Prime Minister François Bayrou lost a knife-edge test of authority he set for himself: a confidence vote tied to his austerity budget. Lawmakers rejected the plan 364–194, and Bayrou resigned; President Emmanuel Macron accepted and will name a replacement “in the coming days.” The failed package aimed to cut €44bn to rein in a 5.8% of GDP deficit and put France on a multi-year consolidation path. The defeat reflects a hung parliament that cannot agree on whether to tighten via spending cuts, tax hikes, or both.

What to expect after the collapse

1) A new PM—but the same arithmetic. Macron is likely to appoint another centrist who can try to stitch together votes for the 2026 budget by October. Names like Sébastien Lecornu have circulated, but any premier will face the same split: parts of the left want higher taxes (e.g., on top earners), the right rejects that, and there is no coalition tradition to bind them. Expect a smaller, slower consolidation mix (some cuts, some targeted revenue) rather than Bayrou’s full plan.

2) Ratings risk in the near term. Fitch reviews France on Friday (currently AA-/Negative). A one-notch cut to A+ would formalise what bonds are hinting at: a political-risk premium until a credible plan emerges. Moody’s (Oct.) and S&P (Nov.) follow.

3) Street politics, not just parliamentary math. Unions and the far left have called nationwide protests (e.g., Sept 10 and Sept 18) against austerity. Even a compromise budget will need to navigate industrial action and public pushback, which can weigh on growth expectations.

4) Snap elections? Possible but not probable near-term. Both the center and the traditional left risk ceding ground to the far right; that dampens appetite for a roll of the dice. Markets would treat any snap vote as spread-widening risk in OATs.

Other need-to-know details you flagged

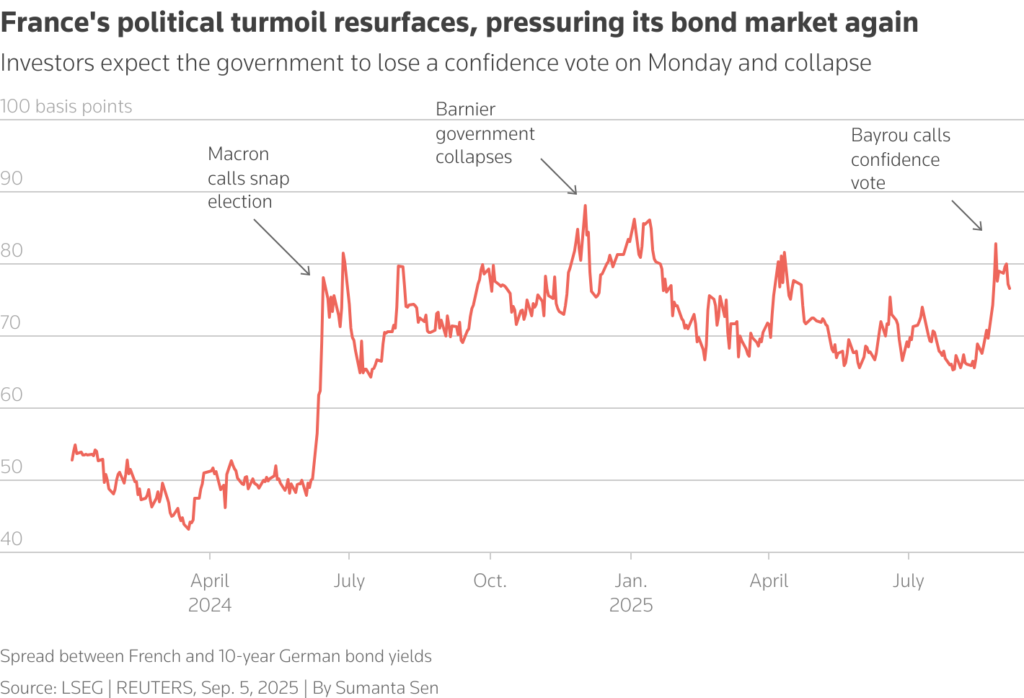

How we got here: Macron’s 2024 snap election produced a hung Assembly; since then, governments have survived by procedural tools and ad-hoc bargains. Bayrou tried to reset the mandate around fiscal repair and lost.

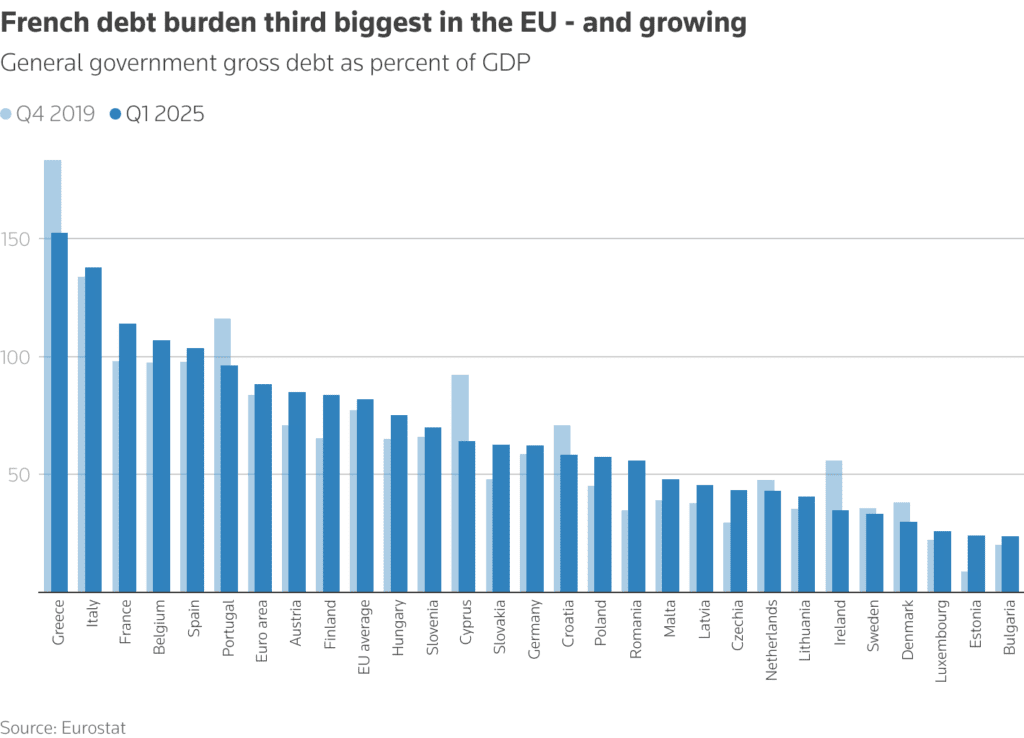

The fiscal hole: Debt near 114% of GDP, deficit well above the EU’s 3% limit; interest costs are rising into the late 2020s—hence the urgency.

Why France ≠ crisis (yet): Current account close to balance and deep markets argue against a self-feeding doom loop, but political paralysis = higher risk premium until policy clarity returns

How markets reacted — and why it matters

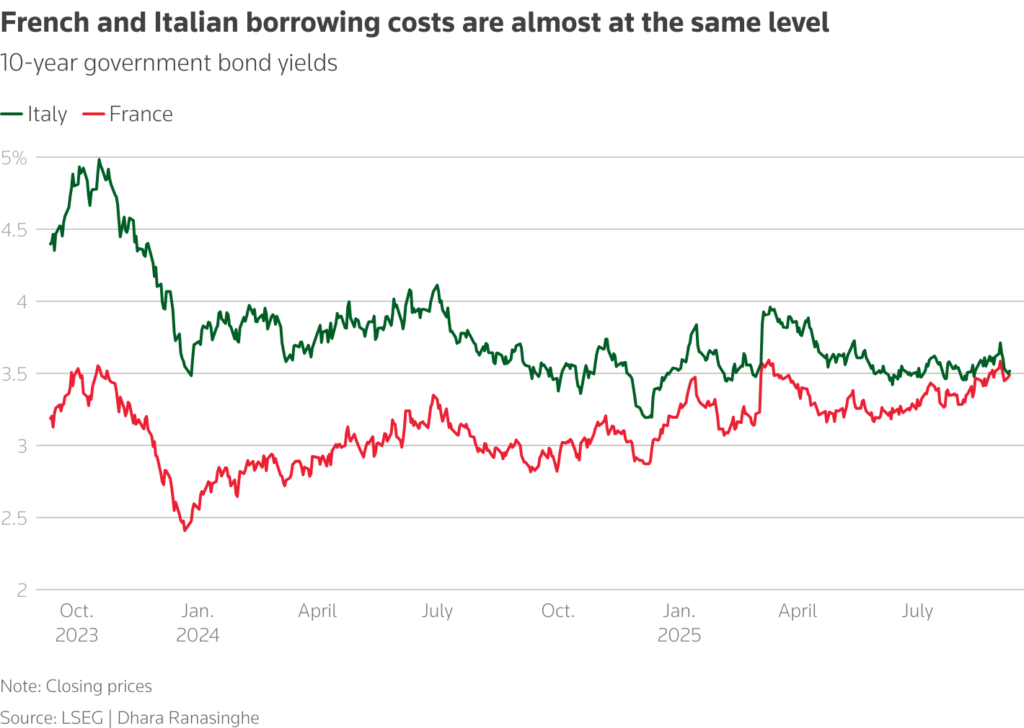

Bonds (the loudest signal). Investors pushed France’s 10-year OAT yield essentially in line with Italy’s—a remarkable repositioning that prices France as #2 risk in the euro area by yield. Vendor snapshots showed France ~3.49% vs Italy ~3.51% intraday; some indices briefly had

higher due to benchmark changes. Translation: this is political-risk pricing, not a pure solvency call. Watch the OAT–Bund spread; persistence at wides would say the market expects watered-down consolidation.

Equities & FX (muted—for now). The CAC 40 opened higher, and the euro was steady—proof that this outcome was widely anticipated and that index heavyweights are globally diversified. But the longer the stalemate, the more corporate-tax noise and weaker domestic confidence can bleed into earnings for banks, utilities, transports and other domestics.

Ratings (near-term catalyst). Fitch on Friday is the next risk event. A downgrade would likely add a 5–15 bps premium near-term; a hold with harsh language could deliver a modest relief rally. Keep an eye on auction covers and foreign real-money participation

What broke — the policy backdrop

Bayrou’s plan to carve €44bn from the 2026 budget to shrink a 5.8%-of-GDP deficit ran into a wall in a hung National Assembly. The opposition prefers tax increases (e.g., on the ultra-wealthy) over spending cuts; the right objects to higher taxes; and coalition math doesn’t exist. Without a durable majority or a grand coalition culture, fiscal consolidation gets watered down, which is why markets now demand more yield to fund France.

The road ahead — scenarios and market tells

- New PM, same arithmetic: Macron likely taps another centrist to try to thread a budget through the fall. Expect smaller cuts, more taxes, and horse-trading with Socialists to avoid snap elections. That path stabilizes the CAC but risks keeping the OAT–Bund spread elevated.

- Technocratic interlude: A caretaker approach could buy time, but without parliamentary buy-in the ratings calculus doesn’t improve much.

- Snap elections: Unlikely near-term (both left and centre fear losses to the far right), but renewed polls would bring spread volatility and could widen OATs again if fiscal clarity deteriorates.

What to watch on screens

- OAT–Bund 10y spread: If it sustains above recent wides, it signals investors expect weaker consolidation under the next PM.

- Rating headlines (Fitch first): A cut to A+ likely adds 5–15 bps near-term to OAT yields; a reaffirmation with a stern outlook could see a relief rally.

- French banks & domestics vs CAC heavyweights: A growing performance gap would flag rising domestic macro risk leak-through despite global earnings buffers.

- Auction cover & bid composition: Watch the investor mix for foreign real-money participation; soft cover would be a warning that pricing pain isn’t done.

Big picture: from “quasi-core” to “political risk premium”

For years, France sat just behind Germany as a core funding market. The collapse of the Bayrou government doesn’t imply a sovereign crisis, but it does mark a shift: investors now price France through a political-risk lens usually reserved for the periphery. If the next government can lock in a credible, multi-year consolidation plan, the spread can retrace; if not, OATs may trade structurally closer to Italy than to Germany for longer.

Bonds told the story: France ≈ Italy on yield is about politics, not solvency. Equities and the euro were calm because this outcome was telegraphed, but ratings day is the next live risk. Watch the OAT–Bund spread, Fitch’s decision, and whether the next PM offers a credible path to shrink the deficit without choking growth.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The Big Question: Are Crypto ETFs About to Explode?

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Bitcoin ETFs Surge on Trump Election Prospects, Market Braces for Volatility