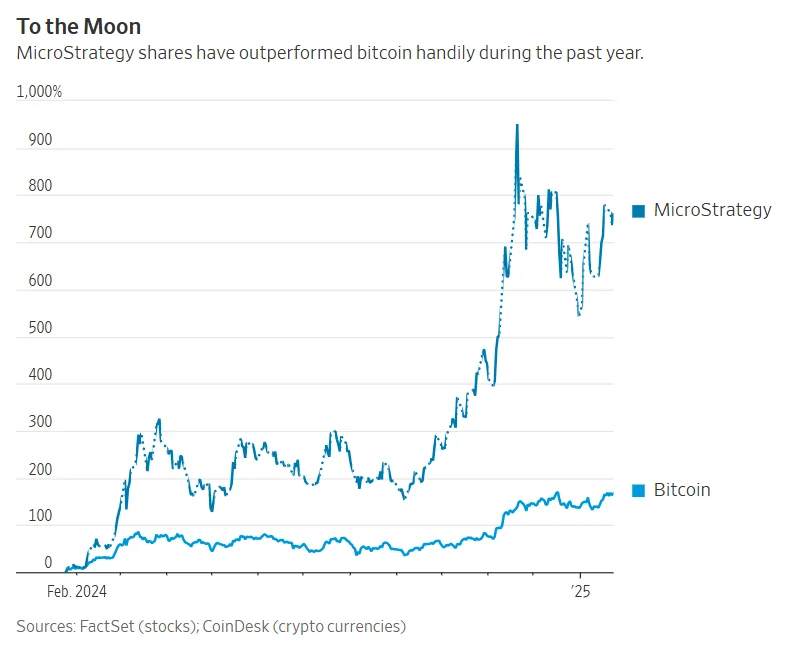

MicroStrategy, a prominent business intelligence firm known for its substantial investments in Bitcoin, is confronting potential federal income tax obligations on approximately $18 billion of unrealized gains from its cryptocurrency holdings. This development arises from the Inflation Reduction Act of 2022, which introduced a 15% corporate alternative minimum tax based on financial statement earnings, including unrealized gains.

- Unrealized Gains Taxation: Traditionally, companies are taxed on investment gains only upon the sale of assets. However, the new tax framework mandates taxation based on the current market value of assets as reported in financial statements, potentially leading to significant tax liabilities for firms like MicroStrategy that hold large amounts of appreciating assets without selling them.

- IRS Exemptions: The Internal Revenue Service (IRS) has proposed exemptions for unrealized gains on common stocks for certain companies but has not yet extended similar exemptions to cryptocurrency assets. MicroStrategy is actively seeking clarification and potential relief from the IRS to avoid substantial tax burdens that could compel the company to liquidate portions of its Bitcoin holdings to meet tax obligations.

- Accounting Rule Changes: Starting this year, new accounting standards require companies to report cryptocurrency holdings at fair market value on their balance sheets. This change means that fluctuations in Bitcoin’s value will directly impact MicroStrategy’s reported earnings and, consequently, its tax calculations under the corporate alternative minimum tax.

- Potential Tax Liability: In a recent disclosure, MicroStrategy indicated that it could face billions of dollars in tax liabilities beginning in 2026 if its average annual financial statement income exceeds $1 billion over a three-year period. This scenario would trigger the 15% minimum tax, significantly affecting the company’s financial strategy and its approach to Bitcoin investments.

The situation underscores the evolving regulatory landscape surrounding cryptocurrency assets and the importance for companies to stay abreast of tax law changes that could materially impact their financial positions.

Source: The Wall Street Journal