As the second week of July kicks off, Wall Street is juggling policy confusion, trade drama, and big corporate signals — all with the S&P 500 ($SPX) hovering near record highs.

President Trump’s landmark tax-and-spending package, signed late Friday, gives investors a new fiscal landscape to process. But the bigger question this week: what happens after July 9, when Trump’s 90-day “Liberation Day” tariff pause ends?

Add in the start of earnings season, the release of Fed minutes, and Amazon’s mega-sale, and the week ahead could easily turn volatile.

Here are 5 key themes to watch across markets this week:

More about: Stock futures fall after Trump warns new 10% tariffs

1. Tariff Deadline Drama: Which Date Actually Matters?

The clock is ticking on Trump’s trade war reboot. Technically, Wednesday, July 9 is the official end of the President’s 90-day tariff pause. But over the weekend, the White House added confusion.

“Tariffs go into effect August 1. But the President is setting the rates and the deals right now,” Commerce Secretary Lutnick said Sunday. Trump nodded alongside him.

Adding fuel to the fire, Trump threatened an extra 10% tariff on countries aligning with BRICS, escalating both geopolitical tensions and inflation risk. Treasury Secretary Scott Bessent confirmed letters will go out to non-cooperative nations, possibly this week.

Bottom line: Wednesday may no longer be a hard deadline, but volatility could spike if any major trading partners (Japan, Mexico, EU) get hit with letters.

2. Fed Minutes and Bond Market Crossfire

Wednesday at 2 PM ET, the Fed will release minutes from its June meeting, offering insight into whether a September rate cut is still on the table. Markets will closely examine the Fed’s views on wage growth, core inflation, and the health of the labor market.

Meanwhile, bond traders face a triple test this week:

- 10-Year Note Auction – Wednesday, 1 PM ET

- 30-Year Bond Auction – Thursday, 1 PM ET

- Fed’s Balance Sheet Update – Monday, 4:30 PM ET

Poor auction results could raise borrowing costs and spook rate-sensitive sectors. Strong demand, on the other hand, may reflect safe-haven appetite amid policy uncertainty.

3. Earnings Season Begins: Delta and Conagra in Focus

Thursday kicks off earnings season with key reports from:

- Delta Air Lines (DAL) – Expect updates on travel demand, fuel costs, and pricing power. Guidance will be crucial in gauging consumer sentiment and global activity.

- Conagra Brands (CAG) – A window into food inflation and consumer resilience. Can packaged food makers hold pricing amid cost pressure?

These reports, while not mega-cap tech names, will set the tone for how resilient US demand remains in Q3.

4. Taiwan Semi’s AI Checkpoint

Taiwan Semiconductor (TSM) is expected to report June and Q2 sales this week. Why it matters?

TSM is the heartbeat of global chip production, and a critical supplier to Nvidia (NVDA), Broadcom (AVGO), and Apple (AAPL). Strong results will reinforce the AI investment boom, while weakness could trigger sector-wide jitters.

Analysts will watch closely for:

- Capacity utilization trends

- Inventory commentary

- Forward demand from AI-related clients

As AI valuations stretch, TSM’s data will either validate the rally — or cause a reset.

5. Tesla’s Turbulence Continues

Tesla (TSLA) is still stuck in neutral despite better-than-expected Q2 deliveries. The stock remains pinned between its 200-day and 50-day moving averages, weighed down by:

- Loss of EV tax credits after September 30

- Phase-out of zero emission credit profits under the new legislation

- Musk’s ongoing political feud with Trump

- Growing autonomous competition from Uber and Mobileye

With robotaxi hype fizzling and structural incentives fading, Tesla needs more than promises to reignite momentum. Investors will watch for any updates on full self-driving (FSD) or international expansion plans.

Bonus Watch: Amazon Prime Day Starts Tuesday

Amazon (AMZN) launches Prime Day on Tuesday, now extended to four full days. Last year set sales records — will high inflation change the picture?

Retailers and investors alike will track:

- Volume vs discounting strategy

- Consumer behavior under cost pressure

- Impact on logistics and inventory

Prime Day offers a real-time read on consumer demand — and Amazon’s execution in a margin-sensitive retail environment.it volume could signal more than just retail strength — they may indicate how cost-sensitive the US consumer remains.

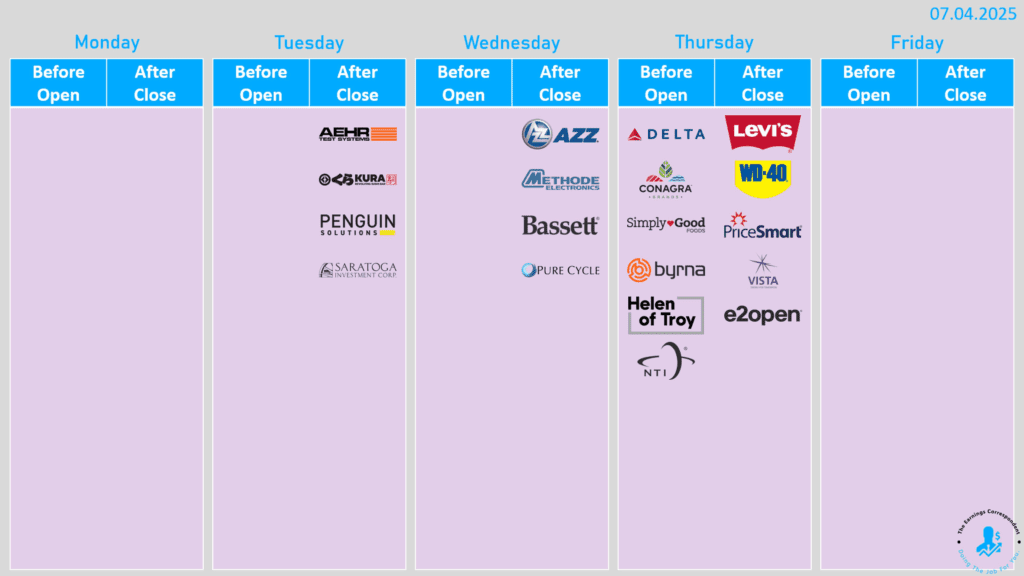

Market Calendar: July 7–11, 2025

Monday

Events: Fed’s Balance Sheet – 4:30 PM ET

Earnings:

- None

Tuesday

Events:

- NY Fed Consumer Inflation Expectations – 11:00 AM ET

- 3-Year Note Auction – 1:00 PM ET

- Consumer Credit (May) – 3:00 PM ET

- API Weekly Crude Oil Stock – 4:30 PM ET

Earnings (After Market Close):

- Aehr Test Systems (AEHR)

- Kura Sushi USA (KRUS)

- Saratoga Investment (SAR)

- Penguin Solutions (PENG)

Wednesday

Events:

- Crude Oil Inventories – 10:30 AM ET

- Cushing Crude Oil Inventories – 10:30 AM ET

- 10-Year Note Auction – 1:00 PM ET

- Atlanta Fed GDPNow (Q2) – 1:00 PM ET

- FOMC Meeting Minutes – 2:00 PM ET

Earnings:

- AZZ (Before Market Open)

- Pure Cycle (After Market Close)

- Bassett Furniture Industries (After Market Close)

Thursday

Events:

- Initial Jobless Claims – 8:30 AM ET

- Continuing Jobless Claims – 8:30 AM ET

- 30-Year Bond Auction – 1:00 PM ET

- FOMC Member Daly Speaks – 2:30 PM ET

Earnings:

- Delta Air Lines (Before Market Open)

- Conagra Brands (Before Market Open)

- KalVista Pharma (Before Market Open)

- Yoshitsu Co (Before Market Open)

- Levi Strauss (After Market Close)

- Platinum Group Metals (After Market Close)

- E2open Parent Holdings (After Market Close)

Friday

Events:

- IEA Monthly Report – 4:00 AM ET

- WASDE Report – 12:00 PM ET

- U.S. Baker Hughes Oil Rig Count – 1:00 PM ET

- U.S. Baker Hughes Total Rig Count – 1:00 PM ET

- Federal Budget Balance (June) – 2:00 PM ET

Earnings: None

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Elon Musk Launches ‘America Party’ After Breaking With Trump

US Manufacturing Hits 3-Year High, But Tariff Fears Loom

What’s in Tax and Spending Bill That Trump Signed Into Law

F1 The Business: Apple chases Netflix’s Formula 1 playbook

Markets Hit New Highs, Fed Cuts Off Table After Strong Jobs Data; Trade Talks & Tariff Risks Still Loom

Markets Hit Highs After Trump–Vietnam Deal, But All Eyes on US Jobs Report Now

FHFA Chief Claims Powell Lied to Congress; Trump Demands Immediate Resignation