The International Monetary Fund has issued a stark warning that Europe is at risk of prolonged economic stagnation if urgent reforms are not implemented to revive investment and productivity.

In its latest Article IV consultation report, the IMF projected the eurozone economy would grow by just 0.8% in 2025, despite record-low unemployment and inflation nearing the European Central Bank’s target. The report attributes the weak outlook to a combination of geopolitical tensions, fragmented markets, and sluggish productivity.

“Heightened trade tensions and uncertainties have dimmed the prospects for domestic demand and exports,” the IMF noted, adding that increased defense spending and infrastructure investments are unlikely to offset broader economic headwinds.

Fragmented Markets Holding Europe Back

The IMF pointed to barriers within the European Union’s single market as a key factor stifling innovation and corporate expansion. According to the fund, internal fragmentation is equivalent to imposing a 44% tariff on goods and 110% on services—costs that drastically hinder growth potential.

To address this, the IMF called for:

- Regulatory harmonization across member states

- Advancement of the Capital Markets Union

- Improved labor mobility

- Energy market integration to stabilize prices and ensure security

The fund estimates that these measures could boost the EU’s GDP by 3% over the next decade.

Fiscal Reform and Rising Costs

The IMF also urged the European Union to increase its collective fiscal budget by 50%, citing rising costs from defense, demographic shifts, and climate adaptation. While countries with fiscal space should invest to support the economy, highly indebted member states will need to consolidate spending to maintain stability.

Despite strong capital buffers and liquidity in Europe’s banking system, the IMF warned of growing vulnerabilities, especially among firms with high exposure to the United States. It also flagged the expanding role of non-bank financial institutions as a potential systemic risk.

Growth Has Slowed Dramatically

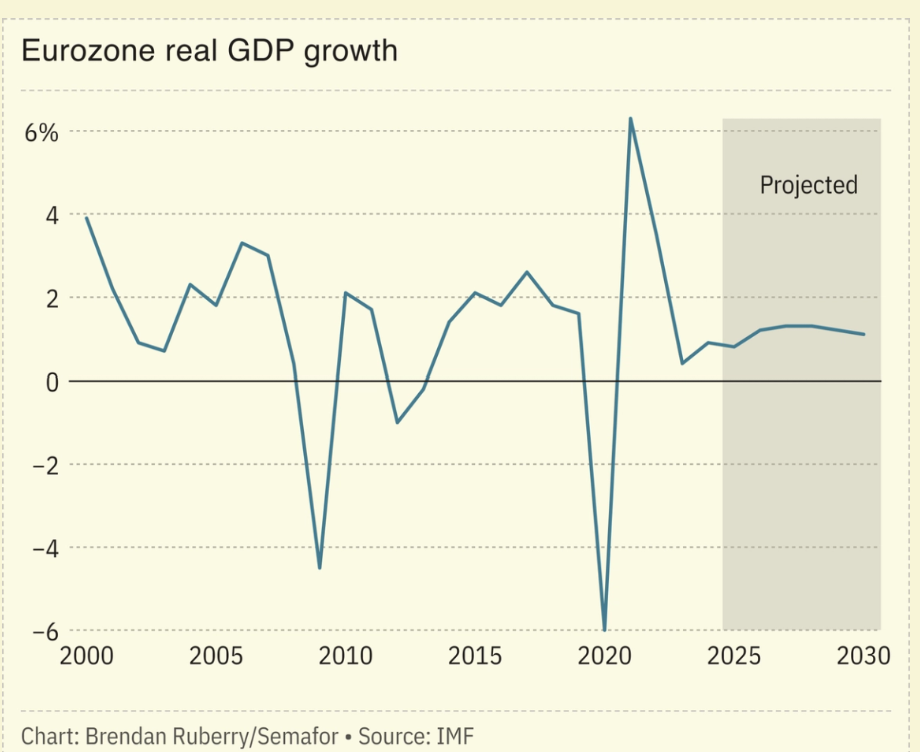

Europe’s economic slowdown has been sharp and sustained. After rebounding with 5.2% GDP growth in 2021, the region has seen a steady decline:

- 3.5% in 2022

- 0.4% in 2023

- 0.8% projected in 2025

Germany, the eurozone’s largest economy, is expected to grow by only 0.3% next year.

While the eurozone has avoided recession so far, the IMF made clear that without bold structural reforms, the region could fall further behind the US and China, both of which are experiencing more robust recoveries and stronger investment flows.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Why Oil Prices Aren’t Surging Despite the Israel-Iran War

Trump Privately Approved Attack Plans for Iran but Has Withheld Final Order

Iran Refuses to Surrender as Trump Mulls Strike: Tensions Surge in Middle East Conflict

Trump Demands Iran’s ‘Unconditional Surrender,’ Escalates Pressure in Israel-Iran Conflict

US and UK Seal Trade Deal — but Steel Tariffs Unresolved

Trump Exits G7 Early as Leaders Urge Mideast Ceasefire: What the Summit Delivered

OpenAI considers antitrust action against Microsoft amid tensions

What Is Trump’s ‘Revenge Tax’ — and Why It’s Scaring Off Foreign Investors