Retail investors were stunned after brokerage Charles Schwab sent out a price alert showing GameStop (GME) at over $40,000 per share, far beyond its actual trading price of $27 at the time.

This latest price glitch, shared on X (formerly Twitter) by @Malone_Wealth, fueled speculation over GME’s price transparency and the possibility of naked short-selling manipulation.

What Happened?

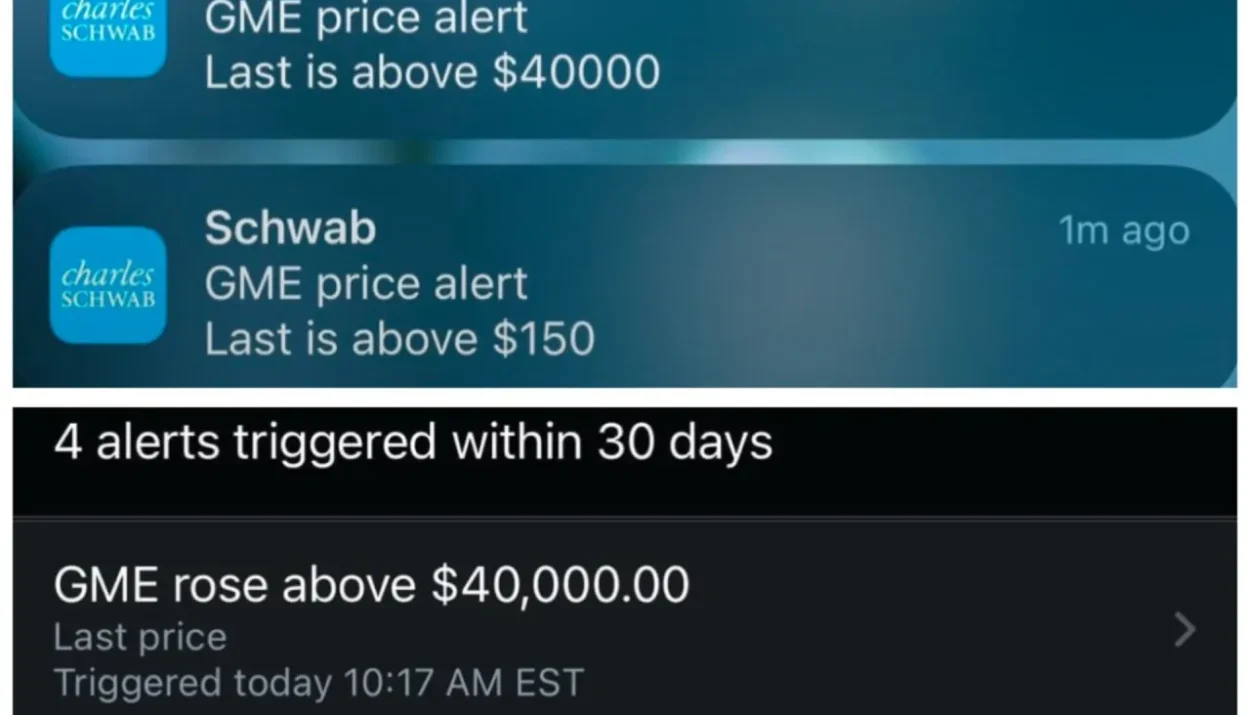

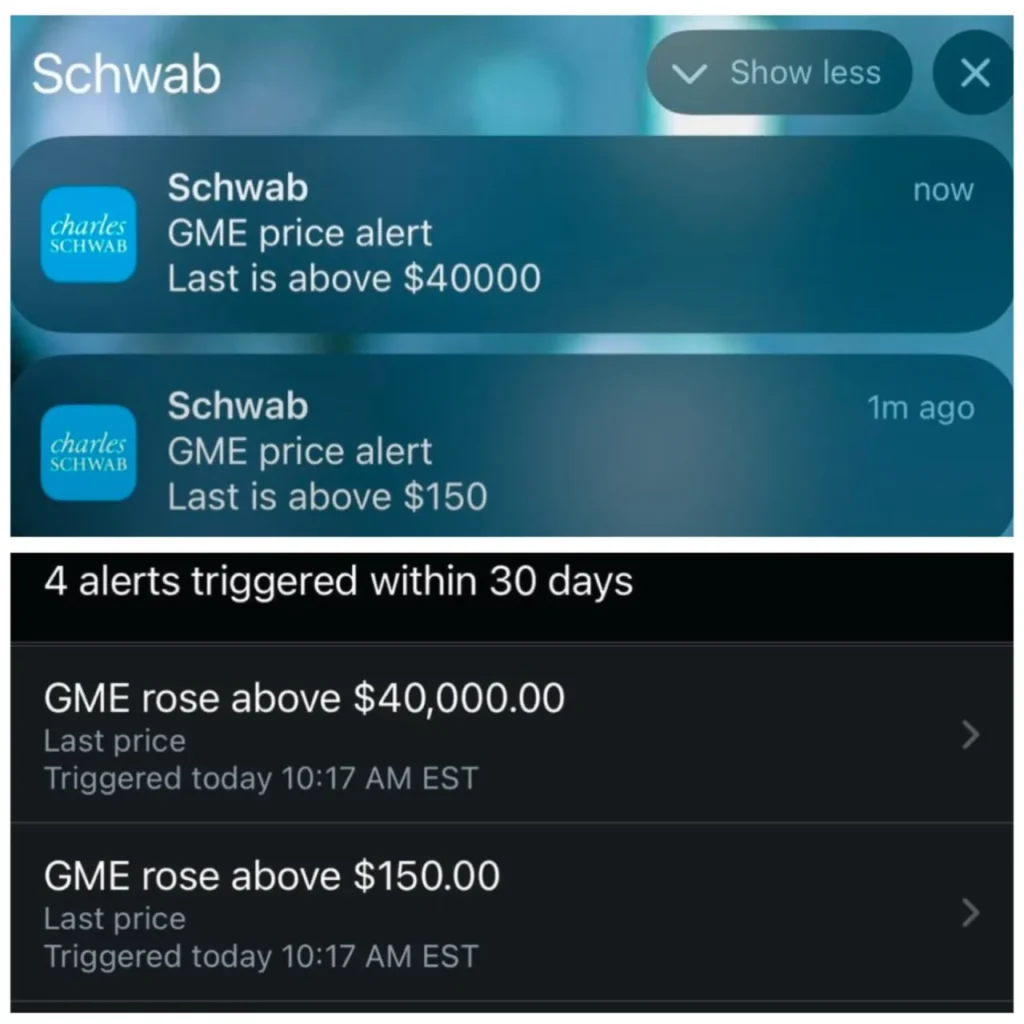

📢 Schwab notification read:

“GME price alert — Last is above $40,000”

📊 Another alert showed GME stock above $150, further confusing investors.

🔹 Retail traders questioned Schwab’s explanation, with one user on X asking:

“Is this malpractice and negligence? Or is it real price action being suppressed?”

Is This Just Another “Glitch” or Something More?

💻 IT experts weigh in, saying such alerts don’t just happen randomly.

👨💻 One user with a background in IT suggested two possibilities:

1️⃣ Someone altered the code manually—raising concerns of intentional interference.

2️⃣ A system update interfered with Schwab’s alert software, causing unintended errors.

📌 Either way, investors are demanding transparency from Schwab about what caused the alert.

Naked Short Selling & SEC Controversy

🔍 Retail investors suspect illegal trading practices, specifically naked short selling, may be a factor.

📉 Failed-to-Deliver (FTD) shares, a known consequence of naked shorting, remain a hot topic.

🚨 Recent SEC Decision:

- The SEC rejected a FOIA request from an investor seeking GameStop FTD data.

- The reason? “Foreseeable harm”—sparking frustration over the lack of transparency.

- SEC routinely publishes similar data, but is now withholding GameStop’s FTD info.

❗ Investors are now questioning who the SEC is protecting.

What’s Next for GameStop & Retail Traders?

✔ Bullish Case:

- If retail investors are right about price suppression, GME could be significantly undervalued.

- Increased pressure on regulators could lead to greater transparency in trading practices.

❌ Bearish Case:

- If this is truly just another glitch, GME remains a highly volatile, speculative stock.

- Without regulatory action, retail traders may continue battling Wall Street insiders without resolution.

As a conclusion, while these type of glitches have become all too common now with GameStop, it leaves retail investors speculating the possibility and illegal role of naked short selling. Even more troubling is the question of whom and what interests are being protected by this withholding of information.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Javier Milei just DESTROYED market: Are meme coins officially DEAD?

The stock market just won’t crack. Bulls say it’s time for a breakout to new highs