Micron (MU) is set to report its fiscal third-quarter earnings after the closing bell on Wednesday, June 25, in what could be a pivotal moment for the stock. Riding high on AI-fueled optimism, MU has nearly doubled in price since April — but the big question remains: can earnings and guidance sustain the rally?

What Wall Street Expects

- EPS estimate: $1.59

Up 156.5% from $0.62 in Q3 FY2024 - Revenue estimate: $8.84 billion

Up 29.7% YoY and up from $8.05B in Q2 FY2025 - Gross margin forecast: ~36.5%

Down from 37.9% last quarter and 39.5% in Q1 FY2025

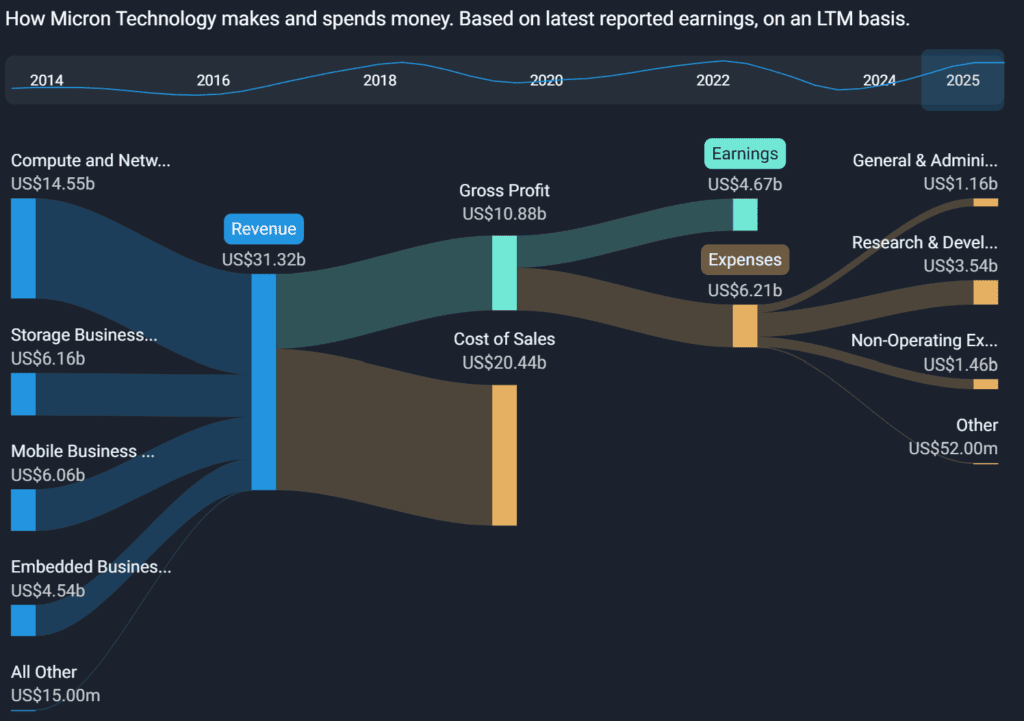

This sharp growth in revenue and earnings reflects robust demand for Micron’s high-bandwidth memory (HBM) used in AI and data center infrastructure, particularly in systems built by NVIDIA, Broadcom, and Marvell.

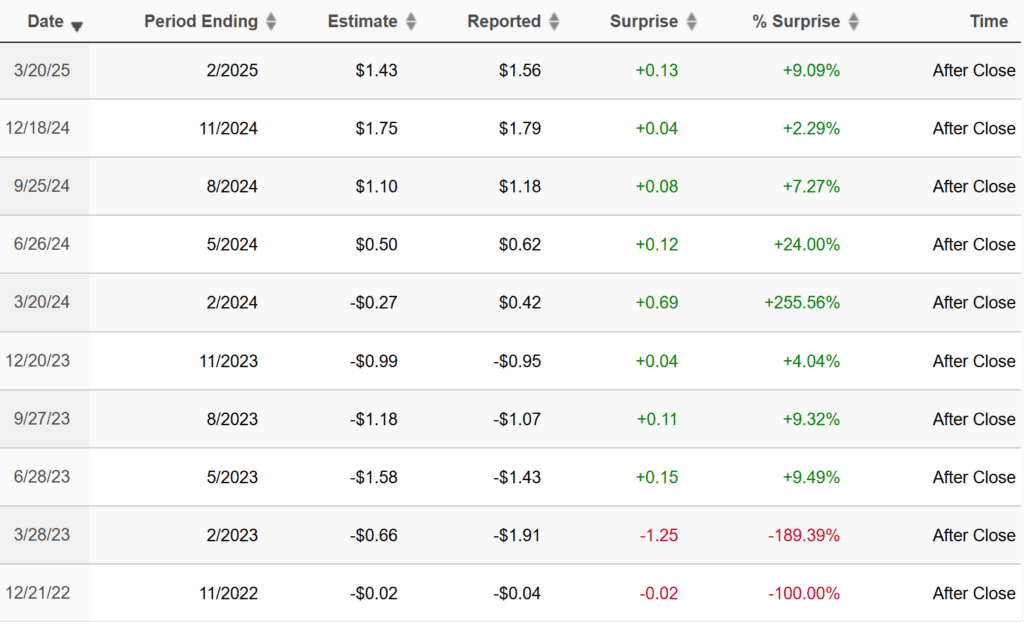

EPS Surprise History: A Story of Rebound

As seen in the chart above, Micron has consistently beat EPS estimates in recent quarters.

The massive rebound began in Q2 FY2024, where MU flipped from an expected loss to a $0.42 profit, shocking markets with a +255% EPS surprise.

Growth Drivers: AI Demand and HBM Dominance

Micron’s turnaround has been fueled by one key catalyst: the AI infrastructure boom.

- HBM3E (High-Bandwidth Memory):

- Supplies NVIDIA’s upcoming GB200/GB300 Blackwell chips

- Entire HBM production capacity for 2025 already sold out

- Price increases of +11% YoY expected in 2025

- Expected market: $35B in 2025, growing to $100B by 2030

- AI Devices:

- Demand for DRAM in AI smartphones and PCs is accelerating

- Micron is benefiting from premium DRAM pricing as competition lags

Importantly, Samsung’s yield issues on HBM3E products have opened the door for Micron to gain further market share in key AI supply chains.

Headwinds: Margin Compression and Macro Sensitivity

Despite surging revenue, gross margins have fallen:

- Q1 FY2025: 39.5%

- Q2 FY2025: 37.9%

- Q3 forecast: ~36.5%

This is due to:

- Aggressive pricing competition across memory segments

- Rising costs associated with advanced chip packaging

- Macroeconomic risks, including consumer device demand volatility

The margin compression may dampen investor enthusiasm, even with strong topline growth, particularly if management signals pricing pressures into FY2026.

Risks & Opportunities

Bullish Viewpoint

- AI boom continues; Micron poised as the lead supplier of critical HBM memory.

- Stock has strong analyst support: 24 Buys, 3 Holds, with targets averaging $127 and potential upside to $172 .

- Momentum backed by operational execution and favorable tech trends.

Bearish Perspective

- Declining margins may limit profitability even if revenues are up.

- Intense pricing pressure could erode future earnings.

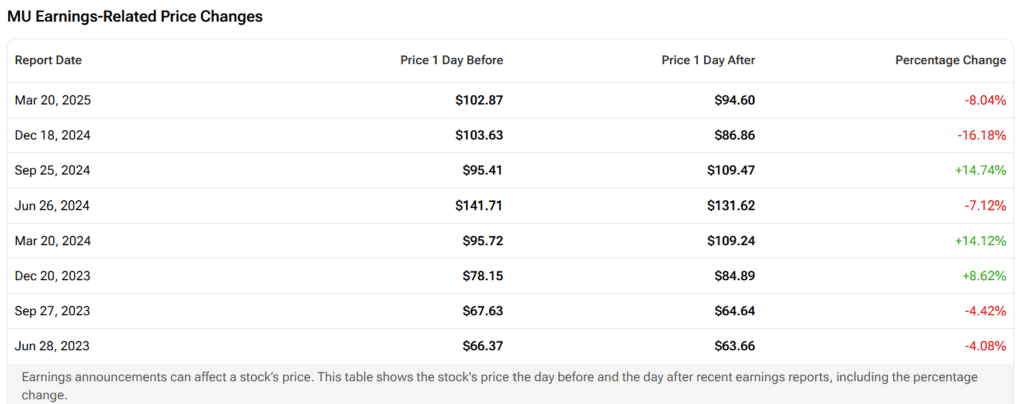

- Elevated expectations mean any surprise or cautious guidance could spark a sharp market pullback.

- Market risks: macro slowdown, unexpected competition, and volatility priced into options.

What Analysts and Traders Are Saying

- TipRanks: 24 Buy / 3 Hold ratings

Avg Price Target: $127.07

High Target: $172 (+39.2% upside) - Bloomberg: MU has doubled since April — now entering an “earnings test zone” with valuation stretched unless growth and guidance deliver

- Traders are positioned for high implied volatility, suggesting strong moves post-earnings (options pricing expects a ~6-9% move)

- Investopedia: Key levels to watch post-earnings are $140 resistance and $118 support, with momentum tied to AI chip demand and DRAM/HBM guidance.

Investor Takeaway: Clarity Over Hype

- Long-term investors: Micron is strategically positioned in AI memory, with dominant HBM exposure and strong DRAM recovery. If you believe in the AI megacycle, Micron offers leveraged upside.

- Short-term traders: Margin compression and valuation sensitivity may trigger whiplash around earnings. Watch not just results, but also forward guidance on HBM capacity, margins, and ASPs.

- New investors: Consider waiting for earnings clarity before entering, especially as pricing power remains under pressure despite volume growth.

Micron’s Q3 FY2025 results won’t just be about beating expectations — they’ll be about proving that AI-driven memory demand can sustain profit growth despite intense pricing battles. If management delivers upbeat commentary on HBM contracts, pricing, and FY2026 expectations, Micron could extend its breakout.

But if margin warnings or weaker-than-hoped guidance emerge, the stock may see a cooldown — giving long-term bulls a better entry point.

Micron is no longer a turnaround story. It’s an AI infrastructure stock — and now it’s time to prove it.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump rebukes Israel and Iran hours after ceasefire: Latest Updates

Ceasefire “Now in Effect” as Israel and Iran End 12 Days of War — But Deadly Strikes Continue

Trump Announces Ceasefire Between Israel and Iran

Why Oil Prices Plunged and Stocks Rose After Iran’s Missile Attack on US Bases

Markets Brace for Chaos as Strikes, Inflation, and FED: What to watch this week

Iran–Israel–US Conflict Erupts: Nuclear Strikes, Hormuz Threats, and Global Fallout

US-Iran Conflict Escalates After Strikes on Nuclear Sites: What We Know So Far

US Hits Iran’s Nuclear Sites — Iran Strikes Back as War Escalates