Wall Street is drowning in euphoria — and fear of missing out (FOMO) is beating every other market worry.

As US stocks hit record highs, options traders are piling into bullish call options with near-record intensity, signaling that the biggest investor fear right now isn’t tariffs, inflation, or the Fed — it’s missing the rally.

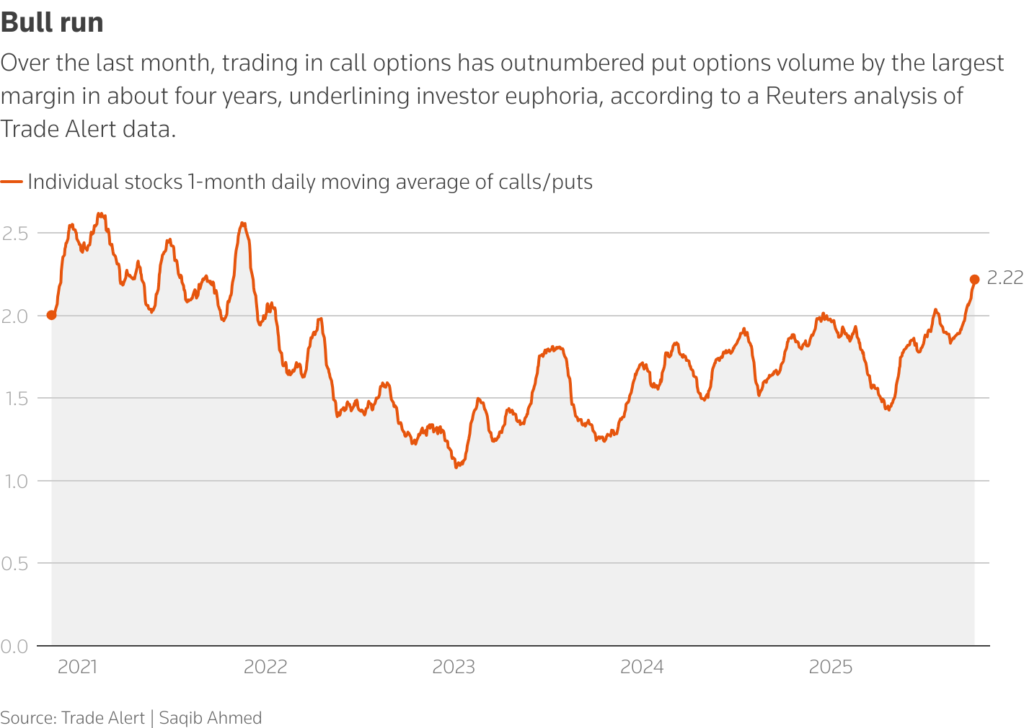

According to a Reuters analysis of Trade Alert data, call volumes now exceed puts by the widest margin in four years, a sign of extreme optimism that BNP Paribas strategist Greg Boutle called “all upside exuberance at this point.”

The Barclays Equity Euphoria Indicator backs that up, sitting nearly three standard deviations above its long-term average — levels typically seen only at peak market cycles. Barclays’ Stefano Pascale said that skew levels have inverted, meaning traders are paying more to speculate on upside than to protect against downside — a classic mark of market euphoria.

“Investor demand for single-stock calls has been extremely strong, especially across AI, semiconductors, and metals,” said Chris Murphy of Susquehanna Financial Group.

AI Stocks at the Core of the Frenzy

The rally has been led by tech giants fueling the AI boom. The Nasdaq is up 19% this year, versus a 15% gain for the S&P 500 — while Nvidia (+38%) and Broadcom (+45%) have become magnets for speculative call buying.

As traders rush to chase the upside, dealers hedging those options are forced to buy the underlying stocks, fueling a feedback loop similar to what drove meme stock surges in past years.

Echoes of the Dot-Com Bubble?

BNP’s Boutle warned the market is starting to feel “late-90s-esque,” comparing current sentiment to the final stretch of the dot-com era — when relentless optimism masked fragility beneath the surface.

Barclays’ data suggests such euphoria often leads to diminishing forward returns, with stocks typically underperforming after extended euphoric periods.

Wall Street’s biggest fear isn’t a crash — it’s being left behind. However, history shows that when traders stop hedging the downside and start hedging the upside, the market may be closer to a mania than to momentum.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.