Public and political pressure is mounting in Germany and Italy to bring home more than $245 billion worth of gold reserves currently held in the United States, amid growing unease over US politics, Federal Reserve independence, and global instability.

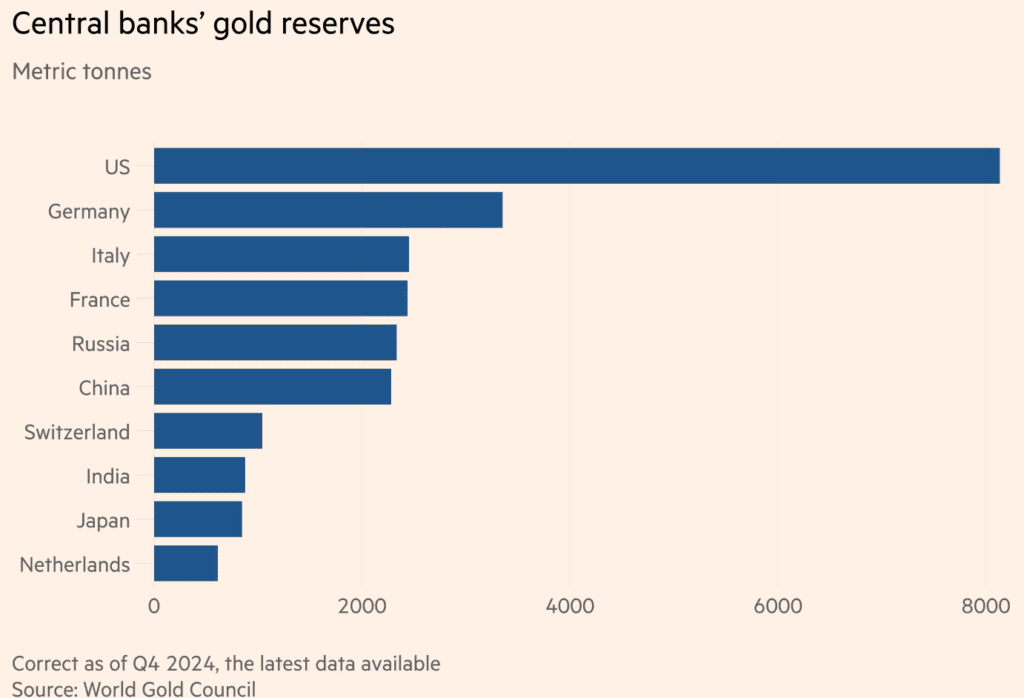

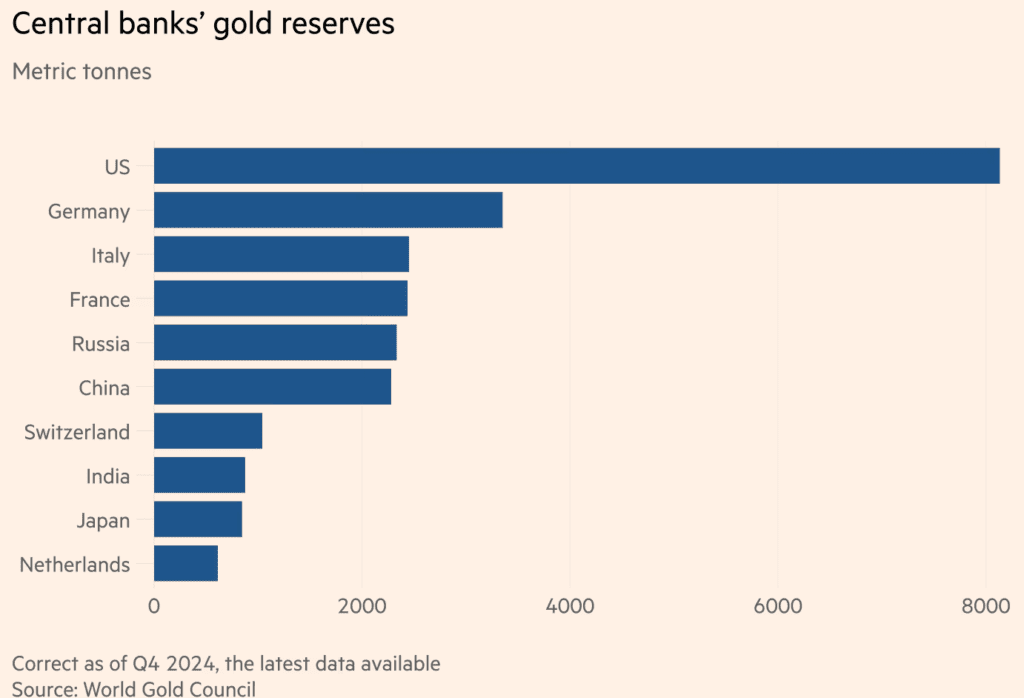

Germany and Italy—holding the second- and third-largest national gold reserves in the world, respectively—store a large share of their bullion at the New York Federal Reserve. But recent comments from President Donald Trump, including threats to “force something” if the Fed doesn’t lower rates, have triggered new calls across Europe to reassess that decades-old reliance.

“There are strong arguments for relocating more gold to Europe or Germany in turbulent times,” said Fabio De Masi, former MEP and now a member of Germany’s populist BSW party.

Together, Berlin and Rome hold over 5,800 tonnes of gold, with roughly a third of each country’s reserves housed in the US. That’s a legacy of the post-World War II economic order, when gold was accumulated during strong trade surpluses with the US and stored abroad as a hedge against conflict with the Soviet Union.

But critics across the political spectrum now say the US is no longer the stable, neutral partner it once was.

Fed Independence Under Scrutiny

Trump’s increasingly direct attacks on the Federal Reserve, combined with his erratic foreign policy and trade threats, have revived long-dormant anxieties in Europe about gold security.

“We are very concerned about Trump tampering with the Federal Reserve’s independence,” said Michael Jäger, president of the Taxpayers Association of Europe, which recently sent letters urging the German and Italian finance ministries to review their bullion arrangements.

“Gold is an asset of last resort… in times of crisis, legal ownership isn’t enough—you need physical control,” added Peter Boehringer, the AfD MP who led Germany’s original gold repatriation campaign in the 2010s.

Bundesbank and Bank of Italy Quiet, For Now

In response to the growing pressure, Germany’s Bundesbank reiterated that it regularly evaluates storage locations based on security and liquidity, but defended its continued reliance on the New York Fed.

“We have no doubt that the New York Fed is a trustworthy and reliable partner,” the bank said in a statement.

Italy’s Prime Minister Giorgia Meloni, who previously pledged to repatriate gold while in opposition, has remained silent on the issue since taking office in 2022. Analysts suggest she is balancing domestic nationalist pressures with a desire to maintain good relations with Washington.

“Bringing the gold back now with great fanfare would send a signal that relations with the US are deteriorating,” warned Bert Flossbach, co-founder of asset manager Flossbach von Storch.

Gold as a Flashpoint in US–Europe Relations

A recent survey of more than 70 global central banks found that an increasing number are re-evaluating where their gold is stored, with many considering domestic vaults amid growing concerns about access in the event of crisis.

While France moved most of its gold to Paris in the 1960s, and Germany repatriated hundreds of tonnes from New York and Paris during the 2010s, both Germany and Italy still keep a large share of their reserves offshore.

With global tensions rising and central bank credibility under fire, the pressure to “bring the gold home” could now shift from fringe debate to mainstream national policy—potentially marking another crack in the post-war transatlantic alliance.

As one German official put it bluntly: “The world has changed. Our gold policy might have to change too.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump rebukes Israel and Iran hours after ceasefire: Latest Updates

Ceasefire “Now in Effect” as Israel and Iran End 12 Days of War — But Deadly Strikes Continue

Trump Announces Ceasefire Between Israel and Iran

Why Oil Prices Plunged and Stocks Rose After Iran’s Missile Attack on US Bases

Markets Brace for Chaos as Strikes, Inflation, and FED: What to watch this week

Iran–Israel–US Conflict Erupts: Nuclear Strikes, Hormuz Threats, and Global Fallout

US-Iran Conflict Escalates After Strikes on Nuclear Sites: What We Know So Far

US Hits Iran’s Nuclear Sites — Iran Strikes Back as War Escalates