It’s back. It’s louder. It’s faster. But it might be even more dangerous.

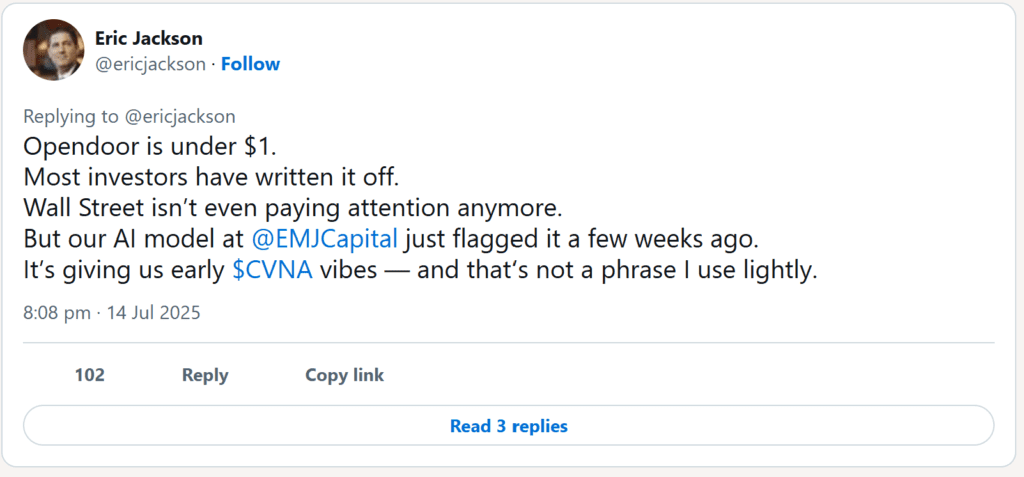

It started the same way these things always do — a ticker no one cared about suddenly lit up trading screens like a firecracker. This time it was Opendoor (OPEN), a once-forgotten SPAC darling barely hanging onto its Nasdaq listing. But on July 14, hedge fund manager Eric Jackson claimed his AI model flagged it as the next Carvana. That one thread on X (formerly Twitter) was all it took.

There were no earnings, no breakthroughs, no turnarounds. Just AI-fueled hype, Reddit-fueled conviction, and a market all too willing to dance again to a tune it knows ends in silence.

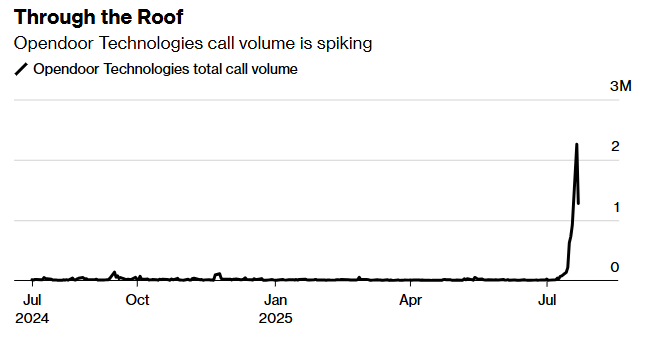

The Redditors showed up. TikTokers piled on. Discord servers lit up. And Opendoor rocketed over 312% in just six days, trading nearly 1.9 billion shares in a single session — 10% of the entire US equity volume. A frenzy.

Then came the others:

- GoPro (GPRO) jumped 75% in a week,

- Krispy Kreme (DNUT) popped 39% intraday,

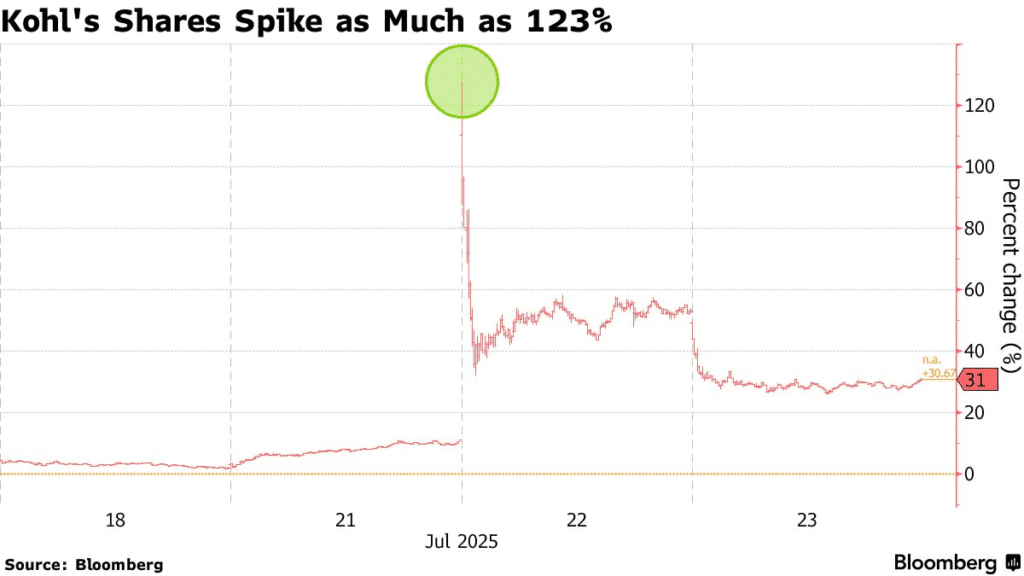

- Kohl’s (KSS) surged over 100% before giving back 14%,

- Rocket Mortgage (RKT) followed soon after.

Together, they formed a new acronym on Reddit: D.O.R.K. — DNUT, OPEN, RKT, KSS. A new meme basket for a new era. And just like in 2021, it wasn’t earnings, growth, or innovation that caused these moves.

It was pure vibes.

Why Meme Mania Is Back (And How AI Is Now Part of the Loop)

Unlike the original 2021 surge, where Robinhood users coordinated inside WallStreetBets to target heavily shorted stocks like GameStop and AMC, the 2025 revival is being powered by AI feedback loops.

Retail traders are now using ChatGPT and other LLMs to generate stock ideas. And what do these models suggest? Exactly what Reddit has trained them to:

- Heavily shorted stocks

- Low share prices

- Turnaround narratives

- High social engagement potential

Thanks to OpenAI’s licensing deal with Reddit in 2024, LLMs have absorbed the meme-stock logic of “high short interest + community = potential moon.” And now, the machine spits it right back.

The result?

Reddit shapes AI → AI influences retail traders → Traders post back to Reddit → And the cycle repeats.

Welcome to algorithmic groupthink — and it’s fueling automated meme trading like we’ve never seen before.

The Psychology: Belonging Over Logic

This isn’t about making money — at least, not in the traditional sense. Meme trading today is about identity, community, and the psychological rush of belonging to a digital tribe.

“HODLTHE($OPEN)DOOR”

“Diamond hands only”

“Max pain for the shorts”

“Let’s squeeze them dry”

These aren’t stock pitches. They’re mantras.

Social media — especially TikTok, Reddit, and X — acts as a giant amplifier. And the psychology behind it is dangerously seductive:

At its peak, Opendoor traded 1.9 billion shares in a single day. According to reports by Bloomberg, that was nearly 10% of all US equity trading volume. Option volume surged too, with more than 3.4 million contracts traded on Opendoor alone, more than any single day during the GameStop rally in 2021.

- FOMO (Fear of Missing Out): You see someone post a fake screenshot of $40,000 in daily gains and think, “Why not me?”

- Confirmation Bias: You Google the ticker, find bullish posts, ignore the bearish data. The algorithm feeds you only what you want to believe.

- Survivorship Bias: You see the handful who got rich. You forget the thousands who lost everything.

- Social Reinforcement: The more likes, the more real it feels. “The community believes, so I believe.”

- Validation Addiction: Posting your own gains (or paper gains) becomes a form of social currency. Engagement becomes more important than returns.

This is no longer investing. It’s digital cosplay with real money.

Even worse, the meme stock trade has become a form of entertainment. There’s humor, trolling, tribalism, even performative suffering. And that’s what keeps retail traders coming back — not rational analysis, but emotional adrenaline.

Why It’s Worse in 2025

Let’s be clear — this isn’t just a rerun. It’s a dumber, faster sequel with even fewer guardrails.

In 2021, meme stocks had fuel:

- Near-zero interest rates

- Stimulus checks fattening brokerage accounts

- Lockdown boredom and mass retail entry

- A surprise factor that caught Wall Street off guard

In 2025, that fuel is gone:

- Interest rates are high and still climbing

- No free government money is circulating

- Retail is overexposed and underprotected

- Hedge funds now monitor Reddit in real time and act instantly

The effect?

- Shorting costs are lower (around 10%, down from 80% in 2021), meaning fewer real short squeezes

- Liquidity dries up faster, because institutions front-run Reddit before it even trends

- Platforms and market makers are faster — meaning retail traders are now last to react

- AI-powered bots scan forums 24/7, meaning anything organic is instantly exploited

This isn’t a squeeze anymore. It’s a spasm — a violent twitch in a dying limb. The trade kicks up, explodes briefly… and then collapses under its own meme-weight.

The Trap Behind the Hype: Who Really Wins

There’s nothing illegal about meme trading. But there is something deeply structural that works against retail:

- Liquidity vanishes at the top — you can buy easily, but you can’t sell fast enough.

- Bid-ask spreads widen just as volatility spikes.

- Conviction turns into hesitation — by the time you decide to sell, it’s already too late.

- Trading platforms slow down or freeze, as they did during GameStop’s peak in 2021.

Retail traders imagine they’re early. But they’re not early — they’re the exit liquidity. They buy the top. They sell the pain. Meanwhile, the same small hedge funds and influencers spark the rally, promote it, then dump on the crowd.

And this time, there are no surprise winners. Just better-prepared sharks waiting for familiar bait.

History Repeats — But This Time With D.O.R.K.

Let’s be honest — this is a rerun.

- GameStop surged to $483 in January 2021. It now trades under $30.

- AMC soared to $72. It’s now worth less than a cappuccino.

- Faraday Future went from 4 cents to $4 in 2024 — and back to cents again two weeks later.

- Opendoor gained 312%, then lost 20% in a day.

- Krispy Kreme gained 39%, then gave it back before the bell rang.

Every time, the signs were there. Every time, the crowd ignored them.

So Why Does It Keep Happening?

Because meme stocks aren’t about fundamentals — they’re about feeling something in a market that’s become too technical, too robotic, and too institutional.

Retail traders are looking for:

- Something to believe in

- Somewhere to belong

- A shot at beating the system

- Or simply, a way to make investing fun again

But markets aren’t games. They’re designed to transfer money from the emotional to the disciplined. And meme stocks? They exploit that imbalance perfectly.

The Bottom Line: Same Movie, Worse Ending

This isn’t momentum. This isn’t rebellion. This is boredom weaponized by social media and AI.

And here’s the truth:

Retail isn’t dumb — it’s just exhausted.

Tired of waiting for returns. Tired of being outmaneuvered. Tired of being the last to know.

So when a new meme play shows up, they jump — not out of greed, but hope. And that’s what makes this cycle so dangerous.

Because just like in 2021, the ending is already written.

Only this time, fewer people are left to cheer.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

The $OST Scam: How Nasdaq-Listed Penny Stock Wiped Out Thousands of Lives

Mystery $33 Billion Medical Fortune Collapses in Days – Regencell

Regencell falls 60% after wild 82,000% rally: Here is Why

Sources

- CNN: Meme Stock Renaissance May Already Be Fizzling

- Reuters: Meme Stock Surge Highlights Retail Fervor

- Bloomberg: Why Meme Mania Swept Up KSS, OPEN, GPRO

- Bloomberg: This Five-Cent Meme Stock Made Up 15% of US Trading Volume

- Forbes: Meme Stocks Are Back, And Retail Is About To Get Burned Again – Jim Osman

- MarketWatch: What’s Different This Time Around

- Invezz: Why Meme Stock Frenzy Is Back in 2025

- Fox Business: Meme Stock Madness in 2025