After a volatile week of tariffs, weak jobs data, and corporate earnings chaos, markets are stabilizing — but confidence in the US economy and the Fed is fraying fast.

Last week’s recap: It was a wild trading week, with some of the biggest headlines of the summer hitting back-to-back — yet markets ended red as trade war fears, Fed indecision, and shaky earnings weighed on sentiment.

The week opened strong, with stocks hitting record highs thanks to optimism over a new 15% US–EU trade deal and anticipation for 150 S&P 500 earnings reports. Super Micro surged on retail buzz, and Tesla rallied on a $16.5B Samsung AI chip deal.

Tuesday brought chaos as Trump’s sweeping tariff order rattled markets. He slapped 35% tariffs on Canada and raised duties on dozens of others. Union Pacific surged on merger talks; UPS tumbled on weak China demand. Healthcare names were rocked as Novo Nordisk plunged 21%, Eli Lilly slipped, and Sarepta jumped 15%.

FOMC Wednesday saw markets wobble as the Fed held rates, but two governors dissented — a first since 1993. Microsoft and Meta lifted after hours with blockbuster earnings. Meta raised guidance citing AI momentum, and Microsoft hit $4T market cap on $76.4B revenue.

Thursday cooled off despite solid earnings. Cramer’s “Celebrate the moment” tweet captured the fading enthusiasm. Figma’s IPO tripled at open. Amazon beat on revenue but dropped 7% on wide guidance. Apple posted strong AI-driven growth.

Friday flipped the tone as revised jobs data showed a much weaker labor market. May/June saw 258k job losses; July added just 73k. Trump fired the Labor Stats chief, adding to uncertainty. VIX jumped, the dollar fell, and the Fed came under fire. Meanwhile, Reddit surged 20%, and Eli Lilly & Novo rebounded on GLP-1 insurance hopes.

This Morning: Market Mood Calms as Rate Cuts Priced In

Global markets opened the week on steadier ground, with traders recalibrating their expectations following last Friday’s dramatic US jobs report and escalating political pressure on the Fed.

- S&P 500 and Nasdaq futures are up +0.4%

- Dow futures gained +0.3%

- EuroStoxx 50 and FTSE 100 futures rose +0.5%+

- Gold is trading near $3,355/oz, easing slightly after a sharp Friday gain

- Oil slipped after OPEC+ confirmed a 547,000 bpd output hike

- The US dollar remains weak, particularly against the yen and emerging market currencies

According to futures markets, there’s now an 85% chance of a Fed rate cut in September, with a full 100bps of easing priced in over the next 12 months. But faith in US economic credibility is fraying after Trump’s decision to fire the BLS chief and move to appoint a loyalist to the Fed Board.

“It opens the prospect of broader support on the Fed Board for lower rates sooner,” said NAB’s Ray Attrill.

“But the credibility of both the Fed and the statistics they rely on is now under scrutiny.”

While investor confidence was shaken by leadership changes at the Fed and BLS, the immediate market reaction is optimistic: equity futures are higher, gold is firm, and rate-sensitive sectors are watching the Fed closely.

More about: Job Numbers Drama Explodes, Economists Warn of Crisis Ahead

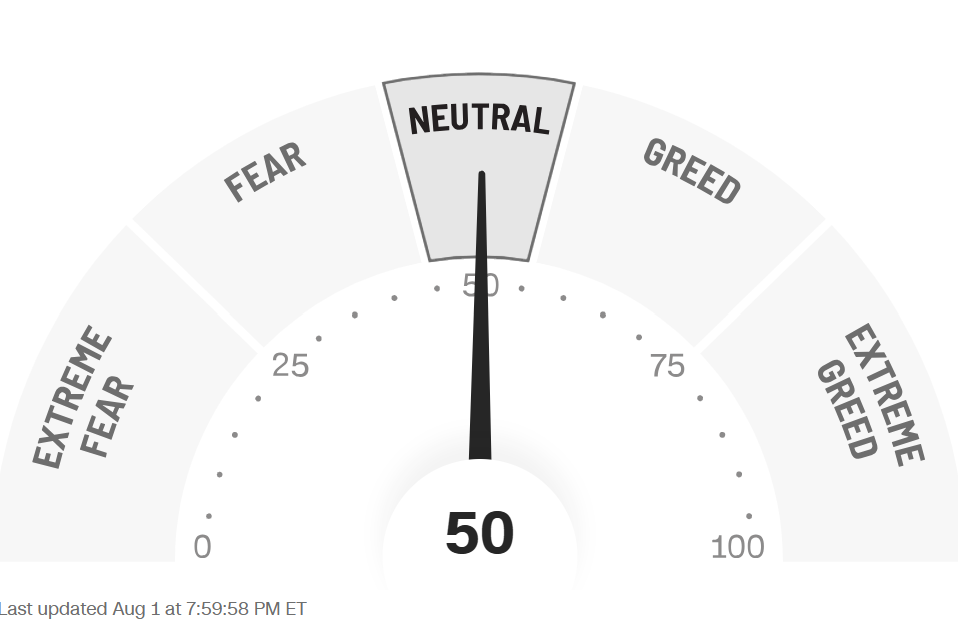

Sentiment Check: Fear & Greed Index = Neutral (50)

Traders are cautious but not panicking. The VIX remains elevated, and bond yields remain low. Market focus is shifting to how deeply the Fed may cut in Q3–Q4.

Economic Calendar – Today (ET):

Monday, August 4: 10:00 AM – Factory Orders

| Company Name | Ticker | Timing |

|---|---|---|

| BioCryst Pharma | BCRX | BMO |

| TG Therapeutics | TGTX | BMO |

| BioNTech | BNTX | BMO |

| Wayfair | W | BMO |

| Palantir Technologies | PLTR | AMC |

| Hims & Hers Health | HIMS | AMC |

| Transocean | RIG | AMC |

| MercadoLibre | MELI | AMC |

| Ardelyx | ARDX | AMC |

| Navitas Semiconductor | NVTS | AMC |

| Axon Enterprise | AXON | AMC |

| Arvinas | ARVN | AMC |

| Aeon Enterprise | AELN | AMC |

That’s all for this morning. Stay sharp, more fireworks could follow if Trump escalates trade pressure or if today’s factory data disappoints.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years