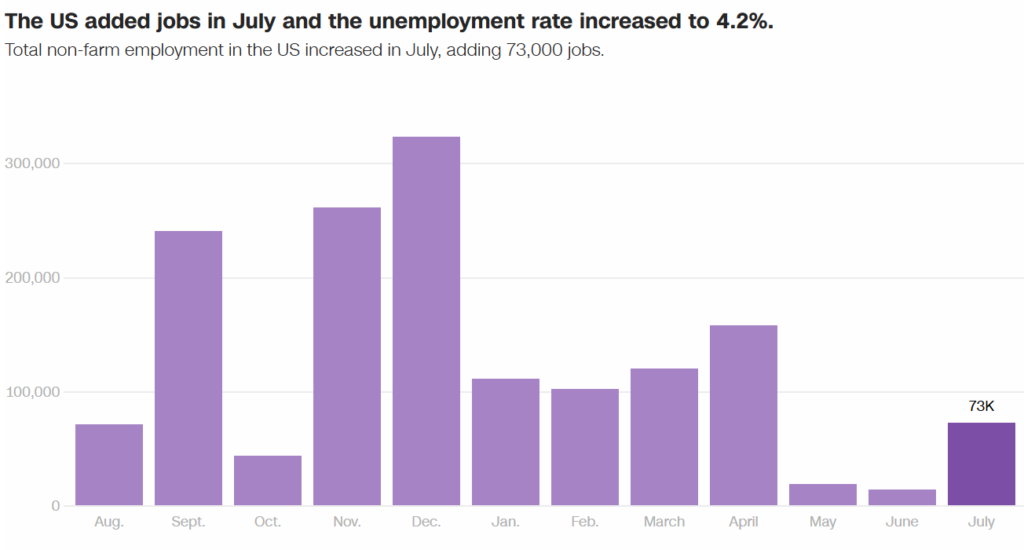

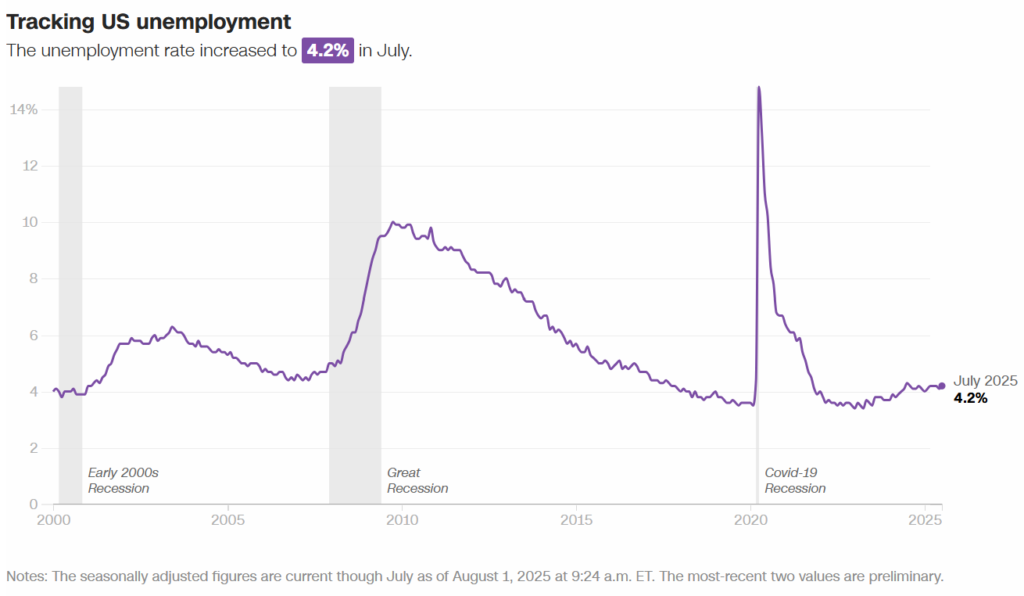

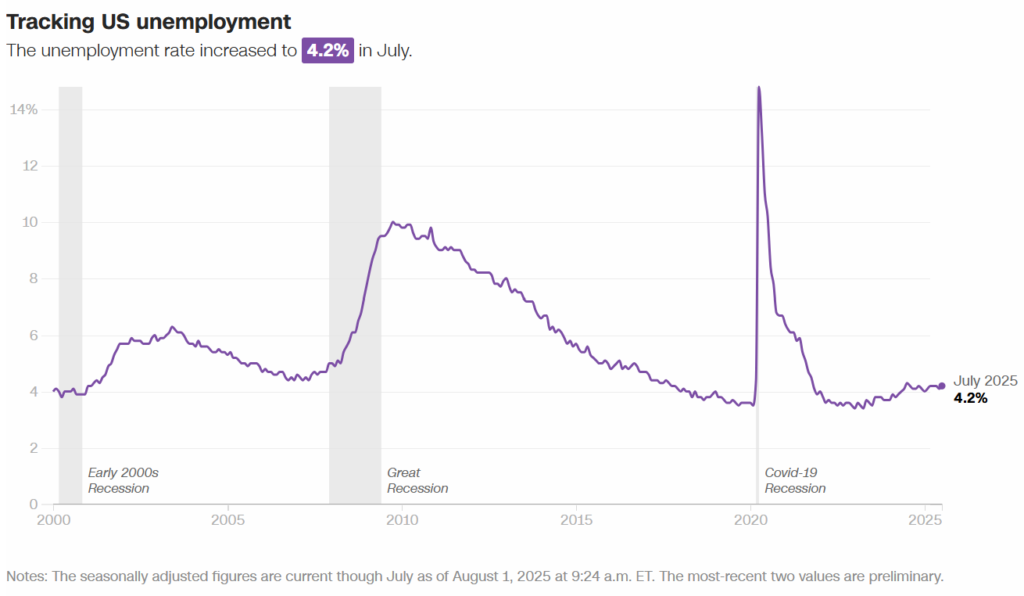

Wall Street ended the week in free fall Friday as shockwaves from a disastrous jobs report collided with political chaos at the highest levels of the US government. Markets sold off sharply after the Bureau of Labour Statistics (BLS) reported that the US economy added just 73,000 jobs in July — far below expectations — alongside stunning downward revisions to the past two months’ employment data.

But it was President Trump’s abrupt firing of BLS Commissioner Erika McEntarfer, coupled with unsubstantiated claims that the jobs numbers were “rigged,” that truly rattled investors and economists alike. The unprecedented move raised fears over political interference in economic data, a development one former official likened to “authoritarianism in real-time.”

The result? A full-blown Friday selloff across every major index:

- $SPY (S&P 500): -2.41%

- $QQQ (Nasdaq 100): -2.21%

- $DJI (Dow Jones): -2.92%

- $IWM (Russell 2000): -4.20%

The S&P 500 heatmap turned a brutal red, with economically sensitive sectors — especially industrials, materials, and small caps — bearing the brunt of the damage.

A Jobs Report That Shook the Market

Economists had projected 115,000 new jobs in July, but the actual number came in at just 73,000, the lowest monthly gain since December 2020. Worse yet, May and June’s job creation totals were revised downward by a combined 258,000 jobs — the largest two-month revision since 1979 outside of the pandemic.

“This is absolutely the worst major economic report since the end of the pandemic era,” said Joe Brusuelas, chief economist at RSM US.

The report revealed that nearly all of July’s job growth came from just one sector: healthcare and social assistance, which added 73,300 jobs. Other areas saw either flat growth or outright losses, including:

- Manufacturing: -11,000 jobs

- Construction: +2,000

- Leisure & Hospitality: +5,000 (well below seasonal norms)

The Black unemployment rate rose to 7.2%, its highest since 2021 — a worrying signal economists say often precedes broader economic weakening.

Trump Fires BLS Chief, Claims Data Was “Rigged”

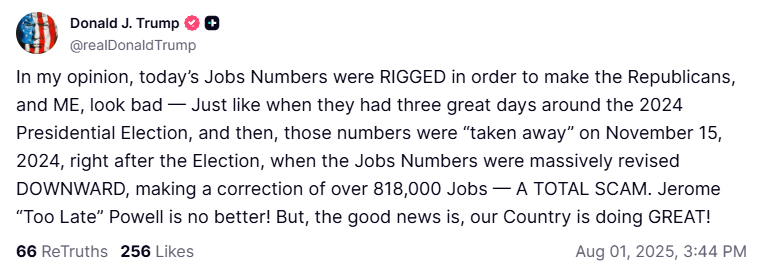

Hours after the jobs data was released, President Trump announced he had fired BLS Commissioner Erika McEntarfer, claiming the data had been manipulated to make him look bad.

“I fired her, and you know what? I did the right thing. I have three people in my mind ( ON BLS)” Trump said at a press conference. On Truth Social, he accused the BLS of publishing “phony numbers” and misleading the public ahead of the 2024 election.

The BLS had already revised previous job numbers lower in 2024, but those revisions were part of its standard annual update process — long accepted as part of professional data reporting. Economists across the political spectrum condemned Trump’s move as a devastating blow to the credibility of US economic statistics.

“Firing statisticians goes with threatening newspapers,” said Larry Summers, former Treasury Secretary. “This is the stuff of democracies giving way to authoritarianism.”

Even William Beach, Trump’s own former BLS chief, said there was “no justification” for the firing:

“It sets a dangerous precedent — punishing bad news instead of understanding it.”

Recession Fears Reignite

The July report showed that outside of healthcare, the US lost more jobs than it created, with total labor force participation also falling for the third straight month to 62.2%.

The average length of unemployment rose to 24.1 weeks, the longest since early 2022.

“We’re down to a one-legged stool holding up the labor market,” said KPMG’s Diane Swonk, referring to healthcare as the only sector adding meaningful jobs.

Adding to the concern is Trump’s escalating tariff policy, which has sparked chaos across global supply chains. The White House announced a new wave of import tariffs, raising average rates to over 15%, targeting partners including Canada, Taiwan, and the EU. Treasury Secretary Scott Bessent claimed the tariffs are locked in, but economists warned of a self-inflicted recession.

“Tariffs and uncertainty are paralyzing employers,” said EY-Parthenon’s chief economist Gregory Daco. “We’re losing the buffer that kept the economy stable.”

White House Defends Move, Economists Sound Alarm

On the Sunday talk shows, US Trade Representative Jamieson Greer defended Trump’s decision, saying:

“The president is the president. He can choose who works in the executive branch.”

National Economic Council Director Kevin Hassett echoed the sentiment, claiming the firing would bring “fresh eyes” to the agency. But economists disagreed sharply.

“This is scary stuff,” said Summers. “It undermines confidence in all government data — not just jobs, but inflation, productivity, wage growth, and beyond.”

Final Takeaway

With jobs growth stalling, political pressure mounting on the Fed, and trust in economic data under attack, investors are bracing for further volatility. Tech may still be flying on the back of AI, but the foundation of the broader economy is starting to crack.

“This type of very weak job growth momentum is essentially eroding the economy’s buffer,” warned Daco.

“And in an environment where the US is facing historic supply shocks, that could tip us into a recession.”

It’s not just a data issue anymore. It’s a trust issue. And the market just sent a message: Something’s wrong.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years