Jeff Bezos likely paid $2.7 billion in taxes last year — but critics say it’s still not enough. Here’s what he really paid, and how he legally lowered the bill.

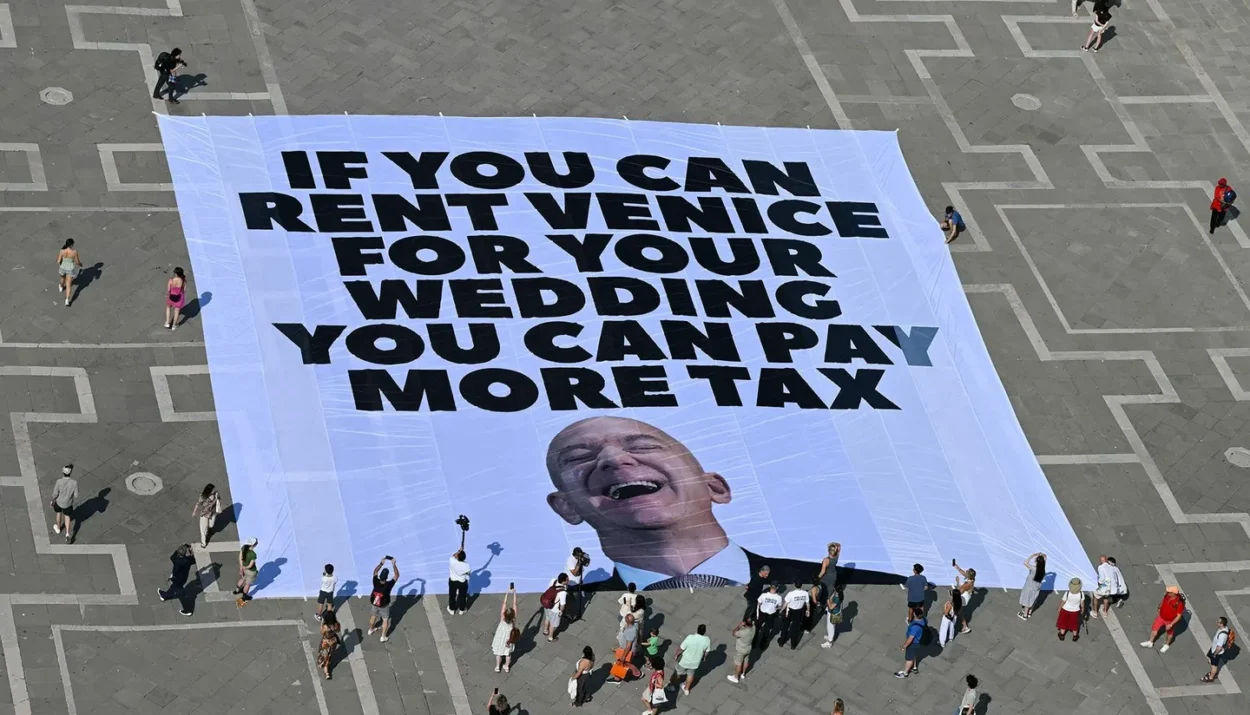

As billionaire Amazon founder Jeff Bezos prepared to tie the knot with Lauren Sánchez in Venice, he found himself the target of a growing global debate over billionaire taxation. On Monday, activists from Greenpeace Italy and the UK-based group “Everyone Hates Elon” unfurled a 4,300-square-foot banner across Piazza San Marco that read: “If you can rent Venice for your wedding, you can pay more tax.”

“This isn’t just about one person—it’s about changing the rules so no billionaire can dodge responsibility, anywhere,” said Clara Thompson, a Greenpeace campaigner.

How much did Bezos really pay in taxes?

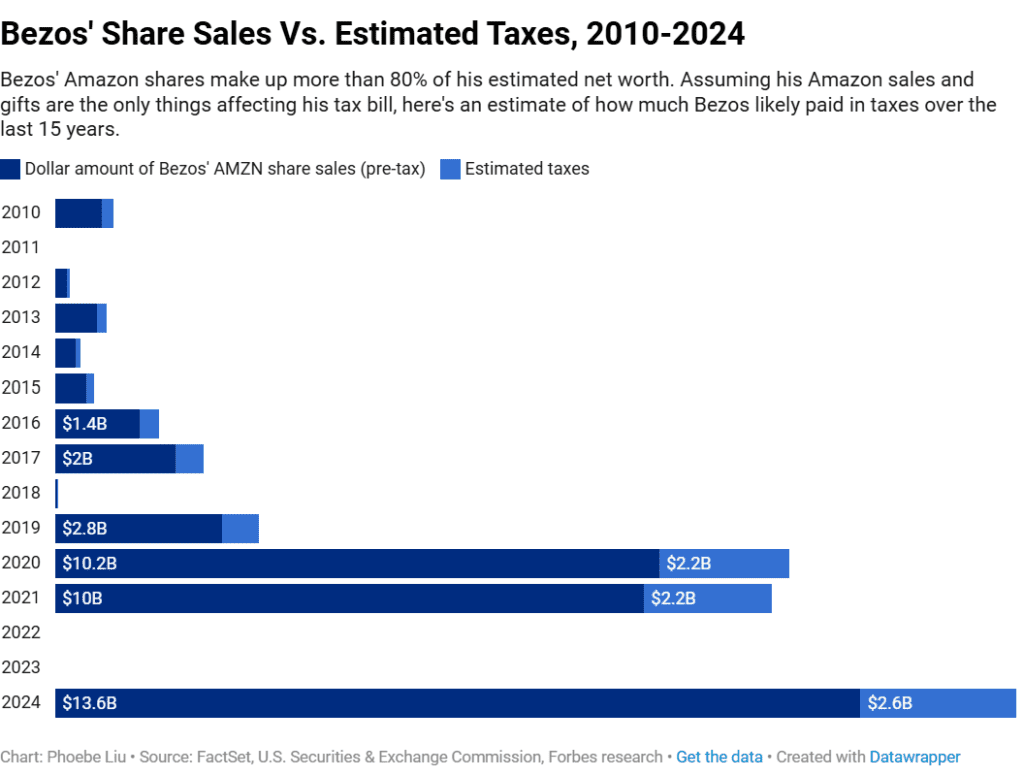

According to Forbes estimates, Bezos — the world’s fourth-richest person with a net worth of $231 billion — likely paid around $2.7 billion in taxes in 2024. But that figure represents only 4.5% of his wealth increase that year, as he gained nearly $60 billion largely from selling $13.6 billion worth of Amazon stock, which soared 46%.

Critics argue that such a tax rate is extremely low, especially since unrealized gains — increases in the value of stock that hasn’t been sold — are not taxed under current US law.

Tactics that lowered his tax bill

Bezos also donated $2.5 billion in Amazon shares to nonprofits over the past three years. If applied to his 2024 tax return, those gifts may have reduced his liability by as much as $600 million, per Forbes.

He further benefited by moving from Washington state to Florida in 2023 — a shift that spared him up to $1 billion in state capital gains taxes, since Washington recently implemented a 7% tax while Florida has none.

His property taxes in 2024 totaled around $7 million across real estate in Florida, California, D.C., New York, Washington, and Hawaii. One property sale in Washington alone resulted in $10 million in taxes.

How the ultra-rich minimize taxes

Like many billionaires, Bezos could also borrow against his assets instead of selling them, thereby avoiding capital gains tax. While Amazon discourages pledging company shares, Bezos could use other investments as collateral without any tax hit. He holds stakes in AI firms like Figure AI and Perplexity, which could generate taxable gains if sold, but until then, remain untaxed.

“As long as they hold onto assets that gain in value, there’s no tax,” said Brian Schultz of Plante Moran. “It’s a broken system.”

What if wealth taxes were in place?

Proposed laws like Elizabeth Warren’s wealth tax or Kamala Harris’ 25% minimum billionaire tax could have pushed Bezos’ tax bill over $10 billion. But neither plan has passed, and critics say these reforms remain political longshots despite public anger.

A UC Berkeley study found that the top 0.1% of Americans paid just 3.2% of their wealth in taxes in 2019, compared to 7.2% for the bottom 99%.

Will the wedding change anything?

Not likely. Bezos and Sánchez — both previously married — are expected to keep their assets separate, with a strict prenup in place. Filing jointly won’t significantly impact their taxes.

Still, the optics of a luxury wedding in Venice, paired with a tax bill many see as too low, have reignited debate. Protesters say it’s time for change — not just for Bezos, but for all billionaires whose fortunes grow faster than their tax contributions.

“This is about fairness,” activists say. “Bezos can afford it — and so can the system he benefits from.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Regencell’s $33 Billion Collapse: The GameStop Moment of Chinese Biotech?

The $OST Scam: How Nasdaq-Listed Penny Stock Wiped Out Thousands of Lives

Why Palantir Stock Is Sinking Today

Trump’s Tariff Deadline? ‘Not Critical,’ Says White House

Nike Reports After the Bell: Here’s Why Wall Street Expects a Weak Quarter

US IPOs Soar 53% in 2025, Led by Circle and CoreWeave — But Can the Boom Last?

In a First-of-Its-Kind Decision, Anthropic and Meta Win Copyright Lawsuits Brought by Authors