IIn June 2025, Henley & Partners released its much-hyped Private Wealth Migration Report, declaring that the UK would lose a record 16,500 millionaires in 2025 — more than any country on Earth. The news was quickly picked up by Business Insider, Evening Standard, and dozens of other global media outlets. Headlines spoke of a “historic wealth exodus” from Britain, a dramatic turning point in the global movement of the rich.

But a deeper dive by the Tax Justice Network (TJN) tells a very different story:

The exodus never existed.

According to TJN, Henley’s own numbers — once stripped of spin — reveal a non-existent millionaire exodus being widely reported in the media once again, despite the authors of the claim backtracking on it following recent criticism by tax justice campaigners.

The media coverage is based primarily on a report by Henley & Partners, a firm that sells golden passports to the superrich and advises governments on how to attract wealthy individuals. The European Court of Justice recently ruled one such program — Malta’s — to be unlawful.

In 2024 alone, over 10,900 articles were published across print, broadcast, and digital platforms repeating Henley’s claims — often uncritically.

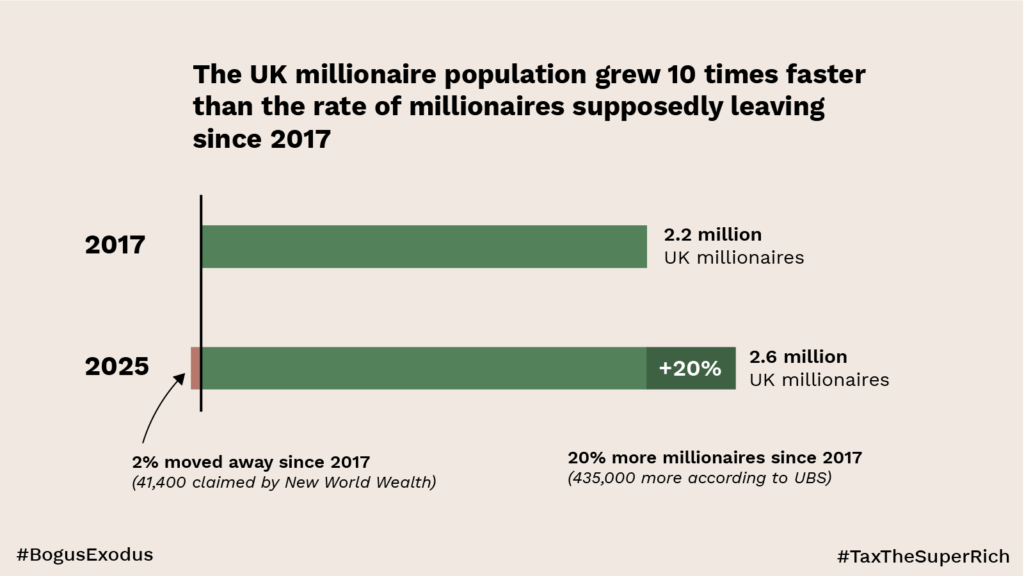

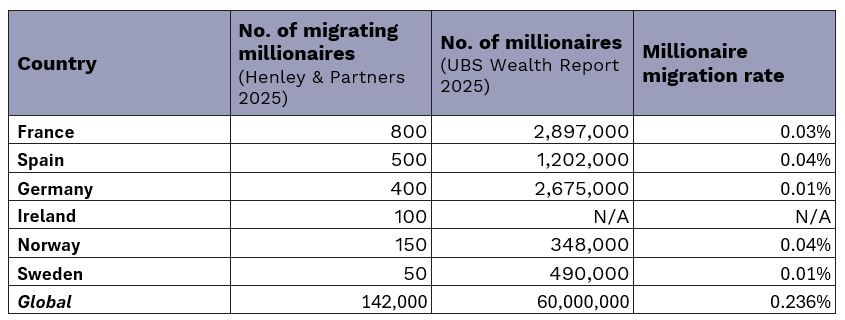

However, TJN’s independent review of the Henley report — co-published with Patriotic Millionaires UK and Tax Justice UK — found that the number of millionaires supposedly leaving countries in this “exodus” actually represented less than 1% of those countries’ millionaire populations.

And in the case of the UK’s 2025 projection, the figure still reflects a tiny, historically normal movement of the ultra-wealthy — not a crisis, and far from a mass departure as the headlines imply.

What Henley Report Claimed

- 16,500 millionaires leaving the UK in 2025

- More than twice the projected outflow from China

- Triggered by tax hikes, political uncertainty, and non-dom reforms

- Framed as a record-breaking outflow, likened to a “Wexit” (wealth exit)

Juerg Steffen, Henley’s CEO, claimed this was “a pivotal moment” in global wealth migration and warned of deep economic consequences for Europe and the UK.

But What the Data Actually Shows

According to Tax Justice Network’s review, Henley’s headline figures are deeply misleading when put into context:

- 0.63% — That’s the actual share of millionaires Henley claims will leave the UK.

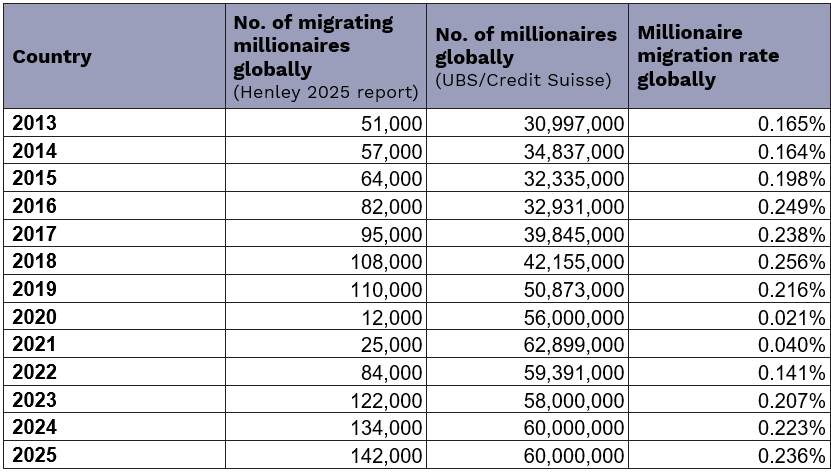

- Globally, the “record” migration of 142,000 millionaires represents just 0.2% of the world’s millionaire population.

- That’s smaller than migration rates in 2016, 2017, and 2018.

- Nearly 100% of millionaires are staying put, based on Henley’s own decade of data.

“Millionaires are highly immobile,” TJN concluded. “The overwhelming majority have not relocated at all since 2013.”

Henley Quietly Backtracked

Interestingly, even Henley’s own tax director, Peter Ferrigno, admitted to rethinking the use of the word “exodus”:

“Is around 1% of a population really a ‘mass departure’? It depends on what agenda the newspaper wants to make a story out of.”

Methodological Red Flags

TJN also raised serious concerns about the integrity of Henley’s research:

- Relies on LinkedIn profiles and work locations, not verified residency

- Excludes most millionaires — only counts those with liquid assets of $1M+

- Heavily skewed sample — overrepresents centi-millionaires and billionaires

- Claims to track 150,000 people globally, but offers no transparent data or public methodology

“Without a representative sample, the claims are statistically meaningless,” TJN argues.

The Rich Speak for Themselves

In fact, 81% of UK millionaires say it’s patriotic to pay a fair share of tax, according to Patriotic Millionaires UK. And 80% support a 2% wealth tax on fortunes above £10 million.

Julia Davies, a member of the group, said:

“This report is a non-story. Less than 1% might leave, and most of us are proud to contribute.”

Media Bias & Political Spin

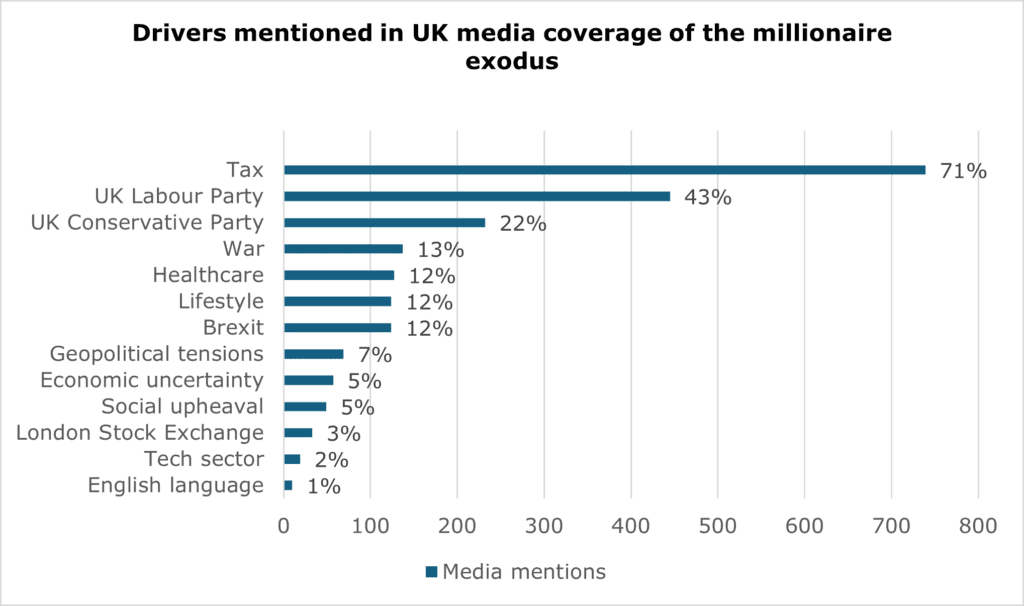

Tax Justice Network found that media coverage often amplified the report beyond its own claims, mentioning “tax” in 71% of UK articles and “Labour” in 43% — despite the Labour Party not being in power when the report was published.

Mentions of a few millionaire departures (like Eddie Hearn and Anne Beaufour) outnumbered stories about millionaire groups calling for higher taxes 3-to-1.

Despite its viral impact, the Henley report — and the media echo chamber that followed — appears to overstate a minor trend, using emotionally loaded terms like exodus to drive attention.

TJN’s core message?

Millionaires aren’t fleeing. The data doesn’t show it. And most of them are still here, paying taxes, and not asking for escape routes.

Sources:

Related:

Elon Musk Launches ‘America Party’ After Breaking With Trump

US Manufacturing Hits 3-Year High, But Tariff Fears Loom

What’s in Tax and Spending Bill That Trump Signed Into Law

F1 The Business: Apple chases Netflix’s Formula 1 playbook

Markets Hit New Highs, Fed Cuts Off Table After Strong Jobs Data; Trade Talks & Tariff Risks Still Loom

Markets Hit Highs After Trump–Vietnam Deal, But All Eyes on US Jobs Report Now

FHFA Chief Claims Powell Lied to Congress; Trump Demands Immediate Resignation

Global Stocks Are Crushing US – But Which Ones?

Market Wrap: Stocks Hit Records, Dollar Slides, and Gold Surges as July Begins