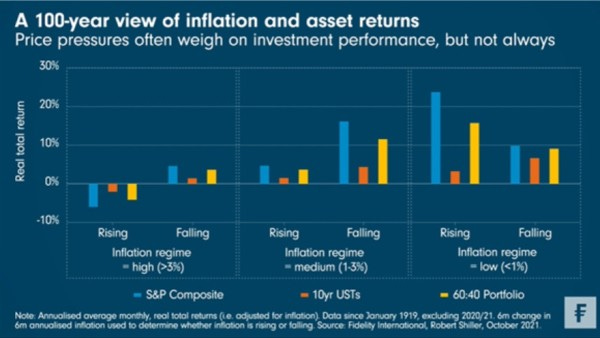

Inflation is one of the most critical forces influencing financial markets.

From periods of high inflation to deflationary regimes, asset classes like equities, bonds, real estate, and commodities respond in very different ways.

Understanding these historical patterns can help us identify the best-performing strategies for today and beyond.

Let’s explore how different inflation regimes affect asset performance and uncover key insights to position ourselves wisely – including what the future could bring.

The Three Inflation Regimes

Inflation regimes can be categorized as low/stable inflation, high inflation, and deflation. In low inflation, economies expand, and most asset classes benefit.

High inflation disrupts growth, favoring hard assets and sectors with pricing power. Deflation slows demand and favors safer, income-generating assets.

Each regime impacts asset classes differently, and understanding these patterns prepares us for what lies ahead. 📊

Equities: What’s Next for Stocks?

Equities thrive in low inflation, supported by corporate earnings growth.

Moving forward, companies with pricing power in sectors like healthcare, utilities, and energy are likely to outperform if inflation stays sticky. In high-inflation periods, commodity-linked equities and industrial firms that pass rising costs onto consumers could continue to see upside.

Conversely, if global demand slows and deflation risks emerge, defensive sectors like consumer staples may offer stability. Emerging market equities could also benefit as their growth often outpaces inflationary risks.

Bonds: A Mixed Future

Bonds struggle in high inflation as rising rates erode their value.

However, inflation-linked bonds, such as TIPS, offer a hedge. Short-duration bonds also perform better in rising-rate environments.

A peak in inflation or easing central bank policies could support long-duration bonds, particularly as economic growth slows. Investors should stay nimble and monitor inflation trends closely.

Real Estate: The Path Forward

Real estate is a traditional hedge against inflation, as rents and property values tend to rise with prices.

Moving forward, it is expected that industrial and logistics properties with strong cash flows and low debt to outperform.

If inflation cools and borrowing costs stabilize, real estate markets in regions with population growth and supply shortages will likely recover.

Investors should also explore opportunities in emerging market real estate driven by urbanization trends.

Commodities: Positioned for the Future

Commodities are the clear winners during high inflation, and I believe this will remain true.

Structural forces like the global energy transition and supply disruptions are likely to support commodity prices:

- Energy: Oil and natural gas will remain essential in the near term, while investments in renewable infrastructure increase demand for critical materials.

- Metals: The clean energy revolution will drive long-term demand for copper, lithium, and other industrial metals.

- Gold: As uncertainty lingers, gold will continue to act as a safe-haven asset.

Commodities remain critical as both inflation hedges and beneficiaries of long-term secular trends.

The Future of Inflation: What Might Change?

Inflation’s trajectory will be influenced by key trends:

- The global energy transition will increase demand for industrial metals and energy infrastructure, supporting inflationary pressures.

- Geopolitical fragmentation and supply chain realignments could raise costs across sectors.

- Persistent wage growth in developed economies may anchor inflation at higher levels.

Alternatively, if global demand slows, central banks may pivot to easing, and deflationary risks could resurface, requiring a shift toward safer assets.

How Investors Should Prepare

A balanced strategy can help navigate these potential inflation scenarios. Focus on:

- Equities with strong pricing power in sectors like healthcare, utilities, and energy.

- Inflation-linked bonds to hedge rising prices.

- Real estate with low leverage and strong rental yields.

- Commodities, particularly energy, industrial metals, and gold, as long-term hedges.

Staying adaptable to shifts in inflation will allow investors to take advantage of opportunities as they arise.

Inflation regimes remind us that no asset class performs well in all environments.

The future will be shaped by energy, policy, and global shifts, so staying adaptable is key.

Whether we face persistent inflation, disinflation, or even deflation, the strategies that worked in the past offer valuable lessons for what’s ahead.

Disclosure: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consult with a financial advisor before making investment decisions.

Related:

Elon Musk’s xAI buys his social media platform X

Trump was supposed to unlock IPO market, but CoreWeave debut reflects ongoing skepticism

Nothing is black and white in the AI world

These Cars May Be More Expensive Under Trump’s Auto Tariffs

What Analysts Think of Tesla Stock Amid Tariff Tensions, Global Pressures, and Elon’s New Warning

Trump’s Auto Tariffs: Here’s How Every Major Carmaker Could Be Affected

Tariff Updates: Trump threatens ‘far larger’ tariffs

Here Are Attack Plans That Trump’s Advisers Shared on Signal

Nvidia’s China sales face threat from Beijing’s environmental curbs

Auto Stocks Fluctuate Amid Anticipation of New Trump Tariffs