Saving by age 30 can feel overwhelming, especially with conflicting advice on how much you should ideally have saved by this milestone. Understanding savings goals is crucial, as building a solid financial foundation early on sets the stage for long-term financial security. So, how much should you realistically aim to have saved by the time you turn 30?

Savings Benchmarks to Hit by Age 30

A common rule of thumb, suggested by financial experts, is that you should aim to have one year’s salary saved by age 30. This means that if you’re earning $50,000 annually, your target savings should be around $50,000 by your 30th birthday. This amount includes all your savings accounts, retirement funds, and any investments.

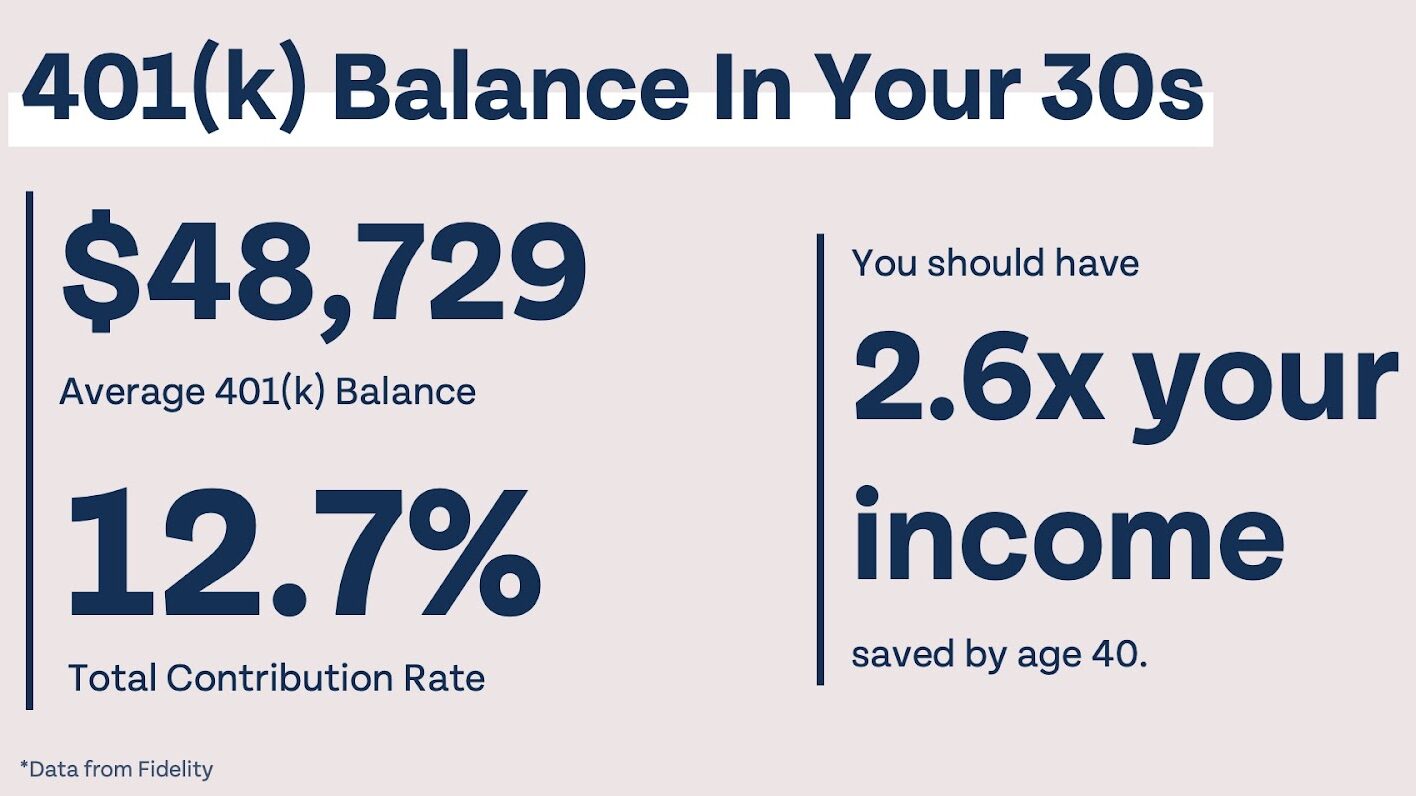

- 1x Annual Salary: Financial advisors from companies like Fidelity Investments recommend having at least one year’s worth of income saved by age 30 to keep pace with retirement goals.

- 50-30-20 Rule: Using this budgeting strategy, aim to allocate 50% of your income for needs, 30% for wants, and 20% for savings and debt repayment. This can help you steadily reach your savings target over time.

Why Saving Early Matters

The earlier you start saving, the more you can benefit from compound interest, which allows your money to grow exponentially over time. Starting to save in your 20s can make a significant difference in your financial health later in life.

- Compound Interest: By contributing to a retirement account like a 401(k) or Roth IRA, your investments grow not only on your initial contributions but also on the accumulated interest. For example, investing $10,000 at an average annual return of 7% could grow to over $76,000 in 30 years due to compounding.

- Emergency Fund: It’s crucial to have 3-6 months’ worth of living expenses saved in an emergency fund. This acts as a financial cushion in case of unexpected job loss or medical emergencies.

Key Savings Strategies to Achieve Your Goal

Building savings by age 30 requires disciplined budgeting, strategic investing, and smart financial habits. Here are a few strategies to help you meet your target:

- Automate Your Savings

Set up automatic transfers from your checking account to a high-yield savings account each month. Automating savings ensures you consistently contribute without the temptation to spend that money elsewhere. - Leverage Retirement Accounts

Maximize contributions to retirement accounts like 401(k)s, especially if your employer offers matching contributions. A Roth IRA is another excellent option for tax-free growth. - Reduce High-Interest Debt

Prioritize paying off high-interest debt, such as credit card balances, as these can significantly impact your ability to save. For example, paying down a credit card with a 20% APR is effectively saving 20% on that money. - Invest Wisely

Consider investing in low-cost index funds or ETFs, which can provide steady returns over the long term. A diversified portfolio with a mix of stocks and bonds can help balance risk. - Cut Unnecessary Expenses

Review your monthly expenses to identify areas where you can cut back. Small savings, such as making coffee at home or canceling unused subscriptions, can add up significantly over time.

How Much to Allocate to Retirement by Age 30

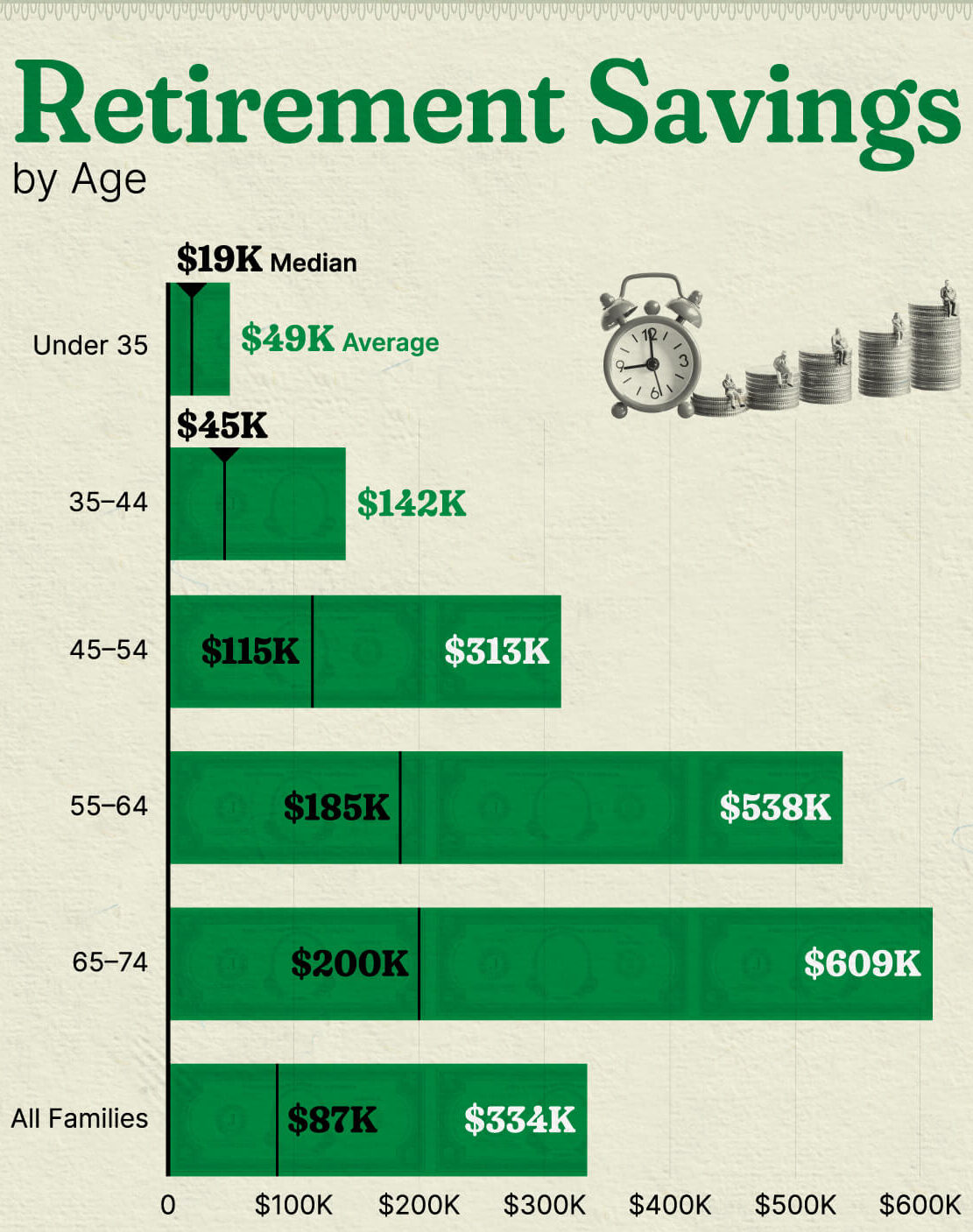

Retirement savings should be a priority, even in your 20s. According to experts, having at least 10% to 15% of your income consistently allocated to retirement accounts is ideal. If you’re starting late, you may need to increase your contributions to catch up.

- Roth IRA vs. 401(k): A Roth IRA is beneficial for younger savers as contributions are taxed upfront, allowing for tax-free withdrawals in retirement. Meanwhile, 401(k) plans provide immediate tax advantages, especially if your employer offers a match.

- Compound Growth Example: If you start saving $200 a month at age 25 in a retirement account with an average 7% return, you could have over $200,000 by age 60. Waiting until age 35 to start saving would result in only about $100,000 at retirement age.

Other Financial Goals to Consider by Age 30

Beyond having a set amount saved, there are other important financial milestones to aim for:

- Building Credit

Having a good credit score (above 700) is crucial for securing lower interest rates on loans and mortgages. Pay your bills on time, keep credit utilization low, and avoid unnecessary debt. - Investing in Real Estate

If possible, consider saving for a down payment on a home. Real estate can be a long-term investment that appreciates over time, helping build wealth. - Diversifying Investments

In addition to saving cash, diversify your investments into stocks, bonds, and real estate. Diversification reduces risk and increases potential returns over time.

Potential Savings Shortfalls and How to Address Them

If you haven’t reached your savings goal by 30, don’t panic. Here are a few strategies to help you catch up:

- Increase Contributions: If possible, increase your retirement contributions by 1-2% each year, especially when you receive a raise.

- Side Hustles: Consider taking up a side gig like freelancing or consulting to boost your income.

- Cut Back on Lifestyle Inflation: Avoid increasing your spending as your income grows. Instead, allocate raises or bonuses toward your savings.

Related articles:

- What percent of 18-29-year-olds are investing in the stock market?

- Why is it important to start investing as early as possible?

- Common Mistakes People Make When Investing and How to Avoid Them

- Behaviors That Prevent Smart Investing Decisions and How to Overcome Them

- How to Get a Startup Business Loan with No Money Online: A Step-by-Step Guide

- How to Invest in Gold and Silver: A Step-by-Step Guide

Sources:

- https://www.forbes.com/advisor/banking/savings/how-much-should-i-have-saved-by-30/

- https://www.cnbc.com/select/savings-by-age/

- https://www.fool.com/retirement/how-much-saved-by-30/