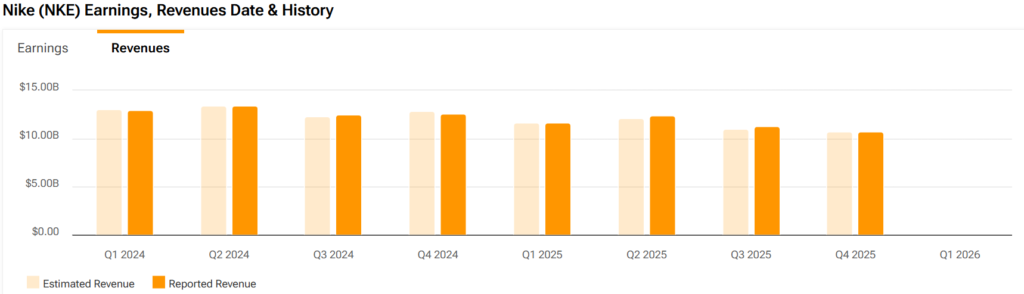

Nike is set to report its Q4 FY2025 earnings on June 27 after the bell. Wall Street expects weak results, weighed down by softer demand in key regions and ongoing cost pressures. Still, growth in digital and Asia-Pacific offers some hope. Here’s a full breakdown of what to watch — from forecasts to market sentiment.

Earnings Context & Dates

- Earnings Release Date: Nike (NYSE: NKE) is set to announce Q4 FY2025 results on Thursday, June 26, after-market, following its fiscal year end on May 31 .

- Fiscal Year Alignment: The quarter reflects the impact of spring/summer collections, with implications for guidance into the back half of 2025.

Street Estimates & Trends

| Metric | Q4 Estimate | YoY / QoQ Comparison |

|---|---|---|

| Revenue | $13.4 billion (-1.5%) | Slight YoY decline; watch regional trends |

| EPS (GAAP) | $0.63 | Down from $0.82 in Q4 FY2024 |

| Adjusted EPS (non-GAAP) | $0.78 | Corporate adjustments expected |

| Gross Margin | ~44.5–45.0% | Soft vs 46.3% YoY; cost pressures remain |

| Operating Margin | ~11–12% | Slight compression from prior quarter |

- Barron’s notes that growing direct-to-consumer (DTC) and digital revenues could offset weakness in wholesale.

- Zacks Consensus remains cautious: U.S. weakness met by strength in China/NA, likely resulting in a minor beat .

Primary Drivers & Market Signals

As Nike heads into its fiscal Q4 earnings, here are the key trends, backed by data and market sentiment:

1. Regional Performance Split

- North America & Europe: Nike has warned of “mid-teens percentage” revenue declines in Q4. Wall Street polls expect around 15% YoY drop—translating to just $10.7B–10.8B in sales, down from ~$12.6B a year ago

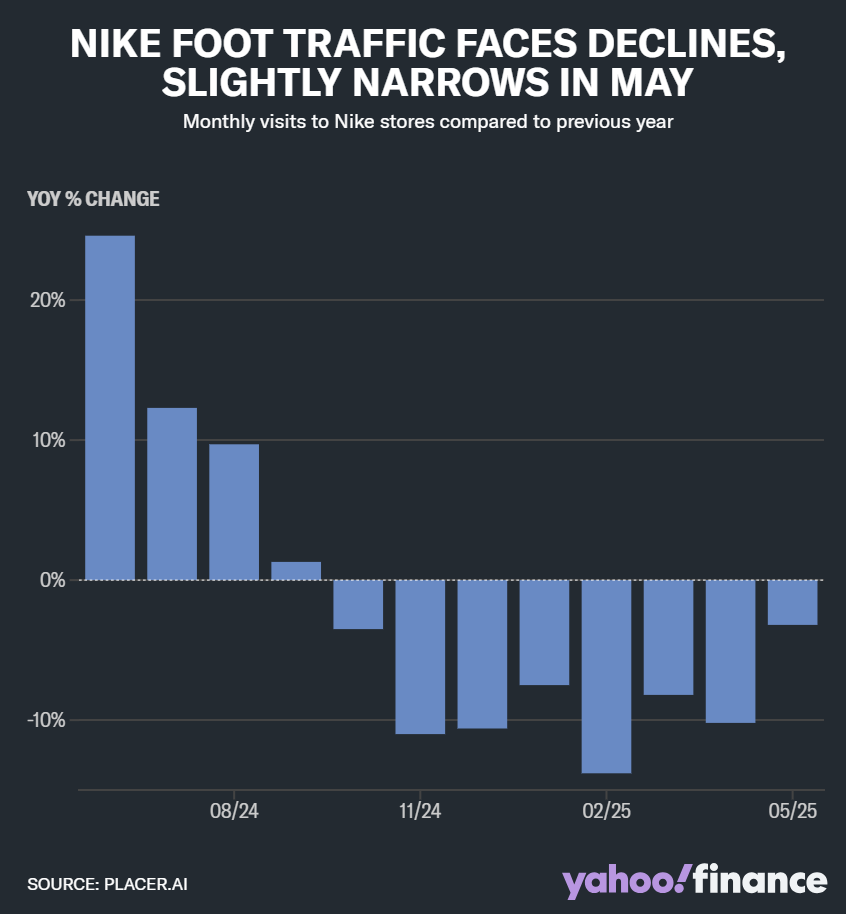

Placer.ai data shows consistent eight months of foot-traffic decline in Nike stores, even modest recovery in May (~–3%), down from –10% earlier this quarter - Greater China & Asia-Pacific: Fiscal Q3 saw a 17% drop in China sales, a key reason margins fell ~330 bps to 41.5%

Analysts expect China to be a focal point: a continued decline could shift the narrative toward “Nike losing relevance” in this market

2. Channel Shifts: DTC & Digital

- Nike’s direct-to-consumer (DTC) and digital channels now make up ~40% of total sales, compared to ~35% pre-pandemic.

- That channel, which includes Nike-owned stores and e‑commerce, is expected down 12% YoY this quarter (~$4.7B versus $5.35B last year) .

- Wholesale sales are also pressured, down

7% YoY ($6.2B vs $6.7B) .

This split shows that while Nike’s DTC strategy offers pricing leverage, it’s not immune to the broader consumer slowdown.

3. Cost & Tariff Pressures

- Nike expects gross margin to fall by 400–500 bps YoY in Q4

- Q3 gross margin was already 330 bps lower YoY at 41.5%, driven by discounts, supply-chain costs, and higher inventory reserves

- Tariffs continue to bite: a new 20% tariff on China imports could affect up to 25% of Nike’s goods

Input inflation (cotton, logistics, exchange rates) continues to pressure margins — Nike may have to absorb costs rather than pass them on to already price-sensitive consumers

4. Insider & Hedge Fund Activity

- According to QuiverQuant, recent insider selling was detected at Nike, which typically doesn’t signal bullish momentum

- Visible Alpha shows a balanced analyst stance: out of 17 ratings, 8 Buys, 8 Holds, and 1 Sell, with an average price target of $72

- Hedge fund positioning is mildly underweight, with limited accumulation ahead of Q4 — cautious quarters ahead, but not outright bearish .

Wall Street’s Expectations: A Bleak But Watchful Quarter

- Most analysts characterize this as a “trough” quarter, with Jefferies calling it “painful” but necessary — and that Q4 may mark the bottom

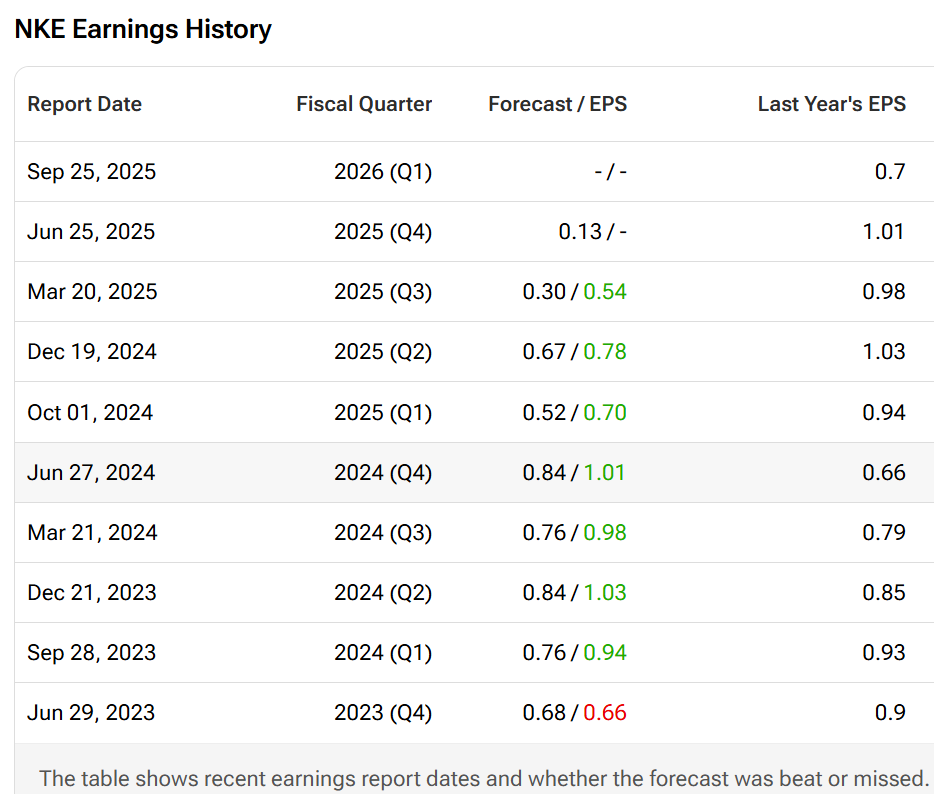

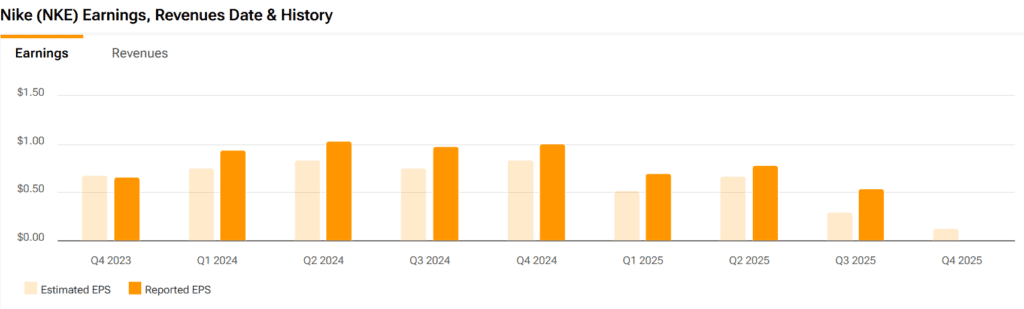

- Consensus projection: EPS around $0.12–$0.13, compared to $0.99 YoY

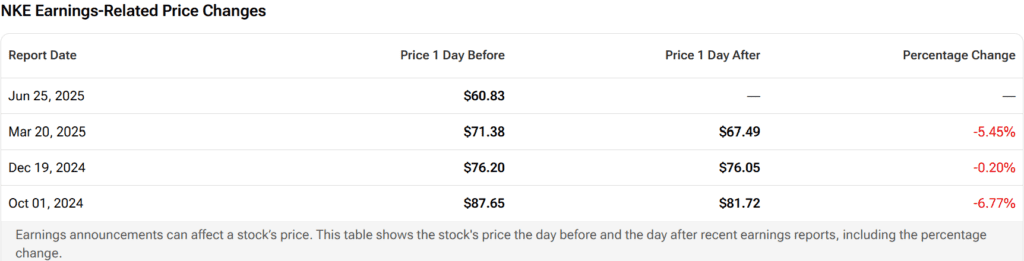

- Similar pipelines expect ~8% stock swing on the day, based on options pricing and historical reactions .

Summary of Signals (with Stats)

- Revenue: Down ~15% YoY to $10.7B

- EPS: Slump to $0.12–$0.13 vs $0.99 YoY

- Gross Margin: Compression of 400–500 bps YoY

- DTC Sales: Down 12% YoY (~$4.7B)

- Wholesale: Down 7% YoY (~$6.2B)

- China Sales: -17% in Q3; remain a drag

- Insider Selling: Detected, some caution advised

- Analyst Ratings: 8 Buys / 8 Holds / 1 Sell; Avg PT = $72

Bull Case: What Could Spark a Rally

- Earnings Upside: Even a small beat vs EPS forecast could lead to stock repricing amid cautious sentiment.

- China Strength: Continued momentum in China could dominate North America/EU softness.

- Digital Momentum: Strong pricing, margin growth and scaling in digital could buoy earnings.

- Positive Outlook: Bullish guidance on fall/winter sell-through and margin improvement would reassure markets .

Bear Case: Risks to Watch

- Revenue Decline: Further softness in major markets could drag full-year outlook lower.

- Margin Compression: Continued pressure on gross and operating margins may weigh on profitability—especially if costs persist.

- Trade/Tariff Headwinds: Escalation in trade tensions could trigger cost inflation.

- Insider Selling Signal: Ongoing sales from insiders may hint at near-term valuations topping out.

Positioning by Investor Type

- Long-Term Investors: Nike remains structurally strong in brand, channel, and global diversification—look through short-term noise for the broader athletic + fitness rebound.

- Active Traders: Nike is likely to have a 3–5% earnings day move; watch for guidance tone and margin commentary.

- New or Cautious Investors: It may be wise to wait until post-earnings clarity on margins and regional demand before adding to positions.

Nike enters Q4 FY2025 earnings with mixed signals: stable channel momentum, especially in China and DTC, but cost pressures and consumer softness remain challenges. Investors should listen not just to the beats or misses, but to forward guidance on margins, tariffs, and digital traction. That commentary will determine if the brand rides out global uncertainty or stumbles ahead of the year-end selling season.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Sources & References

- Yahoo Finance – Wall Street Expecting Weak Fiscal Q4 Results

- CNBC – Nike Q4 2025 Earnings Coverage

- Zacks – Can Shares Keep Running?

- INKL – Market Expert Says Things Aren’t Looking Good

- Tastylive – Tariff Fears in Focus

- Nasdaq – Insider Trading & Hedge Fund Activity

- IG (SG) – Navigating Challenges

- Barron’s – Stock Price Outlook

- Nasdaq – Can Shares Keep Running?

- IG (Global) – Strategic Position Overview

- Ainvest – Turnaround Quarter for the Swoosh?

- QuiverQuant – Opinions on Q4 2025 Earnings

- Financial Modeling Prep – Financial Performance & Market Position

Related:

In a First-of-Its-Kind Decision, Anthropic and Meta Win Copyright Lawsuits Brought by Authors

Kalshi Hits $2 Billion Valuation as Prediction Markets Go Mainstream

S&P 500 Nears All-Time High After Stunning Rebound from April Lows

Trump rebukes Israel and Iran hours after ceasefire: Latest Updates