Tuesday delivered a striking rotation under the surface of US markets. While the S&P 500 closed at only –0.59%, momentum favourites collapsed, and value stocks rallied.

- Momentum losers: Nvidia (–3.5%), AMD (–5.4%), Oracle (–5.8%), Palantir (–9.3%), Meta (–2.1%).

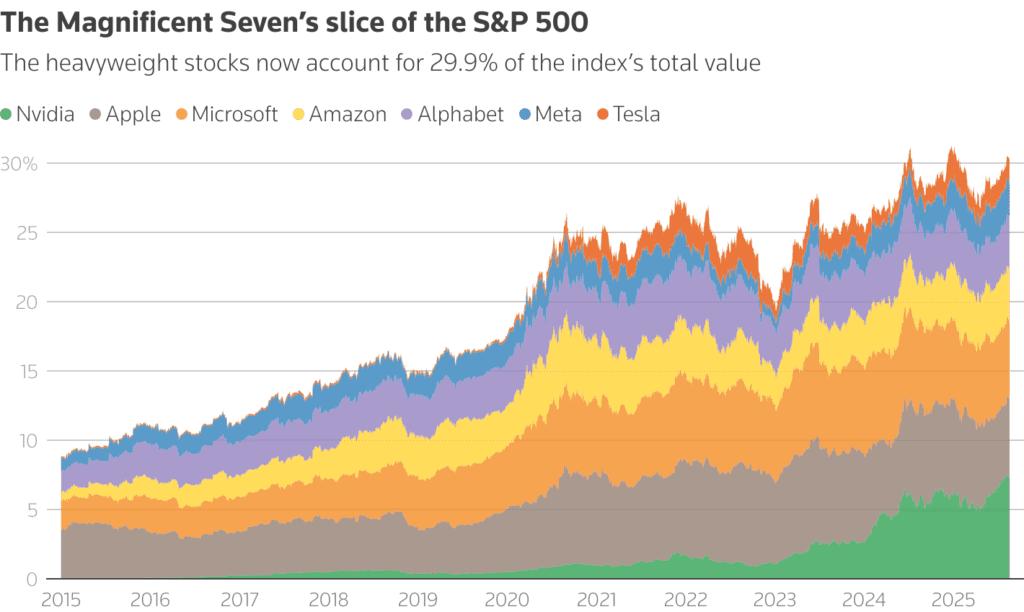

- Value outperformers: iShares MSCI USA Value ETF rose +0.47% vs. a –3.34% decline for the Momentum ETF. It was the sixth biggest outperformance of value vs. momentum this year — and it felt bigger given how sharply the “Magnificent Seven” faltered.

The question now: Was this the start of a structural shift away from crowded AI/momentum trades, or just a one-day blip?

Global Markets: Tech Selloff Spills Over

Wall Street’s tech wreck reverberated globally on Wednesday.

- Asia: Tech-heavy Taiwan (–2.6%) and South Korea (–1.7%) led declines, dragging MSCI Asia ex-Japan down –0.7%.

- Europe: Stoxx 600 fell –0.2% at the open, with tech and industrials lagging, while defensives (real estate, utilities, personal care) outperformed 【Bloomberg†source】.

- Futures: Nasdaq-100 contracts led losses, down ~0.5%. S&P 500 and Dow contracts followed, modestly lower.

Macro Focus: Fed, Powell’s Legacy, and Inflation Risks

Inflation and Fed Policy

Markets now turn to the FOMC minutes (July meeting) later today, followed by Jerome Powell’s Jackson Hole speech on Friday — his last as Fed Chair.

- Powell’s expected shift: He is widely expected to announce the Fed will abandon average inflation targeting (AIT) — the framework that tolerated inflation overshoots to offset past shortfalls. Critics argue AIT contributed to the Fed’s slow response during the post-pandemic spike. The Fed is likely to revert to a straight 2% target, with Powell framing a more preemptive policy stance to guard against supply shocks and services-driven inflation.

- Inflation reality: Inflation is currently running one percentage point above target, with services prices heating up even as tariffs only mildly feed into CPI/PPI. Fed officials from Cleveland (Hammack), Atlanta (Bostic), and Kansas City (Schmid) have all flagged concern that sticky services inflation could keep pressure high.

- Market pricing: Traders still see an 83–85% chance of a September cut (25bps), though odds softened after the hotter PPI print.

- Investor mood: Treasury yields climbed again, with the 10-year hitting 4.32%, its 4th straight gain. Gold stayed firm, a hedge against both inflation and geopolitical risk.

Labor Market Weakness

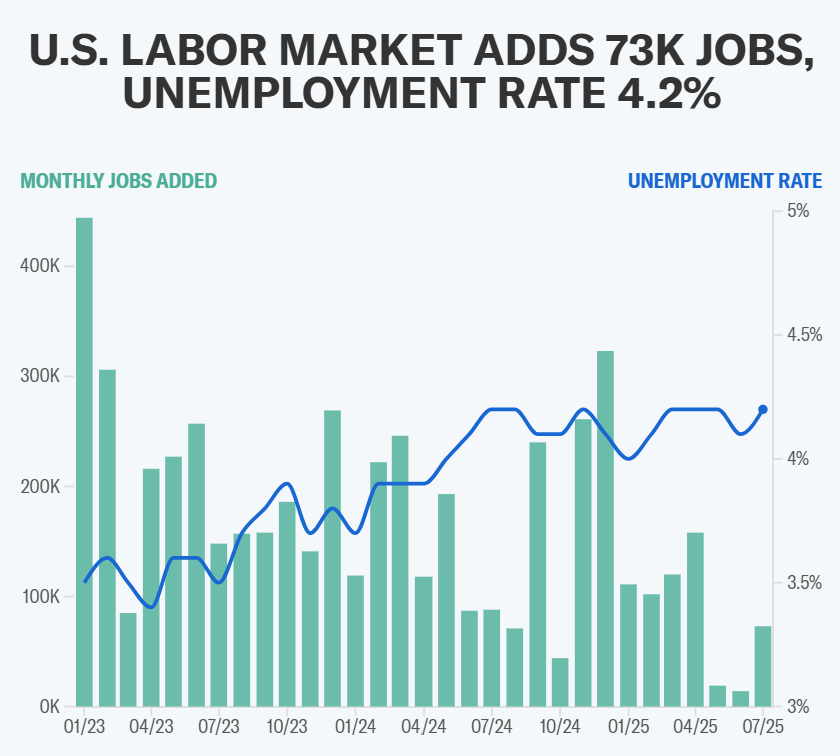

At the same time, the jobs picture is deteriorating — fueling the Fed’s dilemma.

- July jobs report: 73,000 jobs added, with big downward revisions pulling the three-month average to 35,000 — the weakest pace in years. Unemployment still hovers near 4%, but under the surface, labor force participation is slipping, job openings are falling, and hiring outside a handful of industries has nearly stalled.

- Fed officials shifting: Mary Daly (San Francisco) and Neel Kashkari (Minneapolis) both moved from “wait-and-see” to openly worried about job market softness. They joined Fed Governors Waller and Bowman, who dissented in July in favor of a cut.

- Goldman Sachs warning: GS economists say hiring momentum is far weaker than it looks — trend job growth is now ~30k/month, too low to sustain full employment. They expect three cuts this year (Sept, Oct, Dec), with possibly more in 2026 if hiring remains weak.

- Structural shifts: Slowing immigration, fading “catch-up hiring” in healthcare/education, and softness in tech, retail, and manufacturing add to pressure. Goldman notes even modest further weakness could “lock out” parts of the labor force, creating lasting scars despite steady unemployment rates.

The dilemma: Inflation still overshoots, but the labor market is faltering. Powell must balance these forces at Jackson Hole. His framework review could reshape Fed strategy for years, but in the short term, the path to the September FOMC decision remains data-dependent — and politically charged, with Trump publicly hammering Powell to cut.

Sector Spotlight: US Housing Shock

Housing weakness is another pressure point.

- James Hardie Industries (JHX) plunged –28%, its worst selloff since 1973, after warning of weak demand in North America. Net profit fell –29% YoY to $127M; U.S. fiber cement sales dropped –12%.

- Toll Brothers (TOL) reported softer orders, reinforcing the cautious housing backdrop.

- Homeowners are deferring major projects, and affordability remains a key drag, prompting Trump to push harder for Fed rate cuts to lower mortgage costs.

Corporate & Policy Watch

- Tech & Politics: Trump’s intervention in the tech sector continues to worry investors. The administration is exploring equity stakes in Intel and others in exchange for CHIPS Act grants. Critics warn this “Presidential creep” into corporate balance sheets could erode margins and add new risks 【Reuters†source】.

- Amazon unveiled its latest AI processors, aiming to challenge Nvidia, Microsoft, and Google in hyperscale computing.

- Bitcoin slipped further, trading around $113,500. The drop followed comments by Treasury Secretary Scott Bessent that the U.S. will not expand its bitcoin reserve purchases — a blow to bullish sentiment that had fueled recent gains.

Key Events Today

- U.S. Housing Starts (08:30 ET)

- Redbook YoY (08:55 ET)

- Fed’s Bowman speaks (10:00 & 14:10 ET)

- FOMC Minutes (14:00 ET)

- Earnings: Target, Lowe’s, TJX before open; Keysight, La-Z-Boy, Toll Brothers after close.

- UK Inflation (July) – expected slight uptick, keeping BoE under pressure.

- NZ: Central bank cut rates, flagged more easing as domestic growth stalls.

A tech-led selloff has shaken confidence in Wall Street’s most crowded trades, spilling into global markets. With value stocks suddenly in favor, housing flashing red, and central banks in focus, investors now look to the Fed minutes and Powell’s Jackson Hole speech for clarity on rates and policy framework.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Stock Market Today: Tech Tumbles, Retail Steadies, Fed Looms

Intel Secures $2 Billion Lifeline From SoftBank, Shares Jump

Zelenskyy–Trump Summit: Key takeaways from Diplomatic Optics to Defense Deals