The global financial system has entered a period of extraordinary turbulence following U.S. President Donald Trump’s sweeping tariff announcement last week, triggering a rapid and massive selloff that has now erased over $5 trillion in global stock market value—an economic shockwave drawing comparisons to the most devastating financial crises in modern history.

As of Tuesday morning, the S&P 500 is teetering on bear market territory, having shed nearly 20% from its January peak. Global benchmarks from London to Tokyo are tumbling, with panic-driven trading wiping out gains built up over the past three years.

While the White House describes the tariffs as a long-overdue rebalancing of global trade, economists and historians are warning: this “Liberation Day” could become a textbook example of how financial shocks spiral into full-blown recessions.

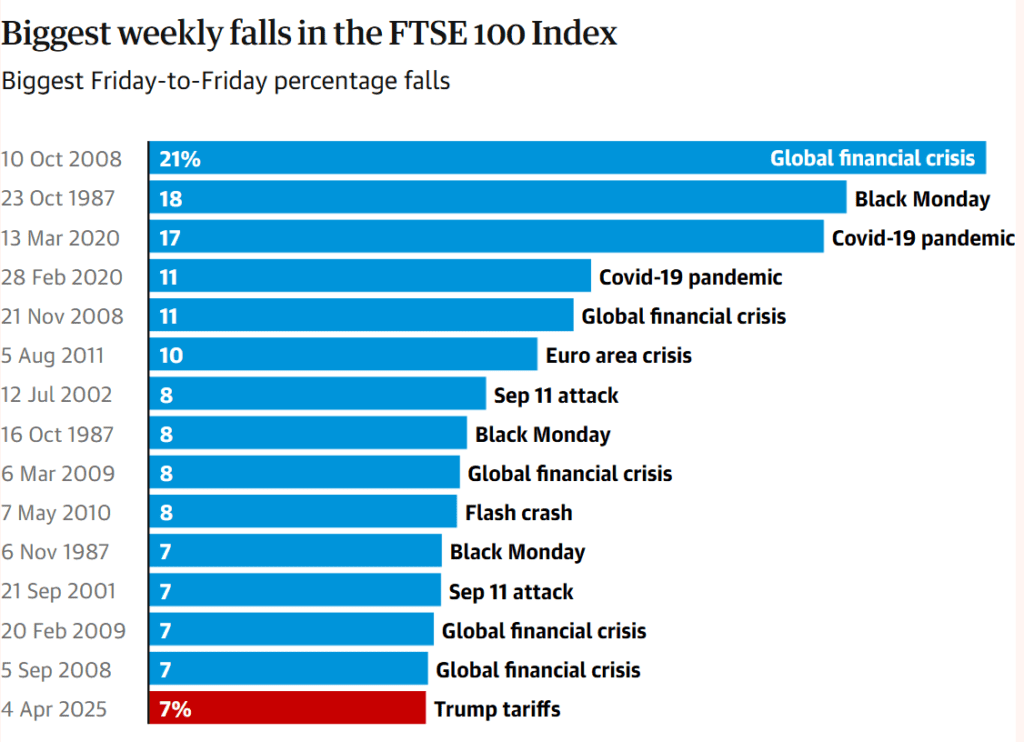

A Crash of Historic Proportions

The scale of the market’s decline has prompted inevitable comparisons to past disasters. Here’s how today’s crisis stacks up:

1929 – The Wall Street Crash

- Trigger: Over-leveraged speculation, widespread margin trading.

- Impact: Dow Jones fell 24% in two days; total loss of 90% by 1932.

- Aftermath: Global Great Depression, soaring unemployment, collapse of international trade, rise of fascism.

- Parallels Today: Sudden deglobalization, major stock rout, collapsing investor confidence.

1987 – Black Monday

- Trigger: Valuation concerns, computerized program trading.

- Impact: Dow plunged 22.6% in one day—largest one-day drop in history.

- Aftermath: Panic selling spread globally. Markets recovered relatively quickly, but the event exposed systemic fragility.

- Parallels Today: Algorithmic trading and ETF volatility accelerated last week’s decline.

2000–2002 – Dotcom Bubble and 9/11

- Trigger: Collapse of tech stocks, followed by geopolitical shock.

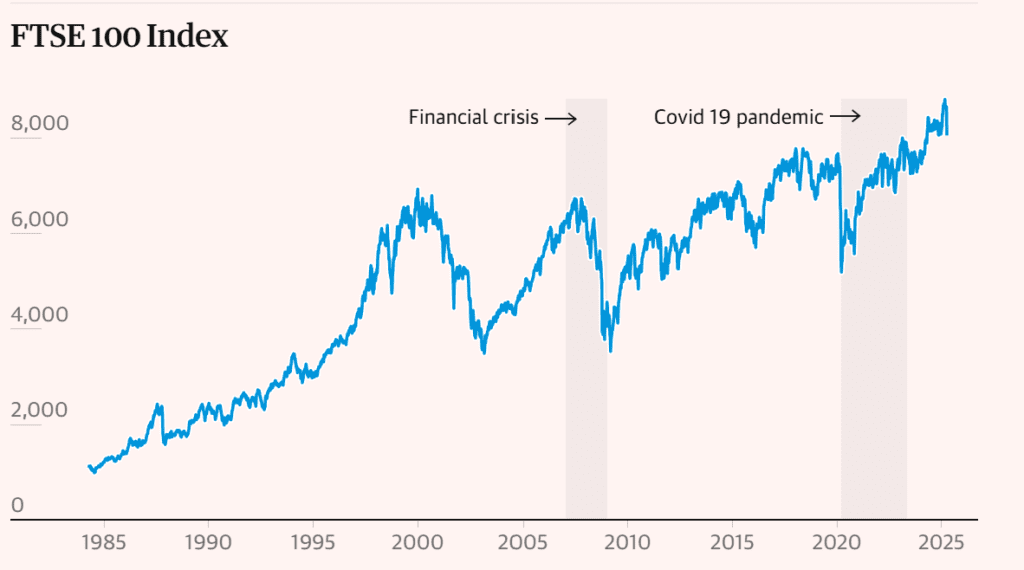

- Impact: Nasdaq lost 78% of its value. FTSE 100 fell from 6,900 to 3,200.

- Aftermath: Multi-year recession in tech, delayed recovery in global equity markets.

- Parallels Today: Overvaluation in “Magnificent 7” tech giants has amplified the current selloff.

2008 – Global Financial Crisis

- Trigger: Subprime mortgage collapse, Lehman Brothers bankruptcy.

- Impact: FTSE 100 and S&P 500 lost more than 30%. Dow dropped 778 points in a single day.

- Aftermath: Global recession, bailouts, unprecedented central bank stimulus.

- Parallels Today: Recession fears are growing as tariffs disrupt supply chains and raise inflation.

2020 – Covid Pandemic Crash

- Trigger: Worldwide lockdowns, halted economic activity.

- Impact: Dow fell 13% in one day. FTSE recorded its worst daily fall since 1987.

- Aftermath: Fast recovery aided by fiscal stimulus and rate cuts.

- Parallels Today: Markets are collapsing quickly, but this time governments are more constrained by inflation and debt.

The Current Rout – April 2025

- $5+ trillion wiped from global equities in 5 days.

- S&P 500: Down nearly 18%, on brink of bear market.

- Nasdaq: Entered bear market, down 21% from its high.

- Dow: Down more than 4,000 points, worst week since March 2020.

- FTSE 100: Fell 4.9% on Friday—largest drop since Covid.

Tariffs Trigger the Slide

The cause of the chaos? Trump’s unilateral “reciprocal tariff” program—a sweeping tax regime on nearly all imports, ranging from 10% to 54%, aimed at reindustrializing America and closing a $1.2 trillion trade deficit.

Major trading partners—including the EU, China, Japan, and the UK—have either imposed retaliatory measures or are scrambling to negotiate exemptions. Talks with Japan are underway, while Brussels is weighing a 25% tariff retaliation on U.S. goods including food, consumer goods, and pharmaceuticals.

Markets had briefly rallied Monday on rumors of a possible 90-day tariff pause, only for the White House to call those reports “fake news.” Commerce Secretary Howard Lutnick confirmed Sunday the tariffs are “here to stay for weeks” and possibly longer.

“We’re going to protect the factories that come to America,” Lutnick said on CBS’ Face the Nation. “The ripoff of the United States is over.”

Recession Alarms Ring

Economists are now issuing warnings of a global slowdown:

- Goldman Sachs, JPMorgan and Apollo Global Management have all raised their U.S. recession odds to over 60%.

- JPMorgan sees negative GDP growth by Q3.

- Inflation risks are climbing as tariffs raise consumer prices.

- Treasury yields are falling, while gold and bonds surge as safe-haven assets.

What Comes Next?

With negotiations beginning but no breakthrough in sight, the financial world is preparing for continued volatility. Trump insists that the tariffs are a form of leverage, but even a short-term standstill could do lasting damage if businesses delay investment and consumers cut back on spending.

As history shows—from 1929 to 2008—global financial contagion often begins with a spark that leaders underestimate.

This time, it may have begun with Liberation Day.

Related:

China vows ‘fight to the end’ after Trump threatens extra 50% tariff

Musk made direct appeals to Trump to reverse sweeping new tariffs

Trump Opens Door to Tariff Talks—But No Pause, No Retreat, Just ‘Tough but Fair’ Deals

Bitcoin: Not so independent from the rest of the market?!…

Tariffs Will Stay in Place for Weeks, Commerce Secretary Howard Lutnick Says

JPMorgan now sees a US recession this year

EU seeks unity in first strike back at Trump tariffs

US starts collecting Trump’s 10% tariff, smashing global trade norms

Automakers seek ‘opportunity in the chaos’ of Trump’s tariffs

Elon Musk hopes ‘zero tariff situation’, ‘free trade zone’ for Europe

Trump Announces Tiered Tariffs on China, EU, India, Others — “This Is Just the Start”

‘No Winner In A Trade War’: China, EU And Others React To Trump’s Reciprocal Tariffs