Global investors are growing increasingly uneasy as tensions in the Middle East escalate, with fears mounting that a direct US military intervention could trigger widespread market disruptions and reignite inflation.

The conflict between Israel and Iran, marked by mutual missile strikes, has already rattled oil markets. Now, with President Donald Trump expected to decide within two weeks whether the US will join Israel’s campaign, financial markets are bracing for worst-case scenarios.

“If attacks take out Iranian oil supply, that’s when the market will sit up and take notice,” said Art Hogan, Chief Market Strategist at B Riley Wealth.

Oil prices spike, inflation fears rise

- Brent crude has surged nearly 18% since June 10, hitting a five-month high of $79.04.

- US crude is up nearly 10% over the week.

- Analysts warn a shutdown of Iranian oil production or a closure of the Strait of Hormuz could push oil above $130 per barrel.

In such a scenario, Oxford Economics projects US inflation could hit 6% by year-end, making interest rate cuts highly unlikely in 2025. The price shock could also sap consumer confidence and hurt real incomes.

“The scale of the inflation spike would likely ruin any chance of rate cuts this year,” Oxford said in a note.

Equities hold ground – for now

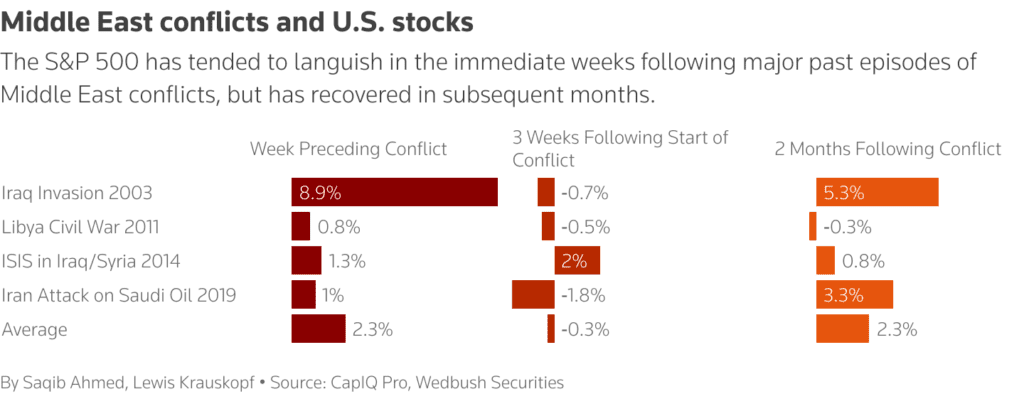

Despite rising geopolitical risks, the S&P 500 has remained relatively stable. Historical data suggests that stocks may dip initially during military conflicts but often rebound within months.

- After similar events like the 2003 Iraq War or 2019 Saudi oil facility attacks, the S&P 500 averaged a 0.3% drop in 3 weeks, but rose 2.3% within 2 months.

“Geopolitical tensions are being ignored by equities, but priced into oil,” noted analysts at Citigroup.

However, if the US launches strikes on Iran, analysts expect a short-term selloff as investors rush to safe havens.

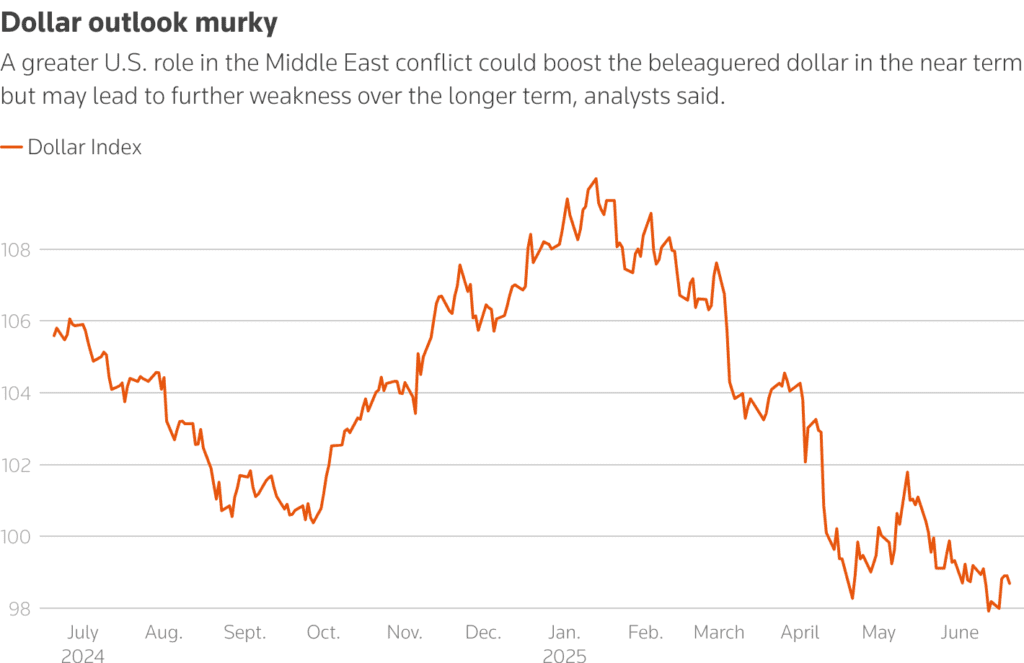

Dollar’s mixed outlook

The US dollar, which has already weakened this year amid economic uncertainty and Trump’s trade policies, could see a temporary boost from safe-haven demand.

“Traders will likely fear greater damage to Europe and Japan than the US,” said Thierry Wizman, Global FX strategist at Macquarie.

But he warned that prolonged US involvement, similar to the post-9/11 wars, could eventually erode confidence in the dollar.

As oil volatility increases and the White House edges closer to a pivotal decision, markets are preparing for a possible turning point. Any move by the US to deepen its involvement in the Middle East could ripple across equities, currencies, and inflation expectations — with global consequences.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

IMF Warns: European Economy Faces Risk of Stagnation

Why Oil Prices Aren’t Surging Despite the Israel-Iran War

Trump Privately Approved Attack Plans for Iran but Has Withheld Final Order

Iran Refuses to Surrender as Trump Mulls Strike: Tensions Surge in Middle East Conflict

Trump Demands Iran’s ‘Unconditional Surrender,’ Escalates Pressure in Israel-Iran Conflict

US and UK Seal Trade Deal — but Steel Tariffs Unresolved

Trump Exits G7 Early as Leaders Urge Mideast Ceasefire: What the Summit Delivered

OpenAI considers antitrust action against Microsoft amid tensions