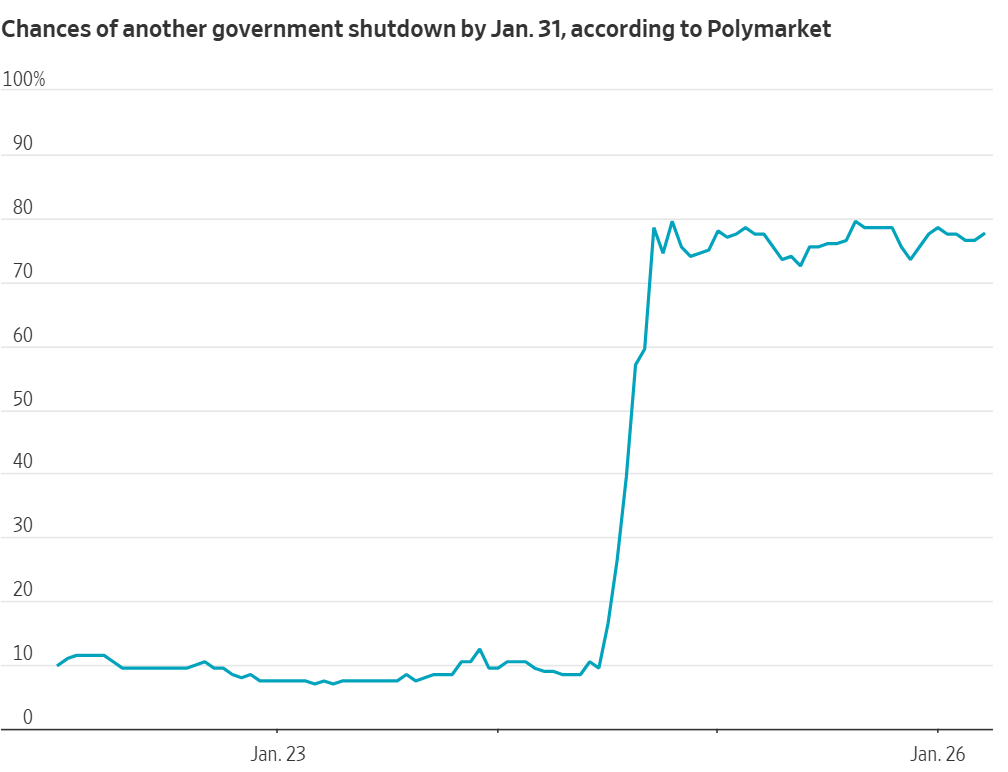

Prediction markets are now signaling a very high probability of a new US government shutdown by January 31, with odds climbing close to 80% in just a few days.

This is no longer political noise. It is a forecast driven by real legislative gridlock, and markets are already starting to react.

Here is what is driving the risk higher, why the timeline is so tight, and what it could mean for investors and crypto.

Why shutdown odds are surging

At the center of the crisis is a standoff over funding for the Department of Homeland Security (DHS).

After another fatal shooting by a federal border officer in Minneapolis, Senate Democrats unanimously decided to block DHS funding unless strict limits are placed on immigration enforcement agencies such as ICE and Border Patrol.

Senate Minority Leader Chuck Schumer said Democrats will not provide the 60 votes needed to pass the spending bill because it fails to rein in what he called “unchecked abuses of power.”

Republicans hold only 53 Senate seats, meaning just a few Democrats withholding support is enough to derail the entire package.

Independent Senator Angus King said he opposes a shutdown but cannot back DHS funding under the current terms. Other Democrats, including Catherine Cortez Masto and Chris Murphy, have called for separating DHS funding so the rest of the government can stay open.

So far, Republican leaders have shown little willingness to split the vote.

Time is extremely tight

The clock is now working against Congress.

A major snowstorm delayed Senate voting until Tuesday evening. Congress plans to begin recess midweek. And if no deal is passed by midnight Friday, several major agencies including Health and Human Services, Education, and Transportation will face partial shutdowns.

House Speaker Mike Johnson said lawmakers may need to be recalled if the Senate amends the bill, warning that tough issues cannot be avoided by sending Congress home.

Prediction markets are reacting fast.

Polymarket now shows a 78% chance of a shutdown before the end of January, up from less than 10% just days ago. Trading volume on shutdown contracts has reached about $7.5 million. Kalshi shows similar probabilities.

What a shutdown really does

A shutdown is not just government offices closing.

In last year’s 43 day shutdown:

• Hundreds of thousands of federal workers worked without pay or were furloughed

• Government services and contract approvals stalled

• Travel disruptions increased and economic activity slowed

• Business confidence weakened as uncertainty spread

Those effects show up quickly in delayed data, slower approvals, and rising market stress.

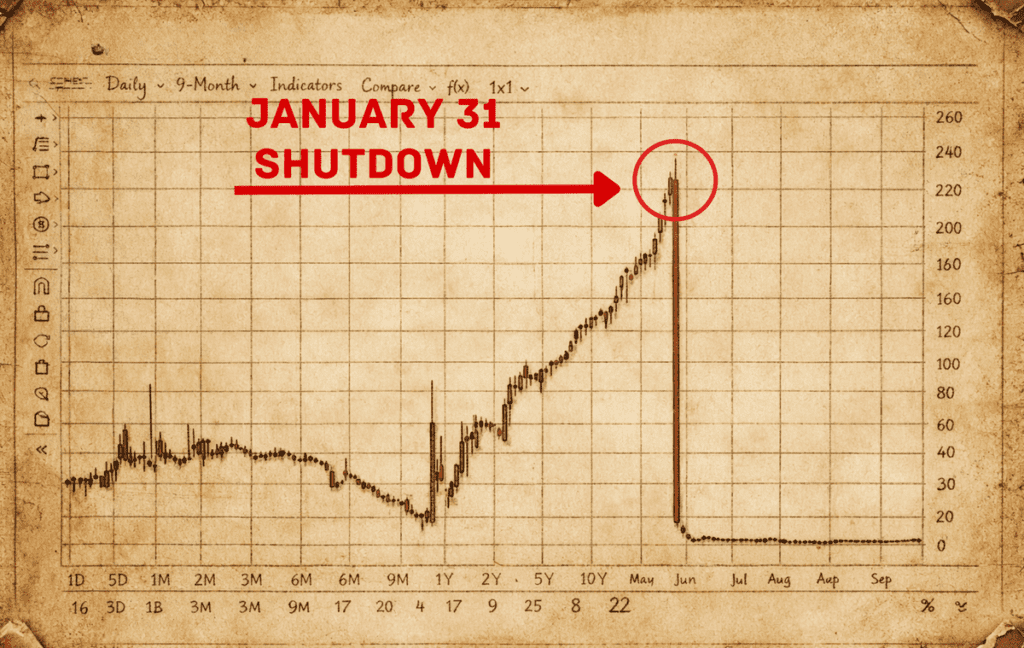

Markets price risk early

Historically, markets do not wait for the shutdown to happen.

This is how it usually unfolds:

• Bond markets react first as Treasury risk premiums rise

• Stocks wobble next as growth expectations fall

• Crypto moves fastest as traders hedge political and liquidity risk

That pattern may already be starting.

Late Sunday, the crypto market lost around $100 billion in six hours. Bitcoin fell more than 3%, Ether dropped over 5%, and more than $360 million in leveraged positions were liquidated, mostly long positions.

Why crypto feels it first

Crypto trades 24 hours a day and reacts quickly to political stress and liquidity shifts.

In a shutdown scenario:

• Economic data releases are delayed

• Investor risk appetite falls

• Liquidity tightens near month end

When traders start preparing for risk, crypto usually moves before stocks and bonds.

Prediction markets are now warning that a shutdown by January 31 is a real and rising risk.

With DHS funding blocked, votes delayed by weather, and Congress days away from recess, the path to a deal is narrowing fast.

For markets, especially crypto, the message is clear:

Political risk is rising, volatility is coming, and markets may price the shutdown before Washington acts.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: US Shutdown Fears Hit Markets as Crypto Loses $100 Billion

What to Watch This Week in Markets: Fed Day, Big Tech “Show Me” Earnings