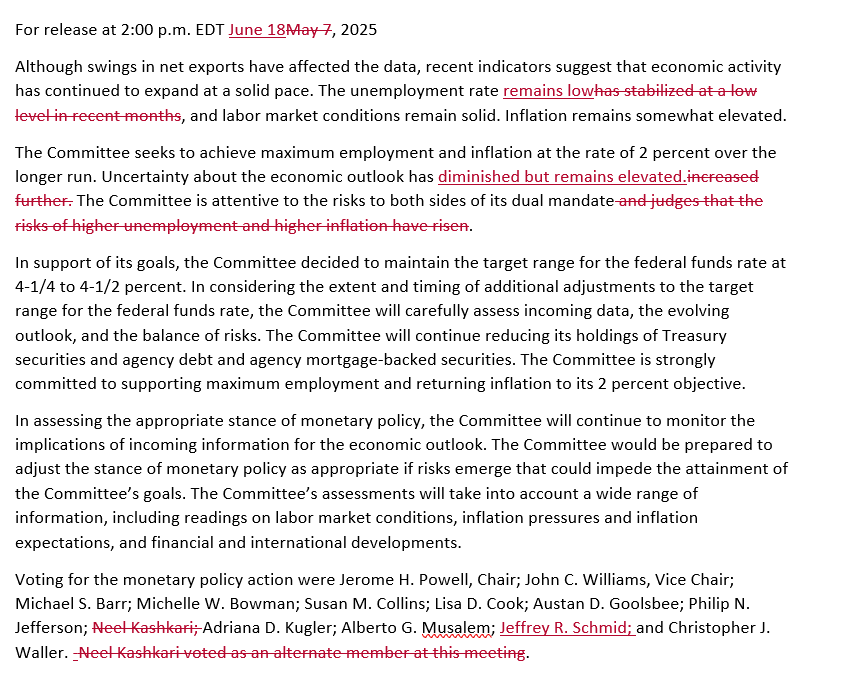

The Federal Reserve left its benchmark interest rate unchanged at 4.25% to 4.50% on Wednesday, marking the fourth consecutive meeting with no change. While officials maintained their projection for two rate cuts in 2025, they also raised their inflation forecasts and downgraded growth expectations, offering a mixed picture of an economy under pressure from both slowing momentum and renewed price pressures.

Fed Chair Jerome Powell defended the decision, citing the need for more data and growing uncertainty tied to President Trump’s aggressive trade agenda and the escalating conflict in the Middle East.

“We expect a meaningful amount of inflation to arrive in the coming months,” Powell told reporters. “We’ll make smarter and better decisions if we just wait a couple of months.”

Inflation Up, Growth Down

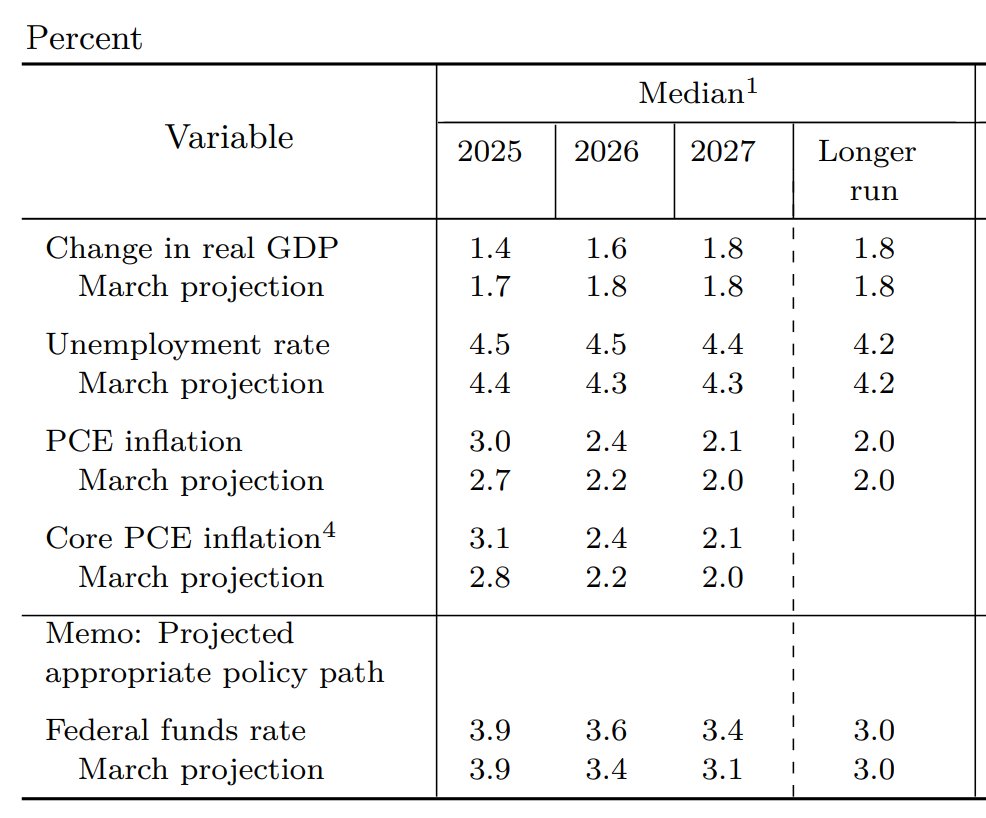

In its updated Summary of Economic Projections (SEP), the Fed forecast PCE inflation at 3.0% and core PCE at 3.1% for 2025—both revised up from 2.7% and 2.8%, respectively, in March. Meanwhile, GDP growth was cut to 1.4%, down from 1.7%, and unemployment is now expected to reach 4.5%.

The Fed’s long-term goal remains bringing inflation back to 2%, but officials acknowledged that the path may be longer and more uncertain than previously thought, especially with firms beginning to pass along the costs of new import tariffs to consumers.

“Goods inflation is moving up a bit, and we expect to see more of that this summer,” Powell said, pointing to the Trump administration’s escalating trade measures.

Divided Fed on Rate Cuts

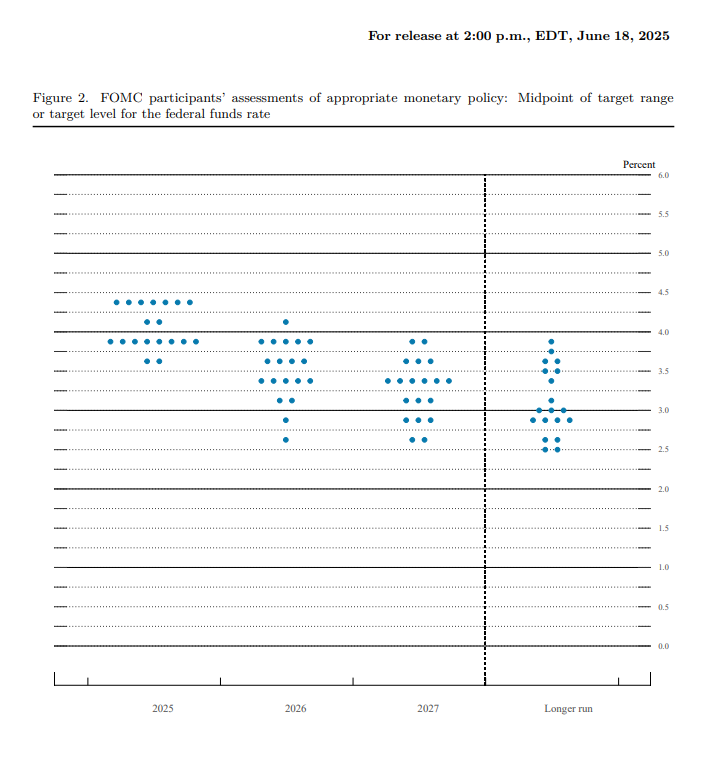

Despite market expectations for easing, the Fed’s internal forecasts revealed growing division. While the median projection still calls for two 25-basis-point cuts this year, seven of the nineteen policymakers see no rate cuts at all in 2025. Two see just one cut, and only two foresee three.

“No one holds these rate paths with a great deal of conviction,” Powell noted. “They’re all going to be data-dependent.”

Looking further ahead, the Fed now sees only one rate cut in 2026 and one more in 2027, indicating a longer path back to the neutral rate of 3.0%.

Trump’s Fury

The decision drew immediate backlash from President Donald Trump, who has publicly demanded sharp cuts to counteract the impact of his tariffs and stimulate borrowing.

“Powell is stupid,” Trump declared on Truth Social. “Too late is Powell.”

He added sarcastically, “Maybe I should appoint myself at the Fed.”

Trump has repeatedly called for a 2.5 percentage point rate cut and accused Powell of endangering the economy by failing to act swiftly. Fed officials, however, remain committed to their independence, and Powell made clear that monetary policy would not bend to political pressure.

“The labor market is not crying out for a rate cut,” Powell said, adding that the Fed’s current stance is only “modestly restrictive.”

Geopolitical and Market Risks

While the Fed made no mention of the war between Israel and Iran in its official statement, Powell acknowledged that global developments could influence energy prices and inflation.

“We’re watching it like everybody else,” he said. “Energy price spikes tend not to have lasting effects, but we’ll remain vigilant.”

Markets largely shrugged off the announcement, with US stocks flat and Treasury yields easing slightly. Futures pricing now favors a September rate cut, with another likely by year-end—aligning with the Fed’s median forecast.

The Path Ahead

The Fed’s decision comes as major central banks around the world have begun to loosen policy. The European Central Bank has cut rates eight times since last June, while the Bank of England is expected to hold steady after one cut in May. But the Fed is clearly charting its own course—one that depends on inflation easing, not just economic softness.

“This is a foggy time,” Powell concluded. “We’re well positioned to wait.”

The next major moment for the Fed will be Powell’s Senate testimony on June 25, where he is expected to face questions on tariffs, inflation, and whether the central bank can maintain independence in an increasingly politicized environment.

The Fed is not budging—yet. Rate cuts are still penciled in, but not guaranteed. With growth slowing, inflation heating up, and Trump escalating the pressure, Powell is choosing patience over politics.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Iran Refuses to Surrender as Trump Mulls Strike: Tensions Surge in Middle East Conflict

Trump Demands Iran’s ‘Unconditional Surrender,’ Escalates Pressure in Israel-Iran Conflict

US and UK Seal Trade Deal — but Steel Tariffs Unresolved

Trump Exits G7 Early as Leaders Urge Mideast Ceasefire: What the Summit Delivered

OpenAI considers antitrust action against Microsoft amid tensions

What Is Trump’s ‘Revenge Tax’ — and Why It’s Scaring Off Foreign Investors