Reddit Inc. (NYSE: RDDT) will release its Q1 2025 earnings on Thursday, May 1, after market close. As Reddit’s first full quarter post-IPO (March 2024), this report will be a key litmus test for whether the iconic social platform can balance user growth, ad monetisation, and market expectations in a fiercely competitive space.

Expected Q1 2025 Results

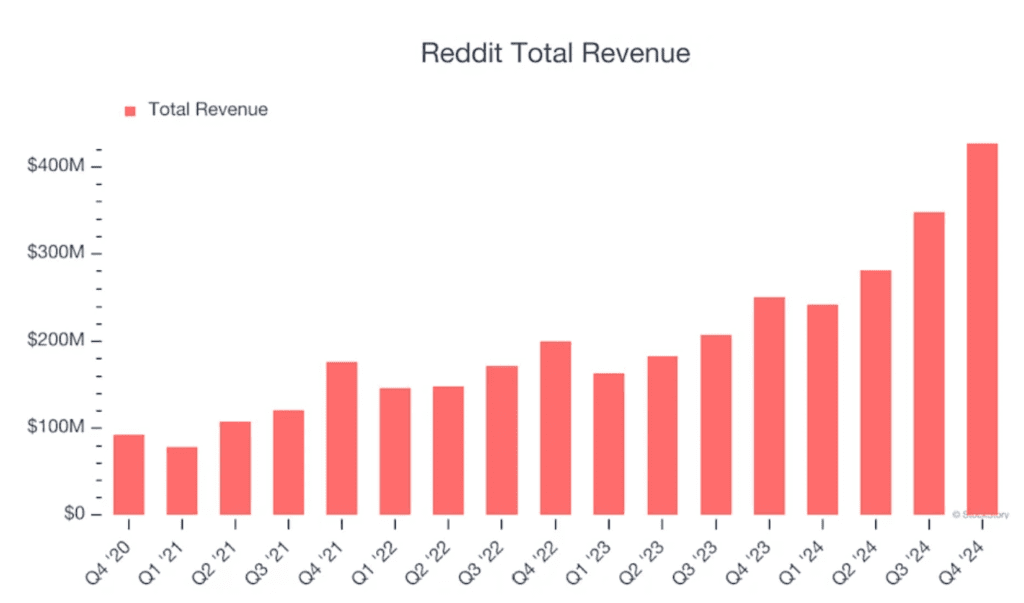

- Revenue Estimate: ~$369.7M → +52.1% YoY

- EPS Estimate: $0.03 (vs. a loss YoY)

Why it matters: These numbers reflect explosive revenue growth, driven by advertising and user engagement gains — but the market will watch carefully for profit guidance and long-term sustainability.

Key Focus Areas

Advertising Revenue → Strong gains expected as Reddit improves ad targeting and attracts brand advertisers.

User Engagement → Q4 daily active users (DAUs) hit 101.7M (+39% YoY); sustained growth here is critical.

AI Innovation → New AI tools like Reddit Answers and enhanced content discovery may boost engagement and ad dollars.

Challenges and Headwinds

- Dependence on Google Search traffic; vulnerable to SEO algorithm changes.

- Rich valuation (~15x sales) raises bar for beating market expectations.

- Heavy competition from Meta, Snap, TikTok, and X for time, talent, and ad dollars.

Bullish Drivers

1️⃣ Massive Revenue Growth (+52% YoY est.)

Reddit is scaling its ad business rapidly, with improvements in ad targeting and partnerships with big brands.

2️⃣ User Base Momentum (+39% DAU growth in Q4)

Reddit hit 101.7M DAUs last quarter, cementing itself as one of the top global social platforms — advertisers love this scale.

3️⃣ AI-Powered Product Innovation

Tools like Reddit Answers and machine learning-driven feed curation help improve user retention and unlock new ad inventory.

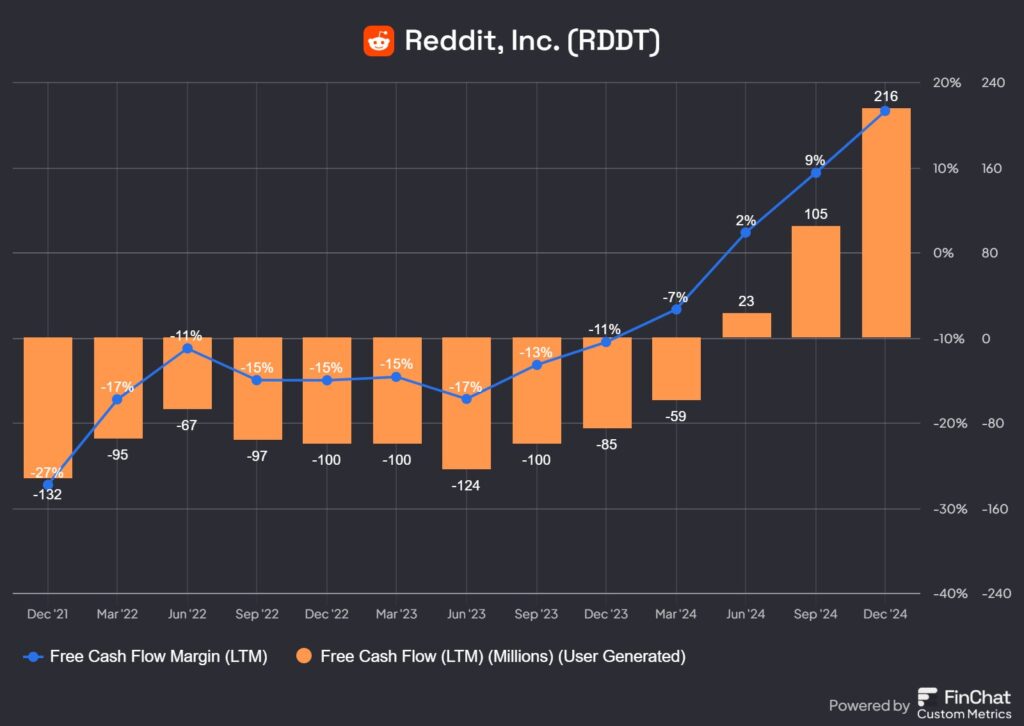

4️⃣ Post-IPO Cash War Chest

With ~$1B in cash from the IPO, Reddit has fuel to invest aggressively in product, hiring, and marketing.

5️⃣ Unique Community Model

Reddit’s mix of user-generated content and tight-knit communities (subreddits) offers differentiation from algorithm-heavy rivals like Meta and TikTok.

Bearish Risks

1️⃣ Google Search Dependency

Reddit’s SEO strategy means ~40% of traffic comes from Google; any change in Google’s algorithms can sharply impact site visits.

2️⃣ Valuation Stretched (~15x price-to-sales)

Some analysts, including at Barron’s and Bloomberg, warn Reddit’s valuation may price in too much perfection, too early.

3️⃣ Profitability Challenges

While revenue is soaring, Reddit has only recently turned modestly profitable (EPS est. $0.03) — thin margins create execution risk.

4️⃣ Stiff Competitive Pressure

Meta, Snap, X, and TikTok are fierce rivals, all of whom have deeper ad relationships, more sophisticated targeting, and larger global footprints.

5️⃣ Content Moderation + Regulatory Risk

As Reddit scales, it faces greater scrutiny over hate speech, misinformation, and platform safety, which could bring regulatory and reputational risks.

Stock Performance and Analyst Sentiment

- Current Price (Apr 29): $121.70

- Market Cap: ~$10.93B

- Analyst Consensus: Mixed — several “Buy” ratings but some caution on valuation

- Average Price Target: ~$130–140 (modest upside)

Reddit’s Q1 2025 earnings will be a make-or-break moment in its young public life.

✅ Bulls will look for proof of massive ad revenue gains, accelerating user growth, and margin expansion.

⚠️ Bears will focus on Reddit’s reliance on Google traffic, intense competition, and high valuation.

Reddit has a powerful brand, sticky communities, and massive upside — but it’s now under the Wall Street microscope.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Airbnb Q1 2025 Earnings Preview and Prediction: What to Expect

What Analysts Think of MicroStrategy Stock Ahead of Earnings?

What Analysts Think of BigBear.ai Stock Ahead of Earnings?

What Analysts Think of Amazon Stock Ahead of Earnings?

Apple Q2 2025 Earnings Preview and Prediction: What to Expect

Eli Lilly Q1 2025 Earnings Preview and Prediction: What to Expect

UK-US trade talks ‘moving in a very positive way’, says White House

Trump Eases Auto Tariffs to Avoid Industry Meltdown

Trump Administration Lays Out Roadmap to Streamline Tariff Talks

Trump Pushes Plan to Replace Income Taxes with Tariffs: “A Bonanza for America!”

California Overtakes Japan to Become Fourth Largest Economy in World