Markets kick off Q3 on a high, but tariff tension, Fed bets, and Trump headlines dominate the outlook.

The second half of 2025 began with a cautious but bullish tone across global markets, as investors digested a whirlwind of headlines: record highs on Wall Street, growing expectations for Federal Reserve rate cuts, and looming trade deal deadlines set by President Trump.

After a spectacular Q2 — with the S&P 500 and Nasdaq both hitting new all-time highs — futures took a slight breather early Tuesday. But optimism remains strong as traders price in a broadening recovery and the possibility of a friendlier Fed.

Where Markets Stand Now

- $SPX closed Monday up 0.52% to a record 6,204, capping a 10.6% gain in Q2

- $NDX climbed 0.47%, while $DJI rose 0.63% (+275 pts)

- Futures Tuesday: $DJI -0.11%, $SPX -0.18%, $NDX -0.25%

In commodities, gold climbed for a second straight day, rising 0.6% to $3,323/oz, supported by falling Treasury yields and rate-cut bets. Silver and platinum also advanced, with the latter up nearly 29% in June on Chinese demand and tight supply.

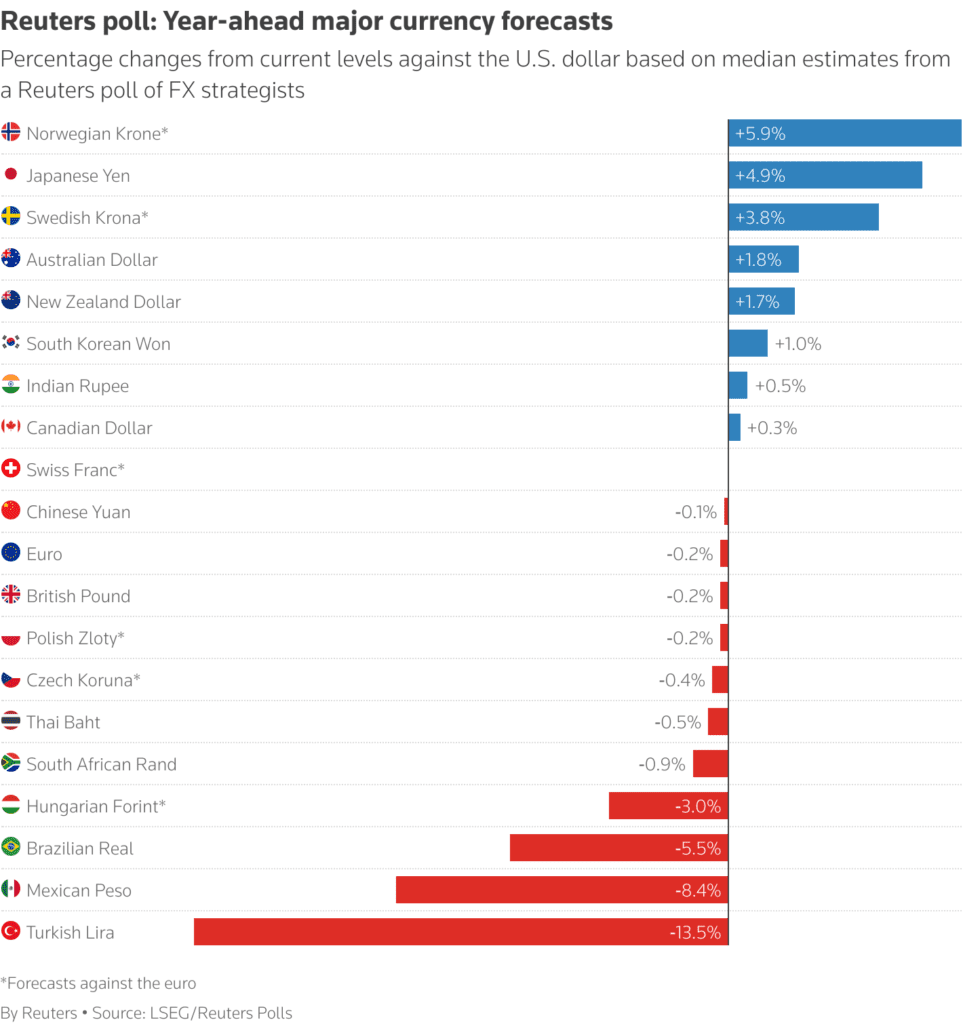

Meanwhile, the US dollar extended its slide, down nearly 11% YTD, marking its worst start to a year since 1973. That’s fueling bullish momentum for gold and other dollar-priced assets.

In crypto, Bitcoin ($BTC) hovered around $107,000, while Ethereum ($ETH) traded near $2,460, also modestly lower.

What’s Driving the Moves?

Markets rallied into quarter-end on optimism that Trump’s sweeping tariffs may be defused through last-minute deals. Canada already backed off its digital services tax to rejoin US talks. The UK and China have tentative arrangements in place, but many nations remain in limbo ahead of Trump’s July 9 tariff cliff.

At the same time, Fed expectations are shifting quickly. Goldman Sachs now sees the first rate cut in September, rather than December, citing muted inflation impact from tariffs and softer labor market data. The bond market agrees — 10-year yields dropped to 4.23% on Monday.

Manufacturing data from the US and Europe will be in focus today, alongside JOLTS job openings — all seen as signals for Fed timing and consumer health.

The Outlook

There’s cautious optimism heading into a holiday-shortened week. Markets close early Thursday and stay shut Friday for Independence Day. But traders will be closely watching:

- June jobs report on Thursday

- ISM and PMI data today

- Whether Trump escalates or eases tariff rhetoric

- Senate progress on Trump’s controversial $4.5 trillion tax cut bill

Despite the political noise, many analysts — including Morgan Stanley’s Mike Wilson — believe this is a broadening rally that still has legs.

“With the Fed likely to cut and demand still pent-up, we see a rolling recovery ahead,” Wilson said Monday on CNBC.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Bessent Warns: US Tariffs Could Snap Back to 50% as July 9 Deadline Looms

Trump’s trade deals are stalling out at worst possible time

What Traders Have Gotten Wrong in 2025

What to Watch in Markets This Week: Jobs Report, Tesla Delivery, Trump’s Budget Deadline

Markets Rally as Trade Talks Gain Steam and Dollar Weakens

Regencell’s $33 Billion Collapse: The GameStop Moment of Chinese Biotec