The S&P 500 just posted its best week since 2023, closing up +5.2%, but don’t zoom out—tariffs, inflation fears, and bond panic still rule the macro mood.

Chaos Recap: Day by Day

Monday: Markets braced for “Black Monday 2.0” after China’s overnight retaliation. Stocks opened red, but traders latched onto a misquoted “90-day pause” tweet.

➤ Result? S&P 500 dipped just -0.23%.

➤ Larry Fink warned of a “bear market recession.” Wall Street half-listened.

Tuesday: The tweet was fake. Then Trump actually imposed 104% tariffs on China.

➤ Bond yields soared as traders dumped long-term notes.

➤ 10Y Treasury yield saw its biggest weekly rise since 2001.

Wednesday: Jamie Dimon predicted a recession. Trump tweeted: “THIS IS A GREAT TIME TO BUY!!!” Then, he paused the tariffs for 90 days—except on China.

➤ S&P +9.52%, Nasdaq +12.16%, Dow posted its biggest point gain in history.

➤ $4.3 trillion added in one day. Everyone hit “buy.”

Thursday: Reality returned. Trump’s “pause” still included 10% base tariffs, 145% on China, and 25% on U.S. allies. Bond selloffs resumed.

➤ 75 countries are now scrambling to negotiate before Q2 carnage.

Friday: China hit back.

➤ 125% tariffs on U.S. imports.

➤ Called the U.S. a “joke,” said they were “done going tit-for-tat.”

➤ Markets held green, but the hangover is coming.

Final Tally: Indexes Fly — But for How Long?

| Index | Close | Change |

|---|---|---|

| S&P 500 | 5,363 | +1.81% |

| Nasdaq | 16,725 | +2.06% |

| Dow Jones | 40,213 | +1.56% |

| Russell 2000 | 1,860 | +1.57% |

Tech led at +3.98%, real estate lagged at -0.54%.

Macro We Missed While Watching Tariff TikToks

- CPI & PPI both fell MoM. Markets didn’t care.

- UMich sentiment? Crashed. 60% of respondents blamed government policy — a record.

- Fed officials?

➤ Collins: Fed is “ready to step in.”

➤ Kashkari: We’re not there yet, but if things get worse, “we’ll act.”

➤ Williams: Recession and inflation may coexist. Hello, stagflation.

Big Lessons This Week

- Markets don’t move on fundamentals — they move on tweets and whiplash.

- Tariff talk is now Fed-level market-moving.

- Volatility is the new normal.

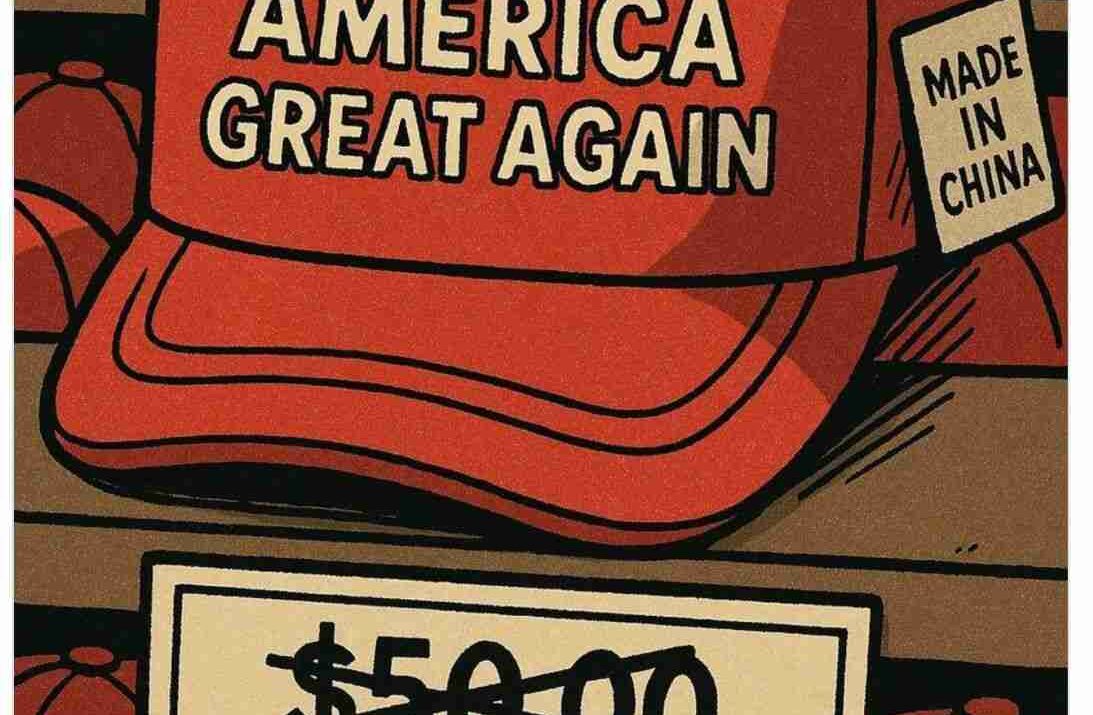

- Trump’s trade policy is basically day trading.

- Investors are exhausted, but portfolios are green (for now).

Bottom Line: Tariff panic, yield spike, tweet relief rally—wash, rinse, repeat. Until there’s clarity, expect markets to flip on headlines faster than you can flip a coin.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

China strikes back with 125% tariffs on U.S. goods, starting April 12

Tesla stops taking new orders in China

145% Tariffs and a Global Showdown: China Rejects US “Arrogance”

EU to impose retaliatory 25% tariffs on US goods from almonds to yachts

Trump Raises Tariffs On China To 125% After Beijing’s 84% Move

China vows ‘fight to the end’ after Trump threatens extra 50% tariff

Musk made direct appeals to Trump to reverse sweeping new tariffs

Trump Opens Door to Tariff Talks—But No Pause, No Retreat, Just ‘Tough but Fair’ Deals