The UK’s HM Revenue and Customs (HMRC) anticipates an additional £3.8 billion in savings tax revenue for the 2024/25 financial year, according to the latest estimates. This projection would bring the total savings tax collected to £10.37 billion, up from £6.6 billion in the previous year, marking a significant 58% increase.

Factors Behind the Increase

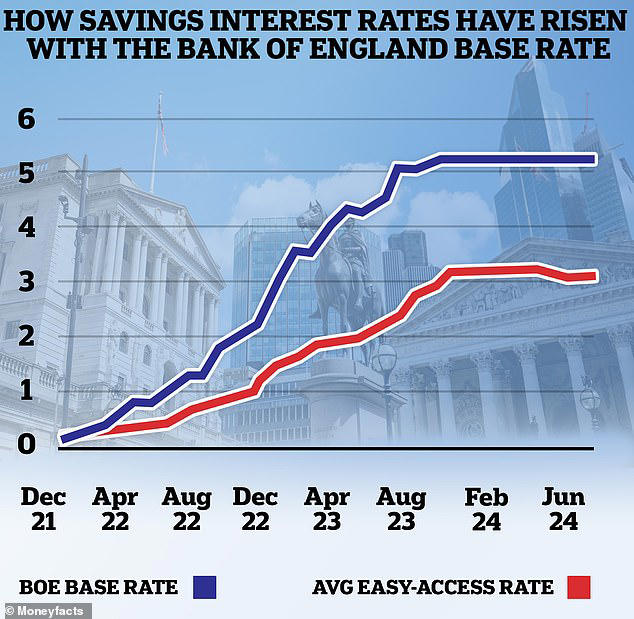

The surge in savings tax is largely attributed to rising interest rates and the stagnant Personal Savings Allowance (PSA). The Bank of England has raised interest rates multiple times since December 2021, increasing from a historic low of 0.1% to the current level of 5.25%. This has led to a substantial rise in the interest earned on savings accounts. For example, the top easy-access account rate has jumped from 0.75% in December 2021 to 5.2% today.

Despite these rising rates, the PSA has remained unchanged since its introduction in 2016. The PSA allows basic rate taxpayers to earn up to £1,000 of interest tax-free and higher rate taxpayers up to £500. As a result, more savers are exceeding their PSA limits and becoming liable for savings tax.

Impact on Taxpayers

HMRC’s data shows that of the projected £10.4 billion in savings interest tax, £1.14 billion will come from basic rate taxpayers, £2.4 billion from higher rate taxpayers, and £6.8 billion from additional rate taxpayers.

The unchanged PSA means that even smaller savings deposits can breach the allowance due to higher interest rates. In December 2021, a basic rate taxpayer could deposit £133,000 in an account with a 0.75% interest rate before exceeding the PSA. Today, just £19,231 in an account with a 5.2% interest rate would breach the allowance.

© Provided by This Is Money

Shelter Through Cash ISAs

To mitigate the impact of rising savings taxes, many savers are turning to Individual Savings Accounts (ISAs). Cash ISAs allow savers to shield up to £20,000 per tax year from taxes on interest earned. The Bank of England reported a record £11.7 billion influx into cash ISAs in April, marking the largest inflows for the start of a tax year since ISAs were introduced in 1999.

Jeremy Cox of Coventry Building Society emphasized the advantage of cash ISAs, stating, “The antidote to paying tax on savings is the cash ISA. You can save anything from £1 up to £20,000 each tax year and you won’t pay a penny of tax on the interest earned.” This is particularly appealing as some of the best cash ISA rates now exceed 5%, aligning with their no-notice easy-access counterparts.

The projected increase in savings tax revenue underscores the significant impact of rising interest rates combined with the static PSA. Savers are urged to consider tax-efficient investment options like cash ISAs to maximize their returns and minimize tax liabilities amidst these changes.