US stocks soared on Monday, closing at fresh record highs across the board as investors celebrated signs of progress in US-China trade negotiations, cooling inflation pressures, and strong early earnings results.

The S&P 500 broke above 6,800 for the first time in history.

The Nasdaq Composite and Dow Jones Industrial Average also ended at new all-time highs, while the Russell 2000 surged on small-cap strength.

Gains were led by tech and consumer names, with enthusiasm ahead of Big Tech earnings and the Fed’s interest rate decision.

A potential trade deal framework between President Trump and President Xi Jinping—covering tariffs, rare earths, and TikTok—boosted market sentiment, setting the stage for a strong open to the week.

US stock futures were slightly lower Tuesday morning

…after that blockbuster Monday, as markets gear up for a high-stakes, catalyst-heavy day.

Today, investors are eyeing:

Big-name earnings reports – including PayPal, Visa, UnitedHealth, UPS, JetBlue, and more

Day one of the Federal Reserve’s two-day meeting, with a rate cut widely expected

The anticipated Trump-Xi summit later this week in South Korea, where trade issues will be finalised

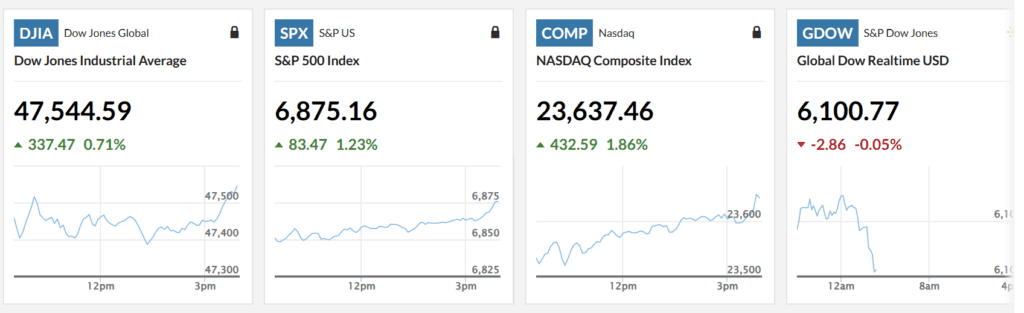

Market Snapshot

- Dow Futures: +0.71%

- S&P 500 Futures: +1.23%

- Nasdaq 100 Futures: +1.86%

- Gold: 3,937.12

- 10-Year Treasury Yield: 4.04% (Highest in over a week)

- Crude Oil (WTI): $61.31

- Bitcoin: $114,145

What to Expect Today — Key Market Movers

1. Big Tech Earnings Kick Off

The “Magnificent Seven” mega-cap tech stocks will dominate this week’s headlines. Today’s earnings include:

- Pre-Market: PayPal Holdings ($PYPL), SoFi Techs ($SOFI), UnitedHealth Group ($UNH), Royal Caribbean Gr ($RCL), United Parcel Service ($UPS), and JetBlue Airways ($JBLU)

- After-Hours: Visa ($V), ContextLogic ($LOGC), Enphase Energy ($ENPH), and Electronic Arts ($EA)

Economic data (EST) CB Consumer Confidence (10:00 AM), 7-Year Note Auction (1:00 PM), API Weekly Crude Oil Stock (4:30 PM

“Earnings expectations are sky-high. Options markets are pricing in potential 6% swings in either direction,” noted LPL’s Adam Turnquist.

2. Federal Reserve Meeting Begins

Markets are fully pricing in a 25-basis-point rate cut when the Fed decision is announced tomorrow (Wednesday). But the real focus is on Fed Chair Jerome Powell’s tone: will he signal another cut in December?

Complicating matters is the ongoing U.S. government shutdown, which has triggered an economic data blackout, leaving the Fed with fewer indicators than usual.

3. US-China Trade Talks

President Trump and Xi Jinping are expected to meet on Thursday in South Korea. A framework deal addressing tariffs, TikTok, and rare earth exports is already in place — and markets are hoping for confirmation, not just another delay.

Wildcards for Today

- Oil prices may react to the API Crude Oil Report due at 4:30 PM ET.

- The 7-Year Treasury Auction at 1:00 PM ET could influence the bond market.

- CB Consumer Confidence (10:00 AM ET) will offer a read on the U.S. consumer’s mindset heading into the holiday season.

Expect a cautious but constructive day. Markets may consolidate after a record-setting Monday, but volatility is on deck with Fed signals, major tech earnings, and Trump-Xi headlines all likely to hit over the next 48 hours.

Today is a “wait and watch” session, but with plenty of fireworks likely before the week ends.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Big Tech Earnings, Fed Rate Cut, and Trump–Xi Meeting Set to Define Markets This Week

Asian Markets Soar to Record Highs on Renewed US-China Trade Deal Optimism