The Federal Reserve closed 2025 more divided than it has been in years, caught between stubborn inflation, a cooling labor market, rising political pressure, and unreliable economic data. As 2026 approaches, investors are preparing for a transition year that could reshape the Fed’s leadership, tone, and pace of interest rate cuts.

How the Fed operated in 2025

A year defined by tension

In 2025, the Fed’s two core goals, price stability and maximum employment, increasingly worked against each other. Inflation stayed above the 2% target, while job growth slowed and unemployment edged higher. That combination forced policymakers into difficult tradeoffs and exposed deep disagreements inside the central bank.

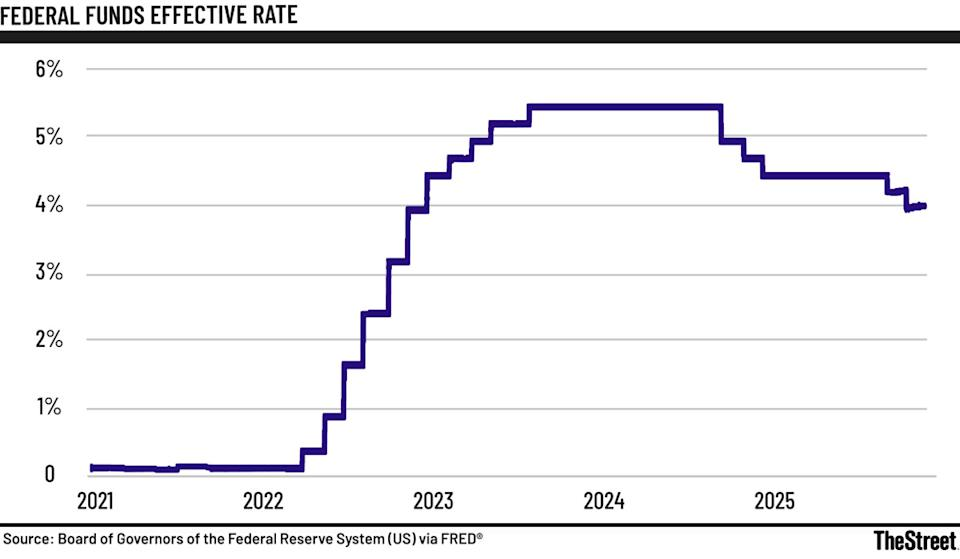

Rate cuts came, but unity faded

Despite the internal strain, Fed Chair Jerome Powell guided the central bank through three interest rate cuts during the year. What stood out was not just the cuts themselves, but the growing number of dissents.

Some officials argued the Fed should cut faster to protect the labor market. Others warned that inflation risks were still too high. By the end of the year, the Fed was cutting rates while openly disagreeing on whether those cuts were even appropriate.

More about: Divisions at the Fed That Shaped 2025 Are Set to Carry Into 2026

Tariffs complicated the inflation picture

Tariffs played a major role in reshaping the Fed’s thinking. Early in the year, many officials viewed tariff driven price increases as temporary. That view shifted after the administration rolled out the most aggressive tariff package in decades.

By midyear, concerns grew that tariffs could prolong inflation, not just cause a one time jump. This added another layer of uncertainty to policy decisions.

Labor market signals became harder to read

As 2025 progressed, the job market cooled. Later in the year, Powell raised a sensitive issue: official employment data may have been overstating job growth. If true, the labor market may have been weaker than headline numbers suggested, reinforcing the argument for rate cuts.

Data problems added to the confusion

A prolonged government shutdown disrupted key economic data releases. With incomplete and delayed information, policymakers relied more on private data and estimates. That uncertainty made the Fed more cautious and less confident in forward guidance.

Where the Fed stood at the end of 2025

By December, the Fed found itself in an uneasy position:

- Inflation remained above target, even as some price pressures eased.

- Unemployment rose modestly, but not enough to signal a crisis.

- Policymakers disagreed on whether inflation or jobs posed the greater risk.

- Political pressure intensified ahead of a leadership change.

The result was a central bank still cutting rates, but with clear fractures beneath the surface.

What changes in 2026

A new Fed chair on the horizon

Jerome Powell’s term as Fed chair expires in May 2026, opening the door for President Trump to appoint a successor. Trump has been outspoken in favor of lower interest rates, raising market concerns about the Fed’s independence.

Powell could technically remain on the Board of Governors until 2028, but historically most chairs step aside rather than stay on as regular voters.

Board changes and political pressure

Other shifts may also shape 2026:

- Stephen Miran’s term ends in January, potentially removing one of the strongest voices for aggressive cuts.

- Ongoing legal battles involving Lisa Cook could alter the Board’s makeup.

- Rotating regional Fed presidents will change voting members, though analysts largely expect continuity rather than a dramatic shift.

Together, these changes suggest more noise and debate, not an automatic policy pivot.

What experts expect for 2026

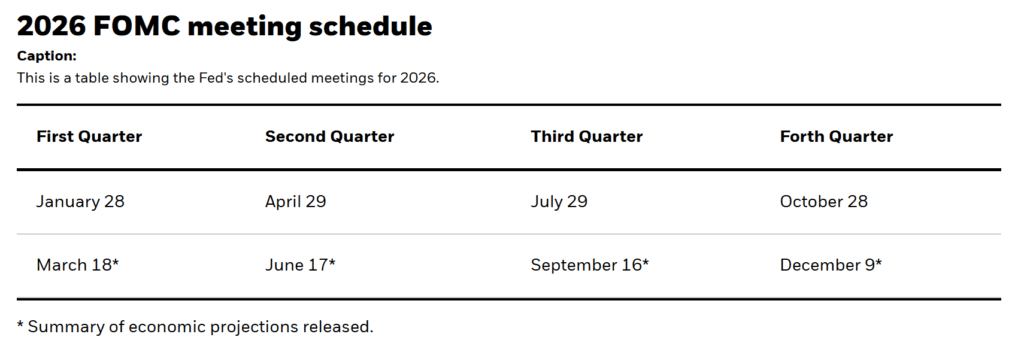

A cautious start

Many economists expect the Fed to pause or move slowly early in 2026, especially while Powell remains chair. Inflation is still above target, and officials want clearer evidence it is cooling sustainably.

Goldman Sachs: fewer cuts, slower pace

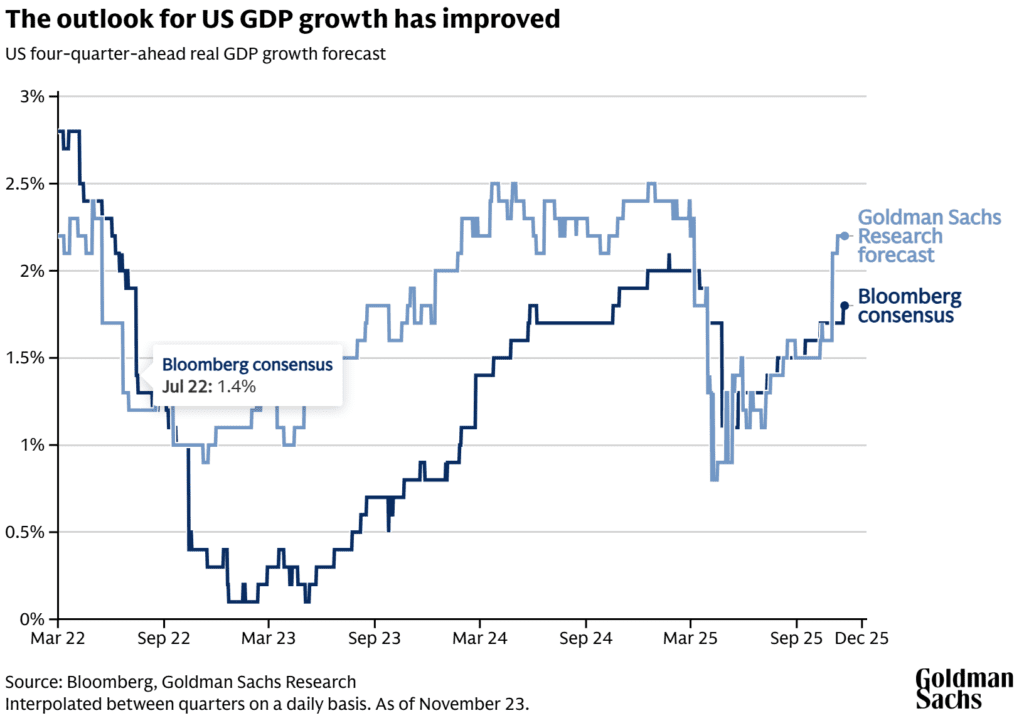

According to Goldman Sachs, policymakers are likely to slow the pace of easing in the first half of 2026. Their base case assumes:

- Economic growth reaccelerates as tariff effects fade.

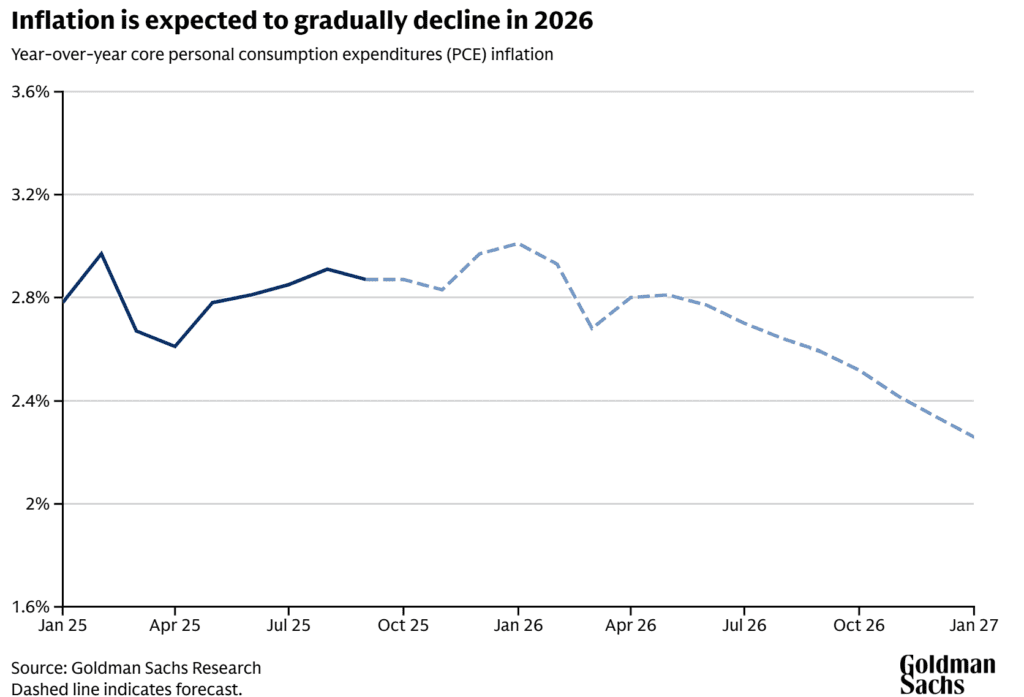

- Inflation gradually cools through mid 2026.

- The Fed pauses early in the year, then delivers rate cuts later, possibly in spring and summer.

Goldman expects the federal funds rate to settle around 3% to 3.25% if inflation behaves as expected.

Others warn inflation could stay sticky

Not all experts agree. Some Fed officials and analysts believe:

- Tariffs, fiscal spending, and strong demand could keep inflation elevated.

- Rates may need to stay slightly restrictive for longer.

- Cutting too fast could reignite price pressures.

This camp argues that patience, not speed, should guide policy in 2026.

A competing view: jobs may force action

Another group sees rising risk on the labor side. If job growth weakens further or layoffs increase, the Fed may feel pressure to cut more aggressively, regardless of inflation concerns.

Supporters of this view argue that employment data may already be overstating economic strength, and that delayed action could deepen a slowdown.

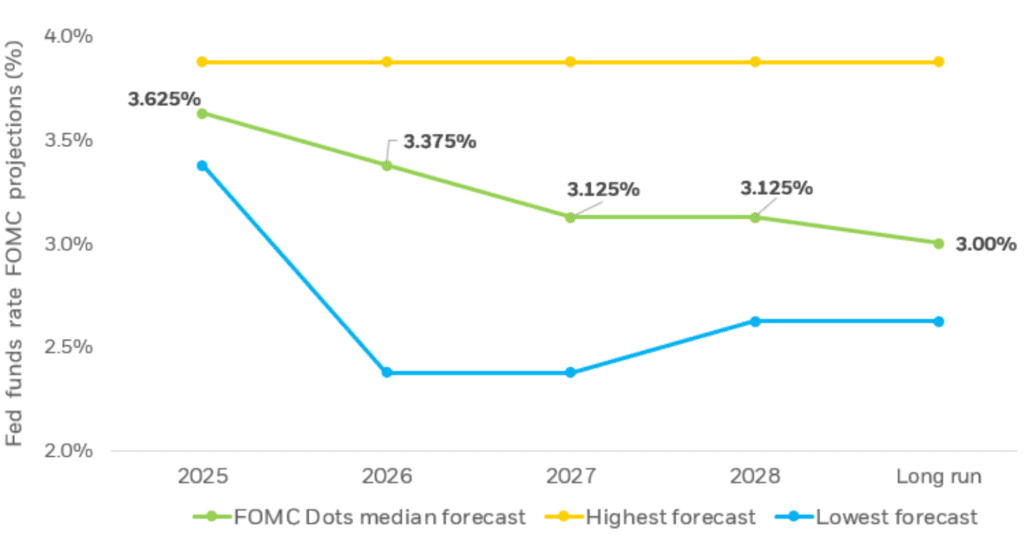

Chart description: Line chart displaying the FOMC “Dot Plot”, showing the highest, median and lowest forecasts for the target Fed Funds Rate.

The bigger picture for 2026

2026 is shaping up as a transition year for the Federal Reserve. Leadership changes, political pressure, and internal divisions are unlikely to disappear. Even with a new chair, the Fed will still face the same core challenge: balancing inflation control with a slowing job market.

The path forward looks cautious, uneven, and heavily data driven. Rate cuts are likely, but they will come slowly, and not without debate.

After a fractured 2025, the Fed enters 2026 still divided, still cautious, and still navigating one of the most complex policy environments in decades.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: How Big Tech Created the 2025 AI Boom on Debt

What’s Ahead for Stocks and Gold in 2026? What Markets and Experts Are Watching

Stocks Look Bullish Entering 2026 — But What Could Go Wrong?

FOMO vs. Bubble Angst Signals More Stock Volatility in 2026

Gold Breaks $4,400 as Silver, Copper and Platinum Hit Record Highs: What Comes Next

Markets Enter Final Stretch of 2025 With Santa Rally Hopes: What to watch

Trade, Tariffs, and Treasuries: The Hidden Cost of Trump’s Protectionism

Want to Know Where the Market Is Going? Don’t Trust This, or Any, Forecast.