Global markets are moving with deliberate calm this morning as investors weigh rate policy uncertainty, trade tensions, and the next macroeconomic clues from the US labour market. Despite lingering headwinds, the S&P 500 continues to hover near record highs, and history suggests it might still have room to run.

Market Snapshot – July 2, 2025

| Asset | Latest Move |

|---|---|

| S&P 500 Futures | +0.3% |

| NASDAQ Futures | Flat |

| Euro Stoxx 50 Futures | +0.5% |

| Japan Nikkei 225 | -0.2% |

| Hang Seng Index | +0.6% |

| 10-yr US Treasury | 4.25% (steady) |

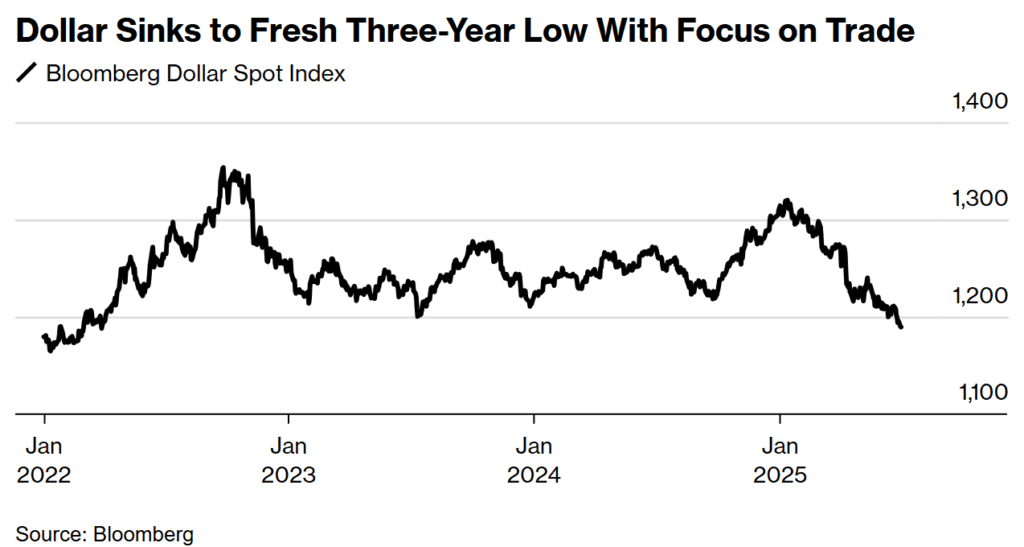

| Dollar Index | Near 3-year low |

| Euro | $1.1797 |

| Gold | $3,332/oz |

| Bitcoin | $106,200 (+0.2%) |

| WTI Crude Oil | Flat at $65/bbl |

Rate Anxiety & Trade Deadlines Keep Traders on Edge

Federal Reserve Chair Jerome Powell struck a familiar tone Tuesday in Portugal, reiterating that the central bank is in “wait-and-see” mode amid tariff risks. Despite President Trump’s public pressure for immediate rate cuts, Powell emphasized the Fed needs more clarity on inflation and the labor market before acting.

This morning, markets are looking ahead to Thursday’s jobs report, which is expected to show 110,000 new jobs, down from 139,000 the prior month. The unemployment rate is projected to tick up to 4.3%, with any disappointment likely triggering renewed rate cut bets.

Trade War Watch: All Eyes on July 9

Trump’s July 9 tariff deadline remains a major global risk factor. The president reaffirmed he has no intention to extend negotiations, signaling that Japan may face 35% tariffs while India is close to a deal. While some analysts expect Trump to pull back at the last minute — a move dubbed “TACO” (Trump Always Chickens Out) — markets are bracing for volatility either way.

“Short-term, we can definitely see some volatility if tariffs get ramped up again,” said Matthias Scheiber of Allspring Global Investments.

More about: Trump Eyes India Trade Deal as Japan Faces Tariff Threat: July 9 Deadline Looms

Goldman Says July Rally Still Has Legs

According to Goldman Sachs, the S&P 500’s summer rally may continue for another couple of weeks before losing steam in August.

“We expect the rally to keep going through the first half of July, supported by strong seasonality and investor positioning,” Goldman analysts wrote.

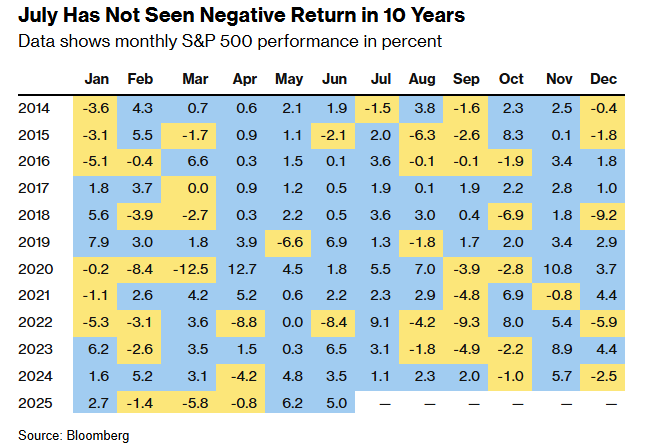

History backs up that view. July has been the strongest month for the S&P 500, with an average gain of 1.67% since 1928, and has not posted a negative July in the past 10 years, per Bloomberg data.

🔹 In 2023, the S&P 500 rose 3.1%

🔹 In 2022: 9.1%

🔹 In 2021: 2.3%

🔹 In 2020: 5.5%

However, August has historically been far less kind, with frequent pullbacks due to thin trading, policy risk, and macro surprises.

Dollar Wobbles, Euro Gains

The US dollar is down more than 10% year-to-date, its worst first-half showing since the 1970s, as investors flee US assets over fiscal concerns and trade instability. The euro hovers near a 3.5-year high at $1.1797, while gold remains firm amid safe-haven flows.

Trump’s $3.3T Bill: What It Means for Markets

The Senate just passed Trump’s sweeping $3.3 trillion tax and spending bill, which now heads to the House.

More about: Senate Passes Trump’s $3.3 Trillion ‘Big, Beautiful Bill’ – What’s Next?

Markets have so far shrugged off the fiscal impact, but analysts warn the bill could elevate long-term yields, raise concerns about US debt sustainability, and pressure the dollar further if confidence in fiscal discipline erodes.

What to Watch This Week

- Wednesday

- Economic events: Euro zone unemployment rate for May, trade deal updates

- Thursday (July 4 adjusted):

- US Nonfarm Payrolls

- Unemployment Rate

- Average Hourly Earnings

- July 9:

- Trump’s Global Tariff Deadline

The market rally is being buoyed by seasonality, soft-landing hopes, and investor patience. But with Trump’s tariff deadline, Powell’s caution, and August’s historical volatility on the horizon, the mood remains quietly tense. For now, July sunshine still shines on Wall Street — but clouds are building at the edge.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Market Wrap: Stocks Hit Records, Dollar Slides, and Gold Surges as July Begins

Bessent Warns: US Tariffs Could Snap Back to 50% as July 9 Deadline Looms

Trump’s trade deals are stalling out at worst possible time

What Traders Have Gotten Wrong in 2025

What to Watch in Markets This Week: Jobs Report, Tesla Delivery, Trump’s Budget Deadline