Palantir heads into tonight’s print with attention centered on (1) whether AIP-driven commercial momentum is translating into operating leverage, (2) how far U.S. federal awards are de-risking the near-term outlook, and (3) how management frames full-year guidance after a sizable raise last quarter. With the stock elevated and expectations not shy, quality of beat and tone of guidance may matter more than headline upside.

Consensus Snapshot (what Wall Street is modeling)

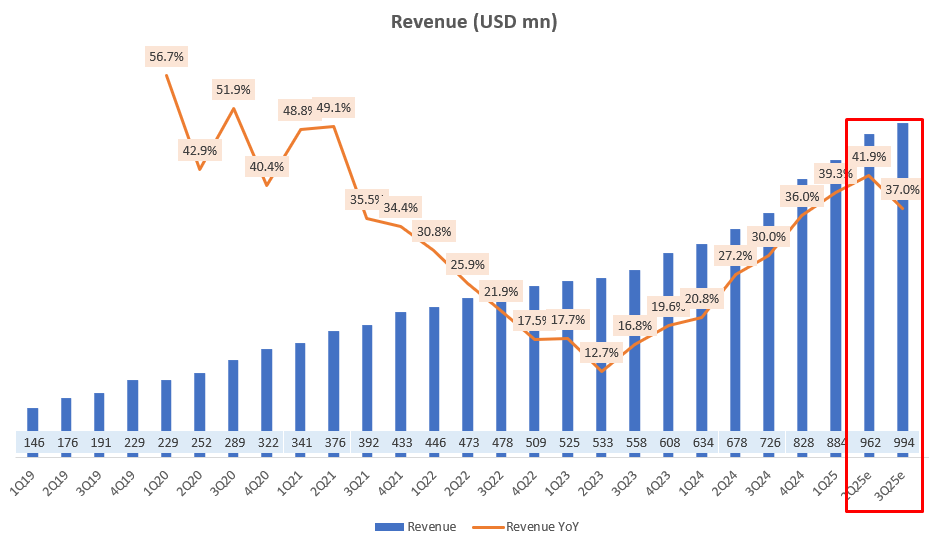

- Revenue: ~$934–$939M (≈ +38–40% YoY), in line with company guidance.

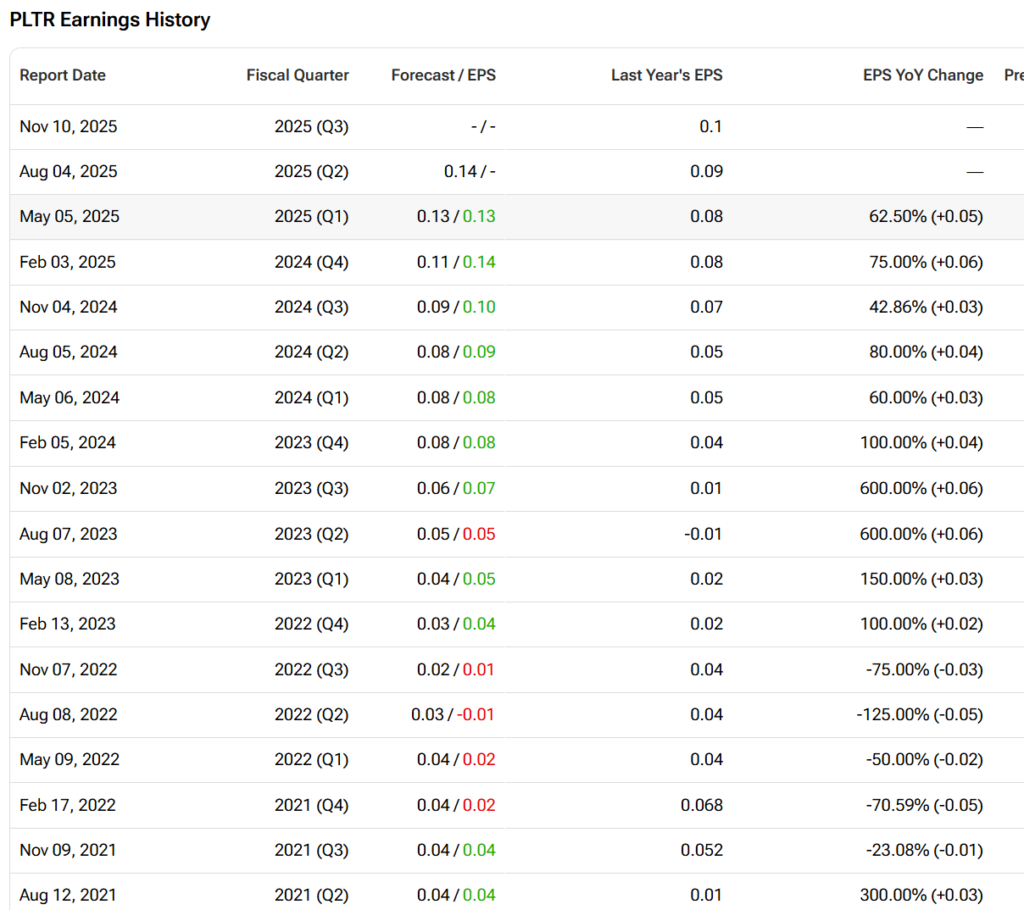

- EPS (GAAP, diluted): ~$0.14 (≈ +50%+ YoY on consensus).

- Adjusted operating income (AOI): ~$401–$405M (company guide).

- Free cash flow (FCF): several previews imply ~$300–$330M for Q2.

- FY25 guide (prior): revenue $3.89–$3.902B; U.S. commercial ≥ $1.178B (≥ +68% YoY); AOI $1.711–$1.723B; GAAP profitability each quarter.

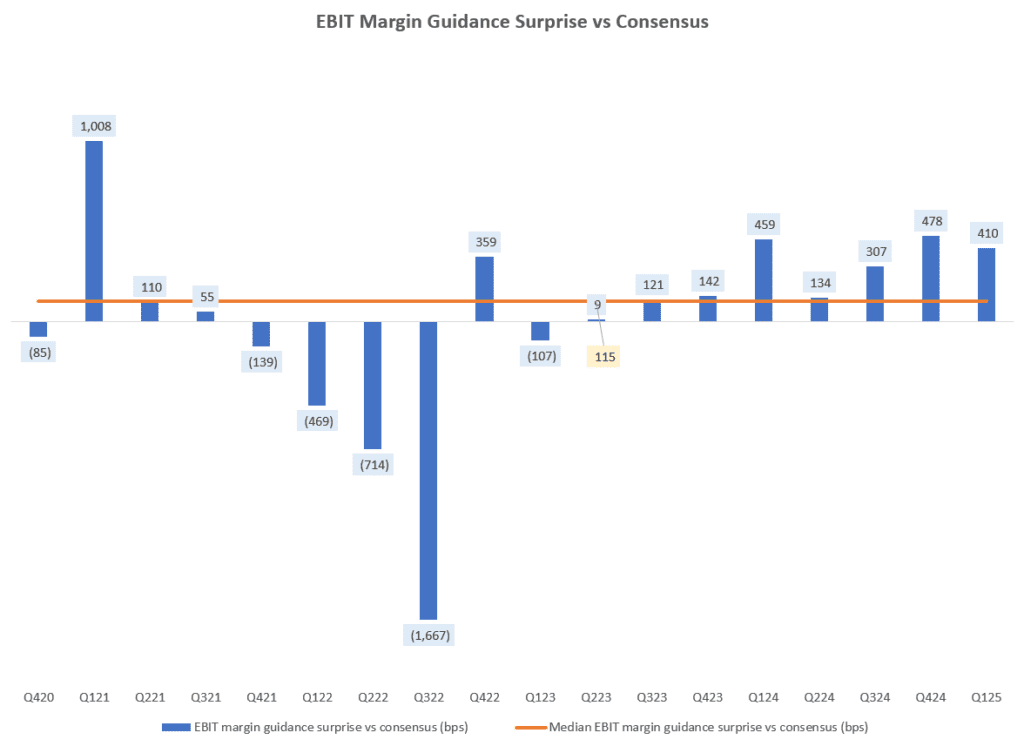

Why it matters: Revenue is guided tightly; the swing factor is margin (AOI/FCF) and how much management raises the FY25 outlook given deal flow in government and AIP adoption in commercial.

What to Watch (and why it moves the stock)

1) U.S. commercial growth & AIP conversion

The Street will look for evidence that AIP (Palantir’s AI Platform) is scaling beyond pilots: new logo adds, seat expansion, and larger initial contracts. Commentary on sales cycle length, price realization (AIP premium vs. Foundry/Gotham), and use-case breadth (industrial, healthcare, energy) will shape durability expectations.

2) Government momentum & contract visibility

Investors will parse updates on DoD programs—including the Army enterprise agreement—for bookings/backlog color and run-rate contribution over the next 12–24 months. Any quantification of TITAN, Navy/air programs, or allied-nation deals (U.K., NATO partners) will help bridge guidance to 2H targets.

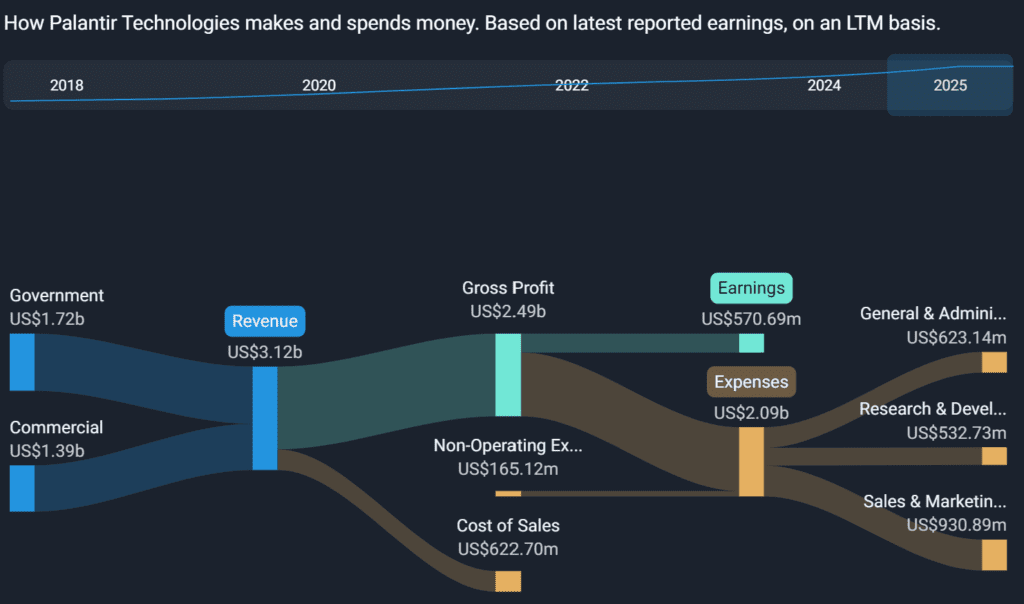

3) Margin mechanics: AOI, FCF, and SBC

Consensus implies healthy operating leverage; the debate is how much is coming from gross margin mix (software vs. services), cloud cost efficiency, and S&M productivity. Watch SBC trajectory and cash tax timing—key to sustaining $1.6–$1.8B FY FCF guidance.

4) Net retention, customer count, and deal sizes

Beyond revenue, NRR, customer adds, and $1M+/ $10M+ deal cohorts will indicate whether growth is broad-based versus concentrated. Any update on U.S. commercial net expansion and international rebuild will be closely watched.

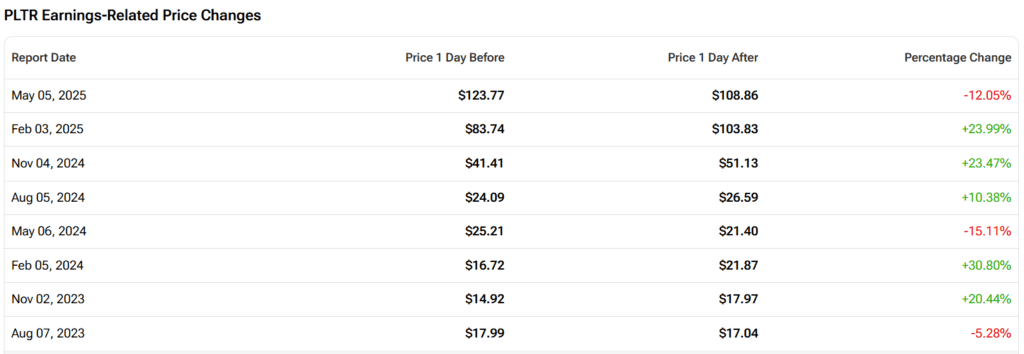

Trading Setup (implied move & positioning)

Into the print, sentiment is divided: fans see accelerating AI monetization and federal tailwinds; skeptics argue the valuation embeds perfection. Previews highlight a double-digit typical post-earnings move for PLTR; options positioning implies a wide reaction band around the guide. In short: a beat is expected—the guide must clear a high bar.

Bullish Case — facts to confirm on the call

- Guide raise with margin follow-through: A lift to FY25 revenue/ AOI/ FCF would support the thesis that AIP + federal is scaling, not just spiking.

- Commercial engine stays hot: Another quarter of outsized U.S. commercial growth (company’s ≥ +68% full-year target) plus strong logo adds would validate pipeline breadth.

- Federal de-risking: More detail on the Army enterprise agreement and associated programs (plus NATO/allied wins) would underpin multi-year visibility and reduce downside variance.

- Cash generation: FCF prints in the $300M+ zip code and stable SBC mix bolster durability of the model.

Bearish Watch-outs — where the narrative could wobble

- Operating leverage disappoints: If AOI/FCF land only in line with guide (or below) despite strong revenue, the market may question cost discipline and the pace of AIP monetization.

- Commercial deceleration or concentration: Signs that growth is concentrated in a handful of mega-accounts, or that international/commercial ex-U.S. is lagging, would dent the “broadening adoption” story.

- Contract timing risk: Government programs can slip; any push-outs or lack of quantification on the Army agreement could temper FY25/26 models.

- Valuation sensitivity: With the multiple stretched, even a meet/ modest beat paired with conservative guide could trigger a drawdown.

Scenario Map (how the tape could trade)

- Bullish: Revenue ≥$940M, EPS ≥$0.15, AOI above top-end; FY25 revenue and AOI/FCF raised; clear color on Army/TITAN and broad AIP adoption → positive re-rate despite lofty expectations.

- Base/Neutral: Revenue $934–$939M, EPS ~$0.14, AOI in-range; FY25 reiterated with constructive tone → choppy to modest reaction given a high bar.

- Bearish: Revenue < guide mid, EPS ≤$0.13, no raise (or cautious tone on federal timing) → multiple compression risk near term.

For tonight, quality of guidance is the fulcrum. Revenue is guided tightly; the stock’s reaction should hinge on how convincingly Palantir translates AIP + federal momentum into higher FY25 revenue, AOI, and FCF, while showing broad-based commercial adoption beyond a few marquee wins. A raise with margin follow-through likely keeps the up-trend intact; anything short risks a “good, not good enough” response for a name priced for excellence.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Sources: Saxo Bank; Investopedia; Investors Business Daily (IBD); Yahoo Finance – Preview 1 • Preview 2 • Top-line Focus; Nasdaq – Earnings Hub • Preview/What to Expect; Zacks – Calendar • Preview • Projections; Morningstar; MarketBeat – Earnings Page • Originals ; TipRanks – PLTR Page • The Fly Round-Up; Simply Wall St; Seeking Alpha – Preview; AInvest – Preview 1 • Preview 2; The Globe and Mail – Press Release; Moomoo – Earnings Page • Community Preview; Investing.com – Preview/Analysis; Saxo/IG – Big Tech Preview Compilations • IG Note; Wall Street Horizon – Calendar; YouTube – Preview Video; Palantir Investor Relations – Newsroom • Q1 FY2025 Release/Transcript.

Related:

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years