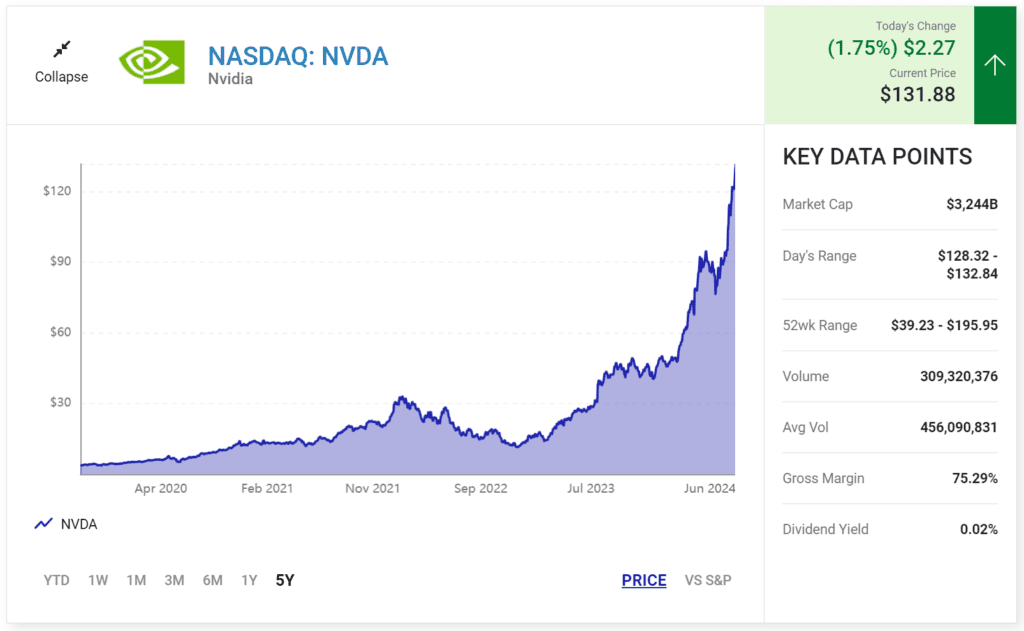

While Nvidia has been a darling of the stock market, surging in value due to its dominance in artificial intelligence (AI), a bold prediction suggests the company’s reign might be coming to an abrupt end, with its stock price poised to plummet by over 50%.

- Artificial intelligence (AI) is forecast to add nearly $16 trillion to the global economy by 2030.

- Nvidia, which completed a 10-for-1 stock split last week, has been reaping the rewards of its first-mover advantages in high-compute data centers.

- Without fail, investors have overestimated the adoption and/or utility of every next-big-thing trend, technology, and innovation since the mid-1990s.

Nvidia (NASDAQ: NVDA) has seen an extraordinary rise, with its stock soaring over 700% in the past 17 months, reaching a nearly $3 trillion market cap. This growth, driven by high-powered graphics processing units (GPUs) used in artificial intelligence (AI) applications, has made Nvidia the dominant player in the AI-GPU market.

Key Points:

- Phenomenal Growth: Nvidia’s H100 GPU has become the preferred choice for businesses developing AI applications, leading to significant revenue and margin increases. As of the latest fiscal quarter, Nvidia’s gross margin reached an impressive 78.4%.

- Stock Split: Nvidia recently executed a 10-for-1 stock split, making shares more accessible to smaller investors. This move did not change the intrinsic value of the company but increased market accessibility.

- Historical Risks: Despite its recent successes, Nvidia faces a historical trend of overvaluation and subsequent corrections in next-big-thing technologies. Historical precedents include the dot-com bubble, genome decoding, 3D printing, blockchain, and electric vehicles, all of which saw their leading stocks plummet significantly.

- Upcoming Competition: Nvidia is expected to face increased competition from Intel and Advanced Micro Devices, which are introducing AI-GPUs aimed at high-compute data centers. Additionally, Nvidia’s top customers are developing their own GPUs, potentially reducing dependence on Nvidia’s products.

Outlook: While Nvidia’s leadership in AI technology is clear, historical trends suggest a potential correction. Nvidia’s valuation may face pressure from both internal developments and external competition. Although pinpointing the exact timing of a market correction is difficult, historical data indicates that Nvidia could eventually see a significant drop in value.

Nvidia’s remarkable rise has been driven by its AI advancements and strong market demand. However, historical trends in technology markets and increasing competition suggest that caution is warranted, with a potential significant correction looming in the future.