Intel, once the dominant force in global chipmaking, is facing significant struggles after missing key technology waves, including mobile computing and artificial intelligence (AI). The company’s future remains uncertain, as it grapples with internal restructuring, competitive pressures, and shifting market dynamics.

- Historical Dominance and Decline:

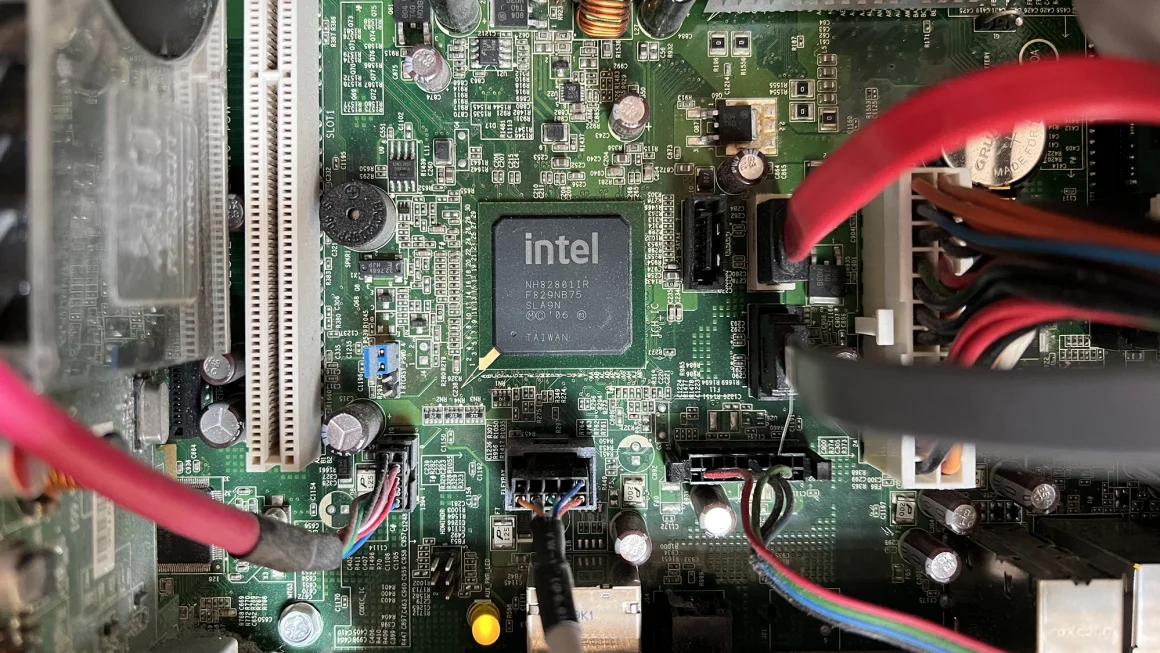

- Intel led the PC revolution in the 1990s and early 2000s but failed to adapt to the mobile and AI revolutions.

- The company’s stock has dropped 68% from its 2000 peak, and it recently lost its spot in the Dow Jones Industrial Average to Nvidia.

- Missed Market Shifts:

- Mobile Computing: ARM overtook Intel as the leader in mobile chipmaking when Apple chose ARM for its iPhone processors.

- AI Boom: Nvidia and AMD have captured the AI market with superior GPU-based technologies, leaving Intel struggling to compete.

- Leadership Challenges:

- CEO Pat Gelsinger’s tenure saw efforts to revive Intel’s manufacturing and product roadmap, but he stepped down after failing to regain market leadership.

- Interim co-CEOs David Zinsner and Michelle Johnston Holthaus face the challenge of steering Intel through its recovery.

- Foundry Ambitions:

- Intel is expanding its foundry business to produce chips for competitors, a key part of the U.S. CHIPS Act initiative.

- However, delays and high costs have raised doubts about the viability of this strategy.

- Financial Struggles:

- Intel announced plans to cut 15% of its workforce and reduce costs by $10 billion.

- Analysts question whether Intel could face asset sales or even acquisition by a competitor like Qualcomm.

Future Prospects:

- AI Opportunities:

- Intel may find a niche in producing lower-cost, energy-efficient AI chips for smaller companies.

- Success depends on whether it can innovate quickly and effectively in this space.

- Geopolitical Dynamics:

- Rising tensions between China and Taiwan could benefit Intel’s U.S.-based manufacturing operations, as companies may seek alternative production hubs.

- Strategic Restructuring:

- Intel aims to simplify its operations and streamline its product lines to better compete with rivals.

- The CHIPS Act funding and government support for domestic chip production could be pivotal.

- Potential Risks:

- Intel must retain majority ownership of its foundry business to comply with CHIPS Act funding requirements, limiting options for spin-offs or acquisitions.

Intel’s ability to recover hinges on accurately identifying and capitalizing on future technology inflection points. The company’s legacy and government support provide a foundation, but it must adapt to shifting market demands and intensify innovation to regain its competitive edge. Investors and industry watchers will be closely monitoring its next moves.