Retirement planning is essential to ensure financial security in your later years. However, starting the process can be daunting. This guide breaks down the key steps to help you begin retirement planning effectively and strategically.

Retirement Planning Basics: Setting Goals and Budgeting

- The first step in retirement planning is to set clear goals. Ask yourself when you want to retire, where you want to live, and what lifestyle you wish to maintain. These factors will determine how much you need to save.

For example, retiring at 55 with plans to travel extensively will require a significantly larger retirement fund than retiring at 67 with plans to live modestly. Use retirement calculators to estimate how much you’ll need based on your desired lifestyle and retirement age.

Before you can start saving, assess your current financial situation. This includes evaluating your income, expenses, savings, and debt. Understanding your financial position is crucial in retirement planning, as it helps determine how much you can save each month for retirement.

- Income: Calculate your total income from all sources.

- Expenses: Track your monthly expenses to see where your money goes. Use budgeting tools to help with this.

- Savings: Check your current savings and investments, including any retirement accounts.

- Debt: List your debts, including mortgages, student loans, and credit cards. Aim to reduce high-interest debt first to free up more money for savings.

2. Creating a budget is crucial for managing your finances and allocating enough money toward retirement savings. Your budget should prioritize saving for retirement while balancing other financial obligations.

- Emergency Fund: Before focusing on retirement, ensure an emergency fund covers 3-6 months of living expenses. This protects you from unexpected costs.

- Retirement Contributions: Decide how much you can contribute to your retirement accounts each month. Aim to contribute at least 15% of your income, but start with what you can afford and increase over time.

Advanced retirement plan: Investing, Employer Benefits, and Long-Term Care

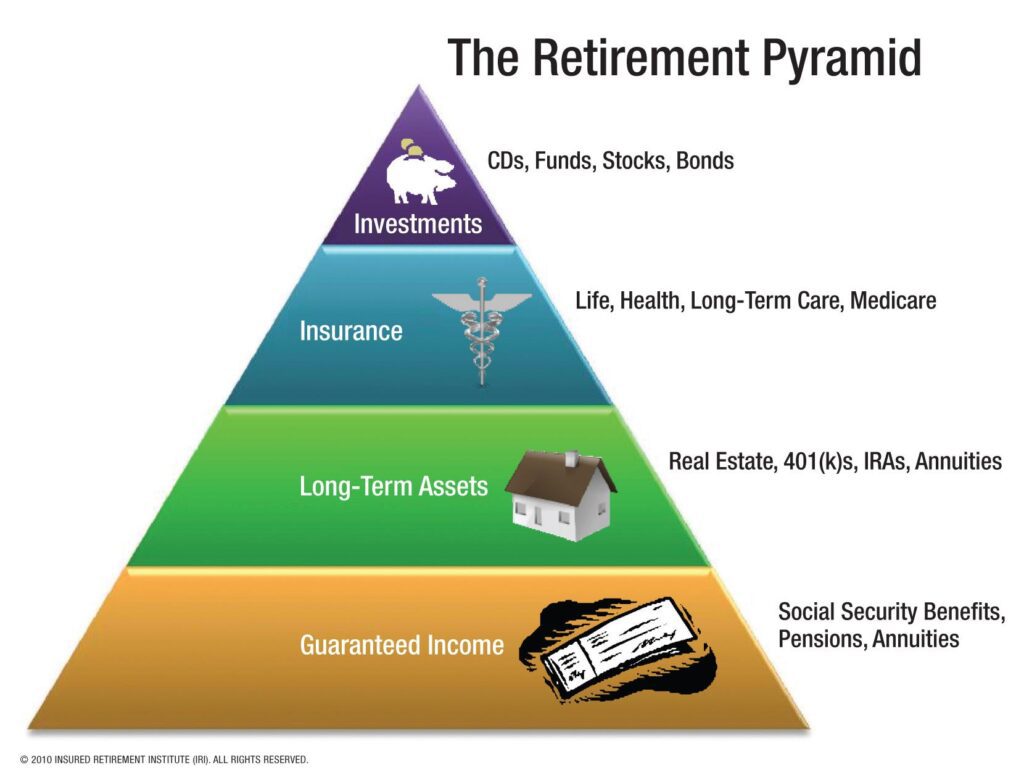

Choosing the right retirement accounts is vital to maximize your savings. Common options include:

- 401(k): Many employers offer 401(k) plans, which allow you to contribute pre-tax income. Some employers also match contributions, which is essentially free money. Contribute enough to get the full match.

- IRA (Individual Retirement Account): If your employer doesn’t offer a 401(k), or if you want to save more, consider an IRA. Traditional IRAs offer tax-deferred growth, while Roth IRAs allow tax-free withdrawals in retirement

In the context of retirement planning, starting to invest early is crucial. The earlier you start investing, the more time your money has to grow. Compound interest allows your investments to generate earnings, which are then reinvested to generate more earnings.

- Asset Allocation: Diversify your investments across different asset classes, such as stocks, bonds, and mutual funds. Your asset allocation should reflect your risk tolerance and time horizon (retirement plans link)

- Rebalancing: Regularly review and rebalance your portfolio to maintain your desired asset allocation. This ensures that you’re not taking on more risk than you’re comfortable with as you approach retirement.

Take full advantage of any retirement benefits offered by your employer. This includes:

- Employer Match: Contribute enough to your 401(k) to get the full employer match.

- Pension Plans: If your employer offers a pension, understand how it works and how it fits into your overall retirement plan.

- Health Savings Account (HSA): If you have a high-deductible health plan, you can contribute to an HSA, which offers triple tax benefits—tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Healthcare is a significant expense in retirement. As part of your retirement planning, it’s essential to plan for these costs.

- Medicare: Understand when and how to enroll in Medicare, and consider supplemental insurance if necessary.

- Long-Term Care Insurance: Consider purchasing long-term care insurance to cover costs that Medicare doesn’t, such as nursing home care.

If possible, consider working longer to increase your retirement savings and delay claiming Social Security benefits. Delaying Social Security until age 70 can increase your monthly benefit by up to 8% per year beyond your full retirement age.

Working longer also allows you to continue contributing to retirement accounts and benefit from employer-sponsored health insurance, reducing your reliance on retirement savings.

Finally, retirement planning requires ongoing attention. Regularly review your retirement plan and make adjustments as needed. Life events such as marriage, the birth of a child, or a career change can impact your retirement goals and financial situation.

- Annual Reviews: Set aside time each year to review your retirement savings and investments. Make sure you’re on track to meet your goals and adjust your contributions if necessary.

- Financial Advisor: Consider consulting a financial advisor for personalized advice and to ensure your retirement plan is comprehensive and aligned with your goals.

Estate planning is another important aspect of retirement planning. Ensure you have a will, power of attorney, and healthcare directive in place. These documents protect your assets and ensure your wishes are followed if you’re unable to make decisions.

- Will: A will outlines how your assets will be distributed after your death.

- Power of Attorney: This document allows someone you trust to manage your financial affairs if you become incapacitated.

Retirement planning involves many steps, but by starting early and following a structured approach, you can build a secure financial future and enjoy your retirement years with peace of mind.

Sources:

- https://www.nerdwallet.com/calculator/retirement-calculator

- https://www.irs.gov/retirement-plans/traditional-and-roth-iras

- https://www.investopedia.com/terms/1/401kplan.asp

- https://www.fidelity.com/learning-center/smart-money/hsa-contribution-limits

- https://www.medicare.gov/basics/get-started-with-medicare