The Federal Reserve’s December rate cut is no longer a sure thing. What markets once treated as a near-certainty has now flipped into a 50-50 toss-up, after several Fed officials signaled hesitation about easing policy without clearer economic data.

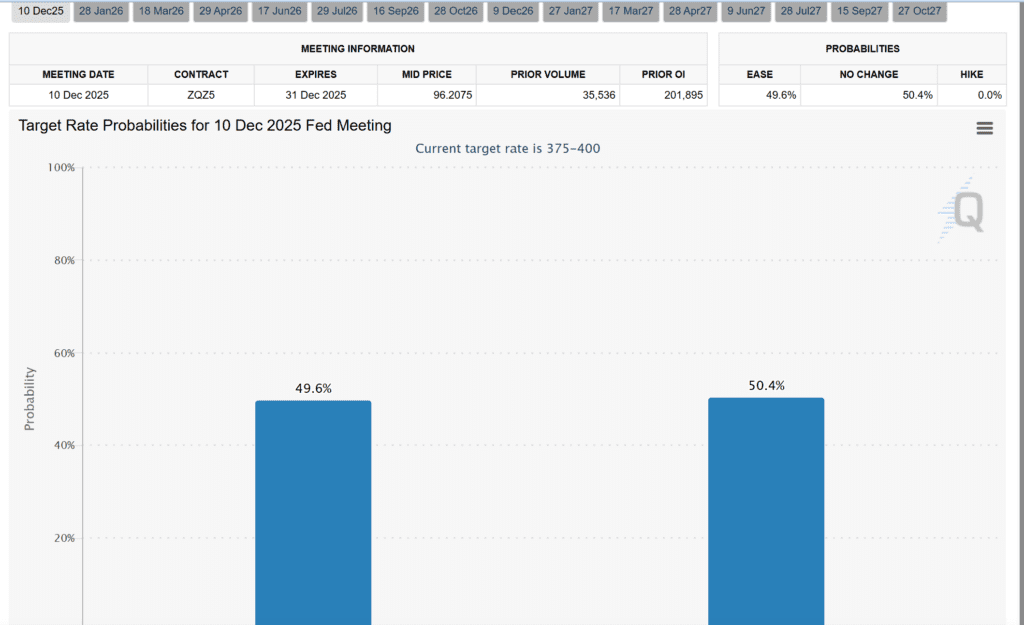

Just days ago, traders were pricing in more than a 65% chance of a quarter-point cut. A month earlier, that probability was 95%. As of Thursday, futures markets show the odds hovering around 49%, according to CME FedWatch.

What changed?

The longest government shutdown in US history froze the flow of economic data, leaving the Fed “flying blind.”

Key October indicators — including inflation, unemployment, and payrolls — may never be released, according to the White House. That’s a problem for a central bank that claims to be “data-dependent.”

At the same time, officials see mixed signals:

- Labor market: Slowing but still resilient

- Inflation: Easing, but still well above the 2% target

- Tariffs: Uncertainty around inflationary effects from Trump’s trade actions

This murky backdrop has strengthened the hand of Fed “hawks” who want to pause cuts.

A surprisingly blunt warning

Boston Fed President Susan Collins, normally a cautious communicator, delivered one of her clearest messages yet:

“It will likely be appropriate to keep policy rates at the current level for some time… I see several reasons to have a relatively high bar for additional easing.”

Her comments align her with other hawkish officials — Kansas City’s Jeffrey Schmid, Cleveland’s Beth Hammack, and possibly the heads of the St. Louis and Dallas Feds.

On the other side, doves like Stephen Miran, Christopher Waller, and Michelle Bowman are still open to deeper cuts.

Powell’s dilemma

Fed Chair Jerome Powell is stuck in the middle, trying to avoid a public split inside the FOMC at a sensitive moment for the institution. After October’s cut, Powell made it clear December was “not a foregone conclusion — far from it.”

Analysts say he may need to choose between:

- A hawkish hold — no cut in December, stressing that policy is already supportive

- A hawkish cut — one more cut, paired with guidance that the easing cycle may be over

The committee’s makeup changes in January, and Powell’s own term expires in May — adding more uncertainty to the path ahead.

Markets react quickly

As confidence in a December cut faded:

- Stocks dropped sharply on Thursday, Treasury yields climbed, Tech led declines as investors reassessed valuations without guaranteed policy support

More about: Stocks Sink as Shutdown Ends and AI Trade Unravels

Traders now assign a 70% chance of a cut coming in January if December is skipped.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.