shock on Friday after reports of a potential Russia–US dollar return triggered a violent selloff across commodities, equities and crypto, wiping out an estimated $3.2 trillion in global market value within an hour.

The turbulence began around 1:30 PM GMT on February 13, 2026, following leaks suggesting that Moscow may be considering a strategic return to US dollar-based trade settlement, effectively reversing years of aggressive de-dollarization efforts under the BRICS framework.

What followed was one of the fastest commodity collapses in recent history, now widely referred to as the Silver Flash Crash 2026.

More about: Gold and Silver Crashed. Here’s What Really Happened and Why It Matters

Precious Metals Collapse as Dollar Surges

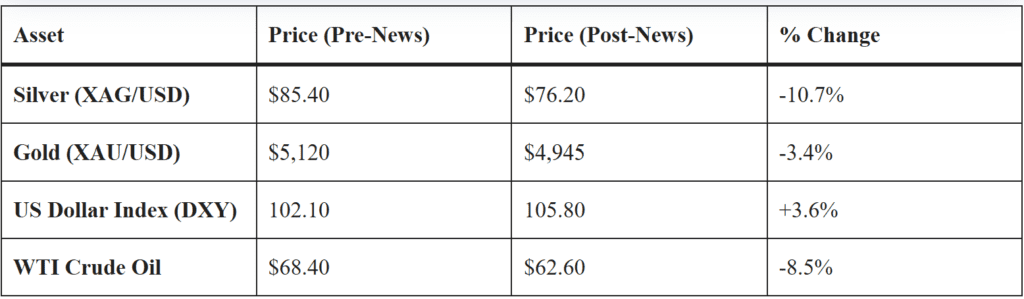

The immediate reaction centered on gold and silver, which had been leading the anti-dollar trade for the past three years.

Within 30 minutes:

- Silver (XAG/USD) plunged nearly 10%, falling from around $84–85 to roughly $76

- Gold (XAU/USD) dropped more than 3–4%, slipping back below the key $5,000 per ounce psychological level

- The US Dollar Index (DXY) surged over 3%, marking one of its strongest intraday moves in years

- Bitcoin fell sharply as well, losing more than 7% in early trading

High-frequency trading algorithms reportedly accelerated the decline once silver broke below key technical levels near $80, triggering automatic liquidation across leveraged positions.

However, a striking divergence emerged between futures markets and physical bullion.

While paper silver contracts on COMEX collapsed, physical premiums in major hubs such as London, Mumbai and New York actually rose, suggesting long-term holders were not selling. Analysts say this indicates the crash primarily flushed out leveraged speculators rather than institutional bullion holders.

What Is the Russia–US Dollar Return?

Though no official joint statement has been released, reports suggest a proposed framework aimed at reintegrating Russia into the Western financial architecture.

Leaked outlines point to several pillars:

- A return to US dollar settlement for trade, potentially reversing “Rubles-for-Gas” policies

- Energy coordination between the US and Russia to stabilize fossil fuel markets

- Cooperation on critical minerals such as lithium, nickel and palladium

- Expanded US commercial access to Russian markets

- Infrastructure investment tied to LNG and energy exports

If formalized, such a shift would represent a dramatic reversal of the BRICS-led de-dollarization movement, which had seen a majority of Russia’s trade move away from the dollar in recent years.

Markets interpreted the reports as a potential death blow to the “post-dollar” narrative that had fueled gold’s historic rally above $5,000 and silver’s triple-digit surge in 2025.

Tech Stocks Hit by Double Shock

The dollar spike also pressured major US technology companies.

A stronger dollar reduces the value of overseas earnings when converted back into US currency, raising concerns about profit margins for globally exposed firms.

Shares of companies such as Nvidia, Microsoft and Apple fell as investors recalibrated expectations. AI-linked stocks were particularly vulnerable, as the dollar surge collided with growing scrutiny over massive AI capital spending.

This created what traders described as a “double whammy”: geopolitical realignment combined with tech-sector valuation stress.

What This Means for BRICS and De-Dollarization

For years, Russia had been one of the most vocal proponents of reducing dependence on the US dollar. Its pivot back toward dollar settlement, if confirmed, would slow momentum toward a proposed BRICS reserve currency.

Countries such as China, India and Brazil have increasingly adopted local currency trade mechanisms. A Russian reversal would complicate that effort and potentially reassert the dollar’s dominance in global trade settlement.

Currency markets reflected that view immediately, with the US dollar gaining broadly against the euro and yen.

Federal Reserve Implications

The surge in the dollar and drop in commodity prices could also reshape expectations for the Federal Reserve.

Lower energy prices and falling metals typically ease inflation pressure, potentially giving policymakers more flexibility to hold rates steady or maintain a restrictive stance without risking overheating.

Traders are now closely watching upcoming Fed commentary for signs of how policymakers interpret the shift.

Strategic Outlook for Investors

Market strategists say the move underscores how quickly geopolitical risk can reprice global assets.

| Group | Segment | Why It Moves | Likely Direction |

|---|---|---|---|

| Winners | US financials and banks | Capital flows back to dollar markets | Upward bias |

| Traditional energy producers | Stronger fossil-fuel demand outlook | Positive | |

| Dollar-denominated assets | USD strength boosts relative value | Bullish | |

| Under Pressure | Precious metals | Strong dollar reduces hedge demand | Bearish |

| Emerging market tech | Currency and funding pressure | Negative | |

| Green energy subsidy plays | Shift toward conventional energy | Weak | |

| Leveraged speculative trades | Volatility triggers liquidations | High risk downside |

Despite the intensity of the crash, some analysts caution that the structural drivers behind gold and silver, including sovereign debt levels and long-term inflation concerns, remain unchanged.

For now, however, the message from markets is clear: liquidity and dollar strength have regained center stage.

A Turning Point in Global Finance?

Whether the Russia–US dollar return becomes a formal policy shift or remains a geopolitical negotiating tactic, February 13, 2026, may be remembered as a defining moment.

After years of momentum toward a multipolar monetary system, the dollar’s gravitational pull proved powerful enough to trigger one of the fastest commodity liquidations in modern history.

Markets remain volatile, and investors are bracing for further developments as diplomatic details emerge.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Is It Too Late to Invest in Gold in 2026?

Gold, silver and defence: reasons to be bullish and bearish

Resources: Silver Flash Crash 2026: Why Russia-US Dollar Return Wiped $3.2T in 30 Minute

Silver Flash Crash 2026: Why Russia-US Dollar Return Wiped $3.2T in 30 Minutes