Nvidia (NASDAQ: $NVDA), the undisputed leader of the AI hardware race, is set to report fiscal Q1 2026 earnings on Wednesday, May 28, after market close. Following a historic 2024 where Nvidia’s valuation soared past $2.2 trillion and revenue nearly doubled, Wall Street now faces a new question:

Can Nvidia keep the AI boom going—despite chip export bans, rising competition, and China revenue headwinds?

This deep-dive preview covers everything traders, investors, and beginners need to know.

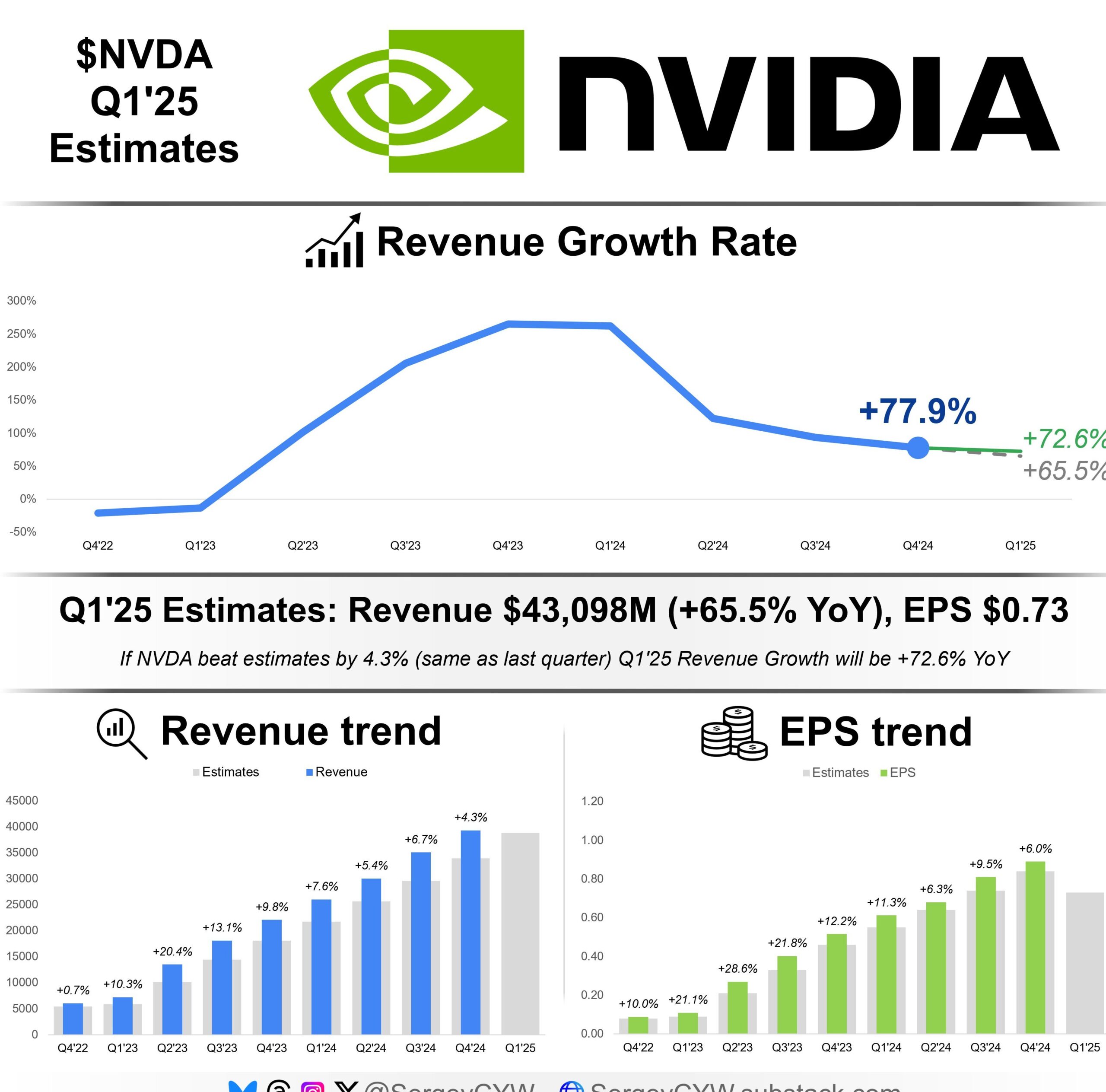

Wall Street Expectations (Q1 FY2026)

As of May 28, 2025 (from TipRanks, CNBC, Nasdaq, Yahoo Finance):

- Revenue: $43 billion

→ Up ~110% YoY from $20.5B last year - EPS: ~$5.58 per share (non-GAAP)

→ Up ~460% YoY - Gross Margin: ~70.6% GAAP / 71% non-GAAP

- Data Center Revenue (expected): $36–38B+

- Gaming Revenue (expected): ~$2.5B

Nvidia last guided for $43B in revenue, citing strong demand for Blackwell chips and sustained hyperscaler orders.

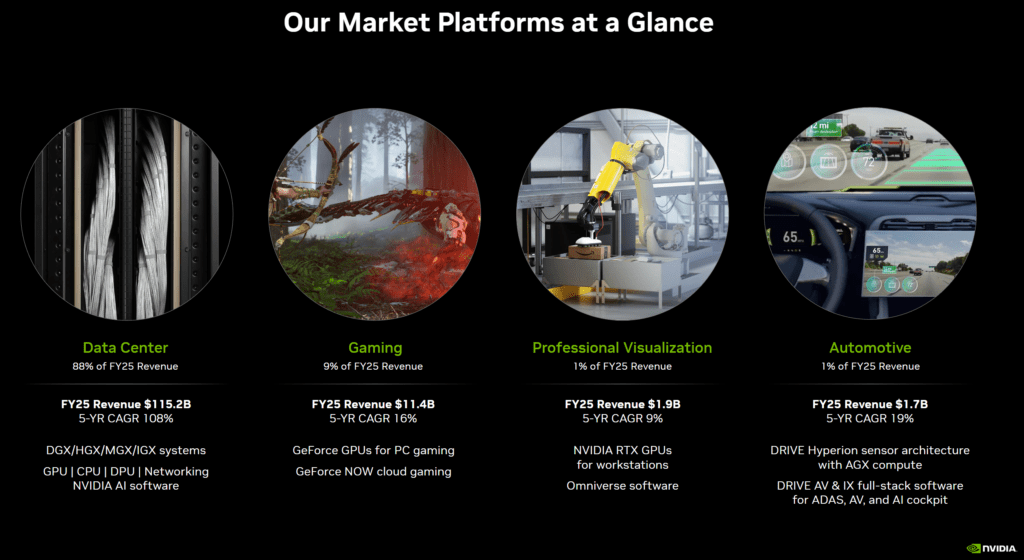

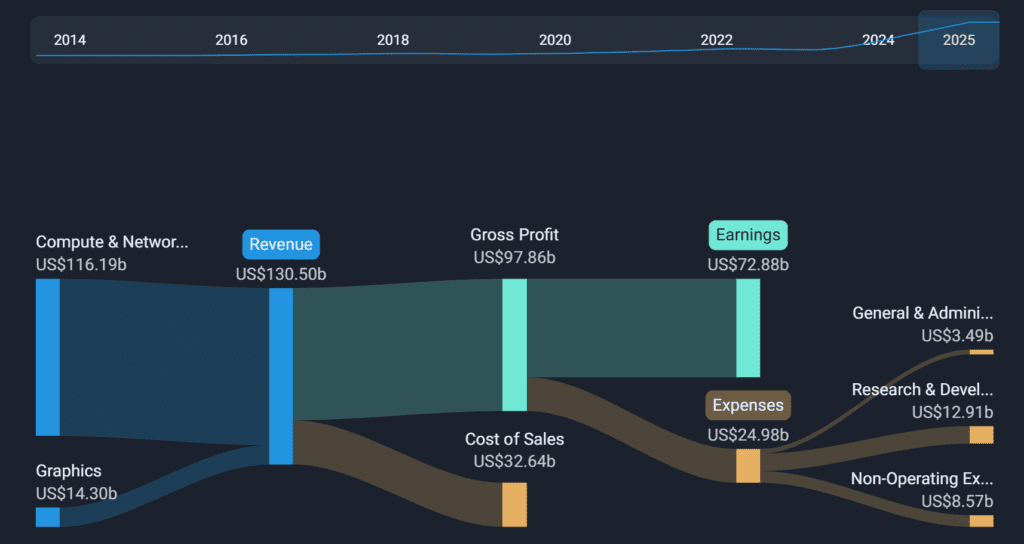

Segment Analysis: Where Growth Is Coming From

Data Center (70–75% of revenue)

- Fueled by demand from Microsoft, Amazon, Meta, Oracle, and Tesla

- Blackwell architecture sales are ramping fast, with $11B in initial Q4 orders

- Total FY2025 data center revenue hit $115.2 billion (vs $52.8B FY2024)

Automotive

- Revenue of $570M last quarter, +103% YoY

- Partnerships include Toyota, Aurora, and Chinese EV makers

- Seen as a long-term “AI on the edge” opportunity

Professional Visualization

- Grew 10% YoY, hit $511M in Q4

- Used in AI labs, digital twins, and metaverse applications

Gaming

- Down 11% YoY

- Still contributes ~$2.5B/quarter but no longer a growth driver

Networking

- Down 3% sequentially

- Supply chain normalization, but long-term still tied to Blackwell and Infiniband sales

Bearish Case

- China export bans remove ~$5.5B in sales

→ H20 ban confirmed in April; no near-term solution - Margins under pressure

→ Gross margin fell to 73% from 74.6% in Q3

→ Management says margins will remain in the low 70s through Blackwell buildout - Gaming weakness

→ Revenue fell 22% sequentially, now just 6% of total sales - Valuation extremely high

→ Nvidia trades at ~35–40x forward earnings, even after rallying 230% in 12 months - Market saturation risk

→ Some analysts (Morningstar, TheStreet) warn of hyperscalers slowing spend after 2025 as capacity stabilizes

Bullish Case

- Blackwell product ramp is record-breaking

→ $11B in Q4; CEO Jensen Huang says demand > supply through 2026

→ Fastest ramp in Nvidia history - Data Center strength unmatched

→ +93% YoY, $35.6B in Q4 alone

→ Total FY25: $115.2B (up from $52.8B in FY24) - AI supercycle still early

→ Goldman Sachs, BofA, and Barclays expect Nvidia to grow >30% YoY in FY2026

→ IG forecasts $500B in cumulative AI capex over next 4 years - International partnerships offset China loss

→ UAE, Saudi Arabia, India AI investments rising (The strategic partnership with HUMAIN could drive $800 million to $1 billion of incremental revenue)

→ New chip variants for restricted countries under development - New verticals ramping

→ Automotive +103%

→ Industrial/robotics use cases growing

Latest Key Factors Influencing Q1 Results

1. $5.5 Billion Charge Due to China Export Restrictions

Nvidia announced a $5.5 billion charge related to U.S. export restrictions on its H20 AI chips to China. This move has significantly reduced Nvidia’s market share in China from 95% to 50%. While the charge is substantial, analysts believe the impact on Q1 revenue may be limited, with more pronounced effects expected in Q2.

2. Resolution of Supply Chain Issues

Nvidia’s suppliers, including Foxconn and Dell, have resolved technical issues related to the GB200 AI data center racks, which combine Grace CPUs and Blackwell GPUs. Shipments began at the end of Q1, potentially contributing positively to the quarter’s performance.

3. Blackwell Product Ramp-Up

The Blackwell architecture, introduced recently, has seen strong demand. Oracle reportedly placed a $40 billion order for Nvidia AI GPUs for a new data center, indicating robust future demand. While significant revenue from Blackwell is expected in subsequent quarters, initial contributions may be reflected in Q1 results.

4. Strategic Partnerships in the Middle East

Nvidia has formed partnerships with Gulf nations, including Saudi Arabia and the UAE, to develop AI infrastructure. These collaborations aim to offset the revenue impact from China and expand Nvidia’s global footprint.

Prediction & Market Expectations

- EPS Beat Likely: Strong demand from hyperscalers and AI developers will drive bottom-line upside

- Revenue Beat Possible: Analysts say Q1 may hit $44–45B vs $43B guidance

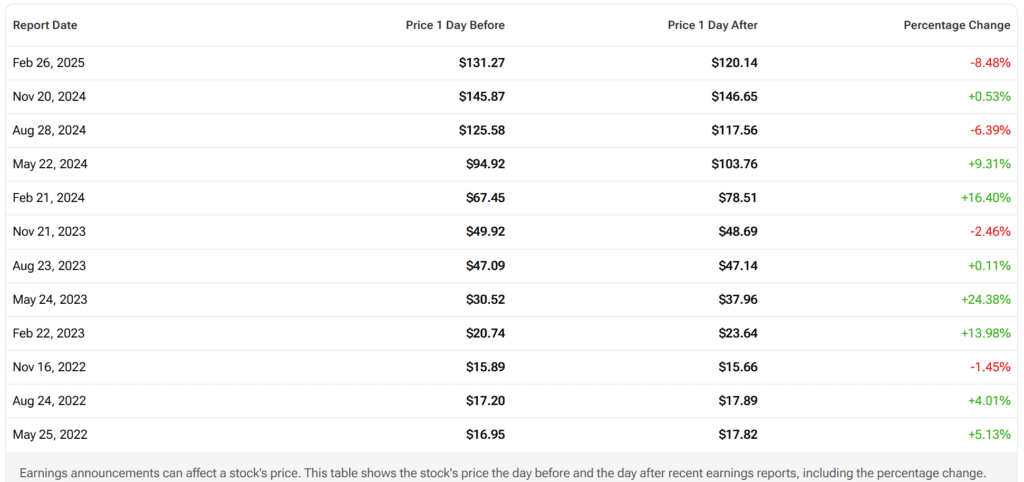

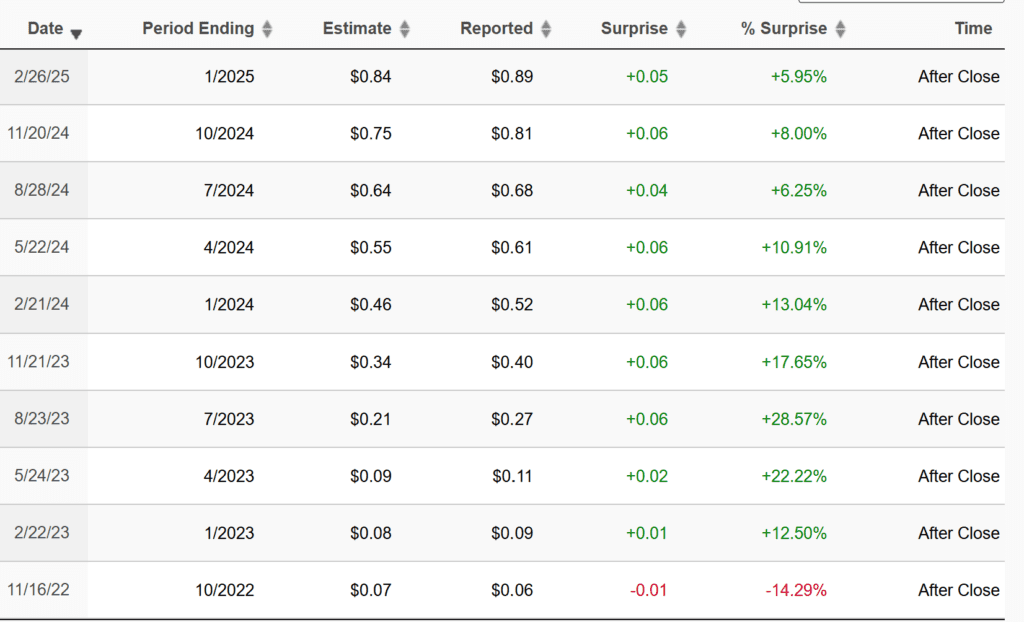

- Stock Reaction: Depends on forward guidance, China update, and gross margin forecast

Final Takeaways for Investors, Traders, and Beginners

Wall Street analysts are unanimously bullish, but extremely cautious going into Nvidia’s Q1 FY2026 earnings, scheduled for Wednesday, May 28, after the bell.

What Analysts Are Watching:

- Whether data center and Blackwell chip ramp beat aggressive expectations

- Impact of $5.5 billion China export charge on margins and future outlook

- Potential upside from AI demand, Arab partnerships, and new supply chain ramp-ups

- Weakness in gaming and China sales from export curbs

Consensus View:

“Expect another strong print, but slower acceleration. Nvidia likely beats again — but any softness in forward guidance, especially around data center momentum or China exposure, could spark a short-term sell-off.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia to launch cheaper Blackwell AI chip for China after US export curbs

Nvidia CEO Slams Biden’s AI Chip Export Curbs as a “Failure,” Backs Trump’s Reversal

Nvidia Expands in China & Taiwan as US Export Rules Tighten

Nvidia’s Partnership With Saudi Arabia Opens a New Frontier in Global AI

Nvidia is working on China-tailored chips again after US export ban