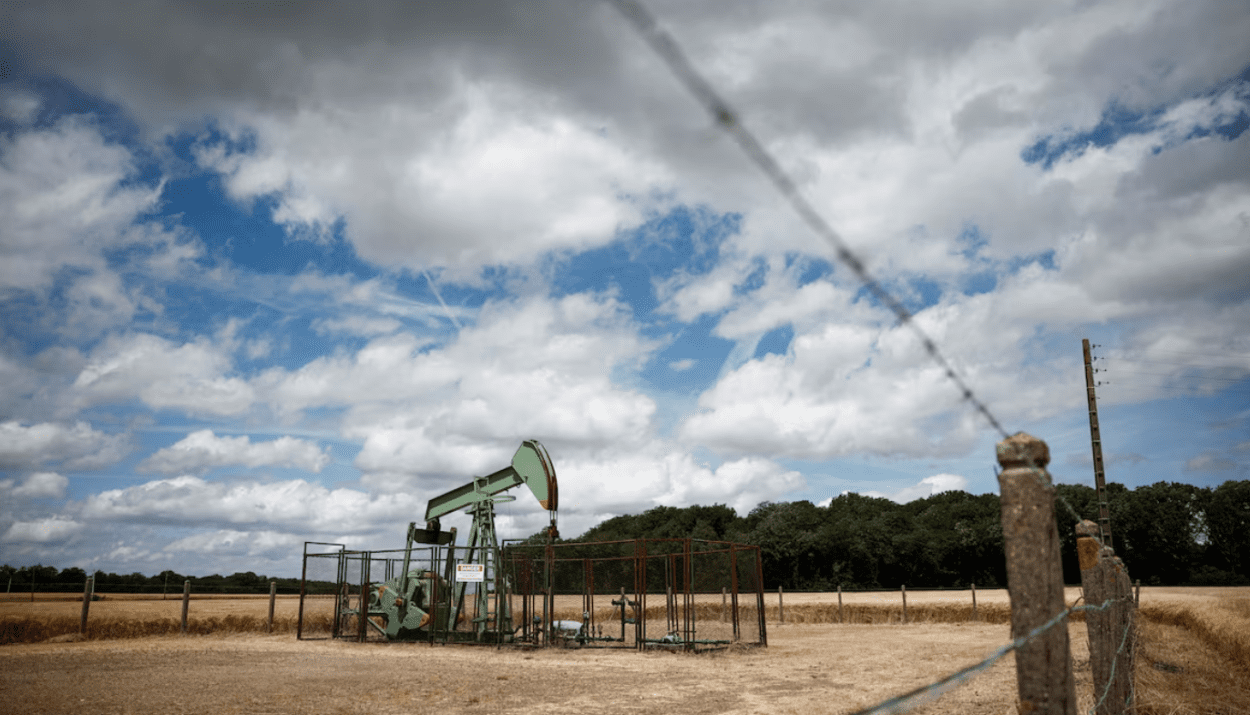

Oil prices experienced a modest uptick earlier this week, driven by escalating tensions in the Middle East and encouraging economic data from China. The U.S. conducted airstrikes against Yemen’s Houthi fighters, raising concerns about potential disruptions to oil supplies from the region. Concurrently, China reported stronger-than-expected retail sales, suggesting a possible acceleration in its economic growth.

Despite these short-term gains, analysts and investors are increasingly forecasting a downward trend in oil prices due to several factors:

OPEC+ Production Increases:

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) have announced plans to gradually increase oil production starting in April, adding 2.2 million barrels per day over the next 18 months. This decision has already led to a significant drop in Brent crude prices, which fell to a five-month low of $70.60 per barrel.

Revised Price Forecasts:

Barclays has reduced its 2025 Brent oil price forecast by $9 per barrel to $74, citing a softer demand outlook and elevated economic uncertainty. Similarly, Goldman Sachs has lowered its December 2025 forecast for Brent crude oil by $5 to $71 per barrel, reflecting expectations of slower global economic growth and increased supply from OPEC+.

Trade Policies and Economic Growth:

U.S. President Donald Trump’s tariff policies are anticipated to slow global trade and economic growth, which could dampen oil demand. Economists warn that these trade tensions may contribute to a global economic slowdown, further pressuring oil prices.

Market Sentiment:

Hedge funds and other asset managers have been aggressively selling off positions in oil contracts, indicating a bearish outlook among traders. This shift in sentiment reflects concerns over supply increases and potential demand slowdowns.

In summary, while geopolitical tensions and positive economic indicators from China have provided temporary support to oil prices, prevailing factors such as increased OPEC+ production, downward revisions of price forecasts by major financial institutions, trade policy uncertainties, and bearish market sentiment are contributing to expectations of a decline in oil prices in the longer term.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Amazon Undercuts Nvidia With Aggressive AI Chip Discounts

BYD Launches Megawatt Super Charging System to Rival Tesla and NIO in China’s EV Race

Warren Buffett’s Berkshire Has Been Selling US Stocks. Where It’s Buying Now

Will Trump Use the Federal Reserve as Leverage in Global Finance?

Key Events and Earning Calendar to Watch This Week (17-21 March)

Facebook’s secrets, by the insider Zuckerberg tried to silence

Quantum computing leader reveals historic breakthrough

Russia Turns to Cryptocurrencies to Bypass Sanctions and Sustain Oil Trade

Bitcoin panic selling costs new investors $100M in 6 weeks — Research