Stocks tumble, allies stunned, and global tensions rise as Trump revives ‘Liberation Day’ tariff threats — this time with an August 1 deadline.

Trump’s 14-Letter Tariff Barrage

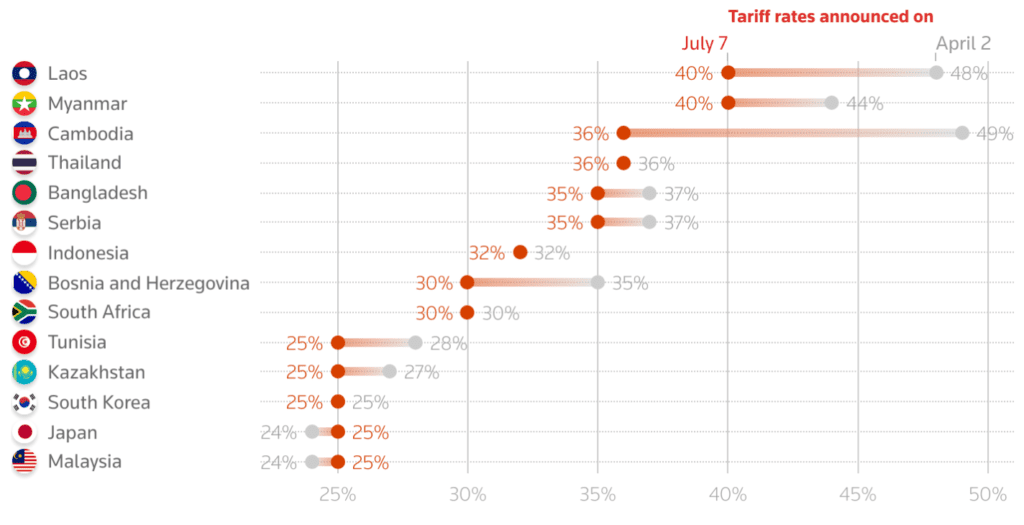

President Donald Trump on Monday posted a new batch of “UNITED STATES TARIFF Letters” on Truth Social, notifying the leaders of 14 countries — including Japan, South Korea, Malaysia, and South Africa — of new 25% to 40% tariffs on their exports to the US. The new tariffs, ranging from 25% to 40%, are set to take effect August 1, replacing the previous July 9 deadline. Trump called the August 1 tariff date “firm, but not 100% firm,” saying he’s open to changes if countries reach out with alternatives.

🔹 Japan & South Korea: 25%

🔹 Malaysia & Kazakhstan: 25%

🔹 South Africa: 30%

🔹 Laos & Myanmar: 40%

🔹 Additional letters: Cambodia (36%), Serbia (35%), Bangladesh (35%), Indonesia (32%), Tunisia (25%)

- Japanese Prime Minister Shigeru Ishiba said the latest tariff announcement was “truly regrettable.”

- South Korea said it will hold a response meeting with relevant ministries at 1:30 p.m. local time.

- Malaysia, which saw its tariff rate rise to 25% from 24%, said it will continue to engage with the U.S. to address outstanding issues.

In the letters, Trump warned that any retaliatory tariffs will be matched or exceeded:

“If, for any reason, you decide to raise your Tariffs, then, whatever the number you choose will be added onto the 25% we charge.”

He also threatened a +10% tariff on any nation aligning with the “anti-American policies of BRICS.”

BRICS push back as Brazilian President Lula accuses Trump of behaving like an “emperor”:

“The world has changed. We don’t want an emperor. It is not responsible or serious…for him to be threatening the world on the internet.” “We are sovereign nations. If he thinks he can impose tariffs, we can too.”

White House Press Secretary Karoline Leavitt confirmed that more than 100 countries will receive similar letters in the coming days, adding that the President signed an executive order to delay the implementation to August 1, allowing room for last-minute deals.

No EU Tariffs — Yet

While most nations received hardline messages, the EU avoided new tariff letters, at least for now. Officials confirmed that the European bloc is in advanced talks with the US, seeking a 10% universal tariff deal with sector exemptions for aircraft, wine, and spirits. EU Commission President Ursula von der Leyen reportedly had a “good exchange” with Trump and hopes to finalize a deal by midweek.BRICS Warning

China Responds

China’s official newspaper People’s Daily slammed Trump’s tariff actions, calling them “bullying” and warning of retaliation, especially against countries that strike deals with the US designed to exclude China from global supply chains.

China has until August 12 to finalize its agreement with Washington. A previously announced framework deal, including eased restrictions on chip design software and ethane exports, remains fragile.

Market Reaction

Early this morning, equity futures are off modestly following Monday’s sell-off. Traders remain cautious—Dow is down ~0.6%, S&P 500 off ~0.7%, Nasdaq roughly -0.8%, as tariff concerns persist.

Global Markets Snapshot

- Gold: Stabilizes around $1,925/oz, propped up by safe-haven demand amid trade uncertainty.

- Oil: Slight dip to $69–70/bbl, after recent OPEC+ production boost softened geopolitical risk premium

- Bitcoin: Consolidating near $108K—Crypto markets remain muted despite tariff headlines

- Currencies: USD holds firm; Euro and Aussie dip as risk-sensitive currencies soften

- Asia markets: Nikkei rose ~0.4% despite US pressure; regional investors taking cues from tariff ‘delay but not delayed’ stance

Goldman Sachs: Don’t Panic Yet

Despite Monday’s market drop, Goldman Sachs raised its 12-month forecast for the S&P 500 to 6,900, expecting gains from large-cap stocks and anticipated Fed rate cuts. The bank expects a +11% return over the next year and projects the index to rise 6% by year-end.

New S&P 500 targets:

- 3-month: +3% → 6,400

- 6-month: +6% → 6,600

- 12-month: +11% → 6,900

“Recent inflation and corporate data show less tariff pass-through than we expected,” analysts noted, though they warned of a gradual impact.

Fed & Rates Outlook

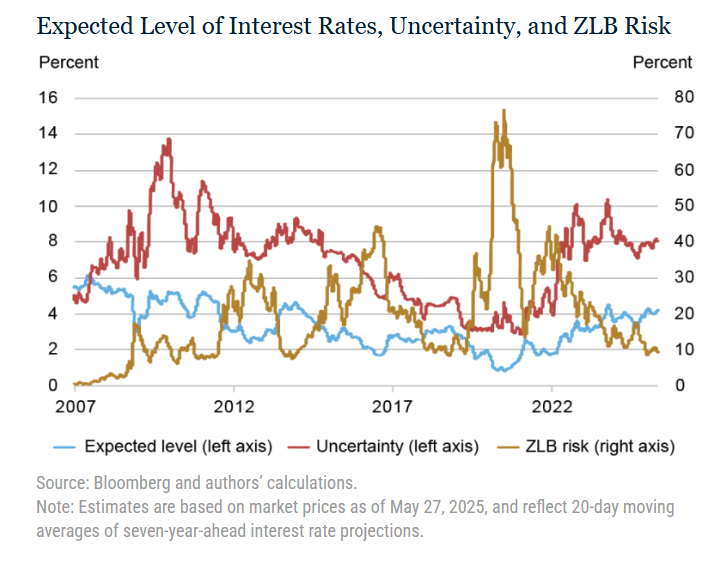

- A new study from the NY & SF Fed warns of a roughly 9% chance that US rates could return to zero within 7 years, given persistent uncertainty and geopolitical risk

- Meanwhile, the Fed remains cautious: last meeting’s minutes signaled no imminent cuts, with rate path dependent on inflation, tariffs, and global risks .

Key Takeaways

- Trump is reviving aggressive trade policy with dozens of countries caught in the crossfire.

- Letters cite unfair trade balances and warn of harsher rates if partners retaliate.

- The US has only secured deals with the UK and Vietnam since April.

- The EU may avoid worst-case tariffs — if it can finalize a deal this week.

- China’s response hints at a potential supply chain backlash if tensions worsen.

What’s Next?

Expectations are high for a Phase 1 deal with India, with Trump reportedly reviewing their “final offer.” Meanwhile, dozens more letters are expected before the week is out.

As trade negotiations unfold and earnings season kicks off, markets will remain volatile. Investors are now bracing for more policy shocks as Trump reshapes America’s global economic ties.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Dow, S&P 500, Nasdaq Drop as Trump Slaps 25–40% Tariffs on Trade Partners

Global Stocks Are Crushing US – But Which Ones?

Markets This Week: Tariff Chaos, Fed Clarity, Prime Day, and Earnings Heat Up

Elon Musk Launches ‘America Party’ After Breaking With Trump

US Manufacturing Hits 3-Year High, But Tariff Fears Loom