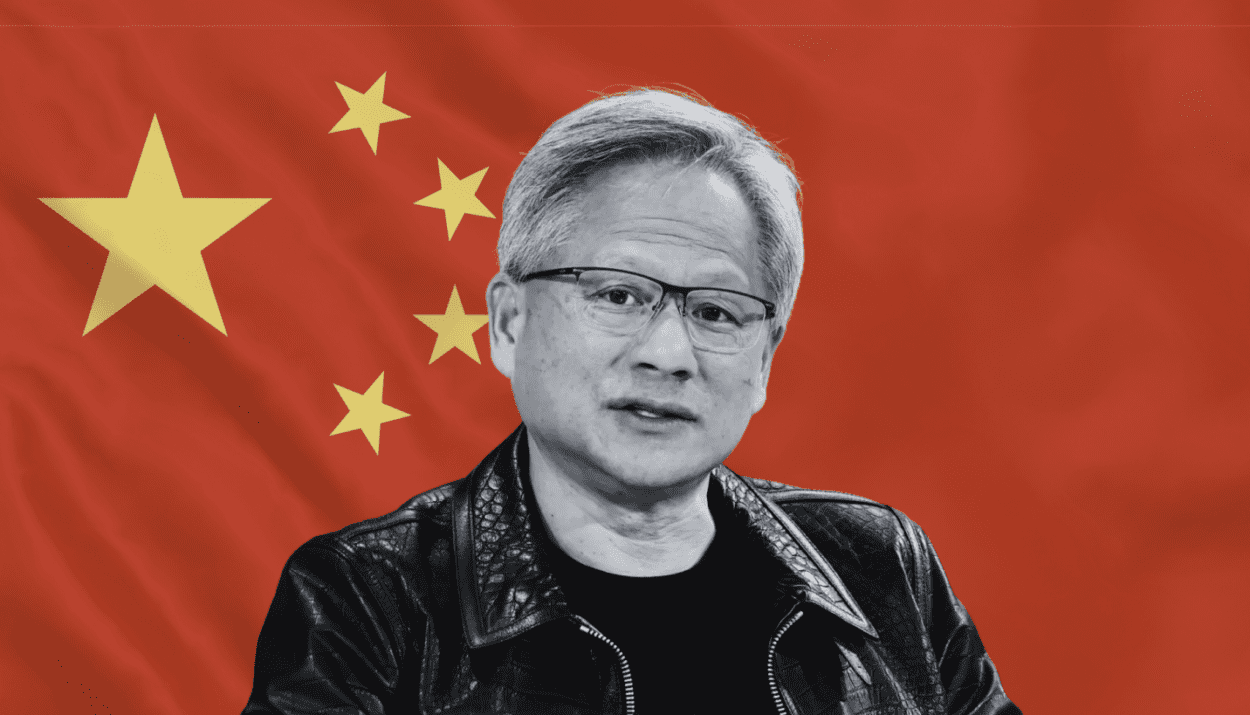

Nvidia CEO Jensen Huang has confirmed the company’s complete exit from China’s AI market — a stunning fall from 95% market share to zero — blaming U.S. policy decisions that he says have cost America one of the world’s largest computing markets.

Nvidia’s China Collapse

At the Citadel Securities Future of Global Markets 2025 event this week, Jensen Huang said bluntly:

“At the moment, we are 100% out of China. We went from 95% market share to 0%. I can’t imagine any policymaker thinking that’s a good idea.”

Huang revealed that Nvidia’s forecasts now assume zero revenue from China, one of its largest historical markets.

“In all of our forecasts, we assume zero for China. If anything happens there—which I hope it will—it’ll be a bonus,” he said.

He added that cutting off trade with Beijing was hurting both sides, warning that China remains “the second-largest computer market in the world” with a “vibrant ecosystem.”

“I think it’s a mistake for the United States not to participate,” Huang said.

How Policy Turned Nvidia’s Stronghold Into a Shut Door

Nvidia’s disappearance from China follows a series of U.S. export restrictions targeting advanced semiconductors and AI accelerators.

Beijing has since directed domestic giants like ByteDance and Alibaba to halt orders for Nvidia chips, even those redesigned to comply with export limits.

In response, Chinese chipmakers such as Huawei Technologies and Cambricon have filled the vacuum, rapidly developing homegrown AI hardware that rivals Nvidia’s restricted models.

Huang’s remarks underline the sharp reversal of fortune: just two years ago, Nvidia dominated China’s data center and AI training market with nearly 95% share. Now, it has no foothold left.

US Chipmakers Feel the Shockwaves

Nvidia isn’t alone. Micron Technology (MU) recently decided to exit China’s data center market, after a 2023 government ban crippled its sales. Analysts say these moves are accelerating China’s self-sufficiency drive, undermining U.S. chip dominance while failing to slow Beijing’s AI ambitions.

“Restrictions may slow China temporarily,” Huang previously warned, “but long-term, they could hurt American companies more.”

A ‘Temporary Goodbye’ or a Permanent Exit?

Industry insiders describe Nvidia’s situation as a “temporary goodbye” rather than a total retreat. The company still hopes for regulatory openings that would allow limited re-entry with next-generation Blackwell chips, though Huang admits that for now, those plans are stalled by Washington’s rules.

Meanwhile, Huawei is pushing deeper into Nvidia’s former turf, unveiling AI hardware designed to compete directly with Nvidia’s Vera Rubin rack-scale systems — a move that could make future re-entry even harder.

The Broader Impact: US-China Tech War Intensifies

Huang’s statement adds weight to growing industry concern that Washington’s export controls may backfire. Analysts warn that as the AI arms race decouples, China’s tech ecosystem will only grow more independent — while U.S. firms lose access to a multi-billion-dollar market.

For now, Nvidia’s China story is over. But its CEO’s message is clear:

“Cutting off the world’s second-largest computing market isn’t strategy — it’s surrender.”

Nvidia’s complete loss of China underscores the cost of the U.S.-China tech war — not just for Beijing, but for Silicon Valley.

What began as a national security measure has now left America’s leading AI chipmaker with zero market share in a trillion-dollar economy — and sparked a debate over whether Washington’s hard line on tech exports is protecting innovation, or sacrificing it.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.