Adriana Kugler, a Biden appointee and labor economist who joined the Fed in September 2023, said in a statement that it had been an “honor of a lifetime” to serve during a critical time for both inflation and labor markets. She will return to Georgetown University as a professor this fall. The Fed did not cite any reason for her departure.

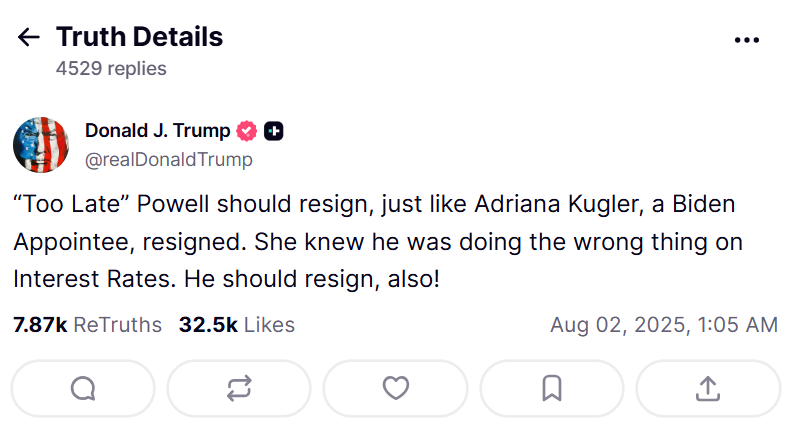

Trump, however, quickly politicized the resignation, claiming without evidence that Kugler stepped down due to disagreements with Fed Chair Jerome Powell, whom he has repeatedly attacked for refusing to cut interest rates. Trump refers to Powell as “Too Late”, arguing the Fed is holding back the economy by keeping rates high.

“’Too Late’ Powell should resign, just like Adriana Kugler,” Trump posted on Truth Social. “She knew he was doing the wrong thing on Interest Rates.”

Although Kugler’s recent views aligned more with a hawkish stance, she had supported holding rates steady to better assess the inflationary impact of Trump’s own tariff policies. She was notably absent from the Fed’s latest meeting, where the board voted to pause rate changes for the fifth consecutive time.

Trump’s Influence on the Fed Grows

With Kugler’s departure, Trump has a chance to place a rate dove on the Fed board — someone aligned with his aggressive push for rate cuts. Two of his earlier nominees, Christopher Waller and Michelle Bowman, have already dissented in favor of easing.

Under current rules, the Fed chair must be selected from among the sitting board governors. That means whoever Trump appoints now could later be elevated to chair if confirmed by the Senate — a critical consideration as Powell’s term as chair expires in May 2026.

However, Powell’s broader term as a Fed governor continues until 2028, meaning he could legally remain on the board even after losing the chairmanship, further complicating Trump’s efforts to remake the Fed leadership.

Candidates and Strategy

Treasury Secretary Scott Bessent has confirmed the administration is actively looking for Powell’s replacement. Potential candidates include:

- Bessent himself

- Former Fed Governor Kevin Warsh

- Current Fed Governor Christopher Waller

- Former Trump economic advisor Kevin Hassett

There is also speculation that Trump may attempt to create a “shadow chair” scenario — appointing someone to the board who openly challenges Powell’s leadership until a formal transition can be made.

Regardless, Kugler’s early exit has added a new layer of urgency and political pressure to what was already shaping up to be a pivotal year for the central bank.

Powell, in a brief statement, praised Kugler’s contributions, saying:

“She brought impressive experience and academic insights to her work on the Board.”

Trump’s influence on future monetary policy — especially as inflation and tariffs collide — is now more tangible than ever.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years