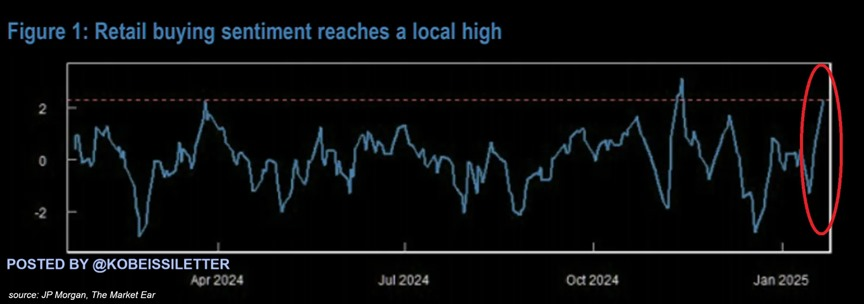

Investors are currently PILING into US stocks at rates rarely ever seen before. Retail investors ALONE bought $7.8 billion worth of US equities over the last WEEK, the most since November 2023.

Investors have never been so optimistic.

The S&P 500 has risen ~5% over the last 7 days and hit an all-time high for the first time this year. This comes after back-to-back annual losses in the “Santa Claus” rally for the 3rd time in history. Recent buying is +2.3 standard deviations above the last 12-month average.

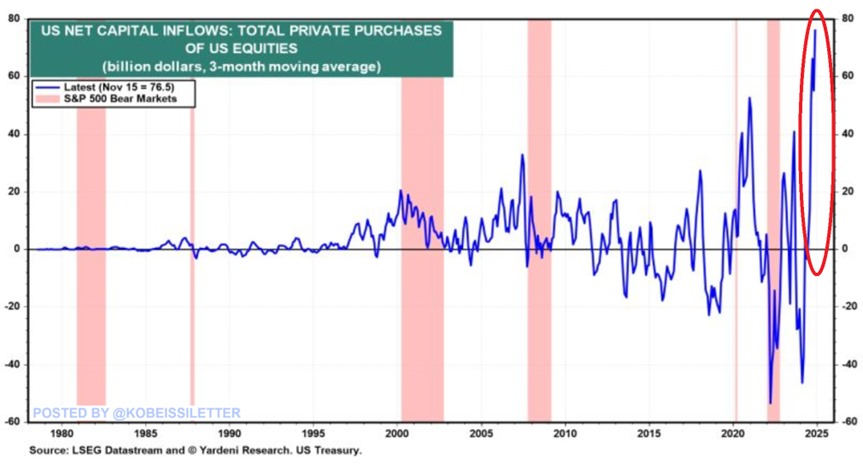

Meanwhile, foreign investors are rotating into US stocks at record levels. These investors purchased a record $76.5 billion US equities over the last 3 months. This surpassed the previous high seen in 2021 by ~$25 billion.

Foreign investors have purchased nearly 50% MORE US equities over the last 3 months compared to the previous record. Currently, foreign investors have 60% of their investment exposure to US stocks, on average. This is also a fresh record high as seen in the chart above.

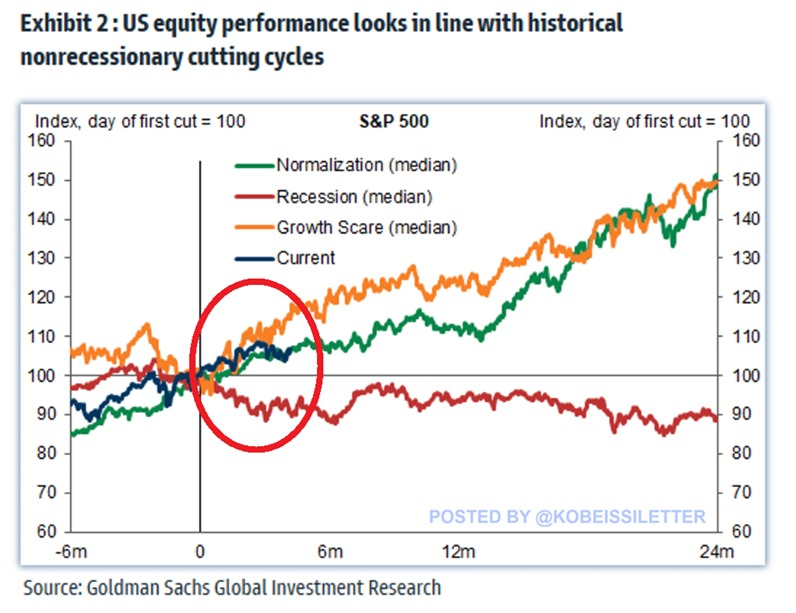

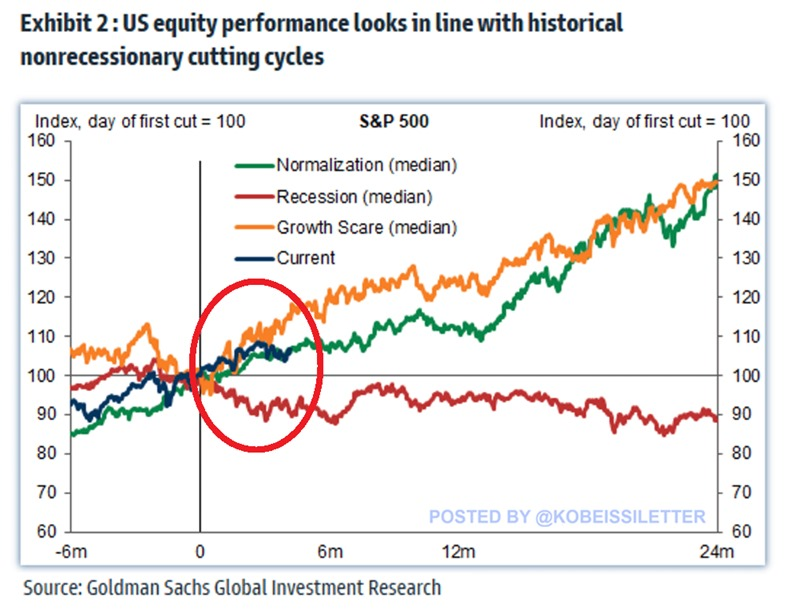

Since the Fed began cutting rates in September 2024, the S&P 500 is up 8%. This is in-line with historical rate cut cycles in the case that a recession was avoided. In the past, the S&P 500 has rallied ~50% on average in the 2 years after a rate cut IF a recession is avoided.

Since August 1st, subs are up ~2,200 POINTS on S&P 500 trades. Interestingly, market breadth is also improving. 89% of S&P 500 stocks are trading above their 10-day moving average, the highest percentage since November.

This is up ~65 percentage points over the last week. 49% of S&P 500 components are above their 50-day moving average.

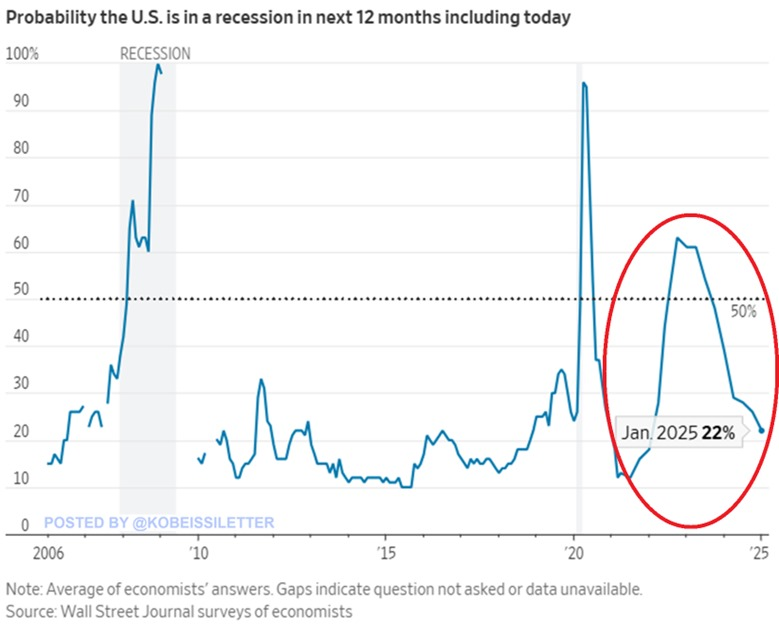

The question becomes, can the US economy avoid a recession into 2026? Back to this chart, we can see equity performance is much worse if the economy enters a recession after cuts begin.

During recessions, the S&P 500 sees an -11% average decline 24 months after cuts begin. Economists seem to think we can avoid a recession. The probability of a US recession within the next 12 months perceived by economists surveyed by WSJ fell to 22%, the lowest in 3 years.

Over the last 2 years, the odds of a downturn have declined by ~40 percentage points.

Oil prices have also come down sharply over the last week. After nearing $80, oil prices are currently trading back below $75.

President Trump has said that his goal is to lower oil prices in order to spur disinflation in the US. He also called on OPEC to do the same.

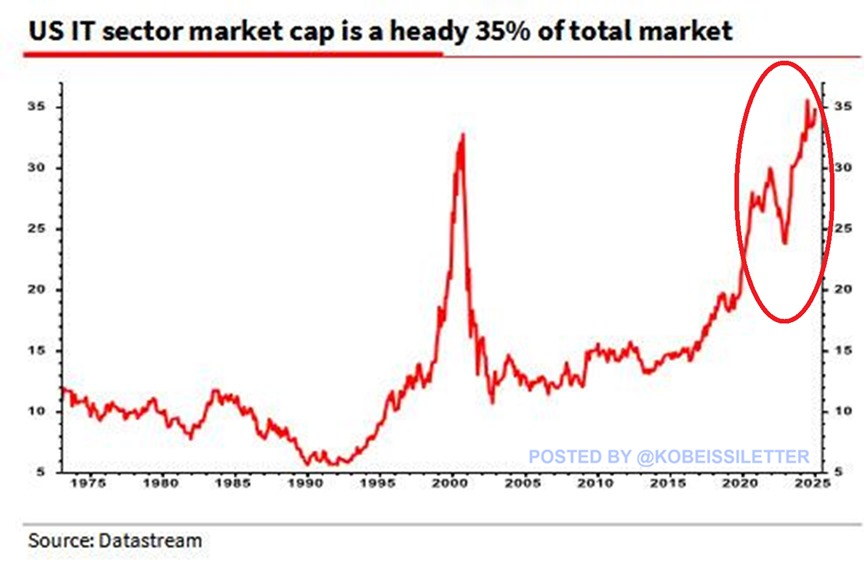

However, the market is also heavily reliant on technology stocks.

The Information Technology sector now reflects 35% of the US stock market, even above the 33% peak seen in the 2000 Dot-Com Bubble. Tariffs and a potential trade war could jeopardize the market rally.

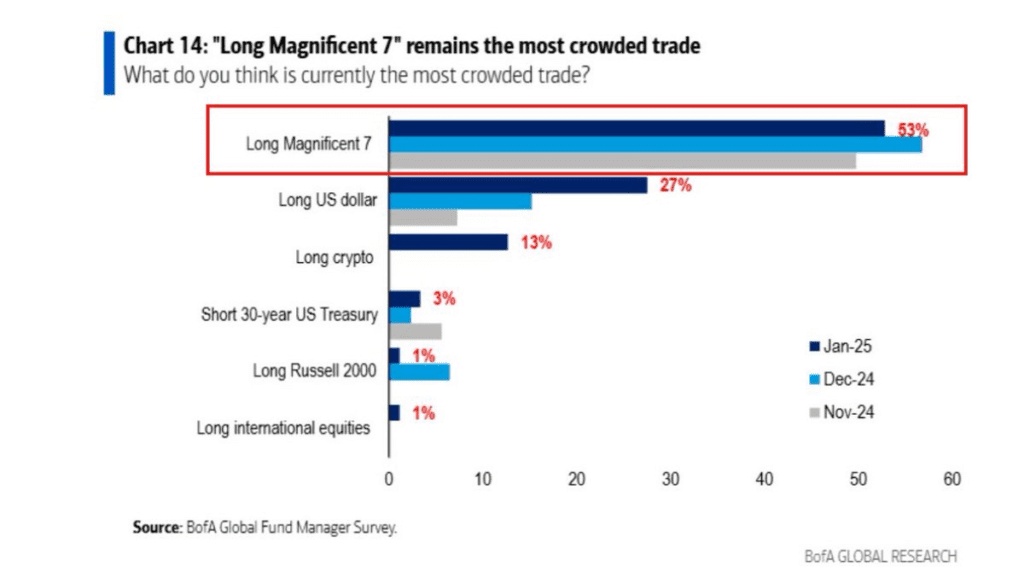

The question becomes, has the bull trade become too crowded? Bank of America’s Fund Manager Survey says the Long Magnificent 7 trade is the most crowded in the market.

Can the bull run continue into 2025?

Source: TKL

Related: $PLTR – Karp: “We have three products that changed the world & We’re just getting started”