Hims & Hers Health (NYSE: HIMS) is set to report its Q3 2025 earnings today after the closing bell. Following a breakout year that’s seen the stock rise roughly 87% year to date, Wall Street is watching to see whether the telehealth disruptor can maintain its momentum in an increasingly crowded digital healthcare space.

With subscriber growth strong, ARPU climbing, and demand for weight-loss and mental health offerings expanding, analysts are expecting another quarter of double-digit top-line growth. But with a rich valuation and intensified competition from Amazon Clinic, CVS Health, and Ro, investor expectations are high, and the pressure to deliver is building.

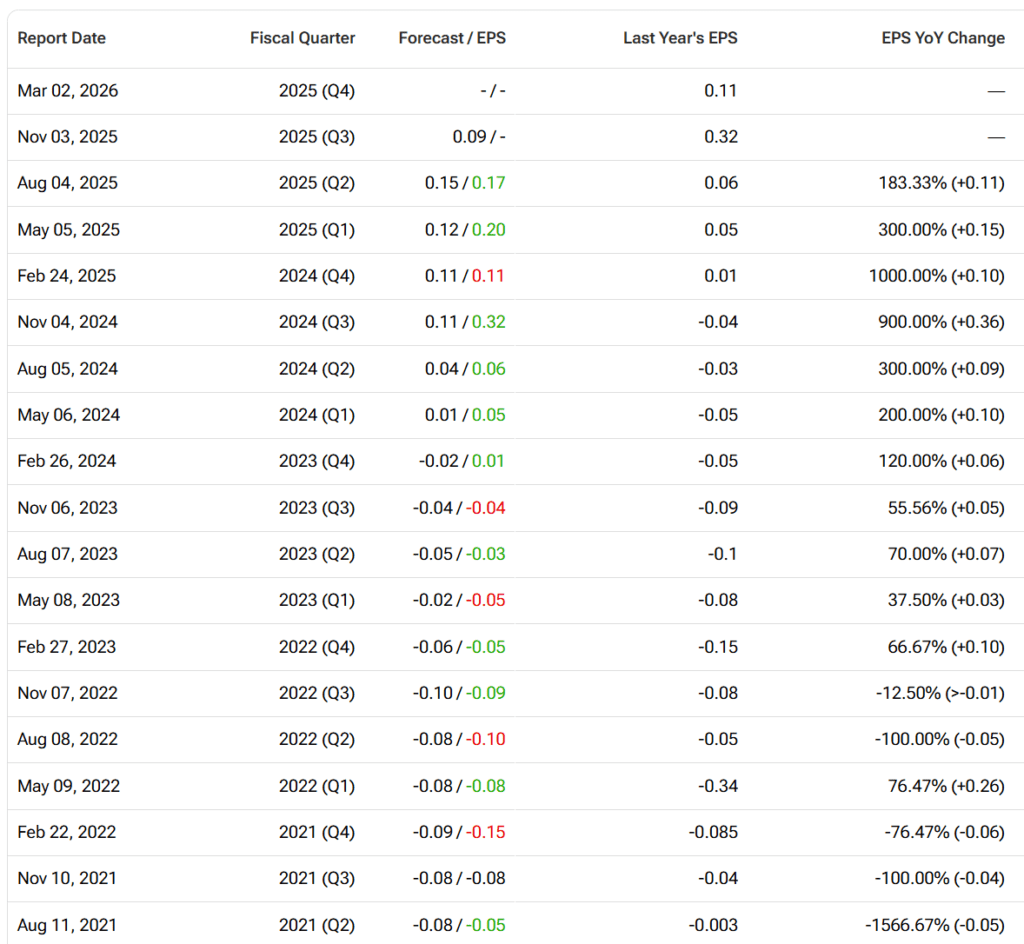

Street Forecast: Revenue Near $580M, EPS Slows to $0.09

| Metric | Consensus Estimate | YoY Growth |

|---|---|---|

| Revenue | ~$580 million | +44% |

| Adjusted EBITDA | ~$65 million | +27% |

| EPS (non-GAAP) | $0.09 – $0.10 | -72% |

Hims & Hers previously guided for Q3 revenue between $570M and $590M and adjusted EBITDA between $60M and $70M. The sharp drop in EPS reflects difficult comps versus last year’s $0.32 figure, which was boosted by one-time tax effects and wider margins.

Prediction: HIMS is expected to report in-line to slightly above consensus on both revenue and EBITDA. EPS should meet the $0.09 target.

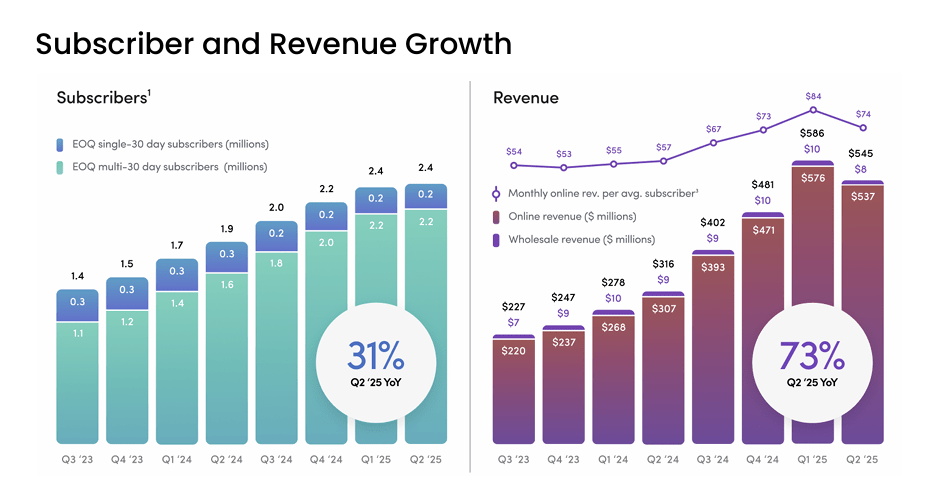

Subscription Growth: Sticky Demand Across Health Verticals

Hims & Hers’ entire business is built around telehealth subscription revenue — which made up over 98% of total sales last quarter. In Q2, the company reported:

- Over 2.4 million active subscribers, up 31% YoY

- Monthly ARPU near $74, up ~30%

- A 90%+ app usage rate among GLP-1 patients

- Retention metrics of 75%+ beyond six months in weight-loss programs

Segment highlights include strength in:

- Weight-loss treatments (GLP-1 programs, compounded therapies)

- Sexual health and dermatology (core segments like ED, hair care, acne)

- Mental health (growing but smaller base)

While subscriber growth is the foundation, ARPU expansion is increasingly important — driven by upsells and bundling.

Prediction: Subscriber growth ~30% YoY continues, and ARPU remains stable or rises slightly. Revenue beats low end of guidance.

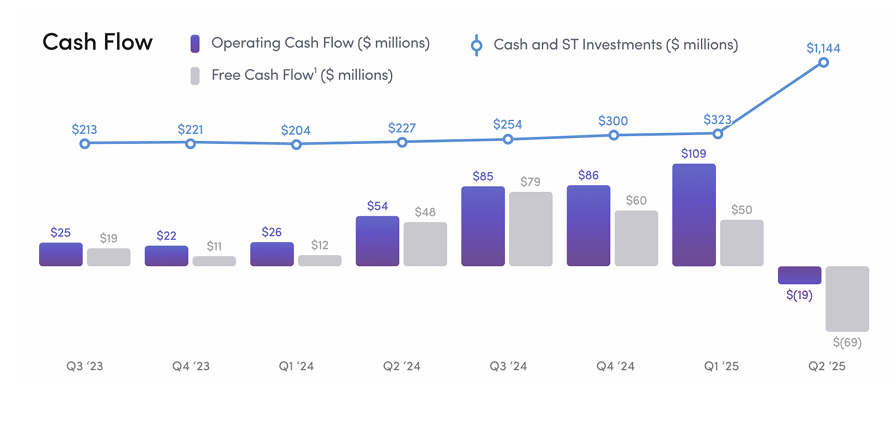

CAC, Margins, and Unit Economics: Solid, but Under Scrutiny

Hims’ customer acquisition costs remain high — historically ~$700–900 per subscriber — but are offset by:

- ~76% gross margins

- High ARPU ($74/month)

- Strong retention and LTV

That math yields healthy payback periods (~10–11 months), with positive free cash flow on cohorts beyond Year 1. Q2 adjusted EBITDA margin came in at 15.1%, and Q3 guidance implies 11–12% due to heavier marketing in the seasonally strong Q3 window.

Prediction: EBITDA margin remains in line with guide (~12%), with commentary focused on efficiency and long-term leverage.

Competitive Threats: Amazon, Teladoc, Ro Crowd the Market

The landscape for direct-to-consumer healthcare is shifting fast:

- Amazon has launched ultra-low-cost ED/hair/skin plans through One Medical

- CVS, Walmart, and Walgreens are ramping up telehealth services

- Ro remains Hims’ most direct digital-native competitor

Despite these headwinds, Hims maintains its edge with brand recognition, vertically integrated fulfillment, and product innovation. Still, investors will be listening for signs of pricing pressure or subscriber churn.

Prediction: Management reaffirms competitive positioning, while acknowledging rising threats from Amazon and retail giants.

Regulatory Watch: FDA and GLP-1 Scrutiny

The FDA recently ended enforcement discretion for compounding semaglutide and tirzepatide, which Hims had leveraged in its “personalized” GLP-1 program. The company has been careful to avoid direct competition with brand-name drugs like Wegovy, especially after its commercial

with Novo Nordisk ended in 2024.

Any guidance around regulatory changes, future weight-loss drug availability, or legal headwinds will be key for the stock.

Prediction: Neutral to cautiously optimistic tone from management. Risks acknowledged but business model positioned to adapt.

Analyst Sentiment: Mixed but Improving

Wall Street remains divided:

- Average 12-month target: $49.75 (~9% above current price)

- Consensus: 8 Holds, 2 Buys, 2 Sells

- Valuation: P/E ~39x, Price/Sales ~4.6x

HIMS has historically traded at a premium due to growth and margin profile. But with EPS dropping and margin compression possible, bulls are looking for continued operating leverage in 2026 and beyond.

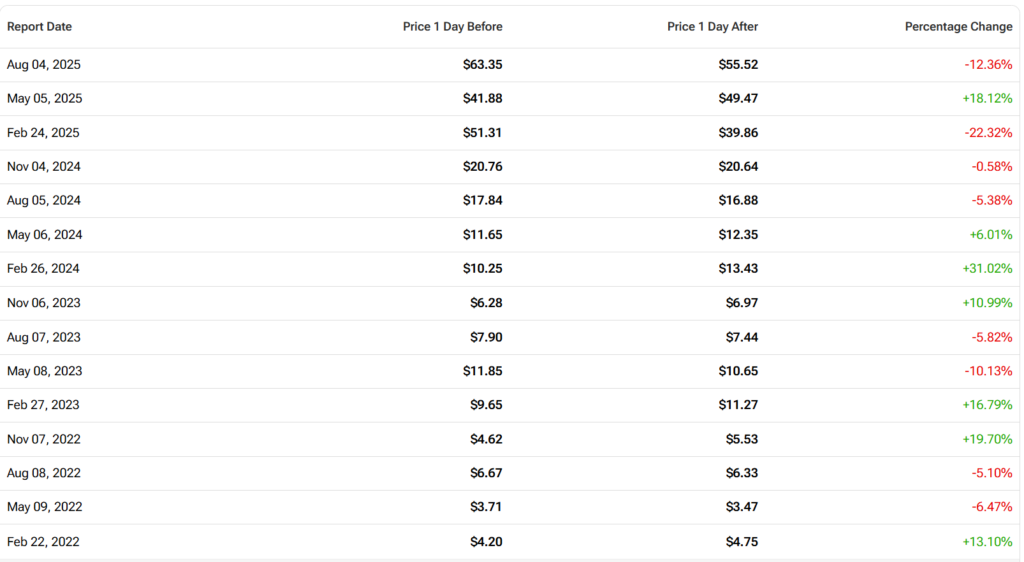

Options pricing implies a post-earnings move of ~15%, reflecting high expectations and volatility.

Can Hims Deliver Another Clean Quarter?

With strong subscriber engagement, a sticky business model, and demand for personalized healthcare still rising, Hims enters Q3 earnings with momentum. But investors are pricing in a near-flawless quarter — and any wobble in margins, subscriber count, or ARPU could trigger a swift reaction.

Final Prediction:

- Revenue and EBITDA come in slightly above the midpoint of guidance

- EPS lands near $0.09

- Stock reaction depends heavily on forward guidance and commentary on weight-loss segment and regulatory headwinds

Unless the company issues cautious commentary or subscriber growth slows materially, we expect a modestly positive market reaction and a reaffirmation of long-term growth confidence.

Disclosure: All predictions and insights shared in this article are based on a comprehensive review of publicly available analyst reports, media coverage, and market consensus. These views are for informational purposes only and do not constitute investment advice. Please conduct your own research or consult a licensed financial advisor before making any investment decisions.