Over the last few years, a clear divide has taken shape in the US equity markets. On one side, growth-driven large-cap giants continue to dominate, bolstered by technological scale and investor confidence. On the other, small-cap stocks, while historically resilient during economic inflection points, have underperformed—yet now may be trading at a historic discount.

Together, these two market realities present a complex picture: one of persistent structural strength in megacaps, and another of undervaluation and potential resurgence in small caps. So, is the current landscape an enduring new normal, or the prelude to a cyclical pivot?

Growth Stocks: Structural Strength, Not a Temporary Surge

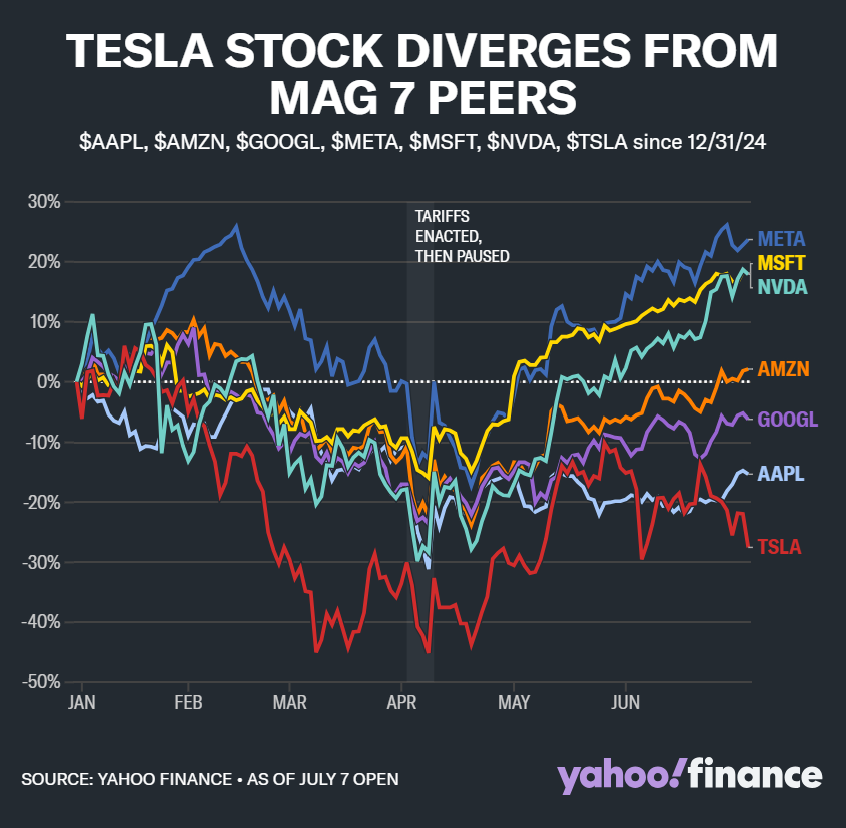

The post-pandemic environment, combined with the ongoing geopolitical and economic disruptions of 2025—like the “Liberation Day” tariffs and cautious Fed signals—has only reinforced the supremacy of large-cap growth stocks. Names tied to cloud, AI, energy infrastructure, and data centres have shown remarkable staying power, even as broader macro risks have intensified.

A recent Yahoo Finance analysis frames this shift as more than just a momentary trend. According to DataTrek co-founder Nicholas Colas, the extended outperformance of large-cap growth names relative to small-cap value stocks is “structural rather than cyclical.” That’s a critical distinction: it suggests that the leadership of companies like Nvidia and the rest of the Magnificent Seven isn’t simply the result of low interest rates or short-term policy choices—it’s the market’s natural response to global realignment.

The broadening rally hoped for by small-cap proponents never materialized. While there were hints of revival in 2024, aided by Fed pivot hopes and optimistic forecasts, the continued trade volatility and elevated rates of 2025 reasserted the dominance of larger players.

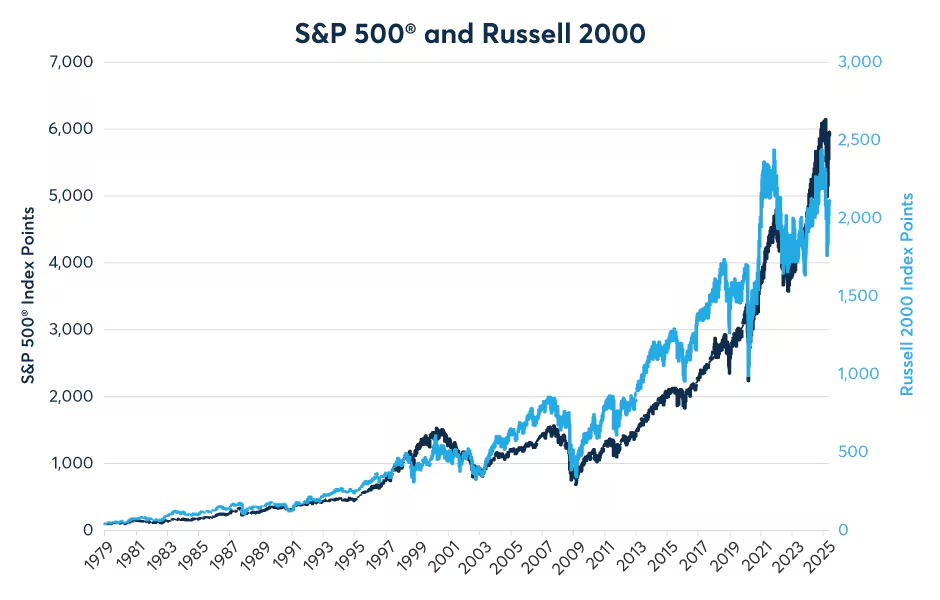

In fact, through the first half of 2025, the Russell 2000 has posted a modest loss of ~1%, while the S&P 500 is up over 6%. And while Nvidia’s continued AI run garners headlines, lesser-known chip and infrastructure stocks have also delivered some of the S&P’s strongest returns. The rising complexity of AI systems and data centres has created an ecosystem in which scale wins, and scale lives in large-cap land.

The Case for Small-Caps: Undervalued, Unloved, and Historically Resilient

While growth stocks shine, another story is quietly building beneath the surface. According to CME Group’s in-depth study, small-cap stocks now trade at valuation levels that suggest a historic opportunity—especially when viewed through long-term cycles.

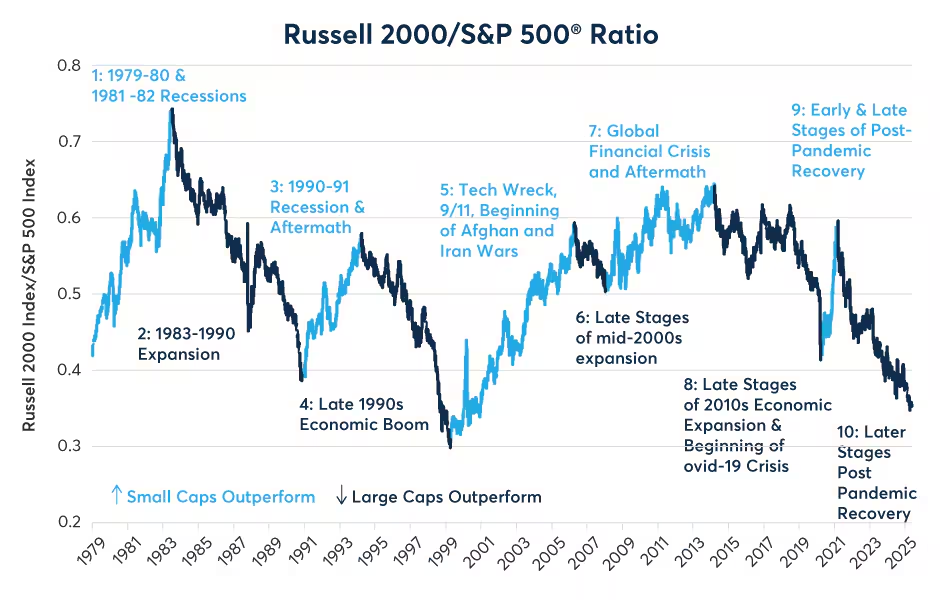

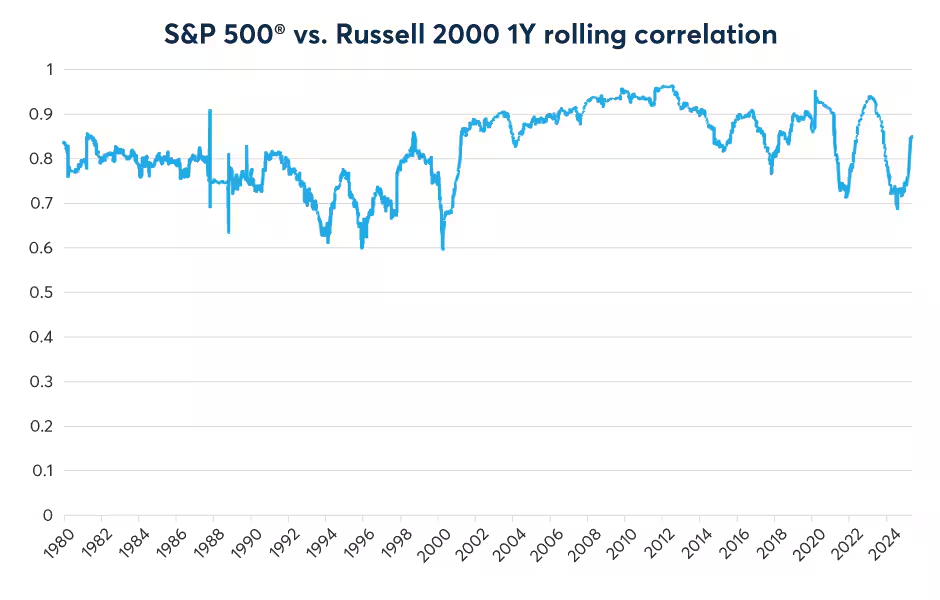

Since 1979, the Russell 2000 and S&P 500 have moved in high correlation, often trading in tandem. However, relative outperformance has shifted dramatically across business cycles. Historically, small-cap stocks tend to outperform during recessions and the early stages of recovery, as these companies are more sensitive to rate changes and macro pivots. Conversely, large caps typically dominate during late-stage expansions, when capital is more expensive and steady cash flows are king.

The current cycle reflects the latter: since March 2021, large caps have outperformed small caps by nearly 70%. But that performance gap has opened a valuation window investors haven’t seen in decades.

Consider these dynamics:

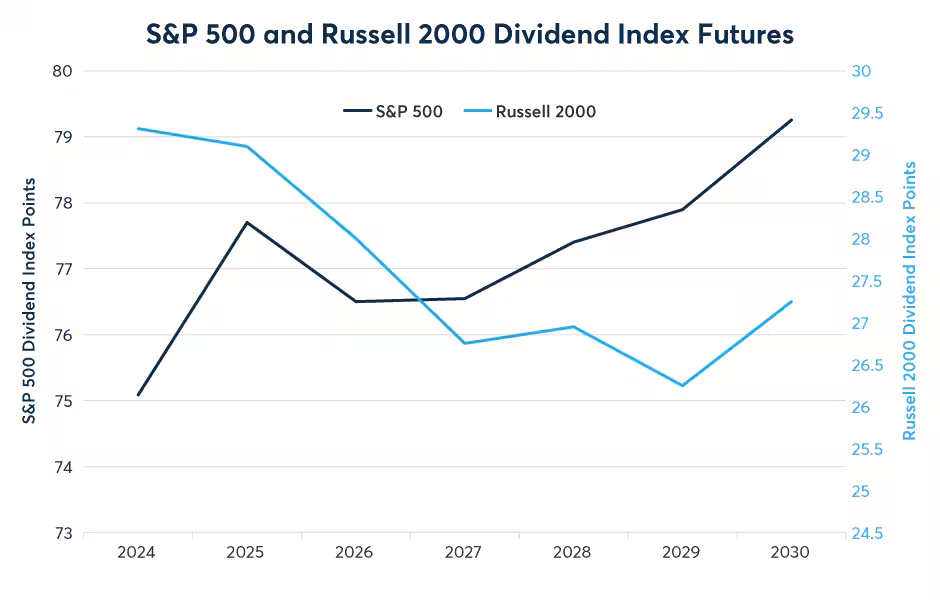

- Dividend futures show that S&P 500 firms are expected to grow payouts through 2030, while Russell 2000 firms are expected to shrink. That paints a less confident outlook for small caps—but also sets a low bar for future surprises.

- Valuation multiples are telling:

- Russell 2000 P/E (trailing): 31.7x

- S&P 500 P/E (trailing): 24.2x

- But for profitable small-caps (like the S&P 600 Small Cap Index), valuations drop to ~16x forward earnings—a significant discount.

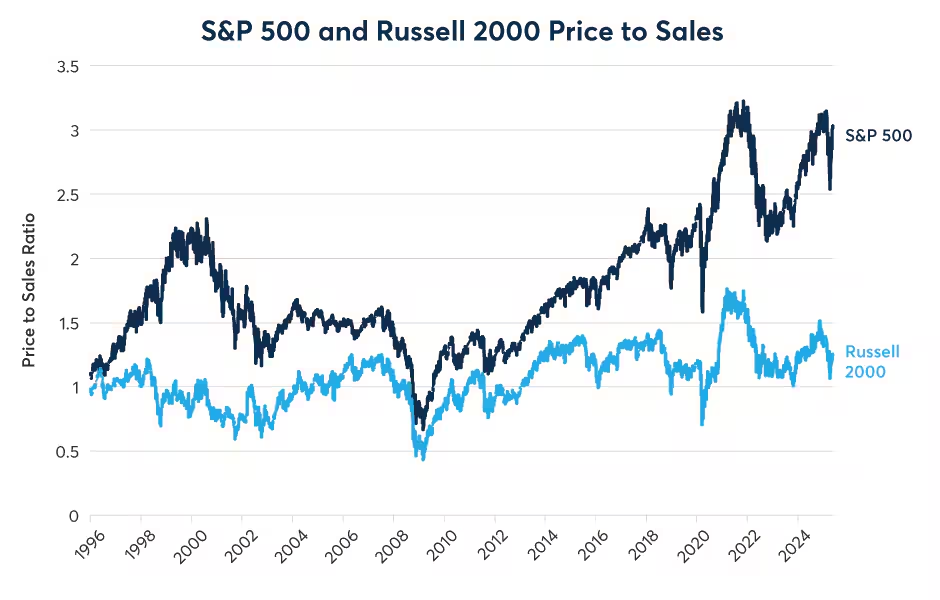

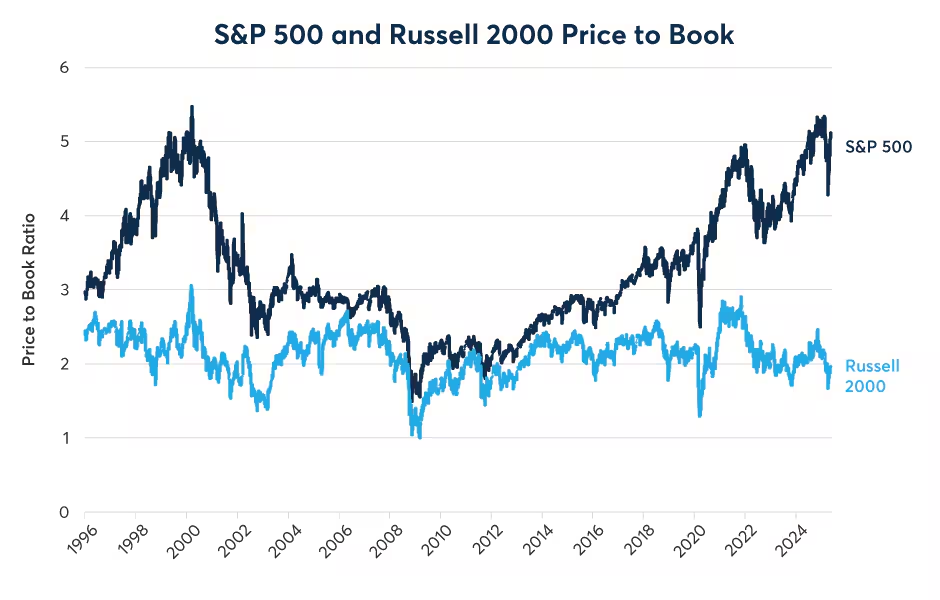

- Price-to-sales and price-to-book ratios show Russell 2000 companies are far cheaper than their S&P 500 counterparts—levels not seen since the late 1990s, just before a long stretch of small-cap outperformance.

This divergence may reflect more than just earnings quality. It could also be a reflection of investor risk aversion, as markets lean into “safe giants” amid geopolitical risks. But history shows that periods of small-cap underperformance rarely last forever, especially when combined with steep discounts across fundamentals.

Interpreting the Disconnect: What’s Next for Investors?

The macro environment remains unpredictable. Fed policy is in flux. Trade tensions, especially under Trump’s revived tariff campaign, have injected uncertainty into global supply chains. While large caps may appear insulated due to their global operations and diversified balance sheets, they’re also susceptible to shifts in policy, taxation, and currency risk.

Small caps, on the other hand, tend to react more nimbly to monetary easing and early recovery phases. Their underperformance could reverse if we enter a downturn—or if central banks pivot harder than expected.

So where does this leave investors?

- If you believe in the resilience of growth, the structural tilt toward mega-cap tech and AI infrastructure remains logical. These firms are capital-rich, globally integrated, and tightly linked to future-forward themes like automation and data.

- If you’re a contrarian or value-oriented investor, this might be an ideal window to selectively accumulate quality small-cap names—particularly those with profitability and cash flow strength.

In short, both stories can be true: growth may dominate structurally, but small-cap value is statistically overdue for a bounce.

Conclusion

- The S&P 500 has outperformed the Russell 2000 since March 2021, reflecting investor preference for large-cap growth amid uncertainty.

- Large-cap stocks tend to thrive in late-cycle expansions like the current environment, while small-cap stocks historically outperform during recessions and the early stages of economic recovery.

- S&P 500 dividend futures project modest but consistent growth in payouts through 2030, while Russell 2000 futures indicate flat-to-declining income expectations.

- S&P 500 firms have lower P/E ratios than Russell 2000 on a trailing and forward basis—but this is skewed by the presence of unprofitable small-cap firms. Among profitable ones (S&P 600), valuations are compelling.

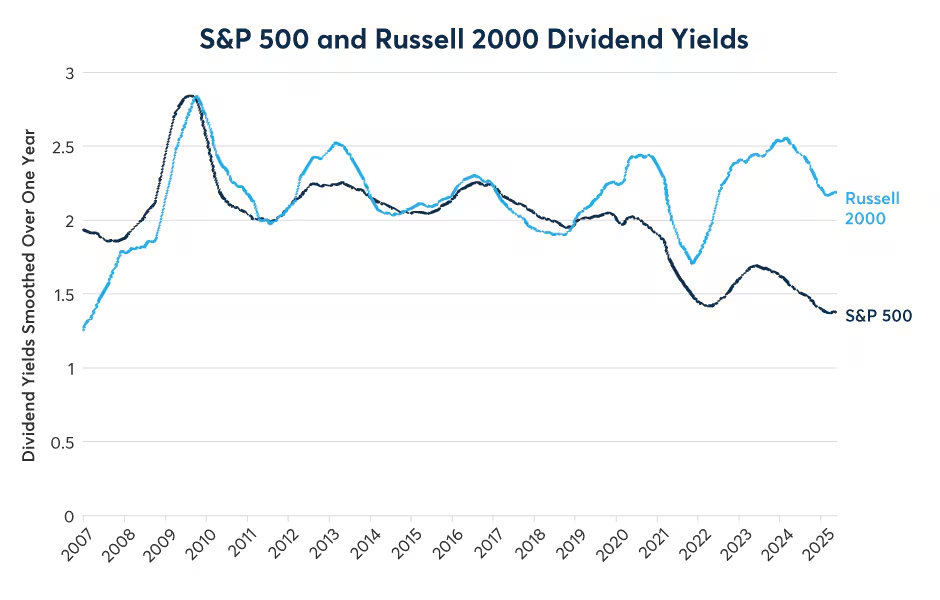

- By price-to-sales, price-to-book, and dividend yield, Russell 2000 firms appear historically cheap, potentially setting the stage for future outperformance—especially if macro conditions turn.

- The “new normal” of growth stock dominance appears structurally strong for now, but history suggests it may be unwise to bet against small caps for too long.

- Growth stocks are the “new normal”—dominant, defensive, and structurally strong.

- Small-caps are deeply undervalued and historically set for recovery—if economic conditions pivot or value becomes the next regime.

- Blend for balance: Growth for scale, small-caps for value and diversification.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Dow, S&P 500, Nasdaq Drop as Trump Slaps 25–40% Tariffs on Trade Partners

Global Stocks Are Crushing US – But Which Ones?

Markets This Week: Tariff Chaos, Fed Clarity, Prime Day, and Earnings Heat Up

Elon Musk Launches ‘America Party’ After Breaking With Trump

US Manufacturing Hits 3-Year High, But Tariff Fears Loom