As 2025 comes to a close, private markets are entering 2026 with familiar pressures but clearer patterns. Private equity, private credit, and commercial real estate are not resetting. They are adjusting. Capital is still there, but it is more selective, more concentrated, and far less forgiving.

Rather than bold forecasts, the outlook for 2026 is shaped by trends already in motion. Fund structures, refinancing risks, and uneven recoveries will continue to define how private markets behave in the year ahead.

Private Equity: Fewer Shortcuts, More Traditional Exits

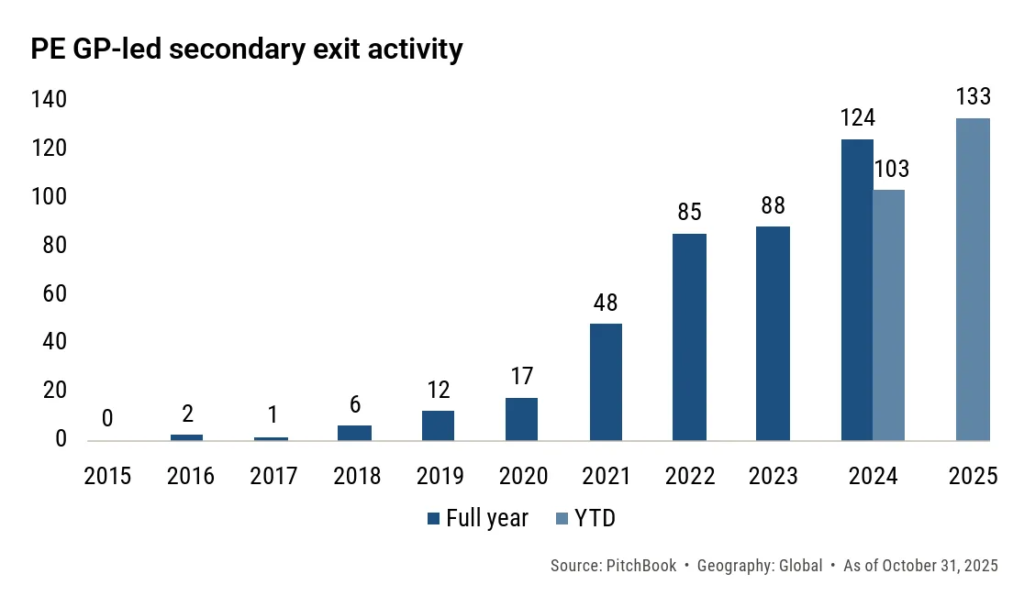

From 2023 through 2025, continuation vehicles became the main liquidity tool for private equity managers. With IPO markets largely closed and M&A activity muted, GP-led secondaries acted as a release valve for aging funds and impatient LPs.

That dynamic is starting to shift.

According to PitchBook, continuation-fund activity is expected to decline in 2026. Not because demand has disappeared, but because alternatives are slowly reopening. Lower interest rates, narrowing bid-ask spreads, and improving financing conditions are making sponsor-to-sponsor deals and IPOs more viable again.

Banks echo that view. HSBC expects rate cuts to ease buyout economics and refinancing, particularly in technology and healthcare, where IPO windows are reopening first.

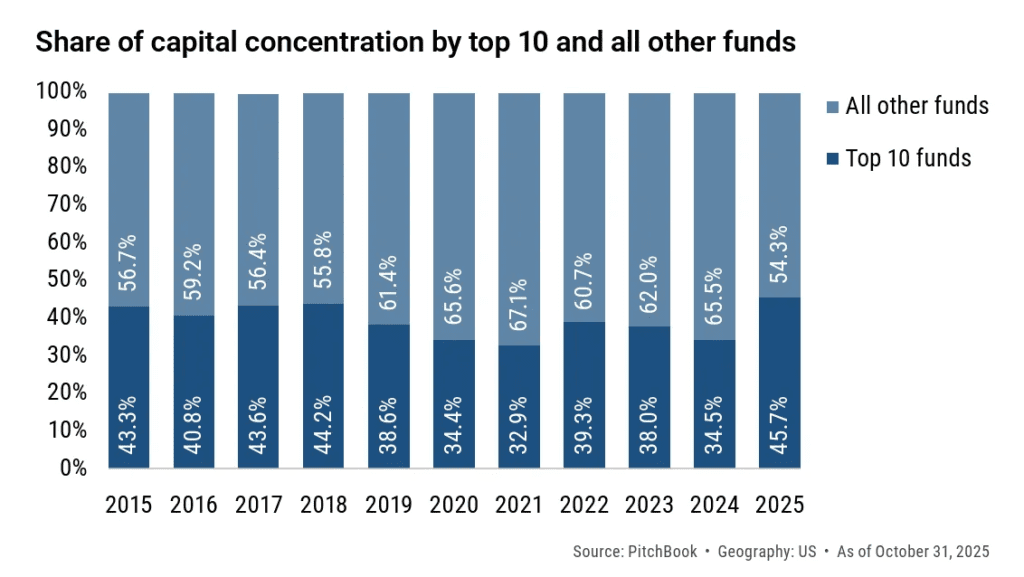

Still, fundraising remains uneven. Mega-funds continue to dominate, while smaller and first-time managers face a far tougher environment. Capital is consolidating at the top, and LPs are becoming far more selective about manager quality and track records.

The message for 2026: exits may normalize, but fundraising pressure below the top tier is not going away.

Private Credit: Defaults Are Quiet, Risks Are Not

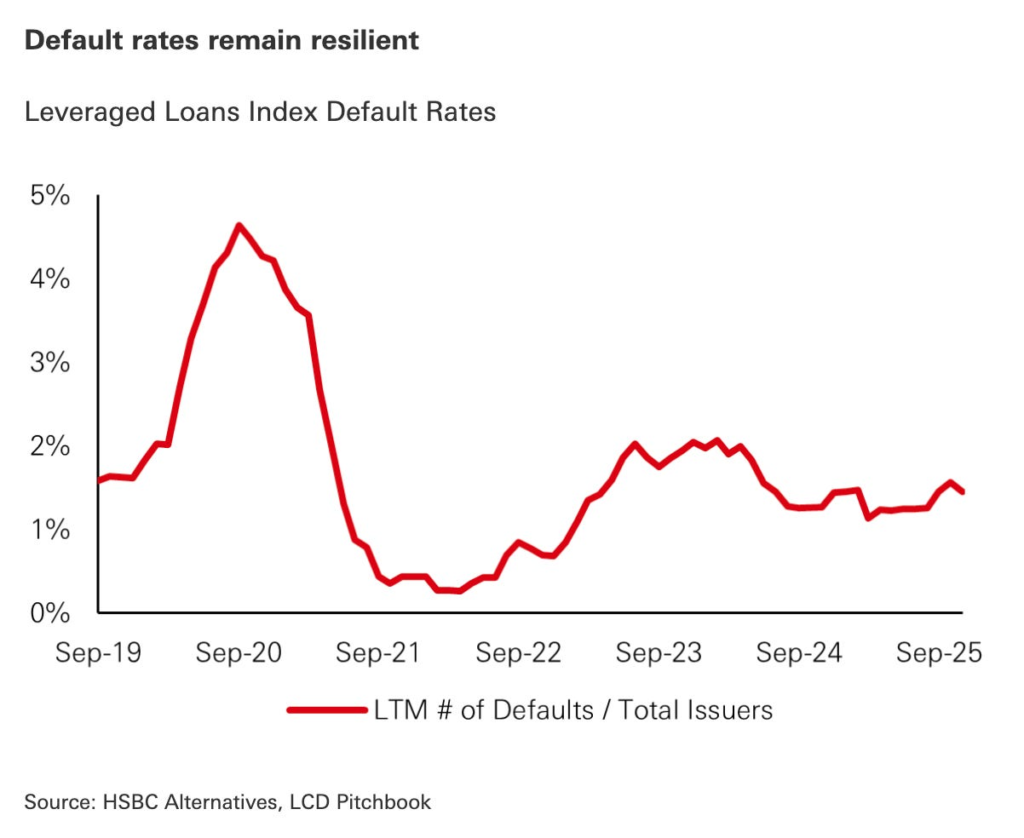

Private credit surprised many investors over the past few years. Despite higher rates, defaults stayed relatively low, helped by strong borrower fundamentals and widespread refinancing.

But averages are hiding stress.

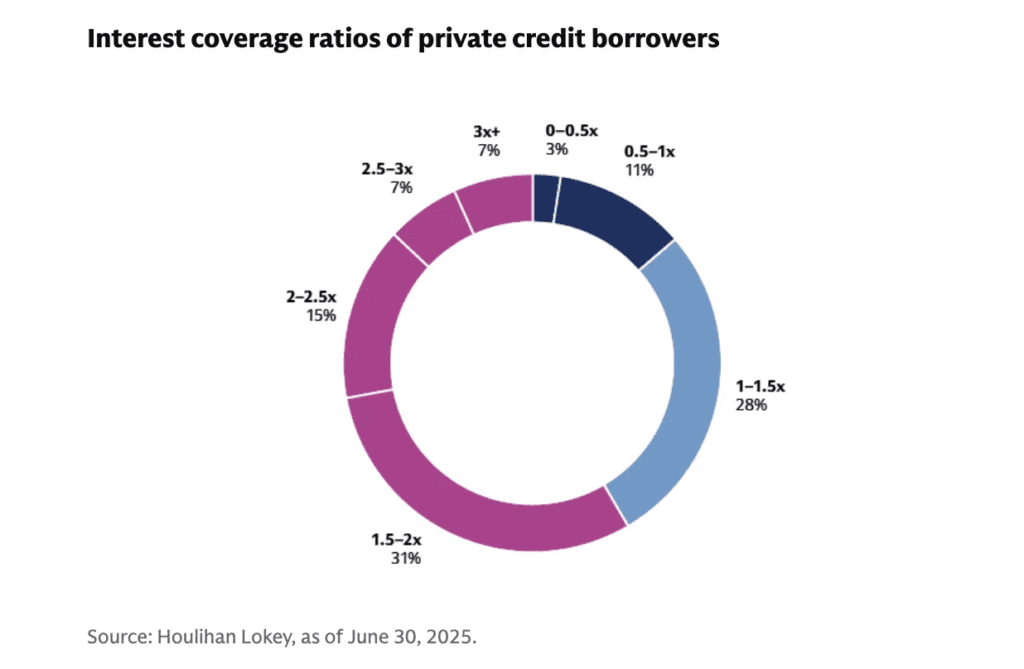

Data cited by Goldman Sachs shows that while overall interest coverage has improved, around 14% of borrowers still fail to generate enough EBITDA to cover interest costs. Risk is concentrated, not systemic, but it is very real.

The biggest fault line remains the 2021 vintage. Loans underwritten at aggressive leverage levels were hit hardest when rates reset. Many borrowers bought time using refinancings or payment-in-kind interest. About 10% of private credit loans now include PIK, much of it added after underwriting, a growing warning sign.

Rate cuts in 2026 may help marginal borrowers, but they are not a cure-all. The real test is maturity. Borrowers near 1.0x coverage are likely to need recapitalizations, hybrid capital, or fresh equity just to refinance.

Meanwhile, competition is intense. Spreads are tightening as private credit competes directly with broadly syndicated loans. According to HSBC, pricing below S+500 is now common in US buyout financings.

For LPs, especially in evergreen funds, portfolio vintage matters more than ever. Exposure to 2021 loans remains a key risk factor.

Commercial Real Estate: Recovery Is Uneven, Not Absent

Commercial real estate went through a bruising period from 2021 to 2024. Rising rates, falling values, and persistent negative headlines triggered sharp allocation cuts.

Capital did not leave because real estate stopped working. It left because losses were large, visible, and slow.

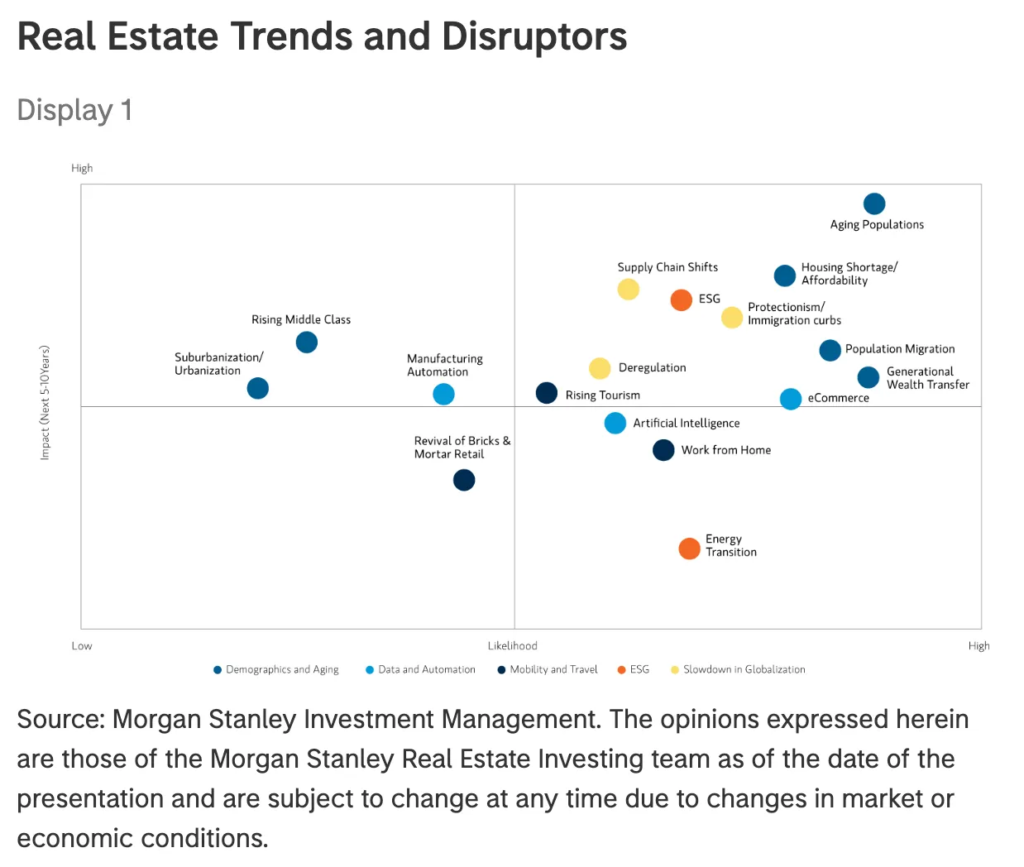

What has changed heading into 2026 is the supply backdrop. According to Morgan Stanley, muted new construction across many segments is setting up a longer, more durable recovery, especially outside traditional office assets.

Returns are shifting away from financial engineering. Cash flow now matters more than cap rate compression. Rent growth, expense control, and local supply-demand dynamics will drive outcomes.

Dispersion is widening:

- Residential benefits from demographic demand and income polarization, though Sun Belt multifamily margins may stay tight through 2027.

- Industrial remains stable, but infill logistics assets outperform regional warehouses.

- Office and retail are still challenged, yet increasingly mispriced in select markets. Blanket avoidance is no longer a strategy.

- Data centers continue to attract capital, though valuations look stretched in some regions.

The takeaway for 2026: success in real estate depends less on timing the cycle and more on owning the right assets in the right locations, with operators who can execute on the ground.

Private markets in 2026 are not about bold rebounds or dramatic collapses. They are about selection, structure, and survival.

- Private equity is slowly regaining traditional exit paths, but fundraising pressure remains intense.

- Private credit looks stable on the surface, yet refinancing risk is building underneath.

- Commercial real estate is recovering unevenly, with income and execution replacing leverage as the main drivers of returns.

For LPs, the environment demands deeper diligence, sharper manager selection, and realistic expectations. The easy money era is over. What replaces it is discipline.

Main source is accreditedinsight

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: How Big Tech Created the 2025 AI Boom on Debt

What’s Ahead for Stocks and Gold in 2026? What Markets and Experts Are Watching

Stocks Look Bullish Entering 2026 — But What Could Go Wrong?

FOMO vs. Bubble Angst Signals More Stock Volatility in 2026

Gold Breaks $4,400 as Silver, Copper and Platinum Hit Record Highs: What Comes Next

Markets Enter Final Stretch of 2025 With Santa Rally Hopes: What to watch

Trade, Tariffs, and Treasuries: The Hidden Cost of Trump’s Protectionism

Want to Know Where the Market Is Going? Don’t Trust This, or Any, Forecast.