Geopolitical tensions, Fed signals, and a bold Tesla move are all hitting at once — and markets may not be ready.

This week brings a volatile mix: rising oil prices from the Israel–Iran conflict, a critical Fed update on rate cuts, and a possible robotaxi rollout from Tesla. Investors are bracing for impact.

- S&P 500 fell 0.6% last week as Israeli strikes on Iran spooked risk sentiment

- Oil prices surged over 12% — with Brent nearing $74 a barrel

- Fed set to hold rates steady, but all eyes are on the dot plot

- Retail sales and housing data will test US consumer strength

- Tesla may roll out robotaxis as early as Sunday, June 22

Oil surges as Israel–Iran conflict stirs global markets

Markets hit pause last week as a renewed military strike by Israel on Iran pushed oil sharply higher. Brent crude jumped above $73 while WTI neared $72 — both gaining over 12% on the week.

That oil pop wiped gains off equities. The Nasdaq dropped 1%, and the Dow lost 1.3%. Now, JPMorgan says that if escalation continues, oil could hit $120/barrel — pushing CPI toward 5%. The Fed wouldn’t like that.

But Bank of America’s Michael Hartnett is still leaning bullish — as long as the oil spike doesn’t last.

Fed decision: Hold expected — but dot plot drama ahead

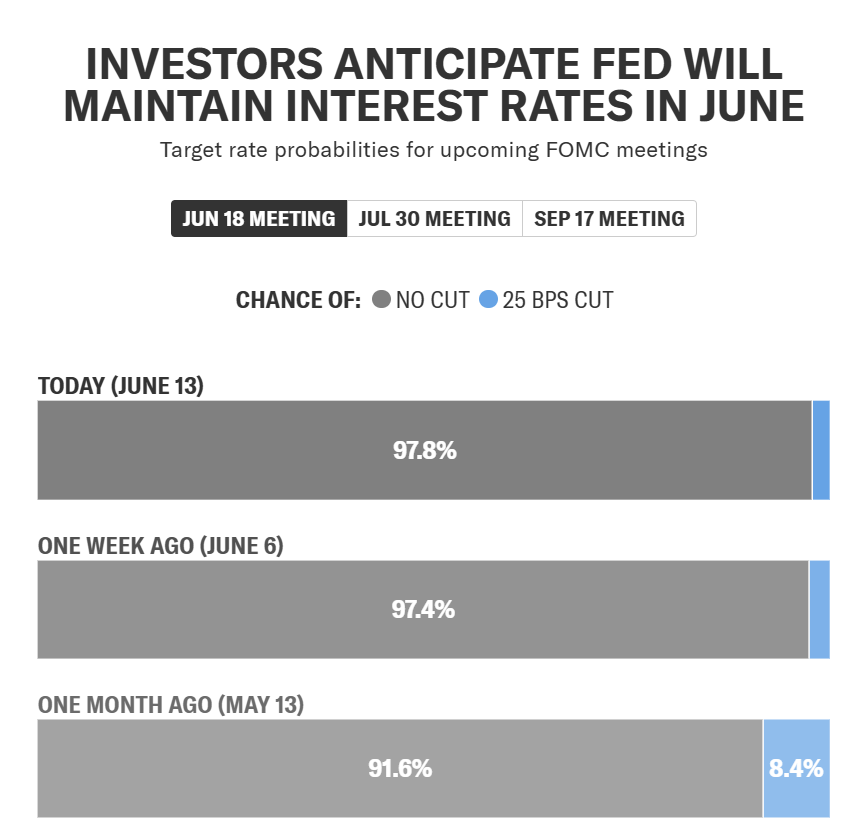

The Fed’s big moment comes Wednesday. No rate cut is expected, but what matters most is the updated Summary of Economic Projections and the dot plot — the Fed’s internal interest rate forecast.

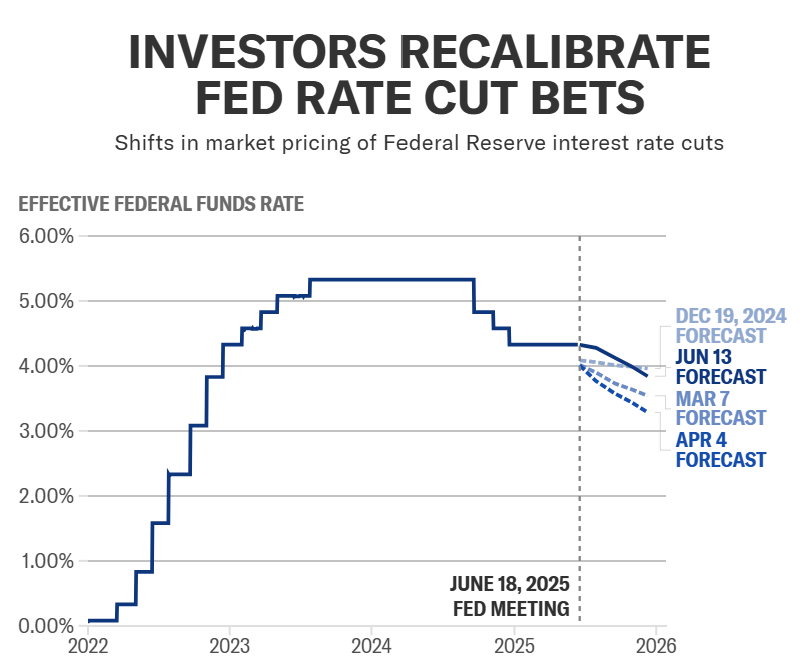

The market is pricing in two cuts in 2025. But since the last projection in March, Trump’s tariffs returned, oil surged, and inflation slowed to 2.4% YoY in May.

Powell will speak at 2:30pm ET. Every word will be dissected. Especially if the Fed hints that the first cut could slide into September — or even later.

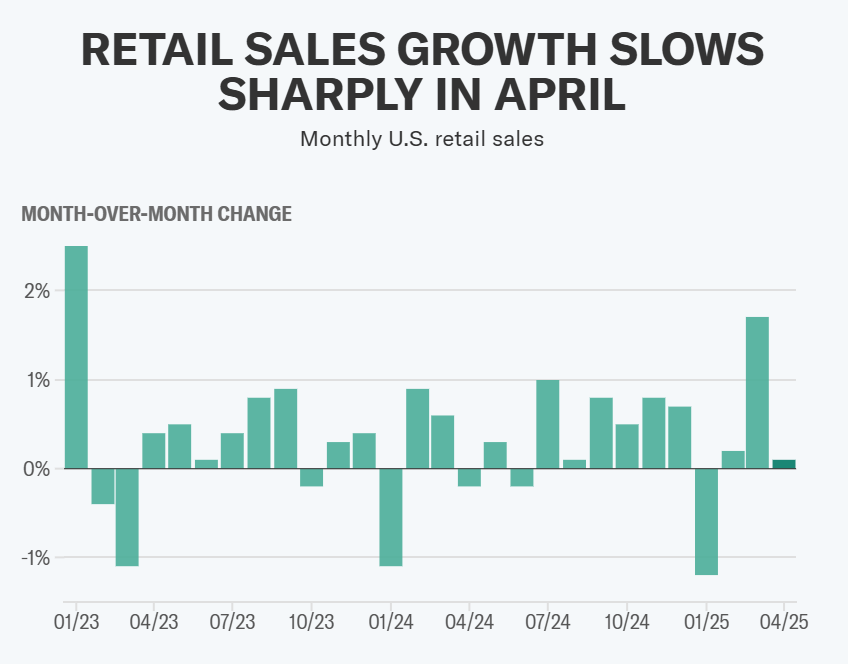

US retail sales: Is the consumer still carrying the economy?

Tuesday’s May retail report is the key test of spending strength. Headline sales are expected to fall 0.6%, but the control group — a more stable GDP-linked measure — is forecast to rise 0.5%.

That would signal the consumer engine is still running, even amid tariffs and higher oil. If sales fall short, expect growth fears to resurface.

Also watch for homebuilder confidence and industrial production on Tuesday — and housing starts on Wednesday.

Tesla’s robotaxi rollout could land this Sunday

Elon Musk says Tesla may launch its robotaxi fleet in Austin on June 22. That’s next Sunday. If it happens, it’s a major milestone in Tesla’s AI play.

Goldman Sachs says Tesla has an edge thanks to its scale and self-driving training data. This could mark the start of Tesla’s next growth story — even if delays are likely.

Investors will be watching for confirmation. Musk is known for pushing timelines. But this time, there’s real money on the line.

Trump’s tariff storm isn’t over

Markets are still digesting Trump’s April “Liberation Day” tariff wave. While some duties were paused, the baseline 10% tariff remains — and a China deal is still just words.

Yale estimates total effective China tariff exposure at 33%. That means inflation may tick higher — just as the Fed looks to cut. If this drags on, good cuts could turn bad.

Markets are closed Thursday for Juneteenth

Don’t forget: US markets are closed Thursday for Juneteenth. That makes Tuesday’s and Wednesday’s data even more crucial — before investors unplug.

| Day | Key Events | Data to Watch | Notable Earnings |

|---|---|---|---|

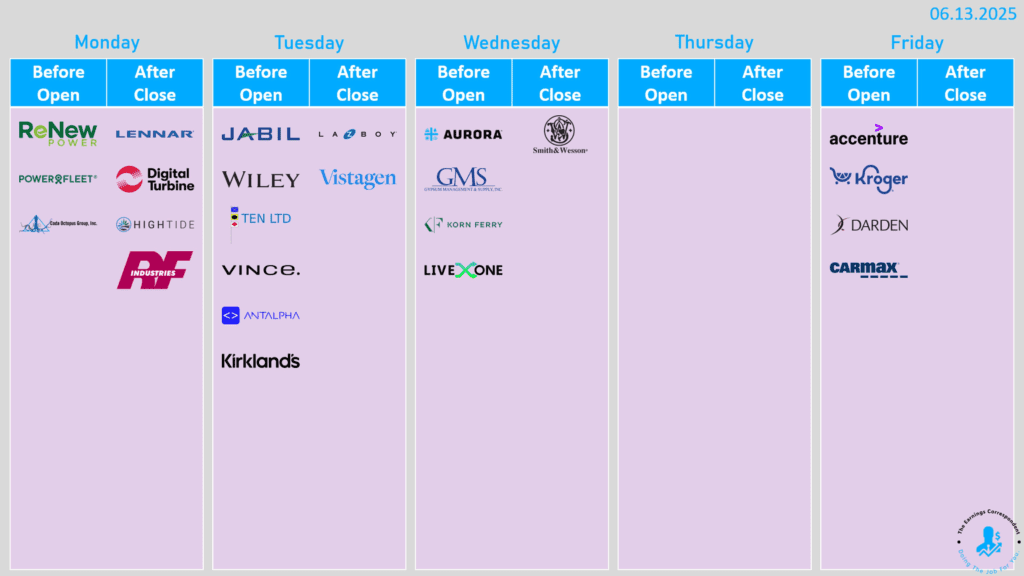

| Mon, June 16 | Market open | Empire State Manufacturing (June, -7.5 expected) | Lennar (LEN) |

| Tue, June 17 | Key data drop | May Retail Sales (-0.6% expected); Retail ex-auto/gas (+0.4%); Industrial production (0%); Import/export prices (May); Homebuilder confidence (NAHB Index, 34 prior) | La-Z-Boy (LZB), Jabil (JBL), John Wiley (WLY) |

| Wed, June 18 | Fed Day | FOMC Rate Decision (Hold expected); Updated Dot Plot; Powell Presser @ 2:30pm ET; Housing starts (May), Jobless claims | Smith & Wesson (SWBI), Aurora (ACB), GMS |

| Thu, June 19 | Juneteenth | US Markets Closed | None |

| Fri, June 20 | Market wrap-up | Leading Indicators (May, +0.1% expected); Philly Fed Outlook (June, 0 expected) | Accenture (ACN), CarMax (KMX), Kroger (KR), Darden Restaurants (DRI) |

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

What the Israel-Iran War Means for Oil Prices

2025 Stock Rally Isn’t Just About Magnificent 7 Anymore

Trump Says Israel Attack ‘Great for Market’ as Stocks Plunge, Oil Soars After Iran Retaliation

10 Reasons China Is Leading the Robot Race

Trump Unloads on EV Mandates, Talks Musk, Tariffs, and National Guard: Here’s What He Said

Why gold beat Euro to become world’s second-largest reserve asset

Trump-Musk Feud Last Phase: Tesla WON

Washington Starts to ‘De-Musk’: 5 Stocks Poised to Gain From the Shift