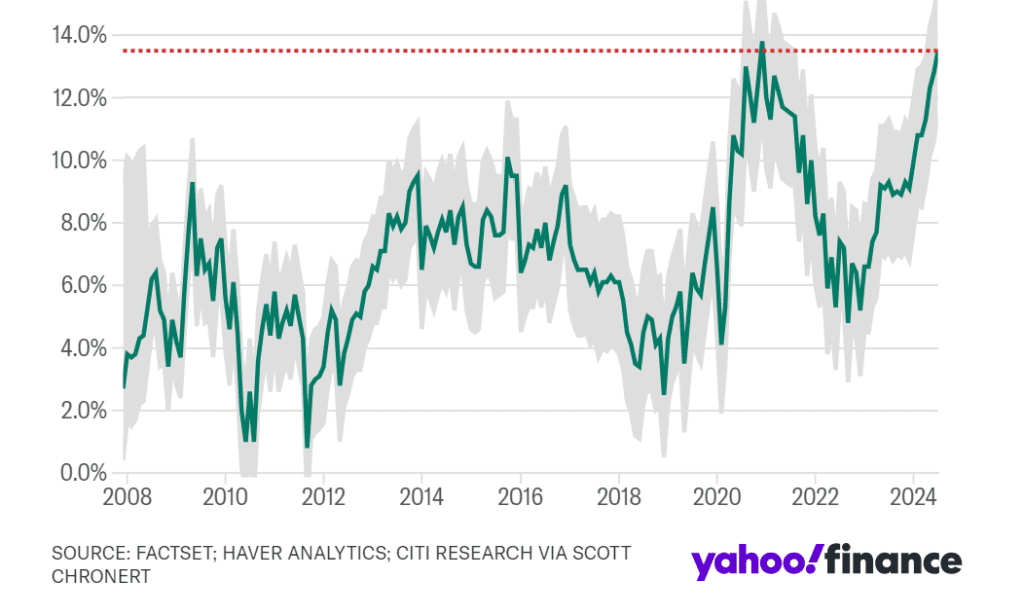

GROWTH EXPECTATIONS NEAR CYCLE HIGHS

Current index levels reflect high market expectations for strong earnings results, indicating optimism for continued growth.

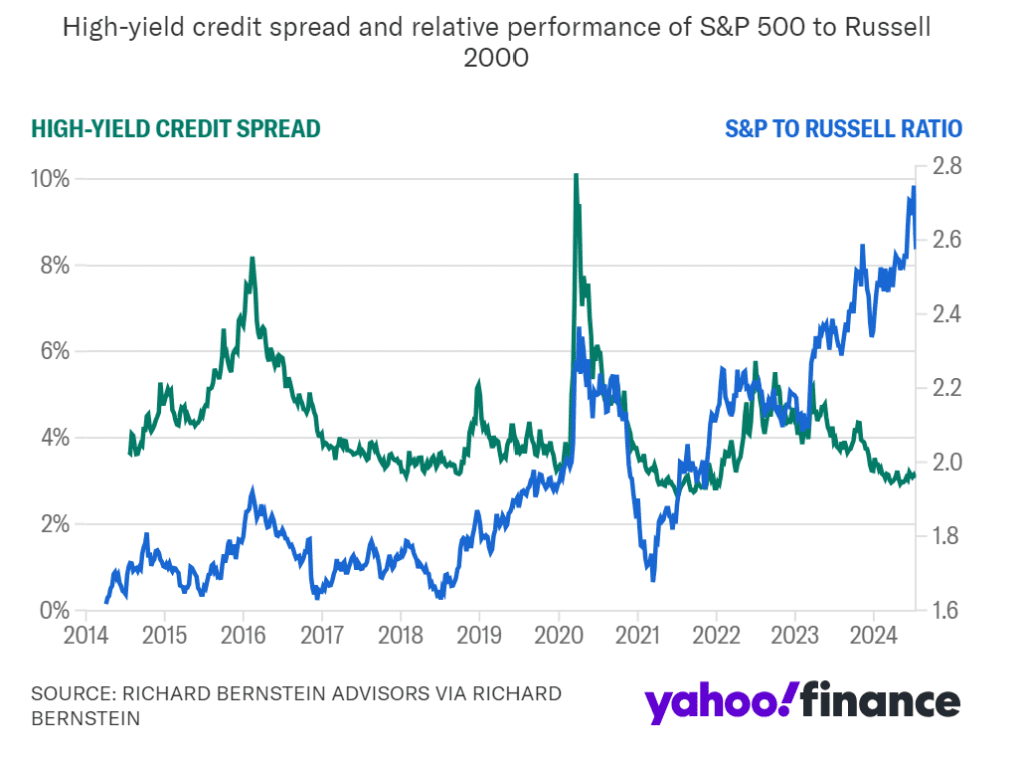

LARGE-CAP RALLY ‘CONFLICTS WITH SOUND ECONOMIC THEORY’

Large-cap stocks have outperformed smaller-cap stocks despite narrowing high-yield credit spreads, a rare trend conflicting with economic theory.

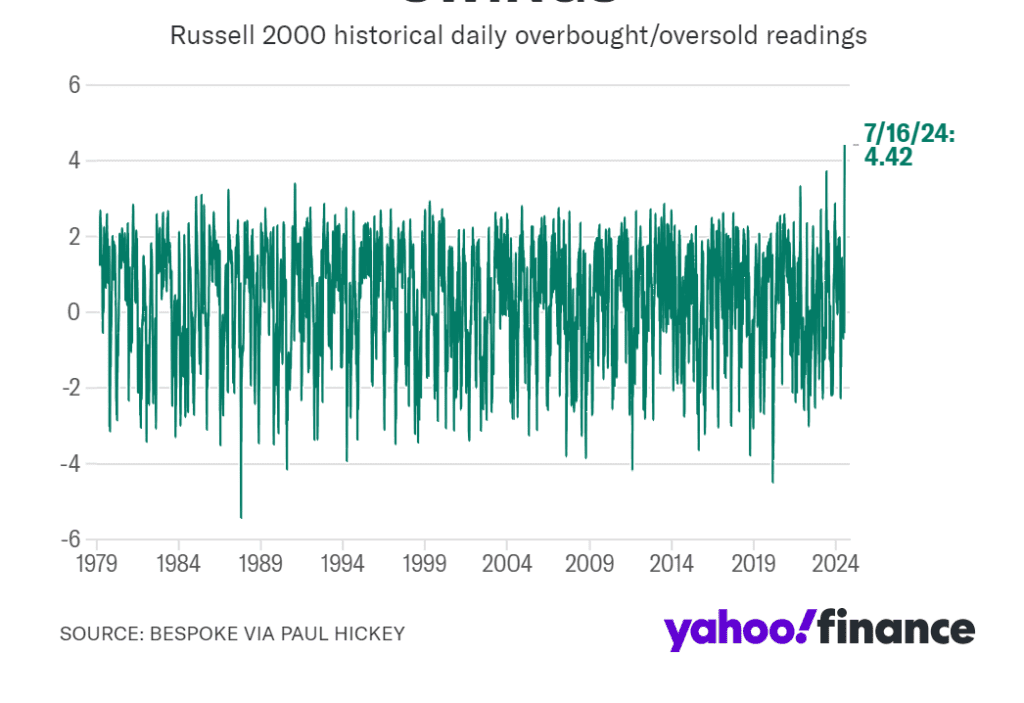

SMALL CAPS ARE ‘SUSCEPTIBLE TO LARGE SWINGS’

The Russell 2000’s overbought status highlights its susceptibility to large swings due to its smaller market cap compared to major indices.

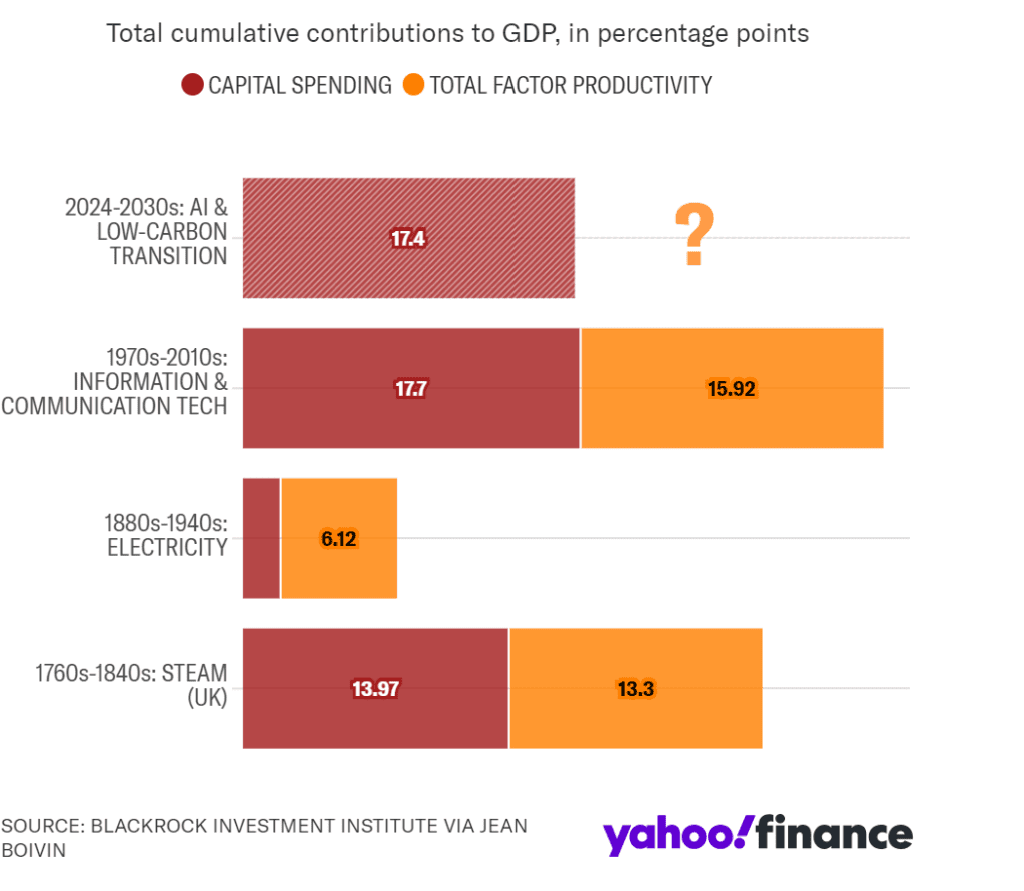

PRODUCTIVITY BOOM TO FOLLOW AI SPENDING?

AI and the low-carbon transition may drive unprecedented capital spending, potentially transforming economies and markets.

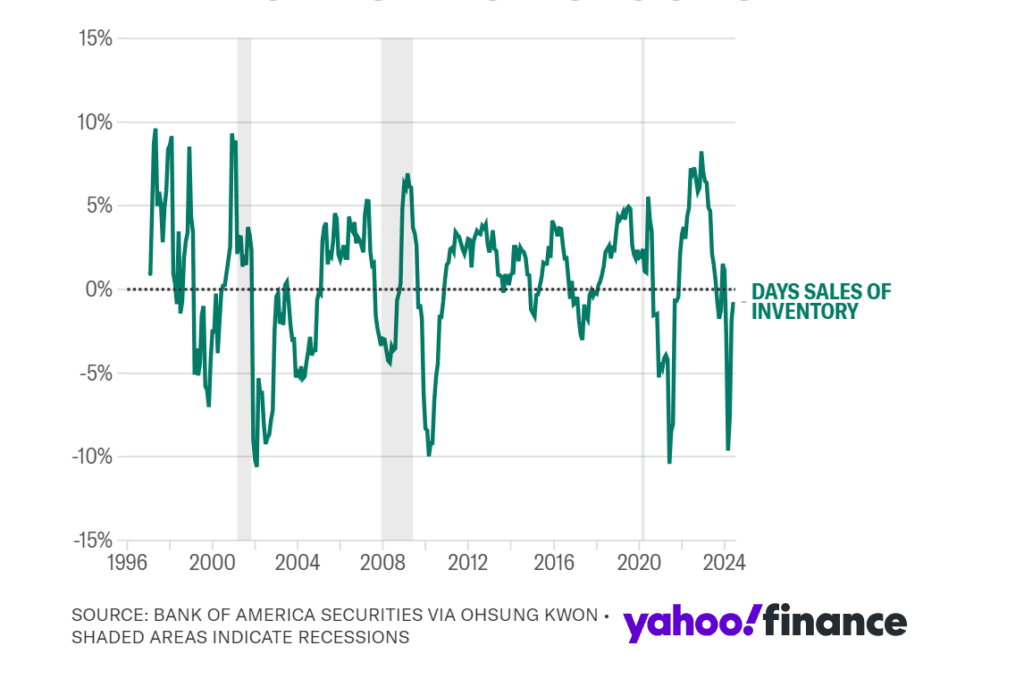

END OF DE-STOCKING CYCLE BULLISH FOR STOCKS

The sharp de-stocking cycle is moderating, indicating the end of inventory contraction, which had been one of the sharpest in history.

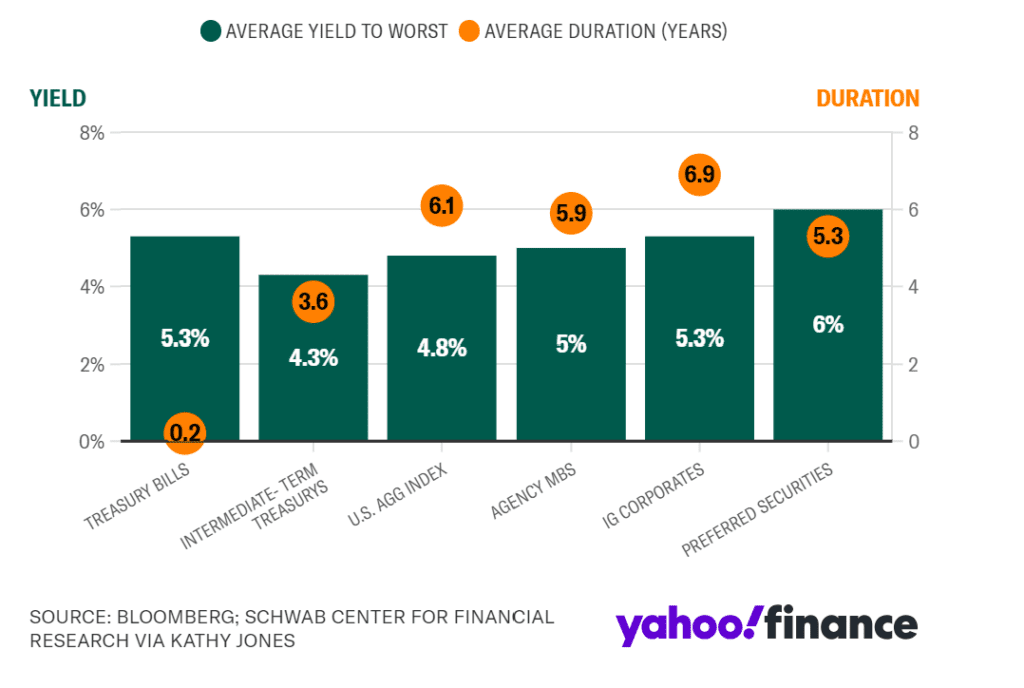

OTHER INSTITUTIONAL INVESTMENTS ARE OFFERING HIGHER YIELDS THAN TREASURY BILLS

With an inverted Treasury yield curve, investors are cautious about extending duration in bond portfolios. Alternatives like investment-grade corporate bonds and agency mortgage-backed securities offer higher yields without significant credit risk.

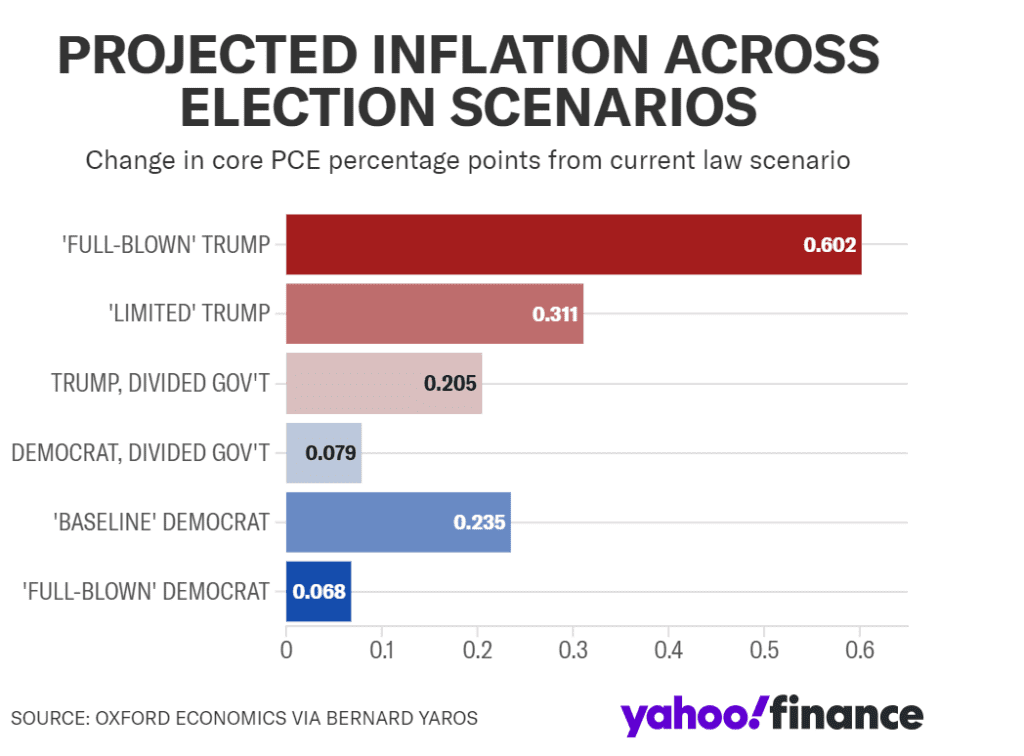

A pending US presidential election

Different election outcomes will influence inflation, with the highest impact under a Republican trifecta and the least under a divided government or Democratic trifecta.

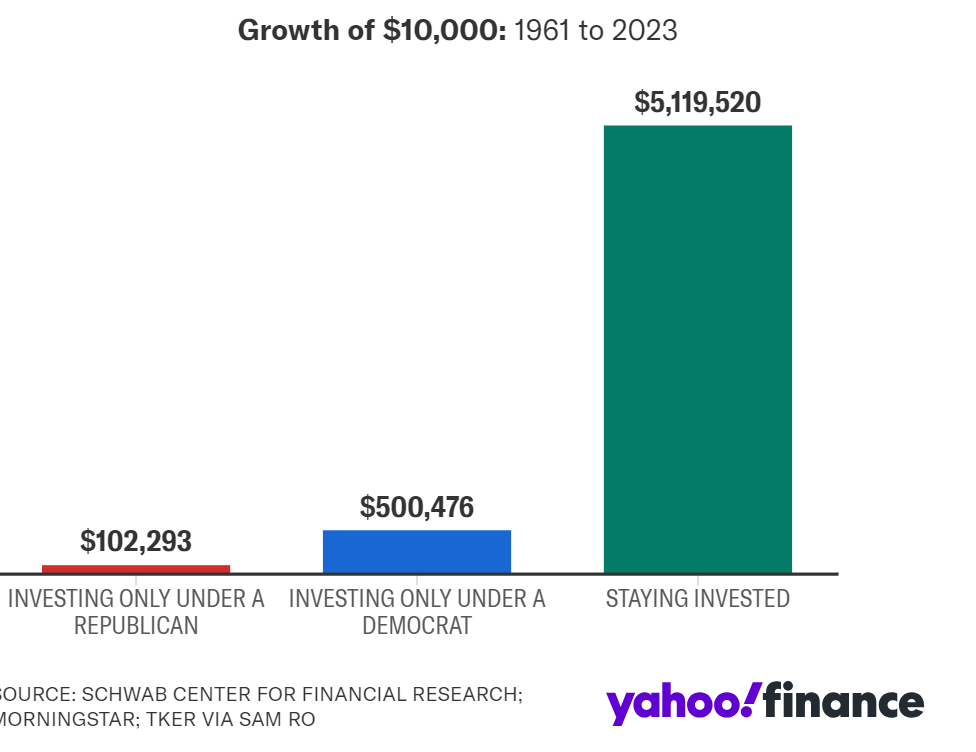

STAY INVESTED NO MATTER THE POTUS

Historical data shows staying invested through different presidential administrations yields the highest returns, emphasizing the power of compound interest.

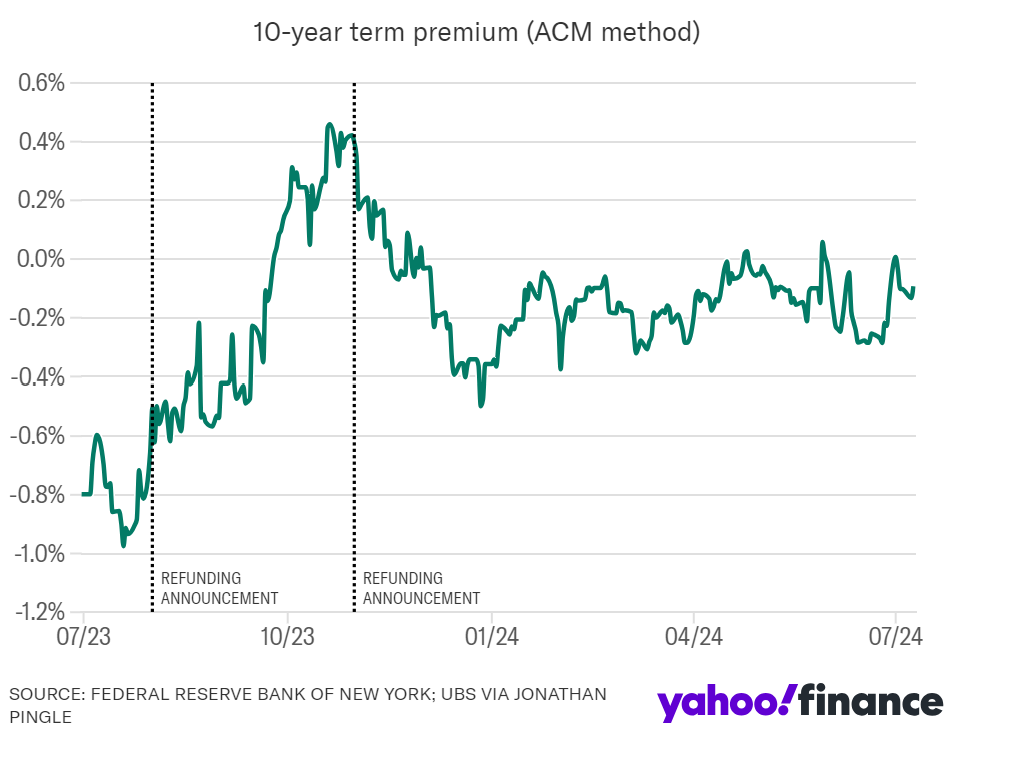

TREASURY POLICY LEANS ON YIELDS

Increased issuance of long-term Treasury bonds initially pressured yields higher, but recent shifts to short-term bills have weighed on longer-term yields.

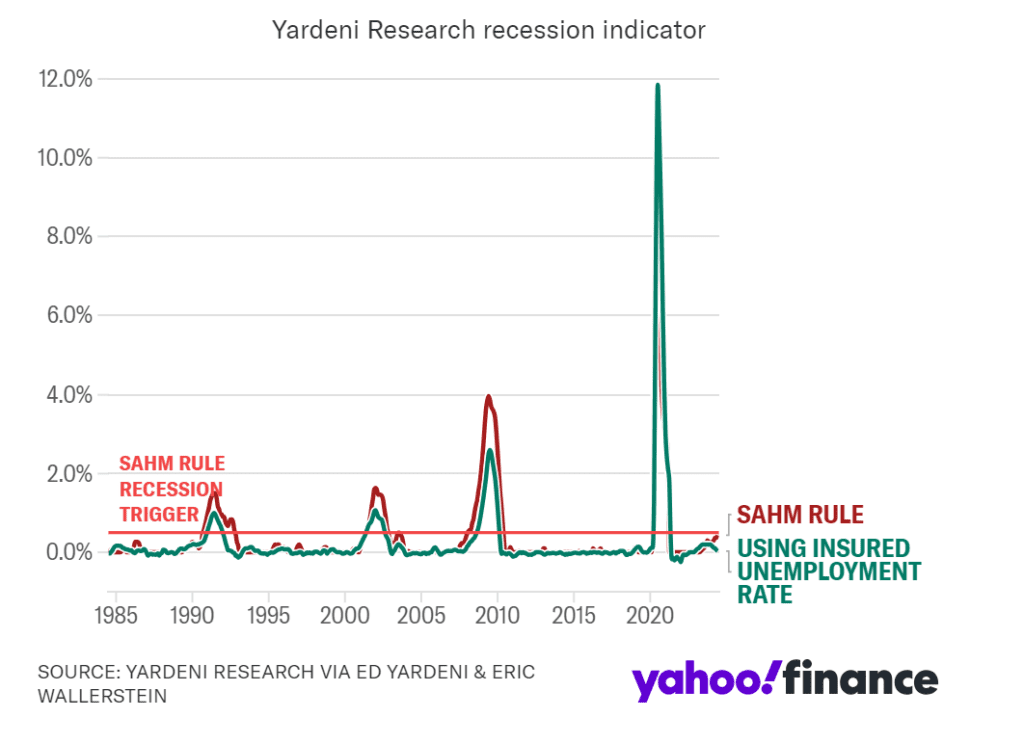

THE LABOR MARKET ISN’T ‘CRACKING’

The labour market is normalizing post-pandemic without an imminent recession. The rise in unemployment is attributed to increased labour force participation, not a market crack.

Click Part 1

Click Part 3