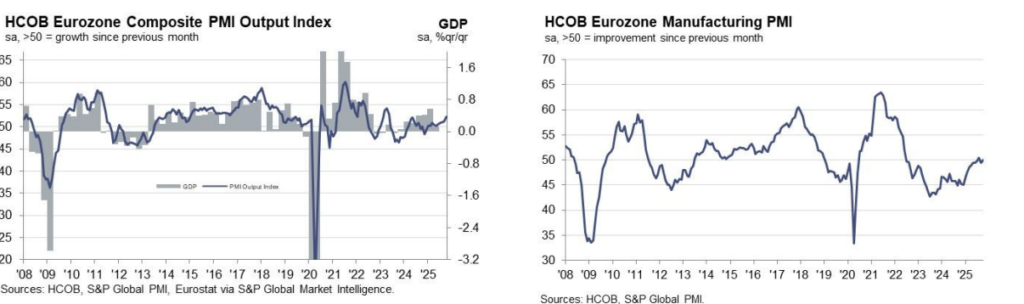

The Composite Purchasing Managers’ Index (PMI) for the eurozone rose to 52.2 in October from 51.2 in September, according to flash data from S&P Global, marking the ninth straight month of expansion and matching the strongest reading since May 2023.

The result defied market forecasts of a slowdown to 51.0, signalling that the bloc’s post-pandemic recovery may be regaining traction. Growth was supported by both services and manufacturing, with services leading the improvement.

The services PMI jumped to 52.6 from 51.3, while manufacturing output returned to the neutral level of 50 for the first time since mid-2022 — suggesting stabilization in industrial activity.

Inflation Pressures Mixed, Employment Rebounds

Employment across the eurozone returned to growth, helped by stabilizing workloads. Input cost pressures softened, but companies raised output prices at the fastest rate in seven months, hinting at a mild rebound in consumer inflation.

Economists said the data supports the European Central Bank’s (ECB) decision to pause interest rate changes, as inflation appears contained despite firming growth.

Germany Leads, France Struggles

The bloc’s two largest economies moved in opposite directions:

- Germany saw its strongest private sector growth in 2½ years, with its Composite PMI rising to 53.8 from 52.0, boosted by services and a steadying manufacturing base. “This is an unexpectedly good start to the final quarter,” said Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, noting rising new orders and improving backlogs.

- France, however, remained in deep contraction, with its Composite PMI falling to 46.8, the lowest since February. Both services (47.1) and manufacturing (48.3) weakened amid political uncertainty over Prime Minister Sébastien Lecornu’s 2026 budget plan.

“France is increasingly becoming a drag on the eurozone economy,” de la Rubia warned, citing fiscal instability and weak business confidence.

Markets Steady Ahead of US CPI Data

European stocks were little changed following the upbeat PMI data as investors awaited U.S. inflation figures. The Euro STOXX 50 was flat, Germany’s DAX held steady, and France’s CAC 40 slipped 0.39%.

Corporate highlights included:

- ENI (+2.44%) after strong quarterly results.

- Sanofi (+0.79%) after an earnings beat.

- Saab (+6.08%) and Valeo (+8.40%) after positive earnings surprises.

The euro held steady at $1.16, while German Bund yields edged up two basis points to 2.61%.

The eurozone’s recovery gained unexpected strength in October, led by Germany’s resurgent services sector. But with France lagging and inflation dynamics uncertain, the region’s rebound remains uneven — offering both hope and caution as 2025 draws to a close.