Nvidia just raised the bar again in AI hardware. The chip giant unveiled its new Rubin CPX GPU, purpose-built for million-token coding and generative video, alongside a rack-scale platform it says can multiply AI performance by 7.5x. But the launch comes as Congress pushes for tougher limits on selling advanced chips to China, putting the world’s most valuable company at the heart of America’s tech rivalry.

Rubin CPX: Built for massive-context AI

At its AI Infrastructure Summit, Nvidia introduced the Rubin CPX GPU, a new processor designed to handle workloads that traditional GPUs struggle with — million-token context for code generation and high-resolution generative video.

Key details:

- Performance: Up to 30 petaflops of AI compute with 128GB of GDDR7 memory.

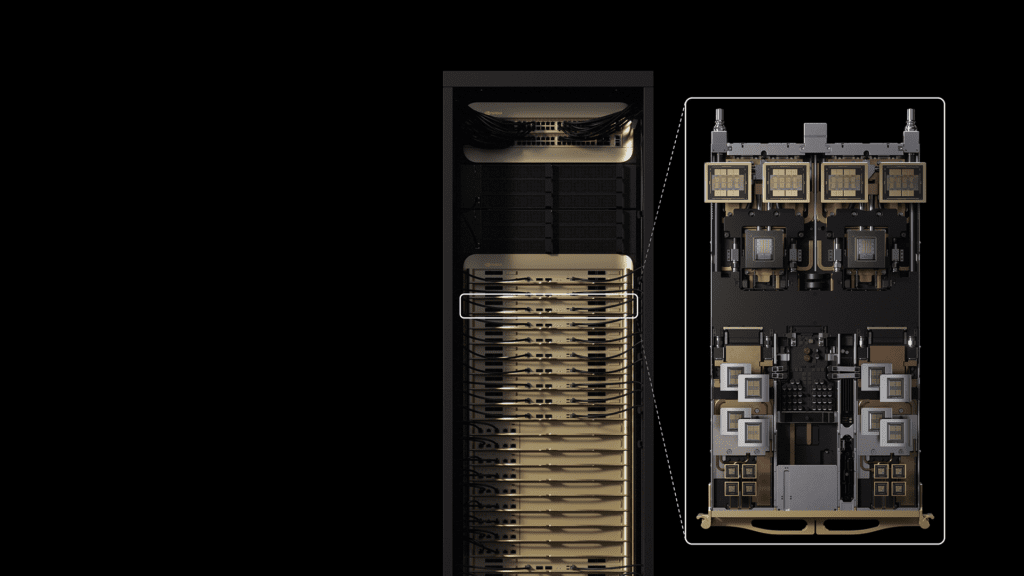

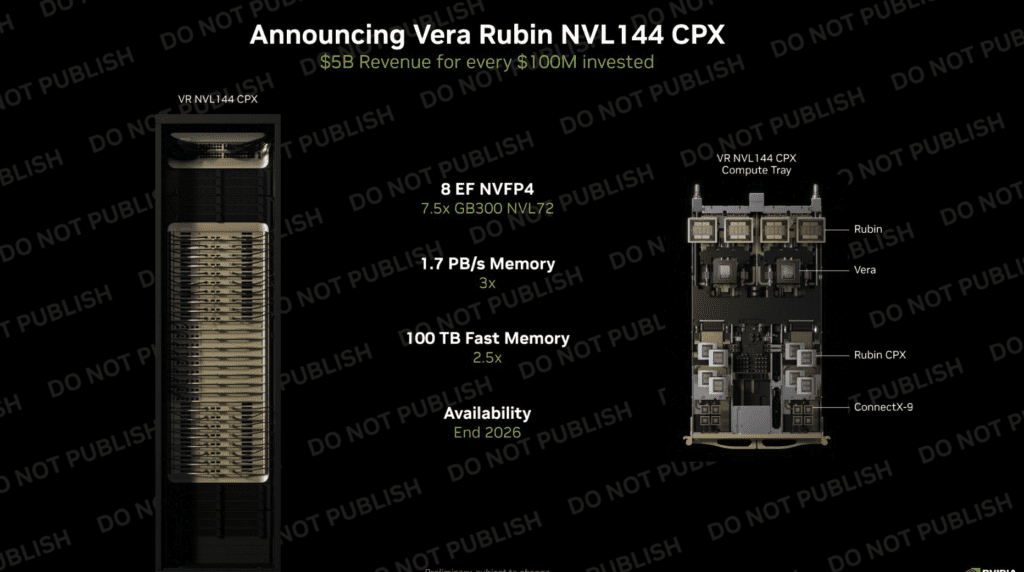

- Platform: The Vera Rubin NVL 144 CPX system (144 GPUs in one rack) offers 7.5x more performance than the current Blackwell GB300 NVL 72, with 100TB of fast memory and 1.7 petabytes/s bandwidth.

- ROI model: Nvidia estimates a $100 million capex investment in Rubin CPX could generate $5 billion in token revenue — highlighting how economics, not just power, drive AI adoption.

- Availability: Late 2026, with early adopters including Cursor, Runway, and Magic AI.

CEO Jensen Huang called it “the first CUDA GPU purpose-built for massive-context AI”, adding that Rubin CPX integrates video decoding, encoding, and inference in a single chip — critical for long-form video and complex reasoning tasks.

Benchmarks: Blackwell Ultra still leading today

Alongside the Rubin announcement, Nvidia reported fresh MLPerf v5.1 results for its Blackwell Ultra (GB300 NVL72) platform, claiming:

- 1.4x more throughput on DeepSeek-R1 versus GB200,

- Per-GPU inference records across key benchmarks, including Llama 3.1 405B and Whisper, cementing Nvidia’s edge in AI efficiency.

These results keep Blackwell at the top of current deployments even as Rubin is positioned as the next leap forward.

Nvidia’s “AI factories” vision

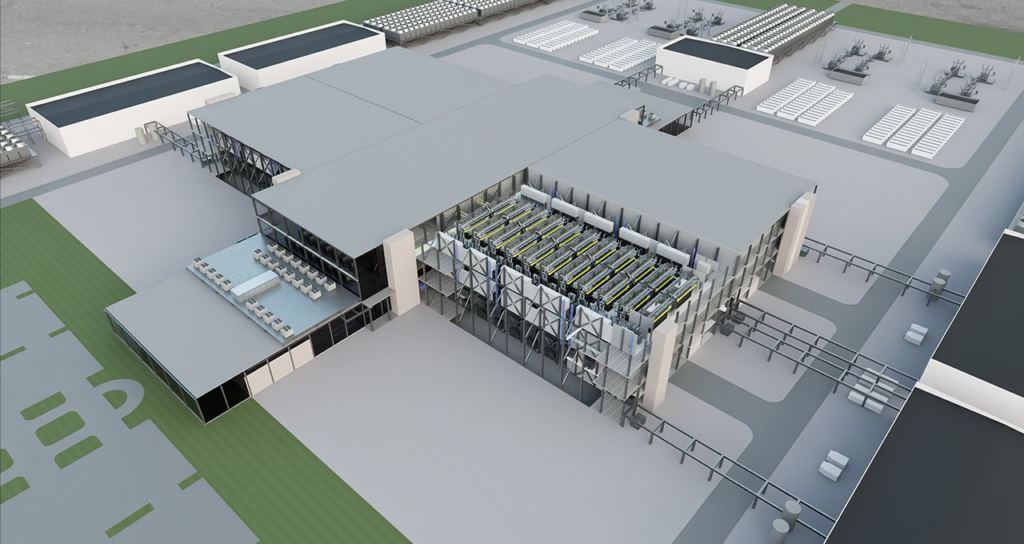

Beyond chips, Nvidia is now pitching full-stack AI factory blueprints: giga-scale data centers purpose-built for reasoning AI. VP Ian Buck said the company is moving “beyond chips into reference designs”, working with Siemens Energy, Schneider Electric, Vertiv, Jacobs, and GE Vernova to integrate compute, power, and cooling.

Key innovation: Digital twins in Omniverse will simulate entire facilities — from power grids to water systems — before construction. The idea: reduce cost, risk, and energy waste while accelerating deployment of AI infrastructure.

Political crosscurrents: China sales in the spotlight

The rollout comes just as Nvidia finds itself in a political storm. Congress is weighing amendments to restrict AI chip sales to China, even as the Trump administration loosened rules earlier this year. Lawmakers argue Nvidia’s chips are too strategic to be exported freely.

- Potential loss: Nvidia could make up to $50 billion in China sales over the next year, making restrictions a major revenue threat.

- Lobbying push: Nvidia has branded critics as “AI doomers,” with White House AI czar David Sacks amplifying attacks on proposed curbs.

- Security hawks push back: Republicans like Senator Jim Banks insist limiting sales is an “America First” move, warning Chinese firms could weaponize U.S. hardware.

The Senate is expected to vote soon on new controls, raising uncertainty over Nvidia’s future in its second-largest market.

Market implications

Nvidia’s announcements underscore why it dominates the AI hardware race: performance leaps, ecosystem lock-in, and full-stack vision. Rubin CPX and AI factories could extend its lead into the late 2020s.

But the geopolitical fight over China sales is the wild card. If Congress forces curbs, Nvidia risks losing a huge revenue pool, testing whether U.S. leadership in AI can coexist with tighter export rules.

For investors, the message is twofold:

- Technologically: Nvidia still sets the pace — Rubin CPX promises unmatched economics for next-gen AI.

- Politically: Washington, not Wall Street, may decide how much of that value Nvidia actually captures.

Nvidia just sketched the next era of AI hardware and infrastructure. But as Rubin CPX promises 7.5x leaps in performance, the company faces a parallel test — whether it can keep selling its most advanced chips abroad, or whether U.S. politics redraws the map for AI leadership.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

France’s Government Collapses — What Moved in Markets and What’s Next

The Big Question: Are Crypto ETFs About to Explode?

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Bitcoin ETFs Surge on Trump Election Prospects, Market Braces for Volatility